Crowd Forecast News Report #296

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport052719.pdf

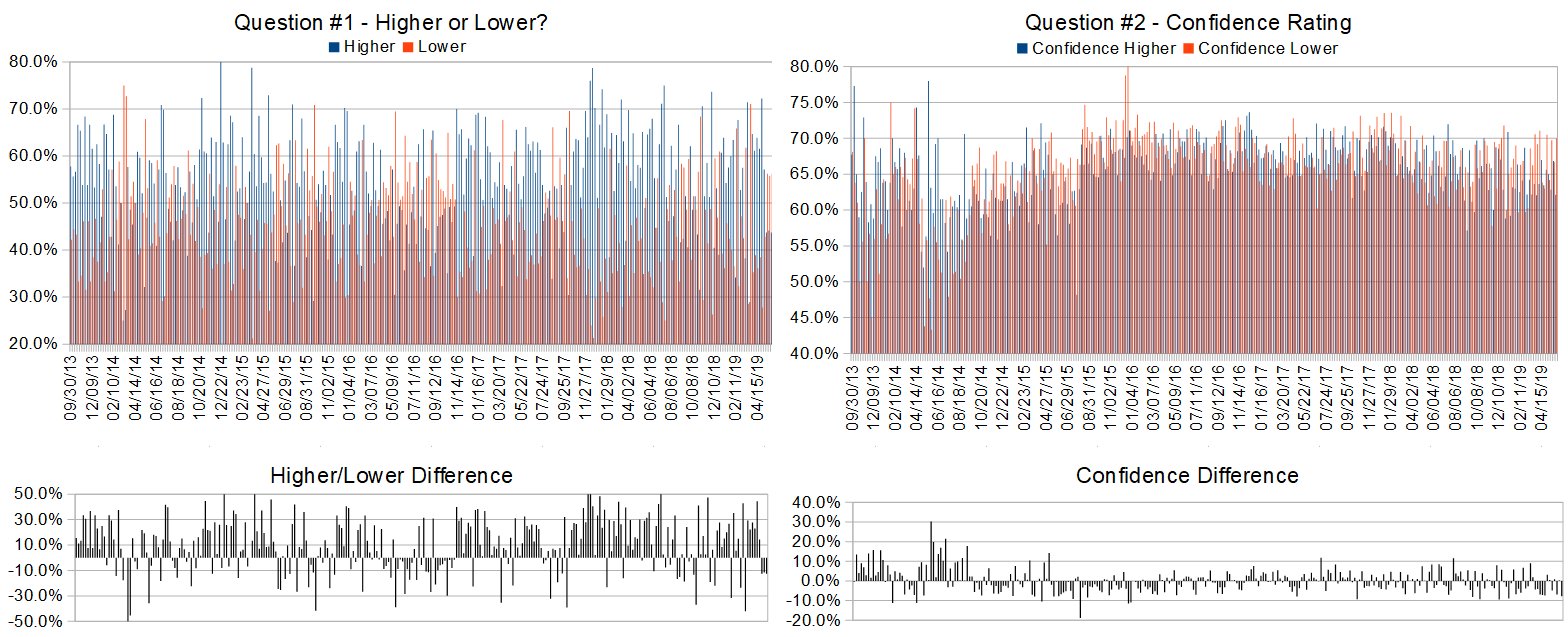

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 28th to 31st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 43.8%

Lower: 56.3%

Higher/Lower Difference: -12.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.6%

Average For “Higher” Responses: 62.1%

Average For “Lower” Responses: 70.0%

Higher/Lower Difference: -7.9%

Responses Submitted This Week: 33

52-Week Average Number of Responses: 38.4

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 55.8% Lower, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.56% Lower for the week. This week’s majority sentiment from the survey is 56.3% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 37 times in the previous 295 weeks, with the majority sentiment (Lower) being correct 43% of the time and with an average S&P500 move of 0.30% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

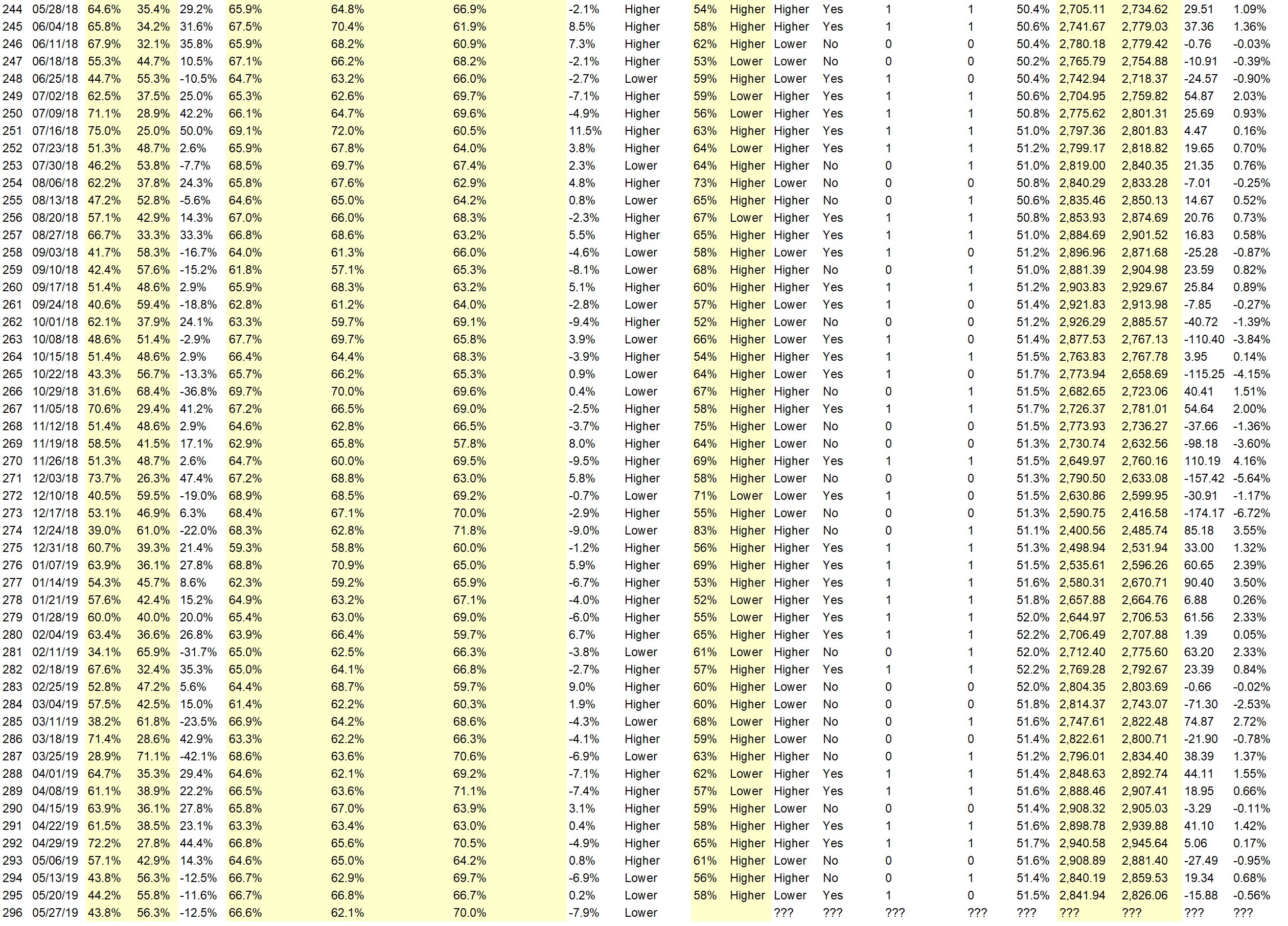

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Antiabrotion law signed by Bryant here

• We are due for a bounce!!!

• high demand of the security traded

• seasonal peak ends in May

• China trade agreement signed!

• wave 4 – unless not

• I think there is a bounce up after the last correction

• Really— not even 50%.

• momentum

“Lower” Respondent Answers:

• bearish head & shoulders pattern

• Sucker rally pestering 0ut

• All of the above

• Sell Cross over of the 10,20 EMA, VIX going up during the rise of the SPX (happens only before big drops), before Trump blew the Dow Futures (+200) into -500 at a highly risky point on May 5th and Trump getting crazier as the investigations keep piling up.

• lot of uncertainty ,spx toggling around 2800 long time ,,see downside to 2776-200dma

• China’s new tarriffs

• There’s no buoyancy in the market, other than in defensive areas such as utilities, REITs, & gold. Inverted yield situation deteriorating, which suggests slower growth ahead.

• Historically worst six months of the year

• Bonds tanked the economic recovery ran its course

• The chart has done a topping pattern, and fundamentals are deteriorating.

• Trend turning to down

• Tariff talk.

• Down below 50dma and at 200dma. I think it pushes below 200da for a time…

Partner Offer:

Fausto Pugliese, ex-SOES bandit and CEO of Cyber Trading University wants to prove to you that he and his students can reach their daily trading goals in less than 2 hours of trading each day!

This Thursday, May 30th at 12:00 pm ET, Fausto Pugliese is teaching a free class called “How to Make a Full-Time Income as a Part-Time Trader (in any market condition)”

TAP HERE to RSVP for this FREE webinar!

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on June 3rd.)

• rading plan

• No

• Quit jaw-boning. Get on with it.

• Review 1929, 2007 and now along woth the Political Parites which were in power during each Crash

• which stocks are market makers likely to push this week?

• How high will gold move in the coming months?

• How to stay invested and protect the portfolio

• risk analysis..

Question #5. Additional Comments/Questions/Suggestions?

• How is quantity important in trade

• None…..

• which sector is due for a push?

Join us for this week’s shows:

Crowd Forecast News Episode #226

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 3rd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #79

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, May 28th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Michael Filighera of LogicalSignals.com (moderator)

Partner Offer:

Fausto Pugliese, ex-SOES bandit and CEO of Cyber Trading University wants to prove to you that he and his students can reach their daily trading goals in less than 2 hours of trading each day!

This Thursday, May 30th at 12:00 pm ET, Fausto Pugliese is teaching a free class called “How to Make a Full-Time Income as a Part-Time Trader (in any market condition)”