Crowd Forecast News Report #312

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport091519.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 16th to 20th)?

Higher: 47.8%

Lower: 52.2%

Higher/Lower Difference: -4.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Responses Submitted This Week: 25

52-Week Average Number of Responses: 36.5

TimingResearch Crowd Forecast Prediction: 55% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

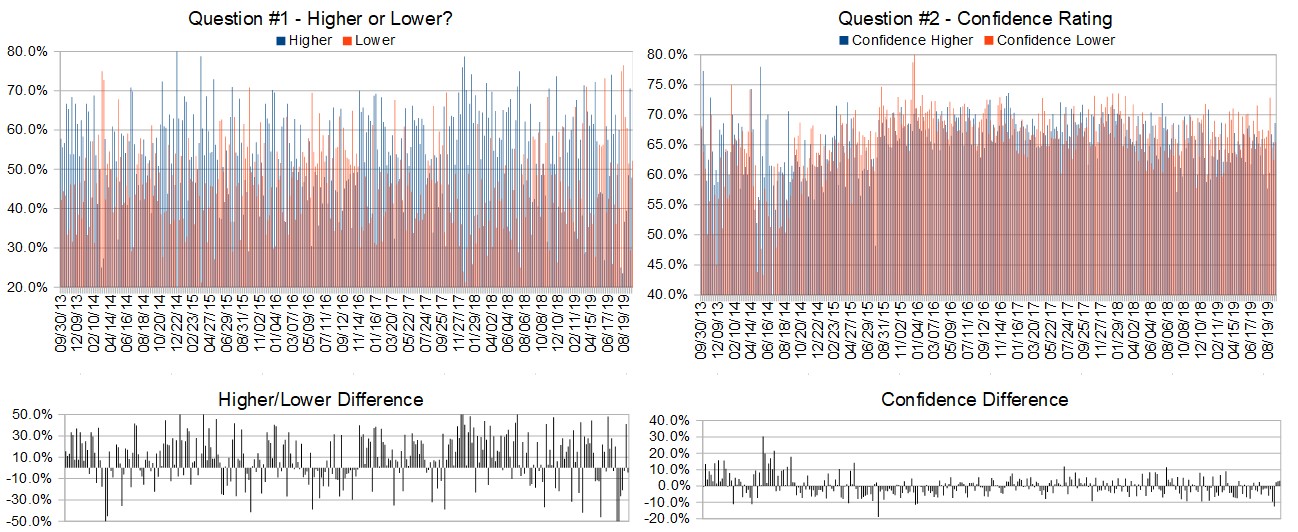

Details: Last week’s majority sentiment from the survey was 70.6% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.63% Higher for the week. This week’s majority sentiment from the survey is 52.2% Lower with a greater average confidence from those who responded Higher. Similar conditions have occurred 22 times in the previous 311 weeks, with the majority sentiment (Lower) being correct 45% of the time and with an average S&P500 move of 0.10% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 55% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

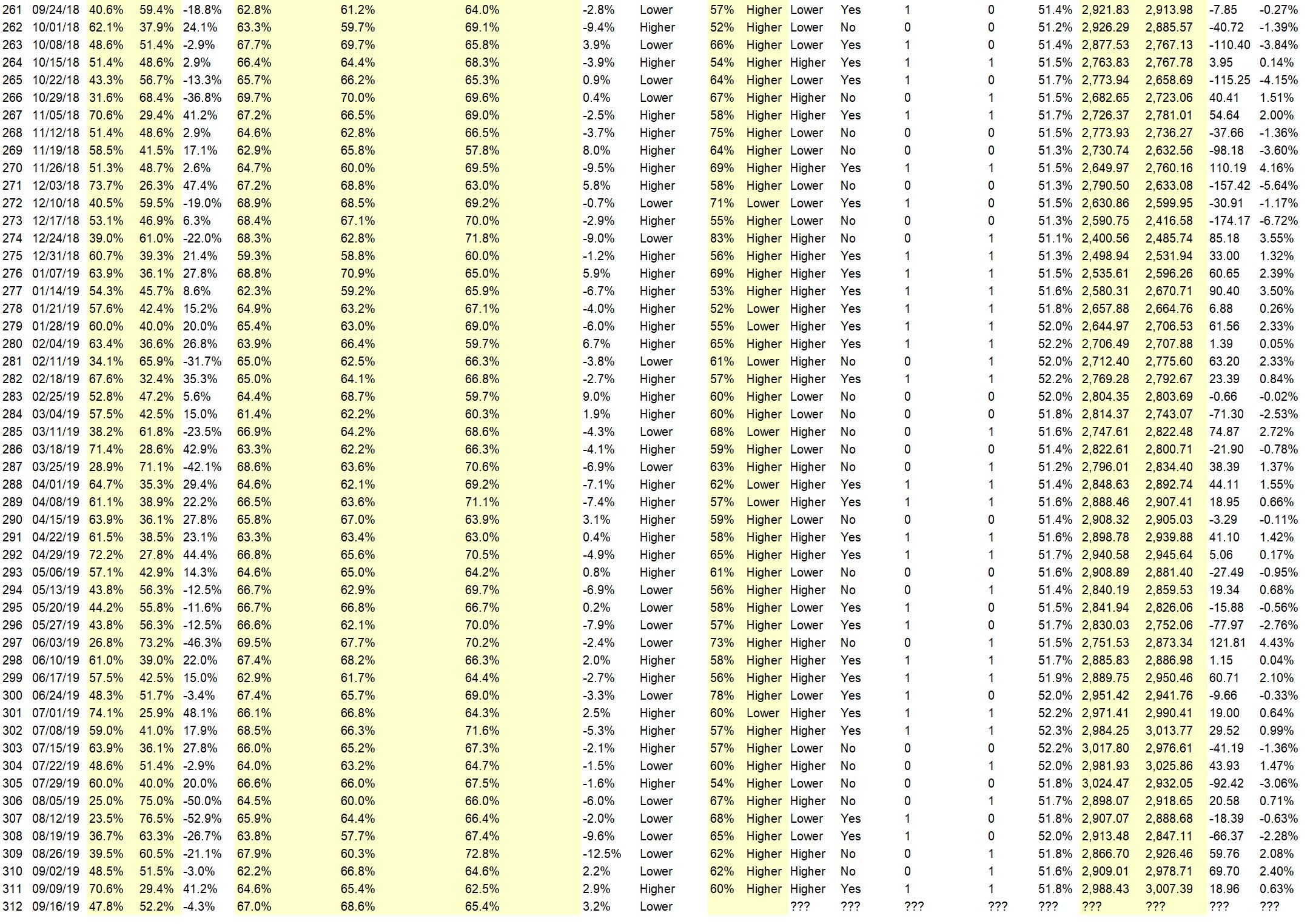

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.8%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• trend

• Bounce

• FED lowering interest rate

• wave 5 still finishing

• recently the S & P broke out of compression

• Momentum

• Market ready for a blow off when rates rise, Setup continues until rates rise blow off coming soon

• sideways move at highs before breaking to new highs

• momentum Fed anticipation internals

“Lower” Respondent Answers:

• Resistance area maybe more selling than buying

• travel too far too fast

• Chart top

• Oil issues middle east and other macroeconomic factors in Europe.

• The S&P 50-day MA is flattening, and the S&P is skirting near the top Bollinger band, which makes a short-time pop less likely. Also, dissent on the Fed may keep the FOMC statement from being dovish.

• Thursday high

• Profit booking may come in the next week

Partner Offer:

Question #4. What methods or techniques do you use to overcome the emotional aspects of trading?

• Have a fixed plan for long term investing

• daily chart

• 20 day. 50 day ma

• I STAY in my Comfort Zone

• sit and watch all my right analisys go to waste

• Oversold/overbought conditions

• back tested strategies and rules

• I am not all that successful at it but try to follow a plan

• Scotch on the Rocks!

Question #5. Additional Comments/Questions/Suggestions?

• i think i will like this page it is like having a trading buddy

• Gold stalls and begins to move higher

Join us for this week’s shows:

Crowd Forecast News Episode #238

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 16, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

– Mark Sachs of RightLineTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #94

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 17th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Felix Frey of OptionsGeek.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders #3

For this event 5 amazing trading educators available to teach you about their top trading strategies. We are inviting you to spend the day learning top trading strategies from leading industry experts that will bring you closer to achieving your trading goals.

Date and Time:

– Saturday, September 21st, 2019

– 10AM ET (7AM PT)

Moderator and Guests:

– 10AM ET: Rob Smith of T3Live.com (first time guest!)

– 11AM ET: Jerremy Newsome of RealLifeTrading.com

– 12PM ET: Anka Metcalf of TradeOutLoud.com

– 1PM ET: Ryan Mallory of SharePlanner.com (first time guest!)

– 2PM ET: TBA