Crowd Forecast News Report #325

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport121519.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 16-20th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.0%

Lower: 37.0%

Higher/Lower Difference: 25.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.7%

Average For “Higher” Responses: 64.4%

Average For “Lower” Responses: 68.0%

Higher/Lower Difference: -3.6%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 33.9

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

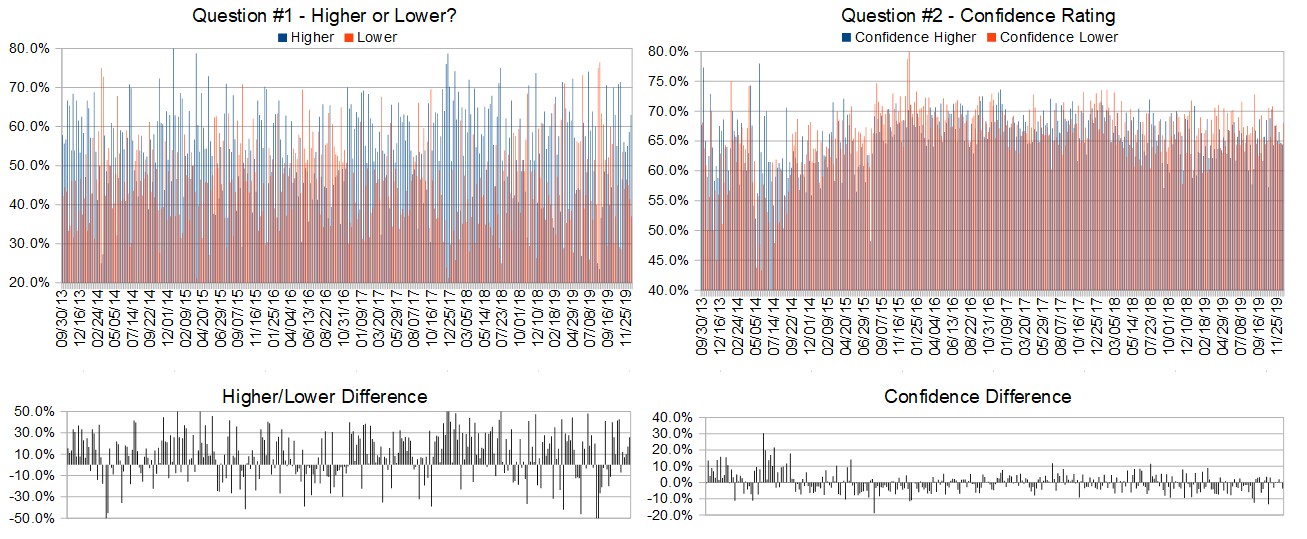

Details: Last week’s majority sentiment from the survey was 58.6% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.86% Higher for the week. This week’s majority sentiment from the survey is 63.0% predicting Higher with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 39 times in the previous 324 weeks, with the majority sentiment (Higher) being correct 54% of the time but with an average S&P500 move of 0.20% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)

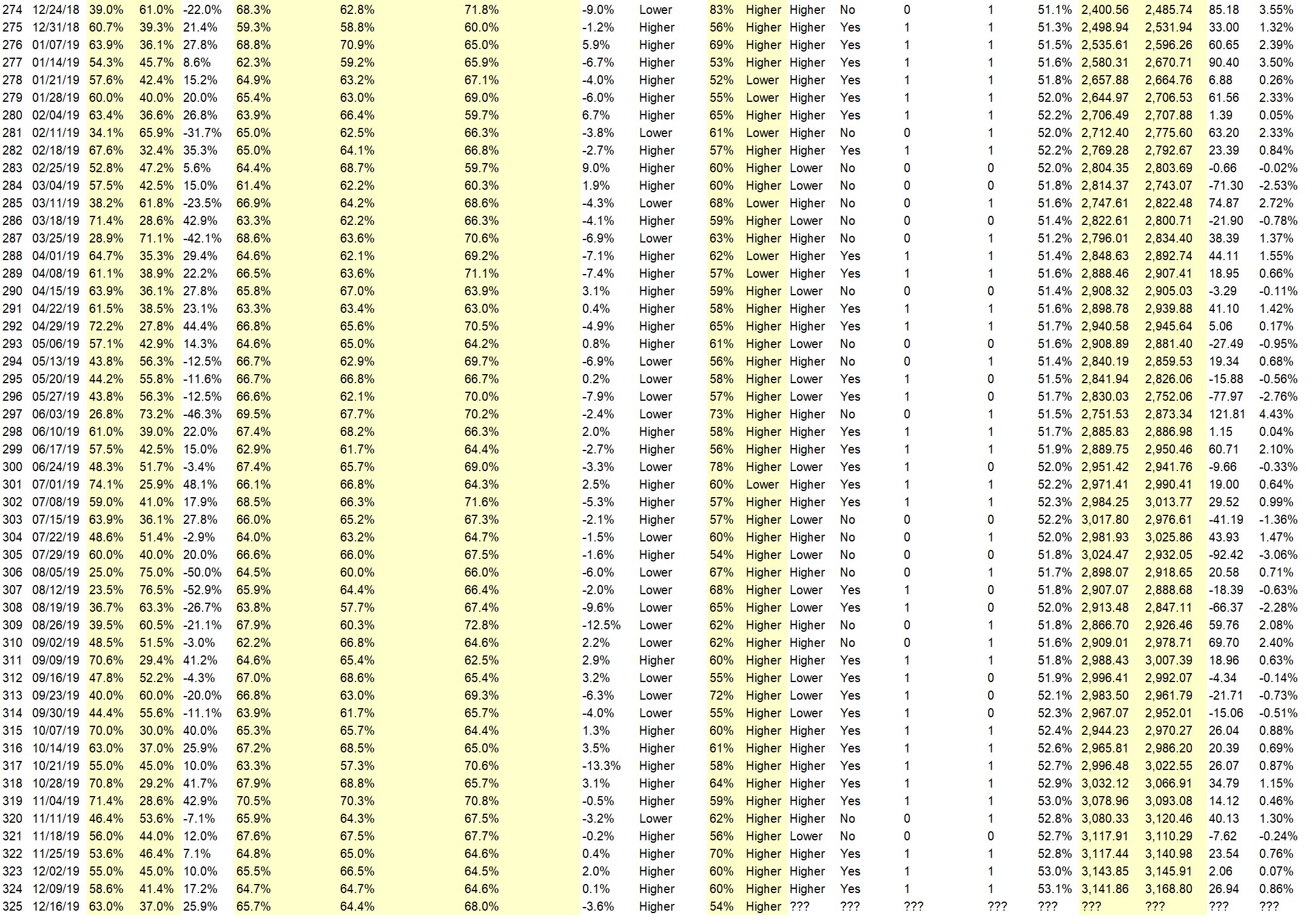

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• At this point in time (12;15pm) All reports indicate strong economy is still doing well & China reports hold on tariffs on autos & more.

• Less volatility

• year-end rally continues

• Best six months of year historically

• wave 5 continues

• End of year mark up.

• Tariff s and holiday

• Historic.

• Looks like US-China tariffs are being reduced, with the tough negotiations with China being put off. “Buy the dip” is still the operative phrase.

• trend continues

“Lower” Respondent Answers:

• Market will chop around a bit, sideways, then lower by weekends end. People tired of Brexit slow process and EU, the people want change and favour the exit!

• Phase one of the China deal is behind us

• reversion to the mean

• Fear-Greed Index is again showing extreme greed.

• Digestion of gains

• Profit taking and tax loss selling will dominate the trading this week.

• Nothing to move higher. China deal still unsigned and could not happen. Market gets time to analyze how little is in the China deal.

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)

Question #4. If you could go back in time and give your 18-year-old self some financial advice, what would it be?

• Lol, buy Apple, McDonalds, Suncor and GE!!

• Save More

• buy fixed dollar amount of the S&P500 index on a monthly basis

• Buy a house with a rental apt.

• Save

• buy the spy-re-invest dividends and put 200.00 month as new money into market along the way.. from 1990–spy-351–to today spy-3700–10x return on your money 29 yrs ..so, 1million in 1990—10 million today dec-2019

• save

• You mean if I could tell the future to an 18 yr old all those years ago? Buy and hold, except during 1987, 2000-2003, 2007-2009, and 2020.

• Invest in growth stocks

• Research before you buy stocks

• Glad you worked for the NYSE at 18 !!!!

• Trade options as a Market Maker.

• Have enough patience to take the time to make sure that you understand what the market or you favorite sector is doing.

• Major in economics

Question #5. Additional Comments/Questions/Suggestions?

• Holidays are here, wishing all institutional and individual investors great blessings today and the coming weeks!

Join us for this week’s shows:

Crowd Forecast News Episode #249

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 16th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– John Thomas of MadHedgeFundTrader.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #106

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 17th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)