Crowd Forecast News Report #324

[AD] eBook: Amplify Your Options Trading with Smart LeverageThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport120819.pdf

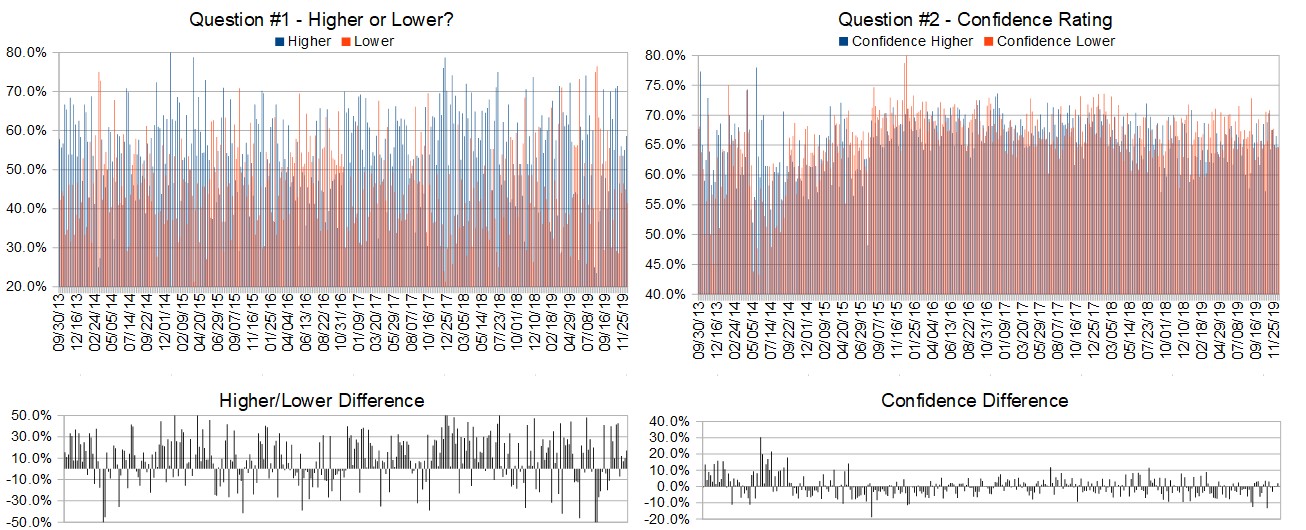

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 9th to 13th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 58.6%

Lower: 41.4%

Higher/Lower Difference: 17.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.7%

Average For “Higher” Responses: 64.7%

Average For “Lower” Responses: 64.6%

Higher/Lower Difference: 0.1%

Responses Submitted This Week: 33

52-Week Average Number of Responses: 34.0

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

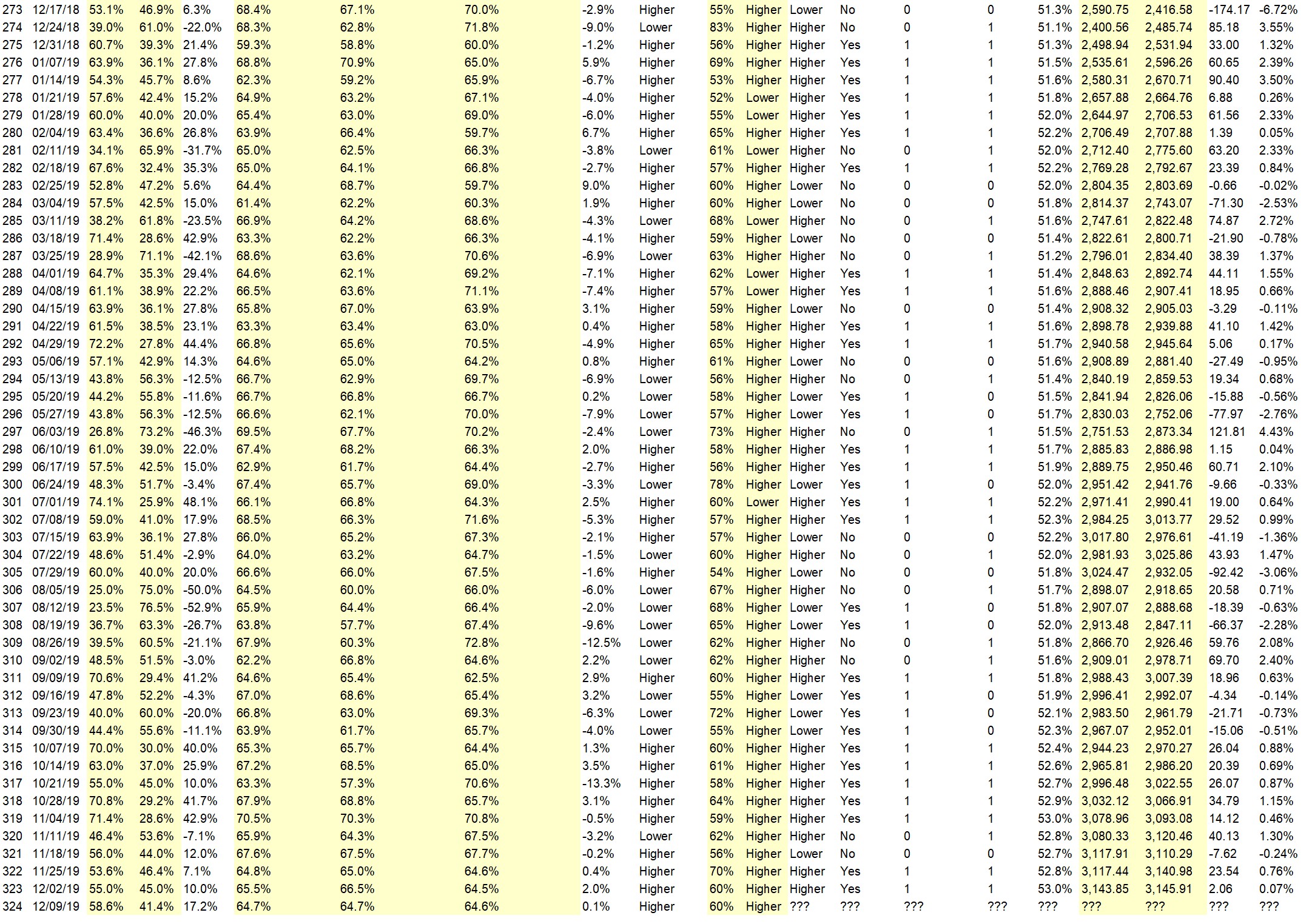

Details: Last week’s majority sentiment from the survey was 55.0% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.07% Higher for the week. This week’s majority sentiment from the survey is 58.6% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 45 times in the previous 323 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.26% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: Amplify Your Options Trading with Smart Leverage

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• President Trump putting Americans to work!

• year-end rally

• Best six months of the year historically

• still finishing wave 5

• Last week finished on a upswing >> but last year saw me lose 25% in the last week. // I’m becoming “Bah, humbug” when Christmas is on the horizon.

• liquidity reelection

• Unemployment

• historic.

• The robust jobs report should prompt the market to continue up, perhaps at a steeper climb.

• Earnings and Momentum

• fundamentals

• Correction over and into the Santa Rally

“Lower” Respondent Answers:

• The economy in all stats is receding. The trade war will end with no winners, only losers. The job numbers are up, because 300,000 people are reaching the age 65 every month. The number of jobs is down over 25,000 each month. The wages are up because of the increases in the minimum wages. The stock market is up only because of stock buybacks by the companies.

• china will not make a deal that is acceptable

• Resistance

• It will always go up as FED and Treasury are supporting trump so that his calls and longs make billions for him plus to show of his treacherous popularity. Whatever we do this market is bound to forever go up and Trump n his billionaiore team is making a billion per week out of all. All our views or tech readings are worthless now. Trump is making his fortunes while he shows off how big he is. Fed is pumping billions each day so what stand shorts stand>

• Needs a 2nd leg down before a final new high, and then a collapse.

• Profit taking and tax loss selling will dominate the market.

• Global monetary issues.

AD: [Workshop] 16 Hour Jump Trades.

Question #4. What indicator influences your trading the most?

• interest rates / fed actions / jim grant

• RSI

• moving average, news

• 200 sma

• moving averages-trends

• RSI + MACD

• RSI

• 50 day moving average EMA maybe i guess i think sometimed

• Price Action

• Trend lines, Channels, Bollinger bands.

• Chart patterns

• Just using.price action with VWAP

• Volume

• The trend of the top 20 stocks is driving the market upwards … Most stocks are actually struggling this year. //// I prefer to look at volume as my leading indicator (sometimes!!)

Question #5. Additional Comments/Questions/Suggestions?

• Profit

• “Go President Trump Go!!”

• With tariffs set to rise on Dec 15, I will get out of longs by Friday and wait

• Totally manipulated unnatural market bound to crush anyone

• I just enjoy your information, and it seems to be quite timely.

Join us for this week’s shows:

Crowd Forecast News Episode #248

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 9th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Dan Passarelli of MarketTakerMentoring.com

– Mike Pisani of SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #105

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 10th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] eBook: Amplify Your Options Trading with Smart Leverage