Crowd Forecast News Report #301

AD: Need more capital to trade? Click for Futures or Forex.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport063019.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 1st to 5th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 74.1%

Lower: 25.9%

Higher/Lower Difference: 48.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.1%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 64.3%

Higher/Lower Difference: 2.5%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 37.6

TimingResearch Crowd Forecast Prediction: 60% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.7% Lower, and the Crowd Forecast Indicator prediction was 78% Chance Higher; the S&P500 closed 0.33% Lower for the week. This week’s majority sentiment from the survey is 74.1% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 15 times in the previous 300 weeks, with the majority sentiment (Higher) being correct only 40% of the time and with an average S&P500 move of 0.32% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Lower this coming week.

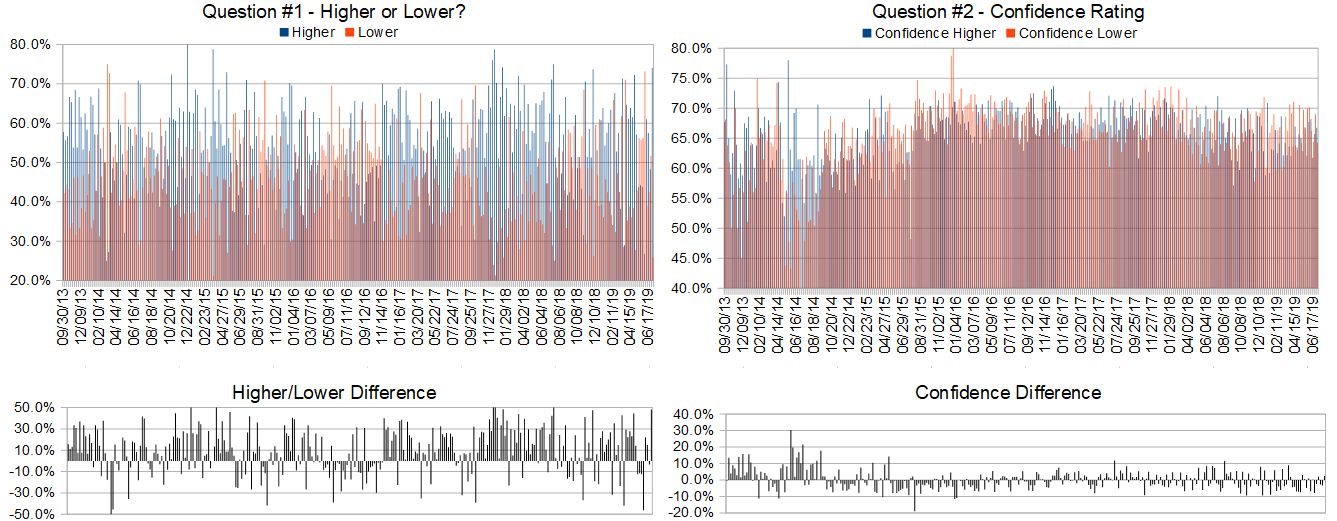

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

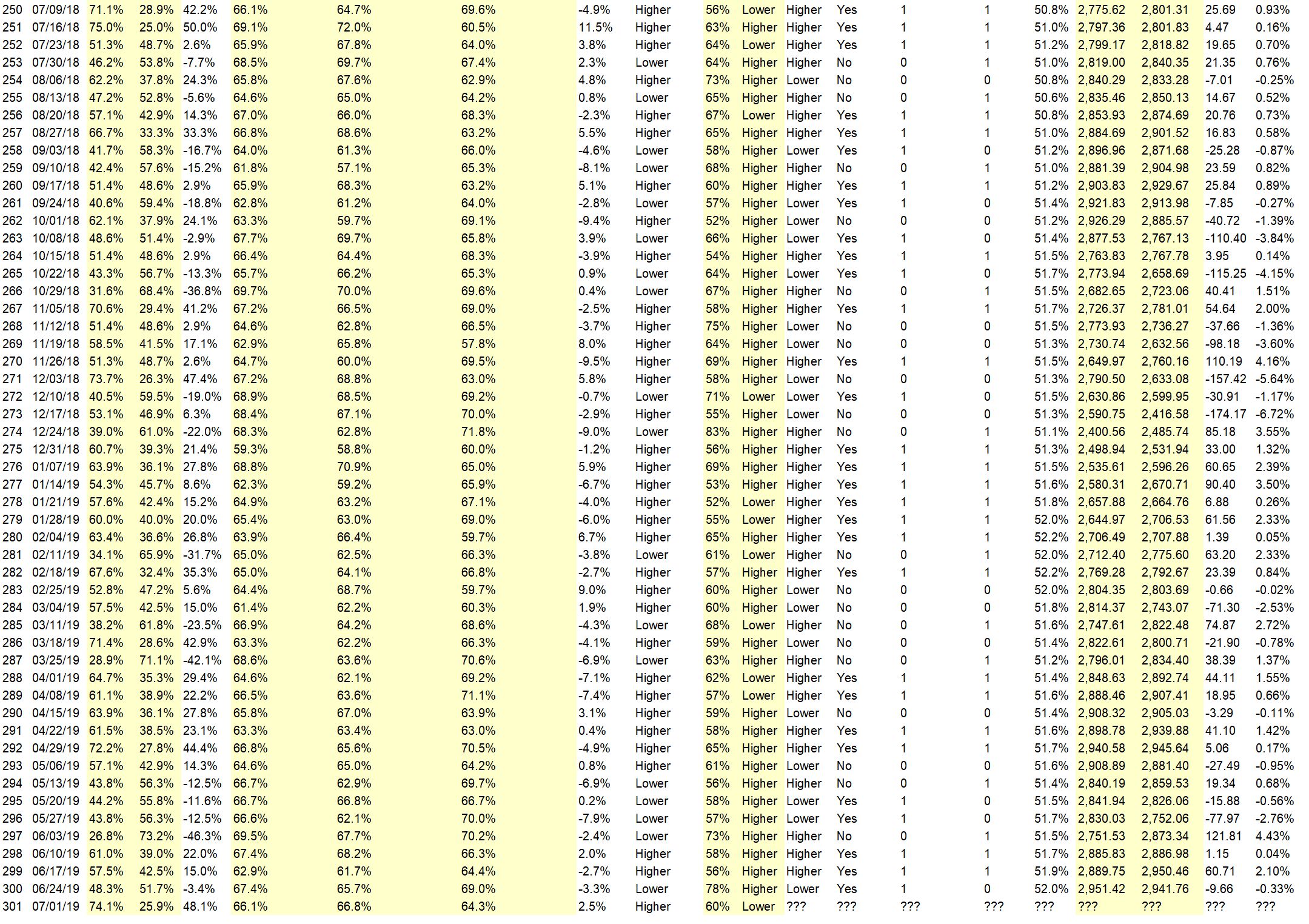

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• China resolution, first of the month and new disposable income coming into the markets. Institutions speculating on the effects of the G-20 meeting.

• wave 5 is still finishing

• new highs coming

• China

• We closed up 40 points last week after a pullback so higher, and the RSI is long.

• continue uptrend until it ends

• Trade talks

• history

• improved momentum

• Trump announcing his bid for the Race

• Holiday trading adjustments

• There’s room to move up to 3000 in the near-term. The US-China trade talks will probably drag on, and therefore not cause the market to drop.

• Talks

• China deal, positive week for next week usually, to much negative sentiment readings

“Lower” Respondent Answers:

• the falling interest rates are causing the herd to panic

• No direction for Trump/China deal

• Panic setting in the herd

• 4th of July Holidays, progress on the Trade Talks somewhat stalled

AD: Need more capital to trade? Click for Futures or Forex.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on July 8th.)

• the market direction

• Oil, uranium, hemp/cbd.

• Market direction

• Dividend stocks

• Not sure, I will think of some…………..

• Trading Systems that have a proven ‘Edge’

• Forecast the future

• momentum analysis and second derivative

• profit

• Indicators that really work

Question #5. Additional Comments/Questions/Suggestions?

• Keep playing the game………………

CFN is off this week but back on July 8th, AYT will be back on July 2nd.

Crowd Forecast News Episode #230

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 8th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com (first time guest!)

– Jake Bernstein of Trade-Futures.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #84

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 2nd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)