Crowd Forecast News Report #350

[AD] PDF: 2025 Market Harvest (20 Lessons!)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060720.pdf

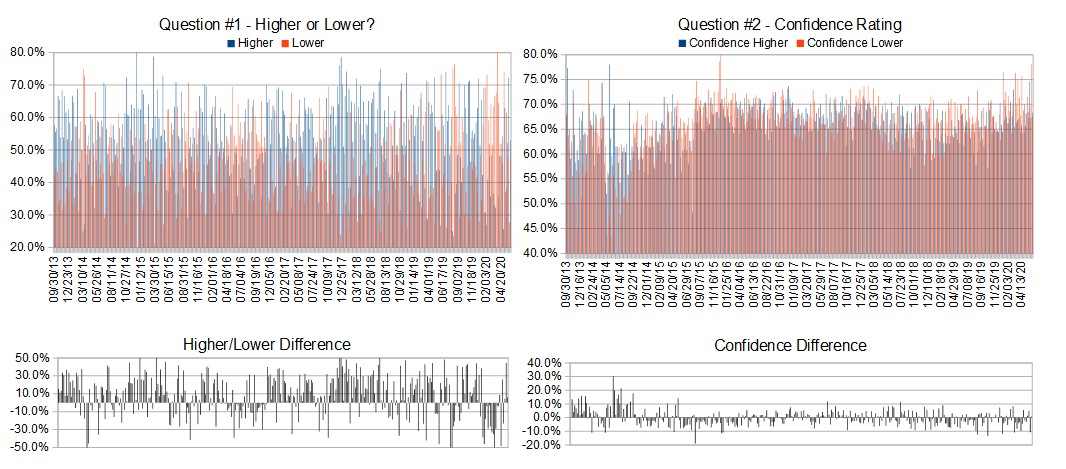

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 8th-12th)?

Higher: 52.9%

Lower: 47.1%

Higher/Lower Difference: 5.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.9%

Average For “Higher” Responses: 68.3%

Average For “Lower” Responses: 67.5%

Higher/Lower Difference: 0.8%

Responses Submitted This Week: 18

52-Week Average Number of Responses: 30.1

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

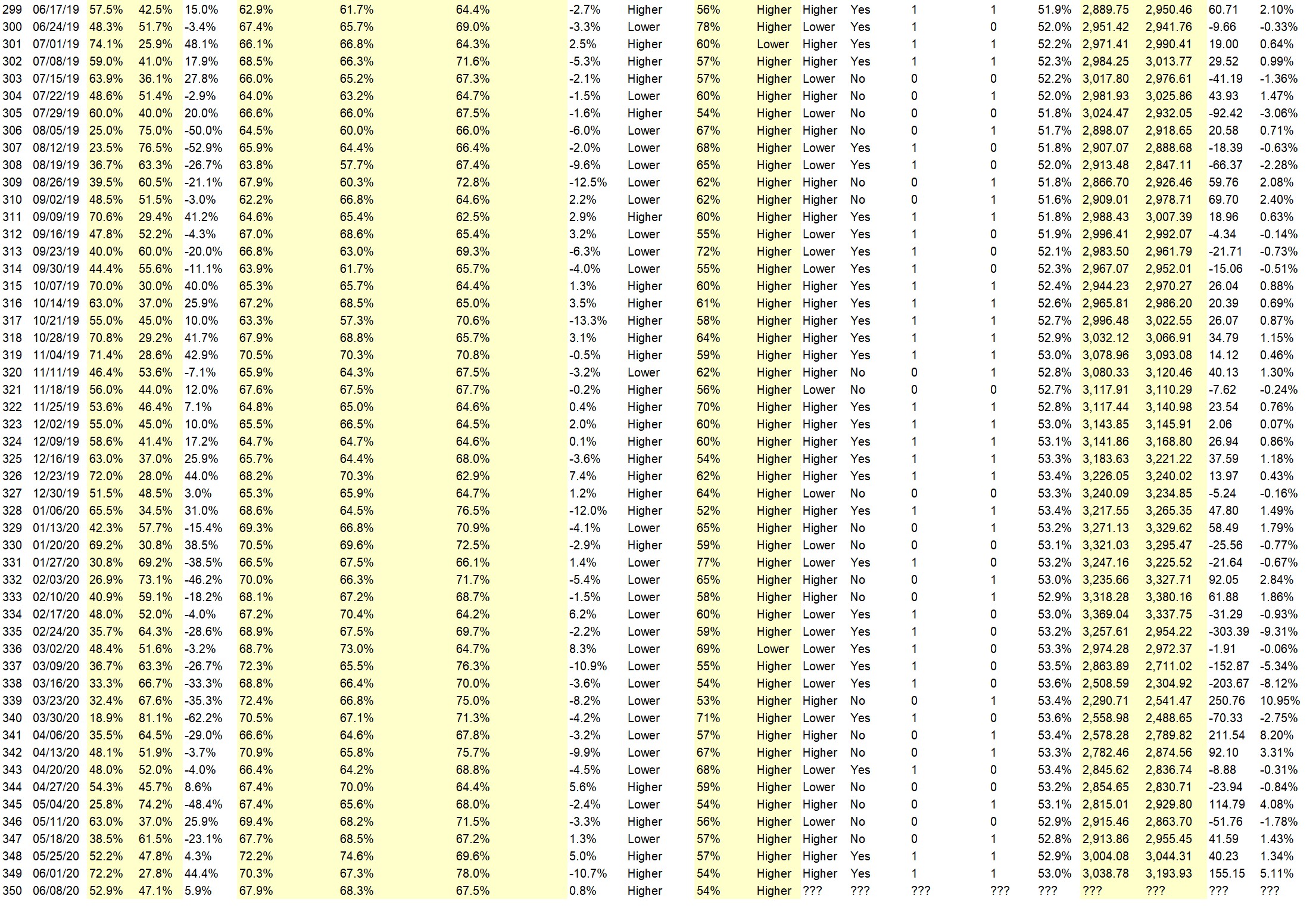

Details: Last week’s majority sentiment from the survey was 72.2% predicting Higher, and the Crowd Forecast Indicator prediction was 54% chance Higher; the S&P500 closed 5.11% Higher for the week. This week’s majority sentiment from the survey is 52.9% predicting Higher but with a much greater average confidence from those who are predicting Lower. Similar conditions have occurred 52 times in the previous 349 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.46% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 2025 Market Harvest (20 Lessons!)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• momentum

• Technical: candle+trend, nfp release was positive

• Good unemployment report. It looks like a V shaped economic recovery.

• More of the economy opens giving greater confidence that we are on the upswing but could be impacted by the growing domestic unrest.

• Momentum is good, which suggests more follow through. Expecting for this week: rotation into lagging stocks, buying of dips, S&P holds up okay.

• Trend

“Lower” Respondent Answers:

• Still large number of people unemployed. Not enough jobs too fill the unemployment gap.

• more protests

• The rise has moved too fast. Bound to have some correction.

• Profit taking from last week

• Market has been overbought for a couple weeks. Last friday the rubberband stretched so far that it needs to correct for a little while. Revert to the average or lower before it continues to rocket higher as things continue to open up. Our Covid 19 numbers were the highest they have been last week but without drastic increase in hospitalizations or deaths so far. The virus might be mutating to a less lethal form while still causing herd immunity- hopefully.

• Volume flow

[AD] PDF: 2025 Market Harvest (20 Lessons!)

Question #4. What styles of trading or methodologies have you had the most success with?

• Long term. Buy and hold.

• Buying when marker crashes

• Analyze charts and trade accordingly.

• To many to share

• Swing trading

• Supply and demand

• Buying a stock tied to crypto. Selling puts for premium, and following leads and trending stocks from Tradesmith, Jeff Brown, Jeff Clark and Tika Tawari, Educated using Option Alpha etc.

Question #5. Additional Comments/Questions/Suggestions?

• none

[AD] PDF: 2025 Market Harvest (20 Lessons!)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies