Crowd Forecast News Report #342

[AD] Report: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport041220.pdf

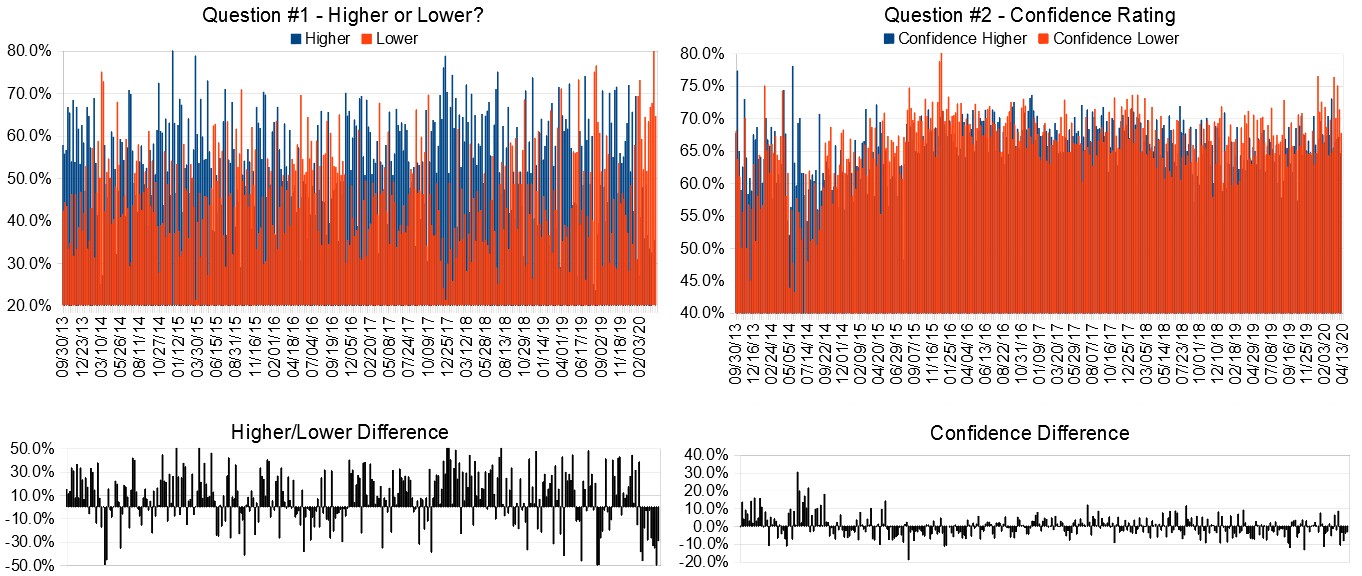

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 13th to 17th)?

Higher: 48.1%

Lower: 51.9%

Higher/Lower Difference: -3.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.9%

Average For “Higher” Responses: 65.8%

Average For “Lower” Responses: 75.7%

Higher/Lower Difference: -9.9%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 31.7

TimingResearch Crowd Forecast Prediction: 67% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 64.5% predicting Lower, and the Crowd Forecast Indicator prediction was 57% chance Higher; the S&P500 closed 8.20% Higher for the week. This week’s majority sentiment from the survey is 51.9% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 21 times in the previous 341 weeks, with the majority sentiment (Lower) being correct 33% of the time and with an average S&P500 move of 0.33% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

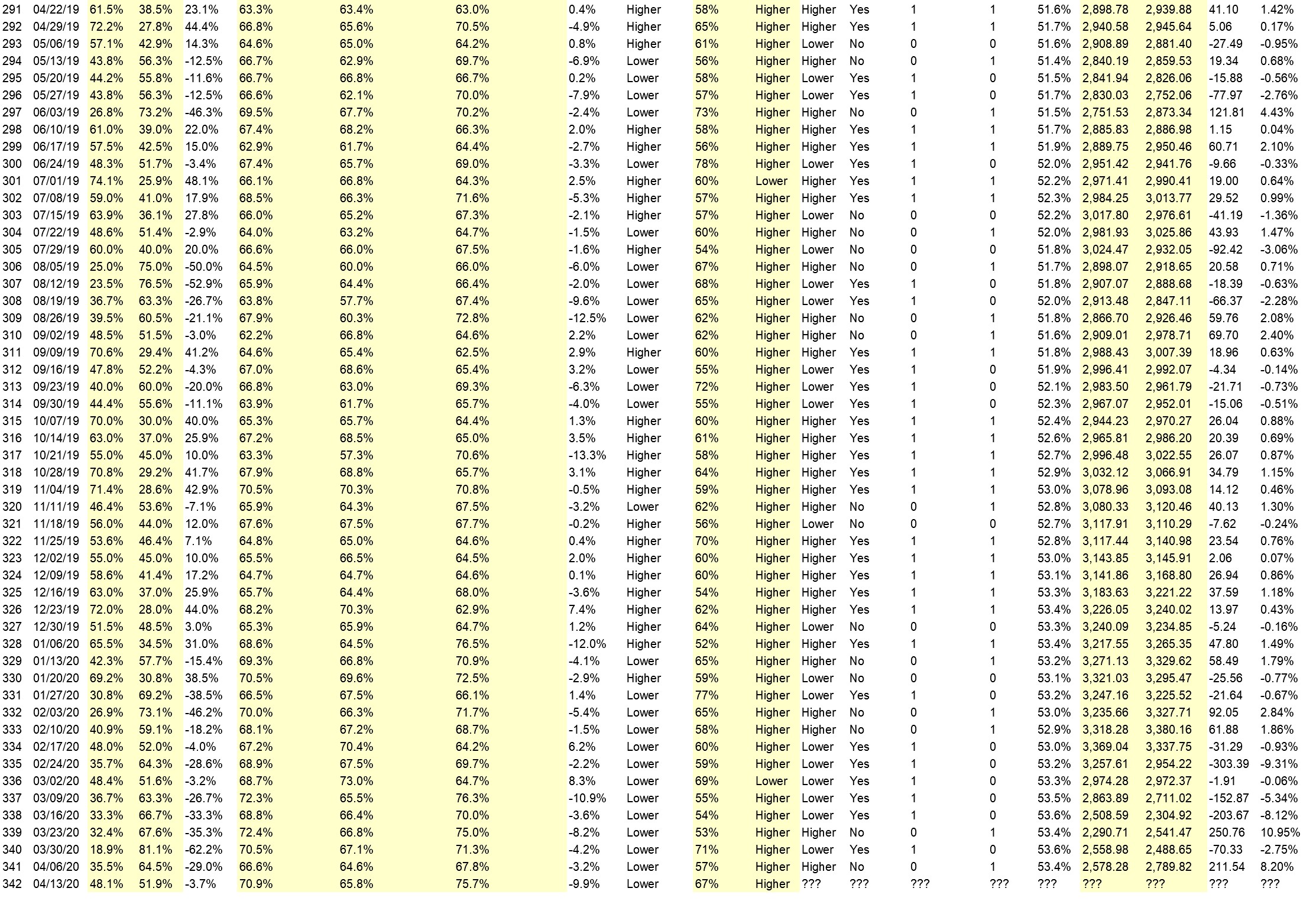

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I’m assuming Pelosi and Shumer stay off the bottle and for once work with congress regarding the PPP.

• liquidity infusion by the FED

• The Market has had enough of the Hong Kong Flue, it is time to move on.

• Good news on CV

• Momentum is climbing

• The major bank stocks rallied on Thursday because of the Fed, but also in front of earnings. I am going with this momentum, looking for the financial sector to keep the S&P from falling, and for the S&P to move up to the next Fibonnaci level.

• they are pumping another $2.3 trillion into the market

• Pre holiday trade pattern until wednesday then sideways or down

• Don’t Fight the FED

“Lower” Respondent Answers:

• price pattern

• poor earnings

• CORONA

• This a dcb which is now becoming frothy.

• catch those last sellers trying to get even

• Reaching time and price area for reversal.

• Nothing but bad news. Until the virus is resolved, the market will head down. High Unemployment, no business growth at all. Earnings will be disappointing.

• technical analysis

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Question #4. Have you changed your trading or investing strategies over the last couple months to cope with the increased volatility? If so, how?

• reducing exposure, trading more options than stock, tightening stop losses

• No, I day trade the spi options.

• no still in cash

• yes rebalanced portfolio

• Listen more, talk less and support the DOW!

• More LEAPS

• 10% buys

• Reduced the size of orders to 20-50% and doubled, tripled the size of my stops.

• Yes I have been buying stocks

• yes, small trade take profit before they disapear

• Yes, mostly trading the micro e-mini’s.

• yes have sold almost everything

• Prepared for decline Feb 24 by buying puts early March

• No , 30% invested since Jan.2020

• yes. MYOB

Question #5. Additional Comments/Questions/Suggestions?

• I hope the Dems go to HELL.

• the virus will continue take earnings down. this could last up to a year.

• It is time for the people of North America to mask up and back to work, enough is enough! President Donald Trump will lead this great American endeavor and all Americans will follow. Canada will follow the southern neighbor recovery and the HK flue will dissipate, through Europe.

• Stupid mistakes earlier this year. This decline helped me achieve almost 300% appreciation. Bear rally caught me off guard because I did not believe my own charts and lost 20% of my gains.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies