Crowd Forecast News Report #277

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport011318.pdf

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

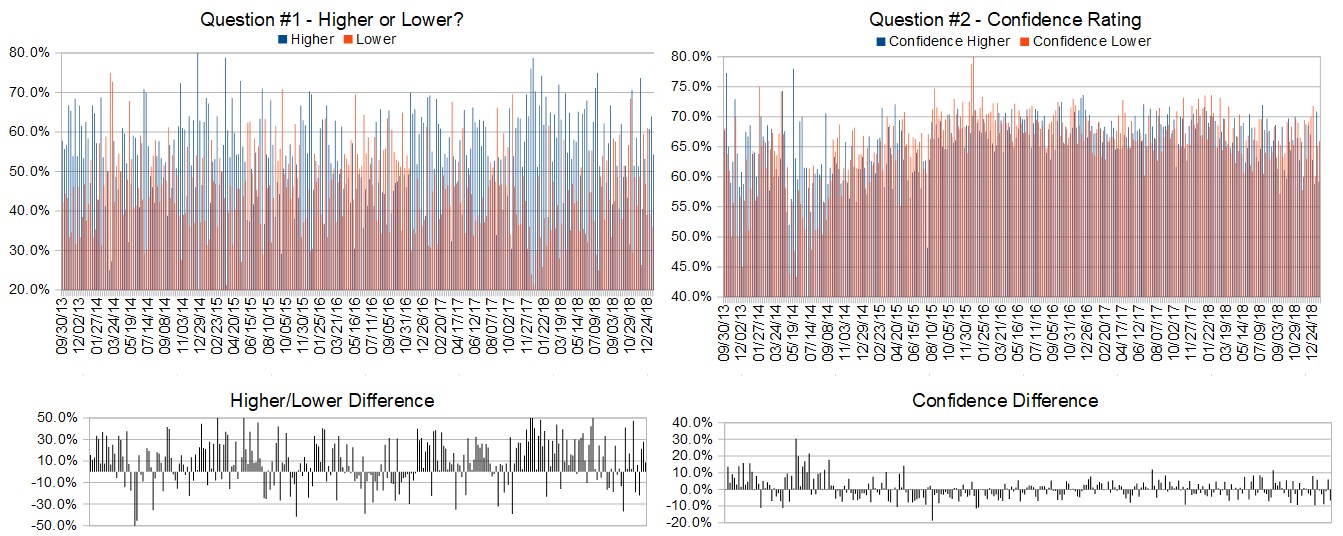

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (January 14th to 18th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 54.3%

Lower: 45.7%

Higher/Lower Difference: 8.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.3%

Average For “Higher” Responses: 59.2%

Average For “Lower” Responses: 65.9%

Higher/Lower Difference: -6.7%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 43.0

TimingResearch Crowd Forecast Prediction: 53% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.9% Higher, and the Crowd Forecast Indicator prediction was 69% Chance Higher; the S&P500 closed 2.39% Higher for the week. This week’s majority sentiment from the survey is 54.3% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 30 times in the previous 276 weeks, with the majority sentiment being correct 53% of the time and with an average S&P500 move of 0.07% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

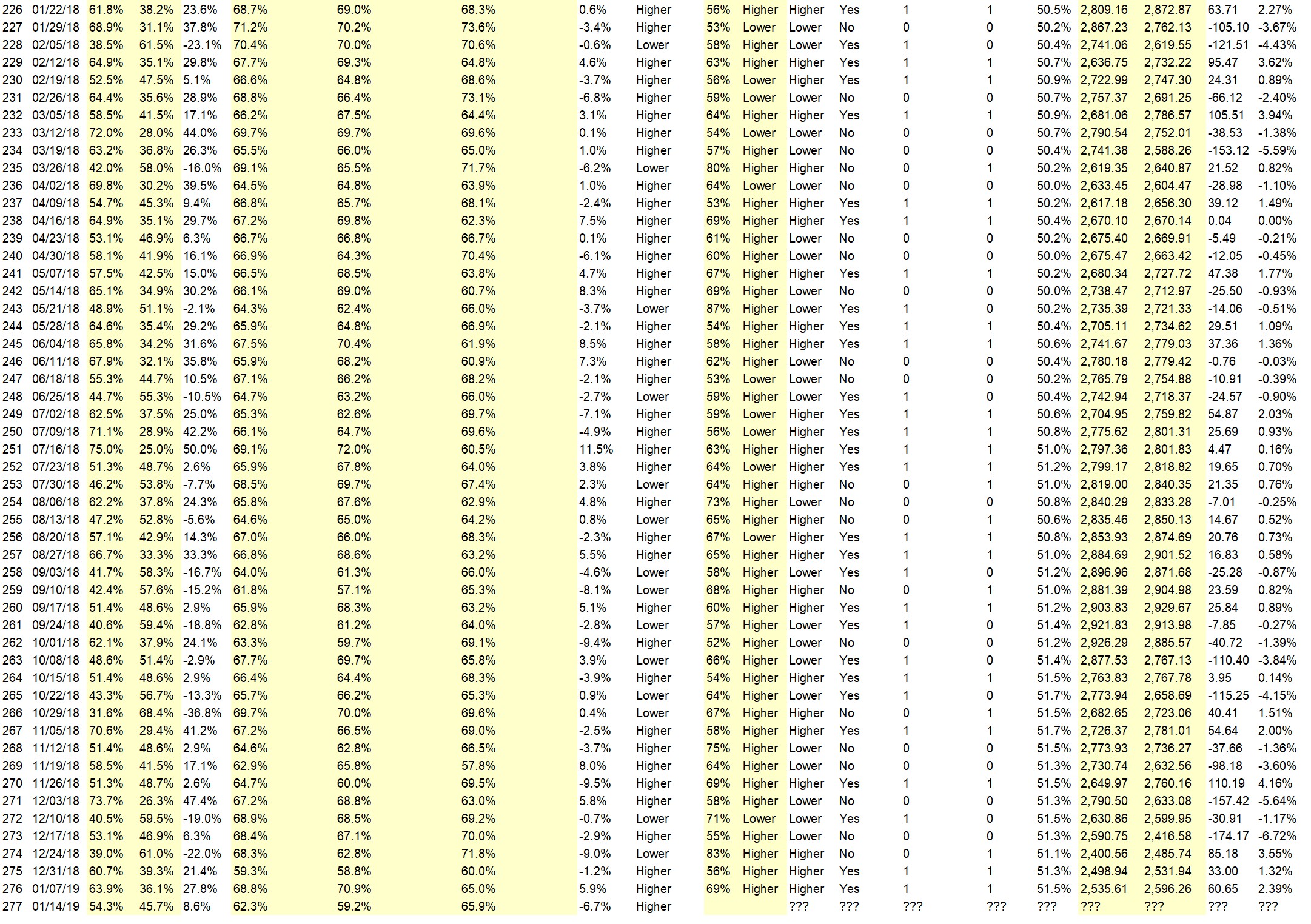

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Good FOMC maybe now group

• In the first part of the week the correction to 2550, until the end of the week penetration rates in 2600

• Looks like we’re rebounding

• Temporary upswing

• Mean reversion and gut feeling

• Market pulling back drawing in more longs.

• China NewYear

• We are at a decision point !!! Either direction can apply. The weekly RSI is dropping, the Day RSI has turned up. The tricky part is the H4 RSI is nearing a high with the H1 RSI being confused. The H4 will either pull back Monday, Tuesday and then continue Long or it will fail and retest 2500 area.

• Index stochastics (daily chart) are in reversal range.

• Honestly I dunno where the heck it’s going!

“Lower” Respondent Answers:

• fragile and reduced buying

• Magic 8 ball

• we are now up at key resistance spx 2600 and dow 24k -time to re-test .

• continued government shutdown

• Recent rally stops at resistance. This weeks earnings reports will put a damper on recent rally.

• Bank earnings this week; expecting uncertainty as they look to the future. Financial sector uncertainty with gov shutdown and future growth expectations can hold back the S&P.

• No resolutions to the 2 primary problems and earnings forecast will be lower

• Short term overbought condition combined with corresponding decline in A/D volume.

• hit the resistance

• volume is low

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #4. What do you think are the main reasons why most traders are not successful and consistent? What could the average trader do to improve consistency?

• If I knew the answer I’d still be trading and doing it successfully.

• Do NOT trade where you think it’s going. Instead, have a plan with stops based on risk/reward/probability. Assume probability is 40-60%.

• lack of a plan and discipline

• Poor money and risk management

• psychological

• fear

• Everything is a trap. If you haven’t seen it, you are in it. If it looks obvious it’s a trap. Wait for the play and then enter.

• Be patient

• Many traders jump into trades carelessly and pay too much attention to bad advice and news headlines.

• You must look at all TF’s and look from the top down as I have in Question #1 If the direction is not clear, do not trade, wait for that clear direction.

• Market Volatility induced by exogenous events.

• too many institutions with more money in the market speculating

• They do not lose losses until they are small. They too believes in their own infallibility.

• Discipline. Trade your plan.

• Stop sells at purchase price

• get better at interpreting candlesticks

• Knowledge needed of trends and market behavior. Few gain the knowledge.

Question #5. Additional Comments/Questions/Suggestions?

• No, thank you, you are the expert.

• The more you learn the more you earn. Never ever give up! you will get it in time.

• Not Sure

• political gridlock

Join us for this week’s shows:

Crowd Forecast News Episode #210

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 14, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #62

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 15th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Oliver Schmalholz of NewsQuantified.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!