Crowd Forecast News Report #339

[AD] Report: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport032220b.pdf

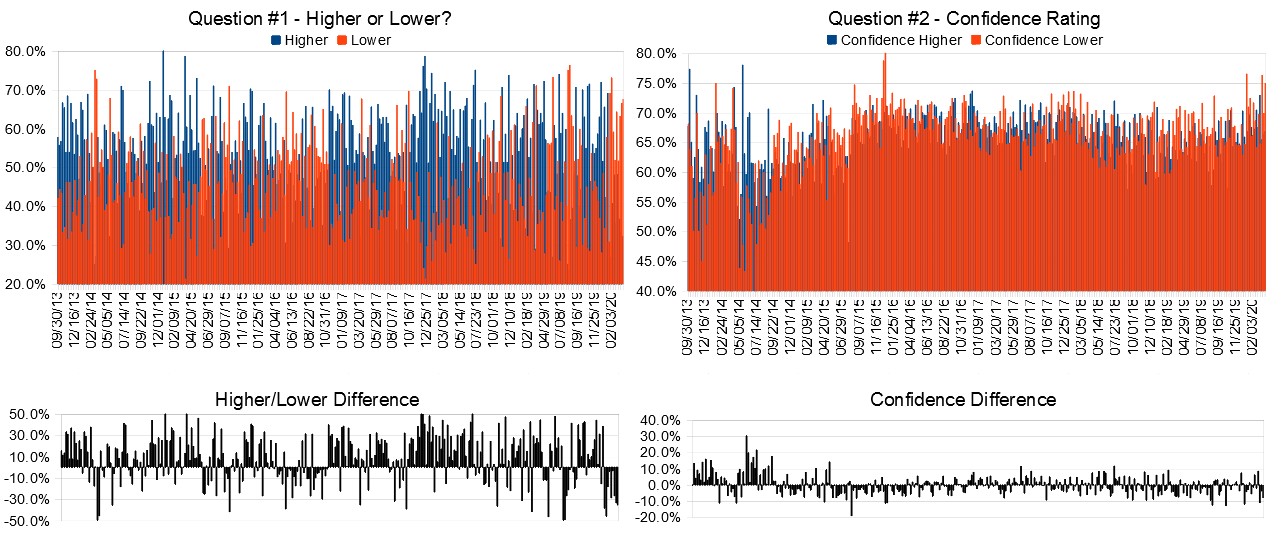

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 23rd to 27th)?

Higher: 32.4%

Lower: 67.6%

Higher/Lower Difference: -35.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.4%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 75.0%

Higher/Lower Difference: -8.2%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 32.0

TimingResearch Crowd Forecast Prediction: 53% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.7% predicting Lower, and the Crowd Forecast Indicator prediction was 54% chance Higher; the S&P500 closed 8.12% Lower for the week. This week’s majority sentiment from the survey is 67.6% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 49 times in the previous 338 weeks, with the majority sentiment (Lower) being correct 47% of the time and with an average S&P500 move of 0.04% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

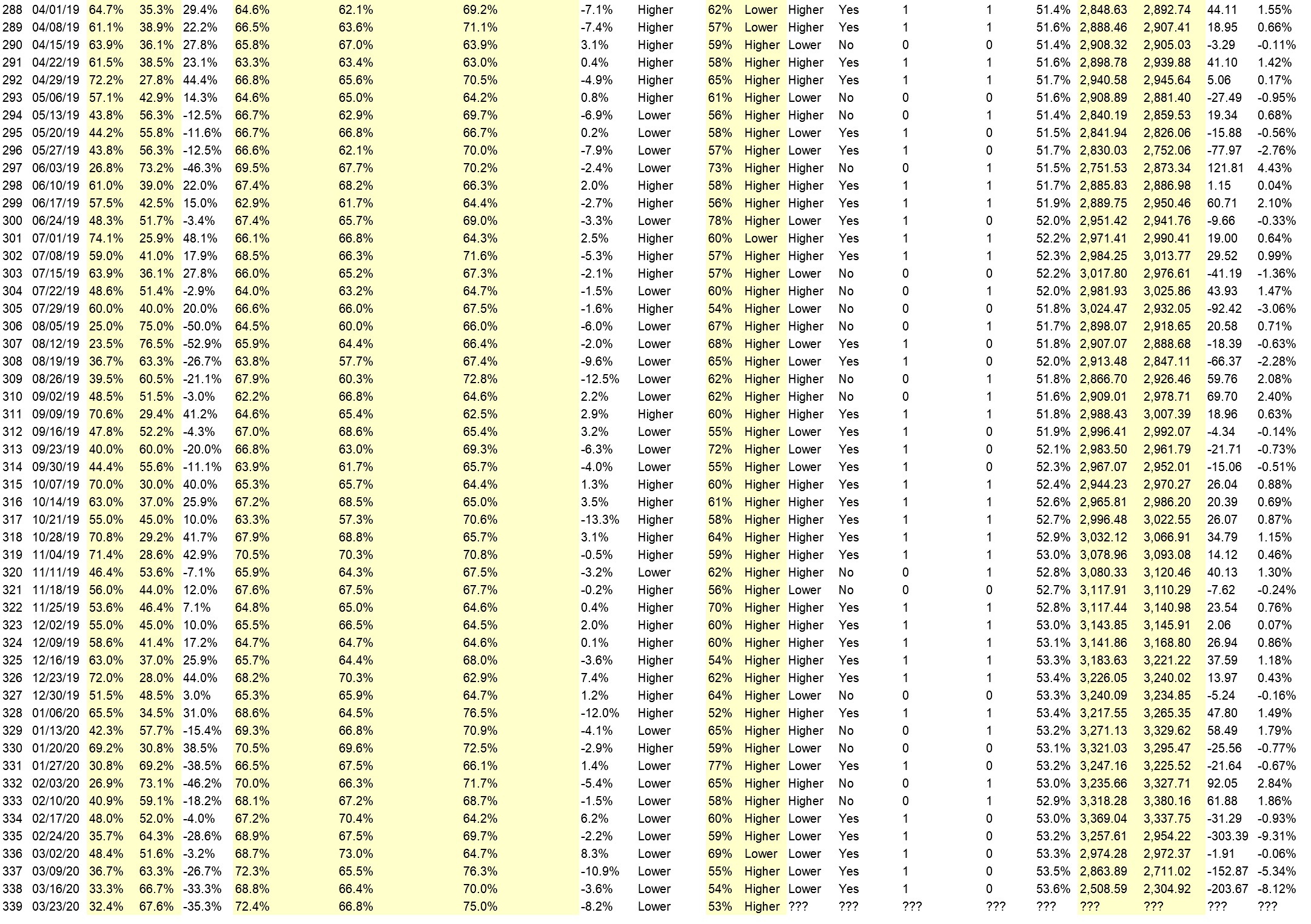

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.6%

Overall Sentiment 52-Week “Correct” Percentage: 66.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Things will start to calm down

• it is due for a rebound after that big sell off

• I believe after a slower start to the week, I’m hoping that the oil market will start to pick up, carrying other equities with it.

• Overdue bouncback

• With the relief packet issued by federal government, confidence in economy is growing and this should take market upwards.

• We are near all time lows.

“Lower” Respondent Answers:

• Developing financial & social implications of CV.19.

• covi19

• Because the price action pattern is still bearish and also the volume is still above 20MA. The lower probability is because the little money flow divergence

• China Flue

• Virus test results still increasing Too much stress incredit markets

• the friday activity was absolutely brutal.

• worsening coronavirus environment

• market is in a huge bubble

• lack of leadership at the executive branch.

• Accumulation going on but in the very early innings of a turnaround alot more down days ahead

• coronavirus hasn’t been priced into the market yet

• coronavirus

• Bad news, no recovery

• The unemployment rate is expected to increase, as businesses face increasing financial pressures, as the coronavirus pandemic continues into another week.

• Monday will open down. Just not sure there will be anything to push the market back up.

• S&P 500 is on a PE of 17 and Corona virus is going to cut earnings to zero

• oil in a downward move as well as US100 … corona virus Big Airlines may go to bankruptcy … and from a technical point of view no support is seen… and the cash dollar will remain the king … any intervention from the FED may change the view.

• Fear of COVID 19. Then the disruption of products and services to escalate

• High. Vix index

• COvid-19 STORY and thin non-liquid market conditions

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Question #4. What are your top questions for trading experts about current market conditions and how to trade over the next few weeks?

• Knowing the bottom has been put in

• average down or wait for a bottom?

• The fact I quit trading because of Forex brokerage houses scam and fraud and many of my friends got scammed including me

• How do you idiots keep your jobs?

• What do you consider the priorities for selecting shares in the immediate future ?

• why didn’t you guys issue a sell recommendation before then during the selloff? and HOW exactly do you idiots keep your jobs?

• what will you be looking for as the signs of capitulation?

• What stock are hedges against further downside of the Doe and S&P?

• How to trade volatility for next few weeks?

• how would you trade bond ETF’s?

• have you ever seen a financial crisis like this before?

• How to stop shorting the markets?

• none

• Is the market becoming a faster moving entity?, due to all the different factors – algo’s, AI, etc. /// does the little guy stand a chance?

• Well the big question is where is the bottom, are we close to it???

Question #5. Additional Comments/Questions/Suggestions?

• Thank you … Wishing you a great time ahead

• when is the crisis, to the markets, going to end?

• Self isolate

• I heard one commentator mention that what used to take weeks to develop in the markets, now only takes hours. // Is this a valid statement?

Join us for this week’s shows:

Crowd Forecast News Episode #257

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, March 23rd, 1PM ET (10AM PT)

Moderator and Guests:

– Anka Metcalf of TradeOutLoud.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #120

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, March 24th, 2020, 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #12

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday-Friday, April 2nd-3rd, 2020, 9AM ET-TBA

Moderator and Guests:

– TBA

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies