Crowd Forecast News Report #355

[AD] Report: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport071320.pdf

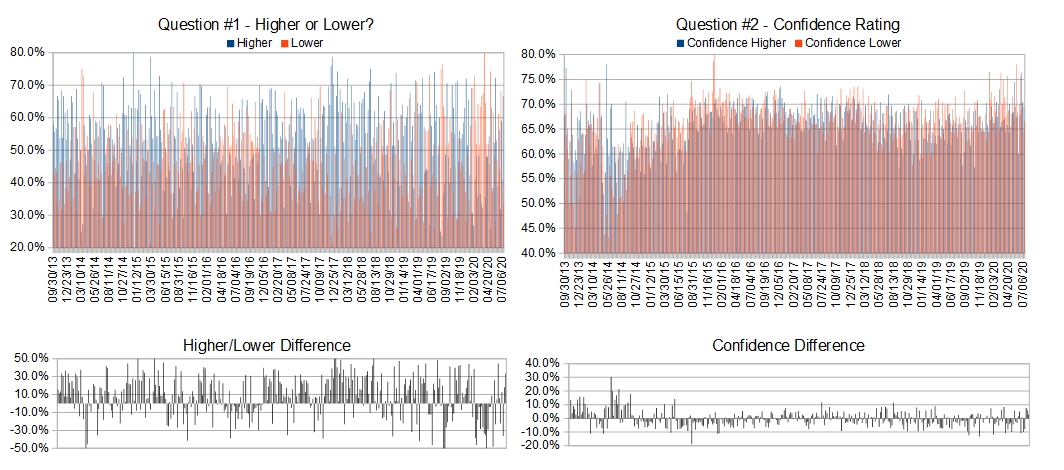

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 13th-17th)?

Higher: 66.7%

Lower: 33.3%

Higher/Lower Difference: 33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.6%

Average For “Higher” Responses: 69.6%

Average For “Lower” Responses: 66.7%

Higher/Lower Difference: 2.9%

Responses Submitted This Week: 19

52-Week Average Number of Responses: 28.6

TimingResearch Crowd Forecast Prediction: 63% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

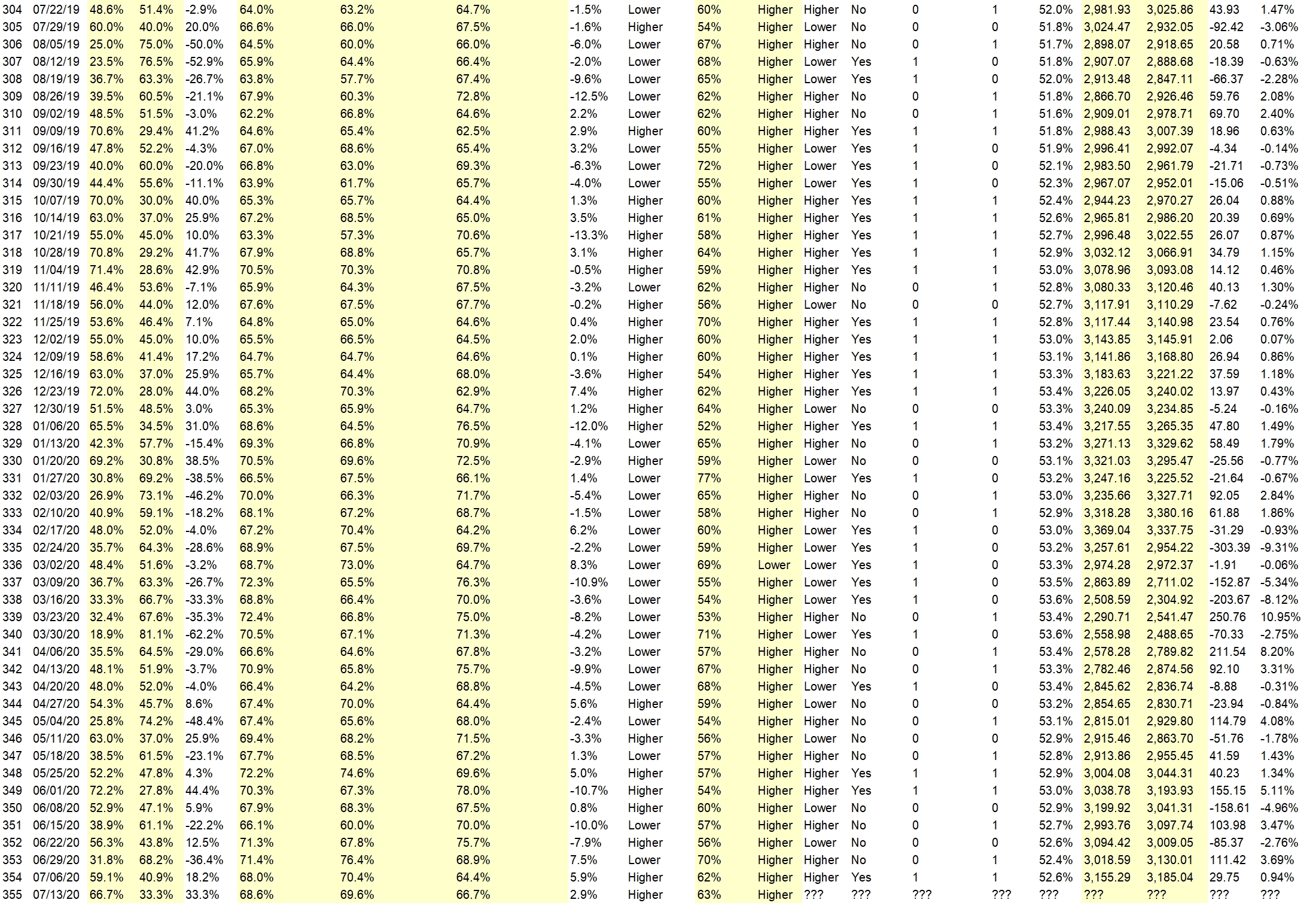

Details: Last week’s majority sentiment from the survey was 59.1% predicting Higher, and the Crowd Forecast Indicator prediction was 62% chance Higher; the S&P500 closed 0.94% Higher for the week. This week’s majority sentiment from the survey is 66.7% predicting Higher and with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 88 times in the previous 354 weeks, with the majority sentiment (Higher) being correct 63% of the time and with an average S&P500 move of 0.21% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 63% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 27.3%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Trend

• Banks need to get their money back after march drop

• Trump poll position continues to drop with no negative market reaction. Looks like markets are factoring in chance of Biden win with little impact. also massive amounts of money on sidelines will eventually have to be deployed. Those hoping for rising rates will be crushed and will throw in the towel which will be the point to reassess.

• Continued QE by the Fed, liquidity measures of the banks.

• Even with all the negative news regarding Covid on Friday, the early dip was bought, and looked strong into the close. The high momentum looks like a positive sign.

• Too many bears out there

“Lower” Respondent Answers:

• Too much money chasing stocks. overvalued. PE to high.

• More COvid-19 cases than expexted over the wholw world.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Question #4. What trading-related questions or topics would you like our experts to discuss on future episodes of the weekly Crowd Forecast News show? (The TimingResearch shows are off this coming week for Wealth365, but back on July 20th.)

• Talk about trading tactics that will work in an up, sideways and down markets.

• Future growth. Secor rotation

• What is the outlook for gold and have any “experts” increased their allocation?

Question #5. Additional Comments/Questions/Suggestions?

• none

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies