Crowd Forecast News Report #337

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport030820.pdf

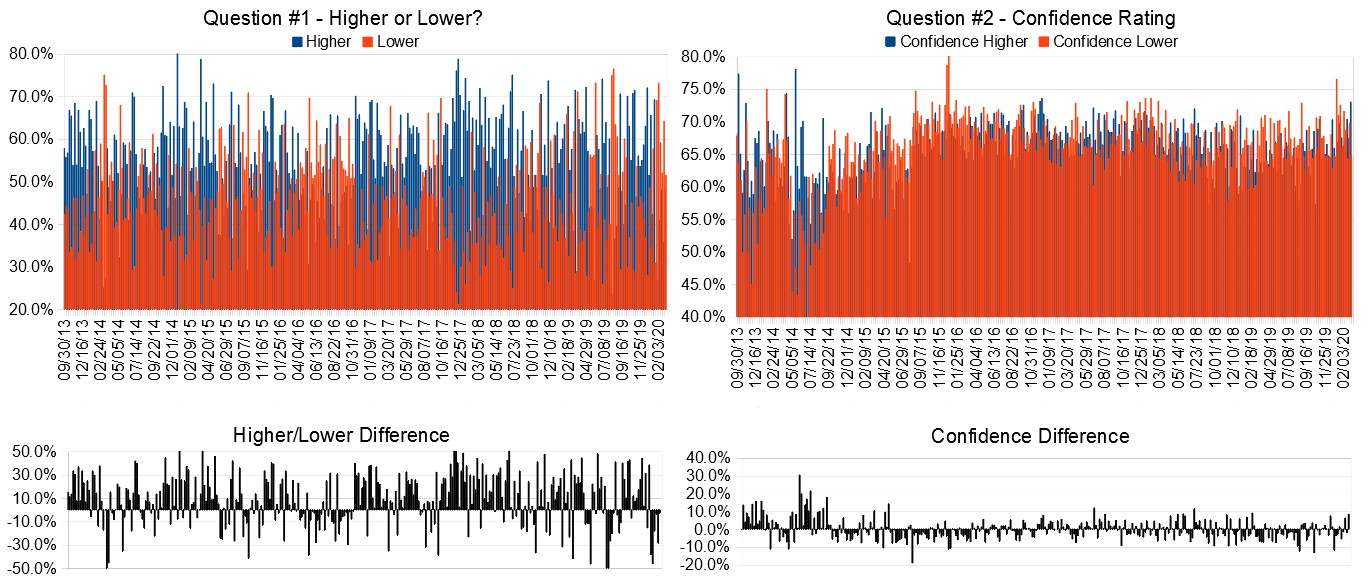

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 9th to 13th)?

Higher: 36.7%

Lower: 63.3%

Higher/Lower Difference: -26.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.3%

Average For “Higher” Responses: 65.5%

Average For “Lower” Responses: 76.3%

Higher/Lower Difference: -10.9%

Responses Submitted This Week: 30

52-Week Average Number of Responses: 32.3

TimingResearch Crowd Forecast Prediction: 55% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

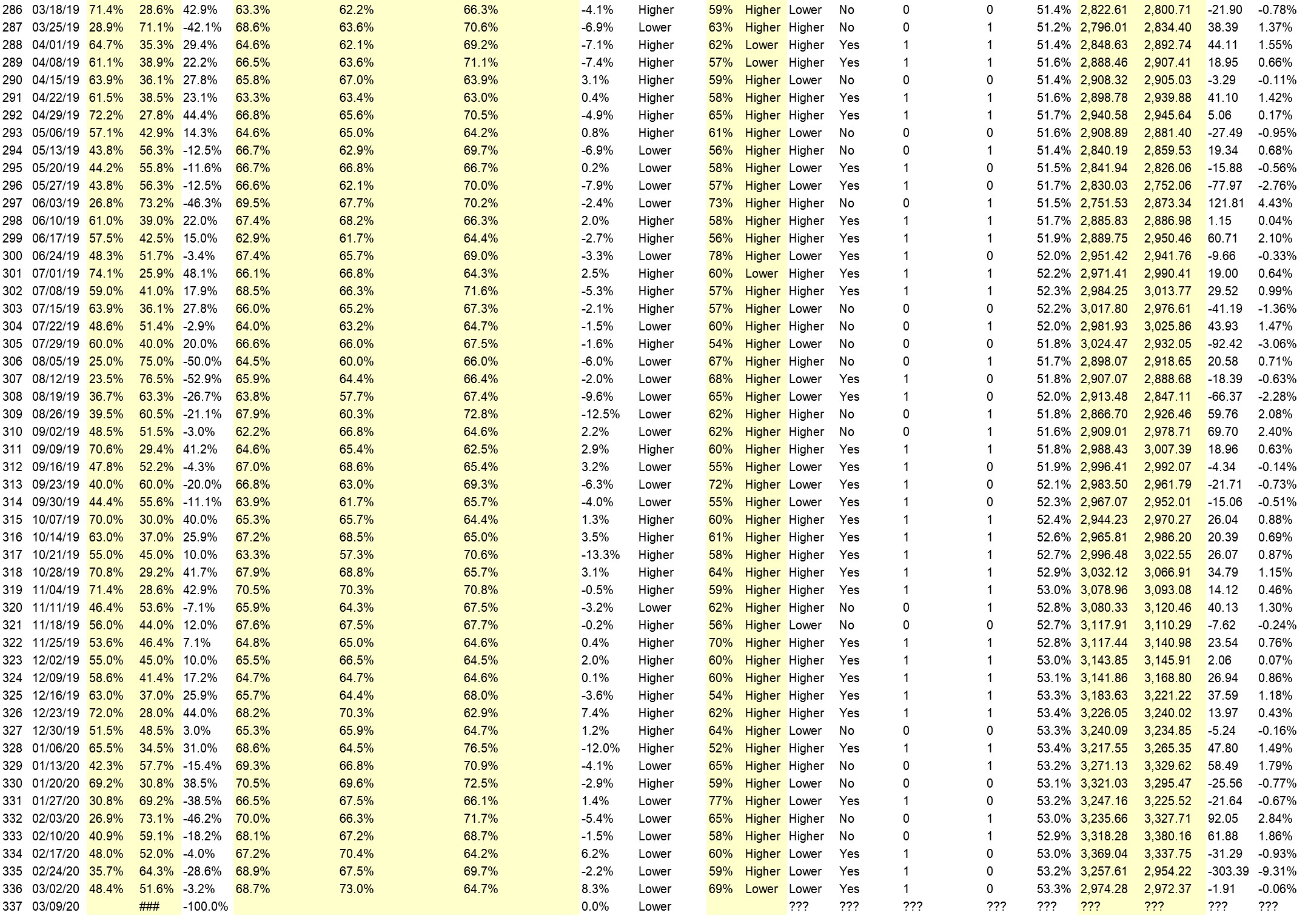

Details: Last week’s majority sentiment from the survey was 51.6% predicting Lower, and the Crowd Forecast Indicator prediction was 69% chance Higher; the S&P500 closed 0.06% Lower for the week. This week’s majority sentiment from the survey is 63.3% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 47 times in the previous 336 weeks, with the majority sentiment (Lower) being correct 45% of the time and with an average S&P500 move of 0.24% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 55% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.3%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• fears ease

• Friday last hour int0 cl0se

• Fridays close

• ready for a small bounce then down further.

• Market appears to have retested the bottom this Friday (March 06, 2020) and recovered into closing. I believe the recent market correction was initiated due to the Corona-virus (Covid-19) becoming a global pandemic.

• The s&p can only go so low before a bounce back. Only an opinion…

“Lower” Respondent Answers:

• China flue & loss of containment in Europe

• greetings from Coronavirus – impacting industry supply-chains, travel, airlines und many more …

• The fool US president, corona virus, and drain on consumer buying power resulting form excess concentration of wealth in too few hands.

• an increase in infections and deaths going to take the mkts lower

• In daily vision it’s poised for an upside, but if you look at a weekly chart it’s not poised for a weekly bounce. My 70% chance it’s because statistically it could bounce after having a retest of the lows, however the Corona Virus pandemic it’s still a risk and it’s not going away soon.

• While I was a little surprised with some of the upswings after the hudge down days, I am not yet convinced that the selling pacic of the corona virus is over. For this reason I voted down for the week but with a low conviction as we watch this new threat progress. Not to make light of this situation but I plan to stay calm and use this time as a buying oppertunity.

• Downward trend

• Last weel performance

• broke major trend line

• production slow down china, corona virus global,

• The Fed lowering rates did not cause a rally, so what will? COVID-19 will continue to spread, with travel & crowd gatherings curtailed more; supply chains in trouble. Economies to be hurt for an extended time.

• Virus fear

• covid is out of control

• collapse in oil prices

• corona

• The news is bad

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading?

• Great question! Something i must work on.

• puts

• buying put spreads

• selling premium

• stops

• I only do speculative trading, however just buying gold or implementing covered calls should be enough.

• We will sometime place a collar on a long term position. I will also trade an underlying that is non-correlated to my open positions and finally we do use inverse TFs from time to time.

• 0

• Buying puts.

• puts

• puts

• gold

• 0

• Sell cash covered puts with low delta rather than buy stock

• emini’s bought and sold.

• I use Collar as a hedging strategy.

• go to cash

• option

• SPX puts

• Try to do a few points and sell after a 2% loss.

• None

Question #5. Additional Comments/Questions/Suggestions?

• Italy has a mortality rate of 26% of those severely infected. Since Italy is an 1st world country, how can China’s numbers be correct, given the fact it hit there 1st and China living conditions are inadequate compared to Italy? This is far worse than shown! Withn two months i believe they’ll be growing issues on every continent.

• Nobody I mean nobody can predict the stock market….only the cheaters.

[AD] eBook: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies