Crowd Forecast News Report #314

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport092919.pdf

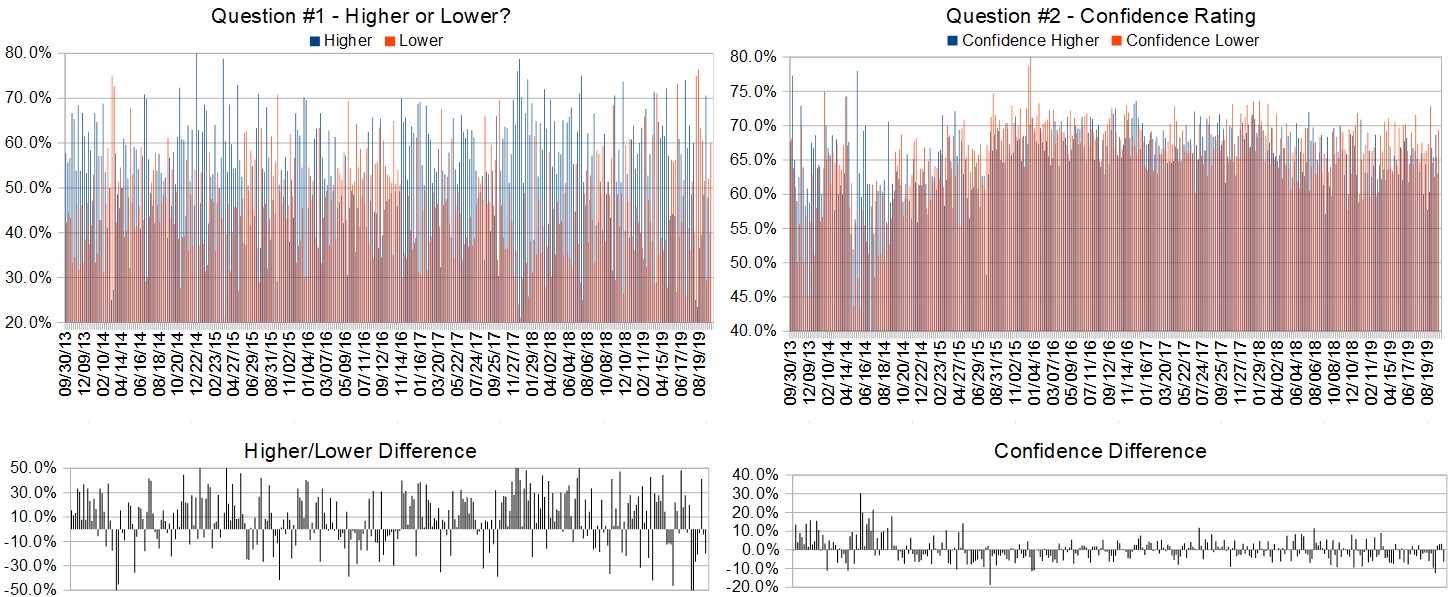

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 30th to October 4th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 44.4%

Lower: 55.6%

Higher/Lower Difference: -11.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.9%

Average For “Higher” Responses: 61.7%

Average For “Lower” Responses: 65.7%

Higher/Lower Difference: -4.0%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 36.3

TimingResearch Crowd Forecast Prediction: 55% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 60.0% Lower, and the Crowd Forecast Indicator prediction was 72% Chance Higher; the S&P500 closed 0.73% Lower for the week. This week’s majority sentiment from the survey is 55.6% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 42 times in the previous 313 weeks, with the majority sentiment (Lower) being correct 45% of the time and with an average S&P500 move of 0.35% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 55% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

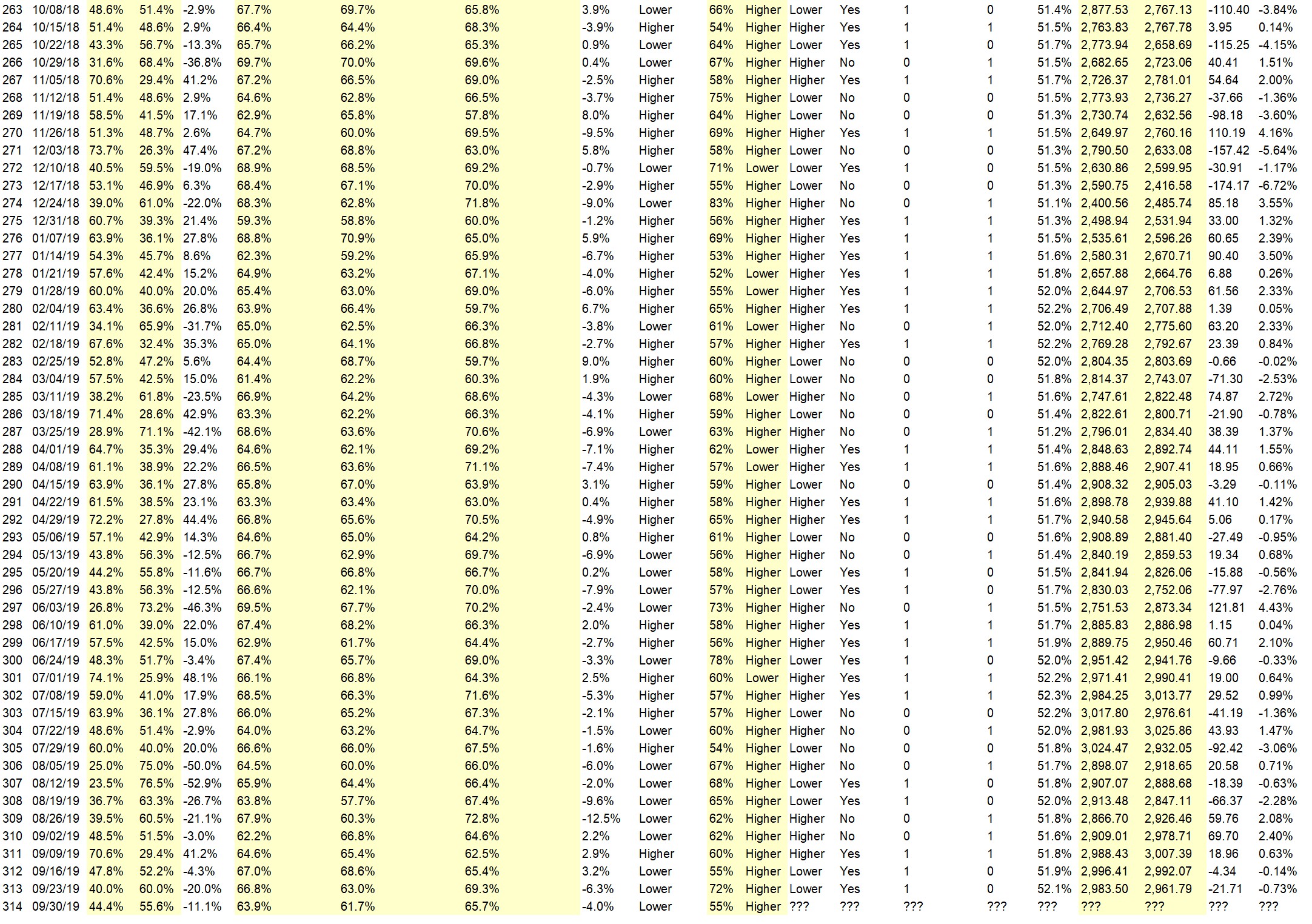

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 63.9%

Overall Sentiment 52-Week “Correct” Percentage: 61.7%

Overall Sentiment 12-Week “Correct” Percentage: 65.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I think next weeks market will move sideways. A lot of uncertainties in trade and the political picture.

• Low interest rates

• Bounce from this week

• resolution of impeachment

• Just a guess

• Trade deal

• The chart pattern suggests a lower start the week followed by a rebound rally.

“Lower” Respondent Answers:

• More White House Craziness

• lower before weekly wave 5 continues

• Range bound with weakness to the downside

• Unexpected move from whitehouse but hope this will be a rumor.

• Harry Dent

• China tarrifs

• S&P struggling at this point. Business investments lower; China trade issues going nowhere.

• Trump tweeting some market shaking things in an effort to move the news cycle away from the impeachment inquiry

• Its September. High probability the market corrects.

• Trends

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading or investing?

• Sell puts when unsure of market direction

• I don’t hedge

• One Triggers Two (OTT) = One Cancels Other (OCO) – at open of the options trade , place orders for both win (at +100% or such) and loss (-50% or such) on the options; ensure losses restricted and winners get closed before retracing

• stop losses

• Selling calls

• sell puts

• with Gold options

• Options: Buy/Sell Puts in-out

• None

• out of money calls and out of money puts

• TC2000

• Options

• Buy puts. Buy inverse etf’s

Question #5. Additional Comments/Questions/Suggestions?

• N/A

• Gold Rising

Join us for this week’s shows:

Crowd Forecast News Episode #240

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 30th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Mark Sachs of RightLineTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #96

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 1st, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Lance Ippolito of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)