Crowd Forecast News Report #272

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post.

Click here to download report in PDF format: TRReport120918.pdf

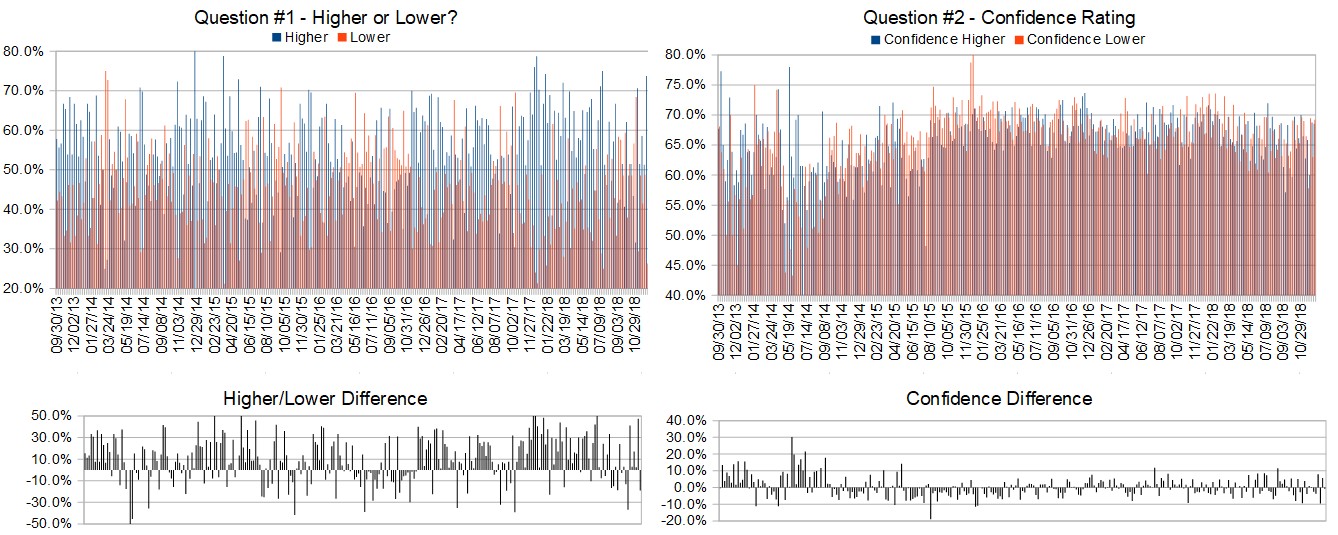

Question #Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 10th to 14th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 40.5%

Lower: 59.5%

Higher/Lower Difference: -19.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.9%

Average For “Higher” Responses: 68.5%

Average For “Lower” Responses: 69.2%

Higher/Lower Difference: -0.7%

Responses Submitted This Week: 44

52-Week Average Number of Responses: 44.6

TimingResearch Crowd Forecast Prediction: 71% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 73.7% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 5.64% Lower for the week. This week’s majority sentiment from the survey is 59.5% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 17 times in the previous 271 weeks, with the majority sentiment being correct 71% of the time and with an average S&P500 move of 0.21% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 71% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.3%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• gut feeling

• Double bottom established in technical chart

• Oversold on the week and at support level.

• Holidays

• Proparity

• Oversold Bounce

• Markets have fallen to near-term support

• oversold buy

• Fed to the rescue.

“Lower” Respondent Answers:

• people will give up

• Futures are lower and indicators are lower. Plus trade issues

• Down trend

• the arrest of Huawei CFO and 3 months of mostly negative talks

• earnings and unemployment metrics

• general impression from chart review session.

• still below 200ma lower lo,s lower hi-s

• continued bad economic news

• I have created a MTF RSIxxx that shows the DAY has just rolled over with the H4 short, H1 short, M15 short. Yes, we will get some short-term pull back, but then further down we will go….

• The downside correction will continue until the public says “Just Get me Out”.

• GDP growth in 2019 is expected to decrease to 2.5%, maybe lower. Federal balance sheet being reduced. Tariffs still a drag. None of this is positive for the S&P.

• There will be no China deal in 2018. The interest rate hike is pretty certain.

• This week’s drop

• we are going down!

• people arre fearful with what the media is saying about the President and the creating divison

• That just seems to be the trend these days. Lower.

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #4. What indicator influences your trading the most?

• Bollinger band analysis

• technicals

• VIX–

• Liquidity

• The Fed

• trend – Mov avgs

• CCI trend

• Custom indicators I have created

• Bollinger bands, MACD.

• 200ma

• RSI for short-term moves

• Moving Averages

• sentiment

• price and volume

• Stochastic

• elliott wave theory

• RSI

Question #5. Additional Comments/Questions/Suggestions?

• people will blame everything. but it’s just over valuation and expectation of decreased profits and the Silicon valley execs gone insane

• Anyone who chooses 100% sure cannot be correct. It only takes 1 future event to make the ship change course.

Join us for this week’s shows:

Crowd Forecast News Episode #207

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 10th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Damon Pavlatos of FuturePathTrading.com

– Glenn Thompson of PacificTradingAcademy.com

– Jim Kenney of OptionProfessor.com

– Michael Filighera of LogicalSignals.com (moderator)

Analyze Your Trade Episode #59

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 11th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Jerremy Newsome of RealLifeTrading.com

– Mike Pisani of AlphaShark.com (moderator)

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!