Crowd Forecast News Report #322

[AD] Report: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport112419.pdf

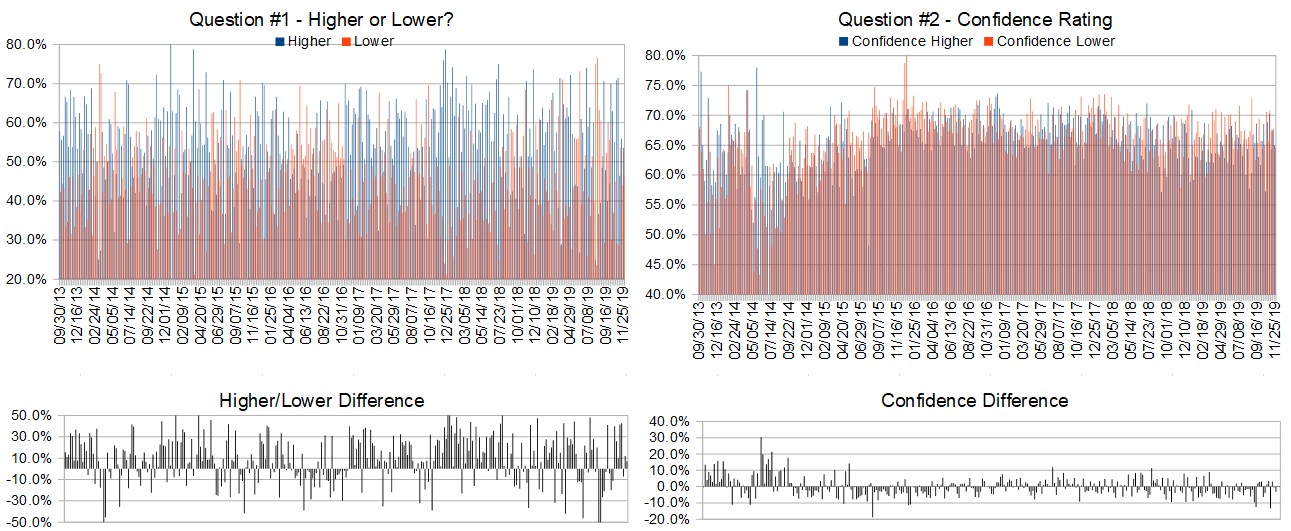

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 25th to 29th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 53.6%

Lower: 46.4%

Higher/Lower Difference: 7.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.8%

Average For “Higher” Responses: 65.0%

Average For “Lower” Responses: 64.6%

Higher/Lower Difference: 0.4%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 34.6

TimingResearch Crowd Forecast Prediction: 70% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 53.6% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 0.24% Lower for the week. This week’s majority sentiment from the survey is 53.6% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 20 times in the previous 321 weeks, with the majority sentiment (Higher) being correct 70% of the time and with an average S&P500 move of 0.66% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 70% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: eBook: The Options Answer.

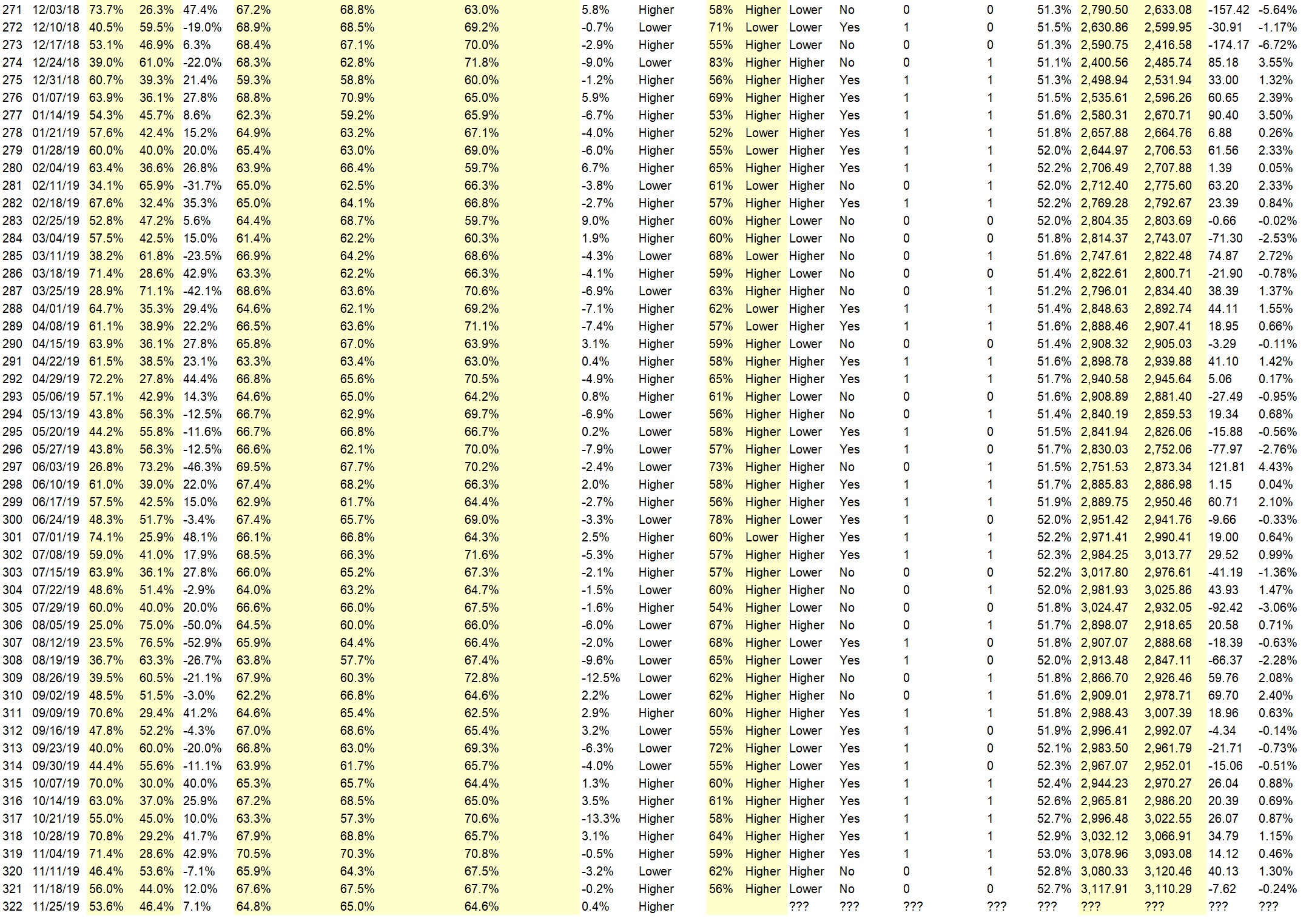

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.7%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• History.

• holidays

• End year

• The S&P stayed above its 20-day MA this past week on a small dip; and it looks like that dip is being bought. The market has been up on 75% of Thanksgiving weeks since 1945.

• Holiday effect

• Stable market

• Best six months of year historically

• Short week

“Lower” Respondent Answers:

• this market is propped up by low interest rates when that ends it will crash worse than 2008

• propped up by artificially low interest rates farther from inflationary recovey but not falling into a recession either

• short holiday week, traders do not want to hold a lot over long-term weekend

• market heading to support3071..3031

• 6 mo stochastic falling

• Mkt needs a pull back before it continues up into the Xmas rally.

• orderly retrace in the uptrend

• Trade talks stall in reaction to Hong Kong bill passage

• Looks like ending diagonal on daily and on weekly.

• Trade concerns

AD: eBook: The Options Answer.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week, but back on December 2nd.)

• brokers fees

• Fundemantal

• auto trading

• Psychology, psychology, psychology

• Selling put options

Question #5. Additional Comments/Questions/Suggestions?

• Gotta keep sense of humour and stops in place and realize that nobody really knows ANYthing, especially myself.

Both shows are off next week, we have arranged this event for you instead:

Synergy Traders #7 – Black Friday and Cyber Monday Trading Strategies

Join us on Monday starting at 12PM ET. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time:

– Monday, November 25th, 2019

– 1PM ET (10AM PT)

Lineup for this Episode:

– 12PM ET: John Thomas of MadHedgeFundTrader.com

– 1PM ET: Simon Klein of TradeSmart4x.com

– 2PM ET: Anka Metcalf of TradeOutLoud.com

– 3PM ET: Brian Miller of OptimizedTrading.com

– 4PM ET: Bryan Klindworth of AlphaShark.com

AD: eBook: The Options Answer.