Author Archives: TimingResearch.com

Author Archives: TimingResearch.com

Watch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Melissa Armo of TheStockSwoosh.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport062220.pdf

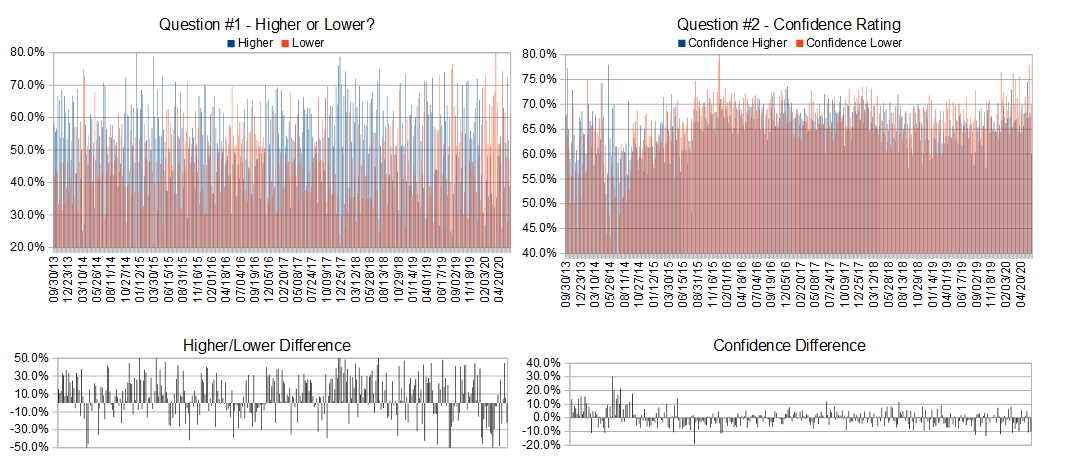

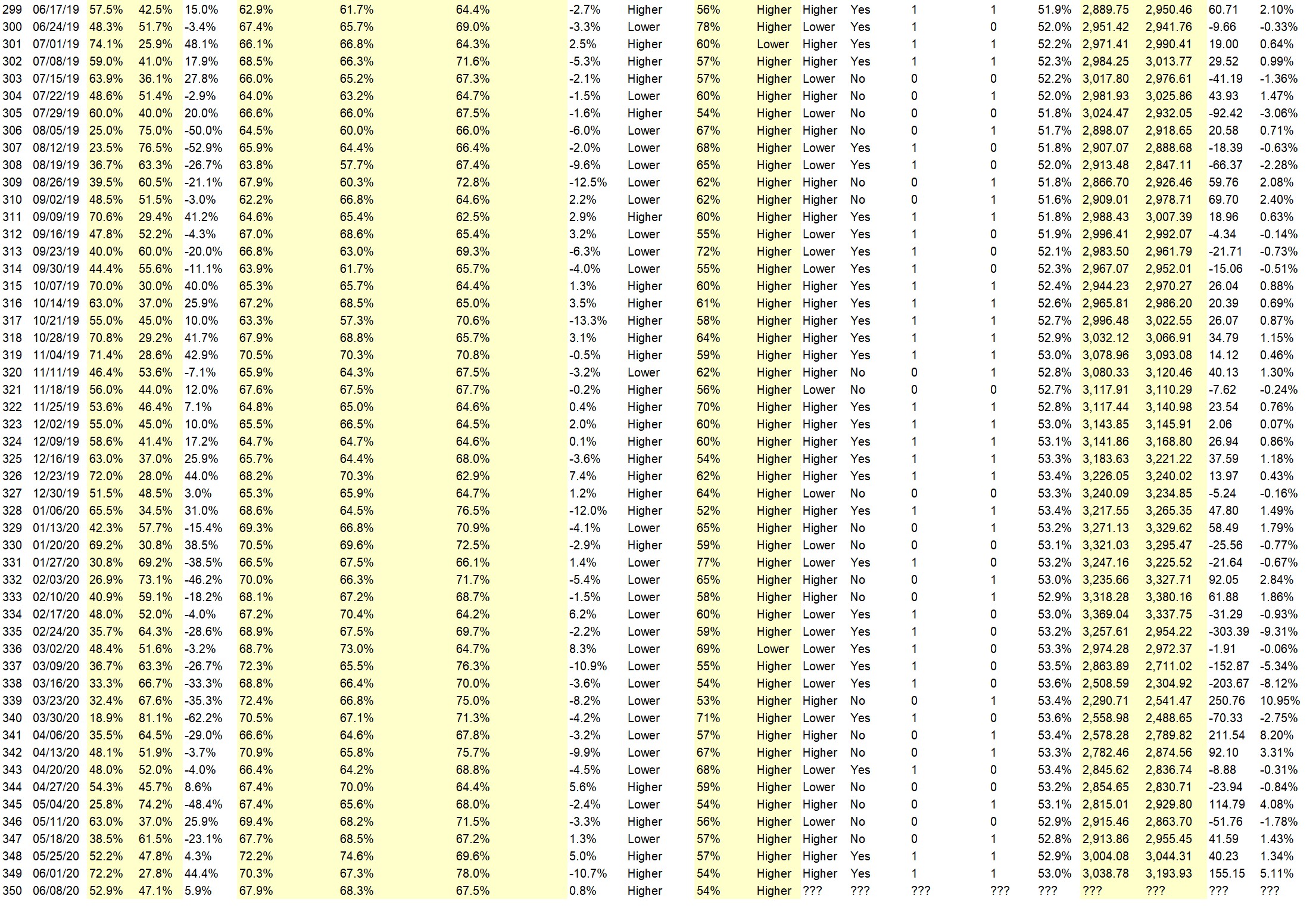

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 22nd-26th)?

Higher: 56.3%

Lower: 43.8%

Higher/Lower Difference: 12.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 71.3%

Average For “Higher” Responses: 67.8%

Average For “Lower” Responses: 75.7%

Higher/Lower Difference: -7.9%

Responses Submitted This Week: 17

52-Week Average Number of Responses: 29.4

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.1% predicting Lower, and the Crowd Forecast Indicator prediction was 57% chance Higher; the S&P500 closed 3.47% Higher for the week. This week’s majority sentiment from the survey is 56.3% predicting Higher but with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 72 times in the previous 351 weeks, with the majority sentiment (Higher) being correct 56% of the time and with an average S&P500 move of 0.01% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.7%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 27.3%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I am not so sure about it.

• Things are picking up in many states

• Because SPY broke 20 day MA. So my contrarian theory is it bounces back above.

• the trend continues

“Lower” Respondent Answers:

• Will be big drop (third wave by Fibonacci)

• Lower because the number of virus cases are increasing and Apple has shut stores down in some locations.

• We are in a depression

• The Covid-19 virus is alive and happy, as the contagion level is rising sharply in some areas. That’s going to discourage a lot of people from spending at a level that supports economic growth.

• 2nd wave of Covid19 plus the uneasyness of the mkt with regard to upcoming earnings.

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• p&l

• P/L

• Measure equity in time

• just watch the market where it headed?

• Extensive spreadsheets and monthly summaries

Question #5. Additional Comments/Questions/Suggestions?

• Need more information about candle stick? When to time the market movements.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

This event was created by TradeOutLoud.com and TimingResearch.com and these presentations were recorded on Thursday, June 18th, 2020.

ST #14.01: What to AVOID During a Market Drop in order to Generate a Serious Investment Income with A.J. Brown of TradingTrainer.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.02: Top Trade Ideas Right Now with Dan Passarelli of MarketTakerMentoring.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.03: Unusual Options Activity with Andrew Keene of AlphaShark.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.04: Option Professor Market Update with The Option Professor of OptionProfessor.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.05: Zero Day Options Strategies with Doc Severson of ReadySet.trade

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.06: How the Top 1% Trade Options with Felix Frey of OptionsGeek.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.07: Financed Call Spreads as a Set-It-And-Forget-It Trend Trade with Samantha LaDuc and Archna Jagtiani of LaDucTrading.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.08: How to Win on Over 80% of Your Options Trades with Price Headley of BigTrends.com

Offer: HERE

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

ST #14.09: Options Trading Panel Discussion with Samantha LaDuc, Archna Jagtiani, A.J. Brown, The Option Professor, and Anka Metcalf

Watch the video here or on YouTube:

Listen to the audio-only version here or on your favorite podcast network:

Watch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Mike Pisani of SmartOptionTrading.com

– The Option Professor of OptionProfessor.com (moderator)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Watch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Marina Villatoro of TheTraderChick.com

– Gary Dean of SentimentTiming.com

– David Keller of StockCharts.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061520.pdf

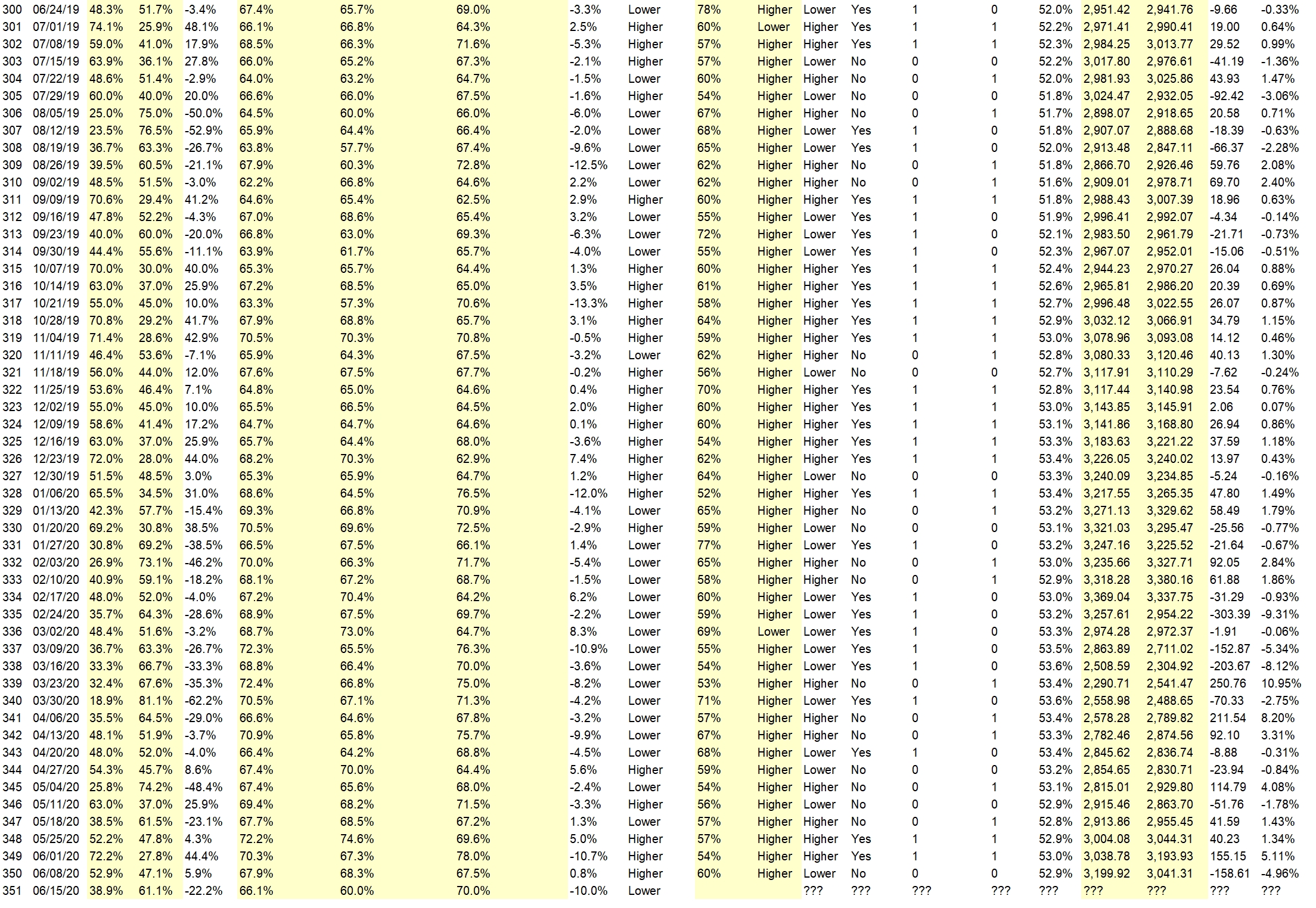

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 15th-19th)?

Higher: 38.9%

Lower: 61.1%

Higher/Lower Difference: -22.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.1%

Average For “Higher” Responses: 60.0%

Average For “Lower” Responses: 70.0%

Higher/Lower Difference: -10.0%

Responses Submitted This Week: 18

52-Week Average Number of Responses: 29.6

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.9% predicting Higher, and the Crowd Forecast Indicator prediction was 60% chance Higher; the S&P500 closed 4.96% Lower for the week. This week’s majority sentiment from the survey is 61.1% predicting Lower but with a much greater average confidence from those who are predicting Lower. Similar conditions have occurred 77 times in the previous 350 weeks, with the majority sentiment (Lower) being correct 43% of the time and with an average S&P500 move of 0.33% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• FED wull keep flooding the market with liquidity

• Being contrarian

• Bounce back from Thursday

• LT Trend/bounce

• High liquidity, people isbuying on the dip.

“Lower” Respondent Answers:

• Overbought for weeks. Too far too fast.

• The market is very high based on fundamentals and in lieu of the increasing virus threat

• A pull back is due as the recent rally has run out o steam

• The daily trend will change next week per moving averages.

• An island reversal (up-gap, then 4 days later, a down-gap) occurred over the last several days. That’s generally bearish. Also, the virus wants to hang around, which dims hopes for economic recovery this year.

• I belive in megafone pattern(weekly chart). Price going to pivot (down)

• Technical

• the US facing Two big problems now a days Corona and protests,the first time i have seen low confident level in the president Mr Trump,these could led market to negative side..

• We are in a depression

Question #4. What trading software/platform(s) do you use to execute your trades?

• Schwab streetssmart

• Fidessa, IB

• online broker has its own I don’t trade frequently

• Schwab

• Etrade

• E-Trade

• Trade station

• Tradestation

• MT4

• ava trade

• Td

Question #5. Additional Comments/Questions/Suggestions?

• Very volatile markets are likely to continue

• this is my first time entry on your website

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Watch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Samantha LaDuc of LaDucTrading.com

– The Option Professor of OptionProfessor.com (moderator)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Watch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Carley Garner of DeCarleyTrading.com

– Amelia Bourdeau of MarketCompassLLC.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060720.pdf

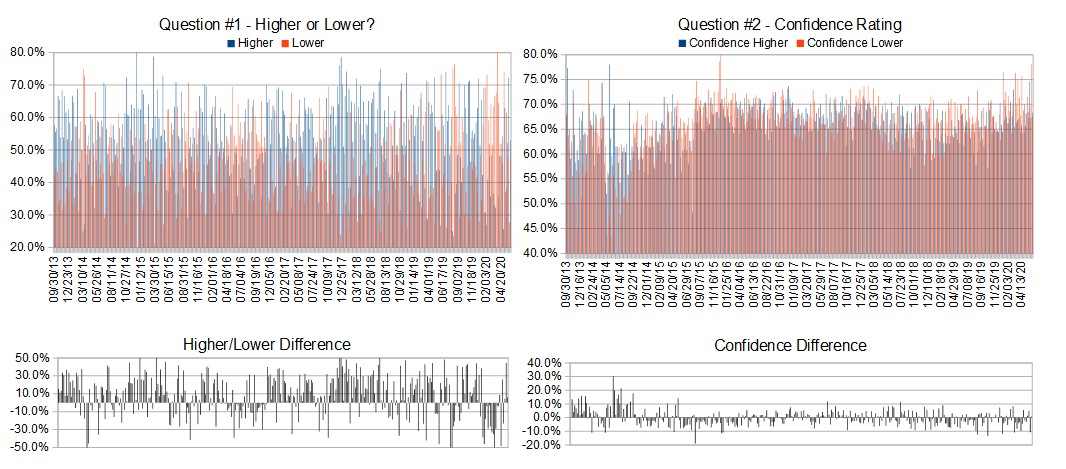

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 8th-12th)?

Higher: 52.9%

Lower: 47.1%

Higher/Lower Difference: 5.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.9%

Average For “Higher” Responses: 68.3%

Average For “Lower” Responses: 67.5%

Higher/Lower Difference: 0.8%

Responses Submitted This Week: 18

52-Week Average Number of Responses: 30.1

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 72.2% predicting Higher, and the Crowd Forecast Indicator prediction was 54% chance Higher; the S&P500 closed 5.11% Higher for the week. This week’s majority sentiment from the survey is 52.9% predicting Higher but with a much greater average confidence from those who are predicting Lower. Similar conditions have occurred 52 times in the previous 349 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.46% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• momentum

• Technical: candle+trend, nfp release was positive

• Good unemployment report. It looks like a V shaped economic recovery.

• More of the economy opens giving greater confidence that we are on the upswing but could be impacted by the growing domestic unrest.

• Momentum is good, which suggests more follow through. Expecting for this week: rotation into lagging stocks, buying of dips, S&P holds up okay.

• Trend

“Lower” Respondent Answers:

• Still large number of people unemployed. Not enough jobs too fill the unemployment gap.

• more protests

• The rise has moved too fast. Bound to have some correction.

• Profit taking from last week

• Market has been overbought for a couple weeks. Last friday the rubberband stretched so far that it needs to correct for a little while. Revert to the average or lower before it continues to rocket higher as things continue to open up. Our Covid 19 numbers were the highest they have been last week but without drastic increase in hospitalizations or deaths so far. The virus might be mutating to a less lethal form while still causing herd immunity- hopefully.

• Volume flow

Question #4. What styles of trading or methodologies have you had the most success with?

• Long term. Buy and hold.

• Buying when marker crashes

• Analyze charts and trade accordingly.

• To many to share

• Swing trading

• Supply and demand

• Buying a stock tied to crypto. Selling puts for premium, and following leads and trending stocks from Tradesmith, Jeff Brown, Jeff Clark and Tika Tawari, Educated using Option Alpha etc.

Question #5. Additional Comments/Questions/Suggestions?

• none

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Watch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Tim Racette of EminiMind.com

– The Option Professor of OptionProfessor.com (moderator)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies