Crowd Forecast News Report #271

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport120218.pdf

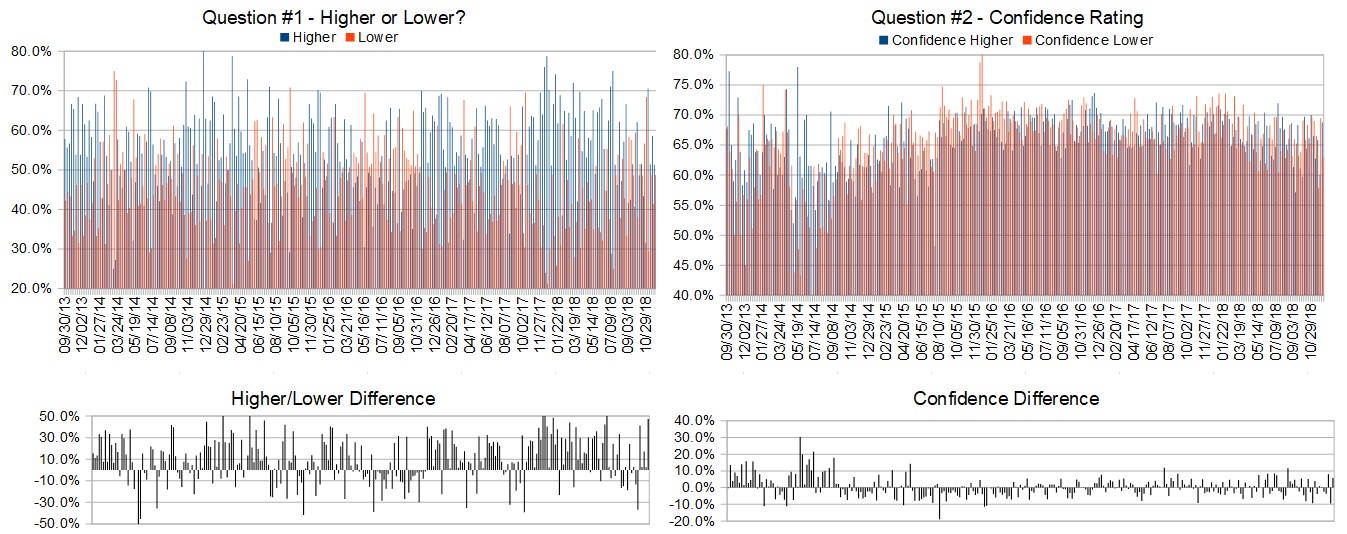

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 3rd to 7th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 73.7%

Lower: 26.3%

Higher/Lower Difference: 47.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.2%

Average For “Higher” Responses: 68.8%

Average For “Lower” Responses: 63.0%

Higher/Lower Difference: 5.8%

Responses Submitted This Week: 40

52-Week Average Number of Responses: 44.8

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.3% Higher, and the Crowd Forecast Indicator prediction was 69% Chance Higher; the S&P500 closed 4.16% Higher for the week. This week’s majority sentiment from the survey is 73.7% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 55 times in the previous 270 weeks, with the majority sentiment being correct 58% of the time and with an average S&P500 move of 0.13% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

Go Full Throttle with Top Gun Options! – A Week of Trading & Training December 3-6

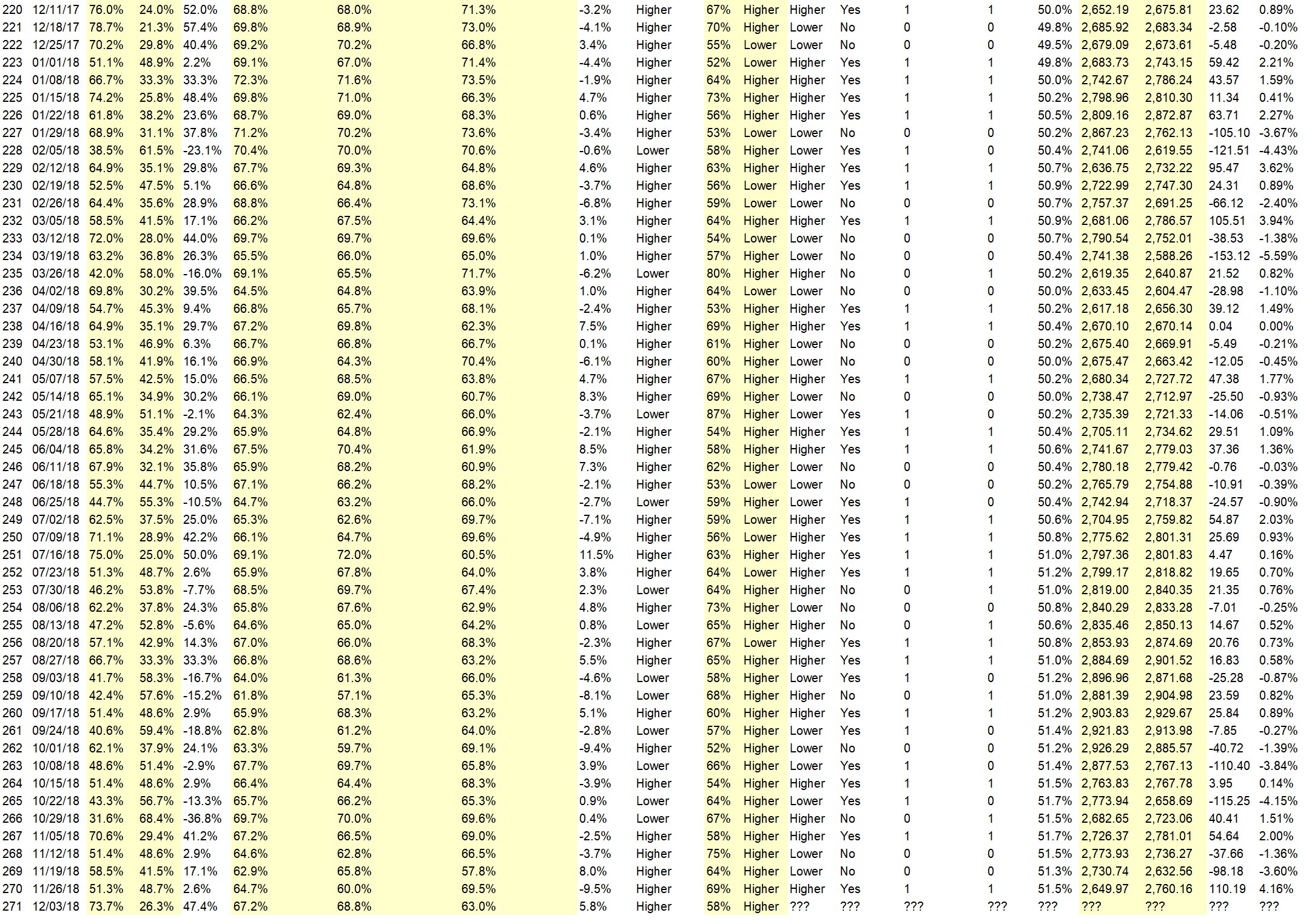

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Deal with China

• Resultado of US and Chinese talos about tarde tarrifs.

• Trump’s info from Southamerica

• Continued Rally from oversold.

• g20 talks positive bias… Fed dovish

• I think there is some optimism about about a trade deal between America and China. Even a hint of a deal would cheer investors.

• es went above 2763.56-on friday close –bullish for me. however ,crude to 48 then 43-.watching CRUDE–and dollar -as catalyst to down-recession???/dollar above 97.63–could kill my bull thesis-crude to 48/43.00 kill bull…….

• AD line going up, NYSI positive

• trade news

• Holiday season optimism

• history

• Short-covering rally to occur following Pres Trump’s relaxation of Jan 1 tariffs.

• This past week had a nice reversal up from the previous down week. The tariff stuff is probably already built into the market. Looking for continuation up.

• China deal

• Bogus rally playing out market loses twenty percent in 2019

• Trump will make it seem as though the trade tariffs are being eased, and the fed has softened their stance. Also money managers need to make a good showing by year end and will be pushing the mono sticks higher.

• Satna Rally

• Continued rally to Xmas

• Stochastics rise a couple more days then ?

“Lower” Respondent Answers:

• I answered lower. Yes, there could be a Santa Clause rally at this time? What I see is QQQ, IWM and SPY are all below the cloud on an ichimoku daily chart. All three are below or just touching the long-term M/A. All of my trend following indicators are pointing down. So there you have it, could continue higher for a while but I am expecting lower.

• Overbought market

• Trump/Xi negative outcome

• decreasing profit trend

• overbought short term

• It]s not so much that I believe markets will be lower next week as it is that I believe that once investors begin to realize the economy in general is really beginning to weaken and reverse course that market indexes begin seriously dropping. It begin next week or not but it is going to happen and sooner rather than much later. So I’m not predicting what will happen next week, necessarily. As the economy slows significantly, then the current spats of “irrational exuberence” will cease to occur as reality sets in.

• christmas / China

• Higher volatility happens in bear markets. Sudden large upmoves is what keeps hopeful bulls in the market even as it overall goes lower (ie in spite of the occasional large upmoves).

Partner Offer:

Go Full Throttle with Top Gun Options! – A Week of Trading & Training December 3-6

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• rate of change

• 3ema—-8ema——20ema—-167ma-multiple time frames–20yr monthly –5yr monthly-macro——-then 3month daily—-1yr daily micro–

• Watch financial news daily

• Journal and assessing other ways I could have done the trade better

• growing/shrinking bottom line

• I keep a simple spreadsheet of results, with a lot of room for notes what we could have done in a better way, mistakes and general observation how a particular stock or ETF behaves.

• Account balance

• A lot of journalling does not work for me. However sometimes there’s an important lesson learned and I’ll keep those highlighted on same page as my current trades so I’m forced to read it as a reminder. By “same page”, that’s my own list of trades entered on my own Excel spreadsheet.

• Input results of each trade into spreadsheet & study results of each trade in a post mortem review. Mark up charts of each trade & save file for future reference..

• Schwab

• financial software

Question #5. Additional Comments/Questions/Suggestions?

• When will this market turn down for the long tern

Join us for this week’s shows:

Crowd Forecast News Episode #206

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 3rd, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Sean Kozak of NeuroStreet.com

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #58

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 4th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Christian Fromhertz of TribecaTradeGroup.com

– Michael Filighera of LogicalSignals.com (moderator)

Partner Offer:

Go Full Throttle with Top Gun Options! – A Week of Trading & Training December 3-6