1

AD: Thursday: How To Beat The Market Investing Just Once A Week.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061619.pdf

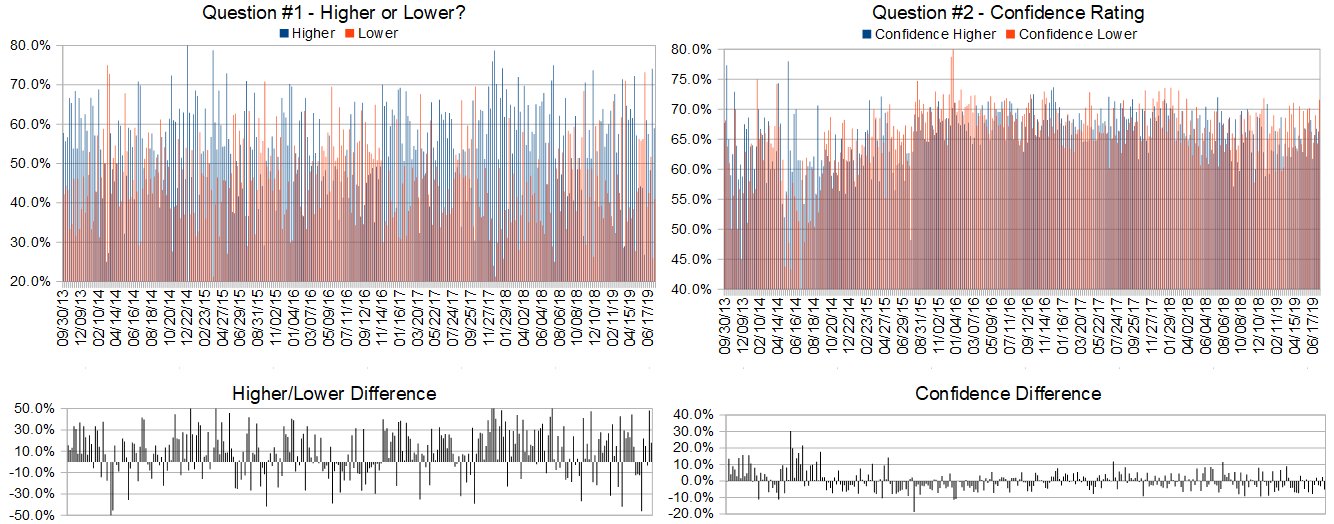

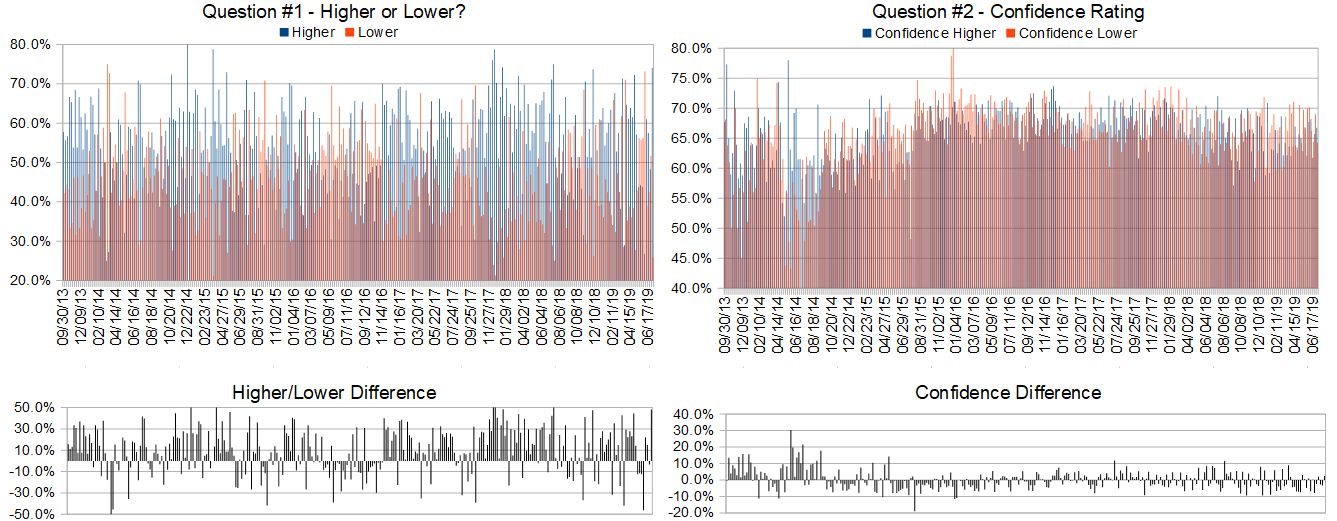

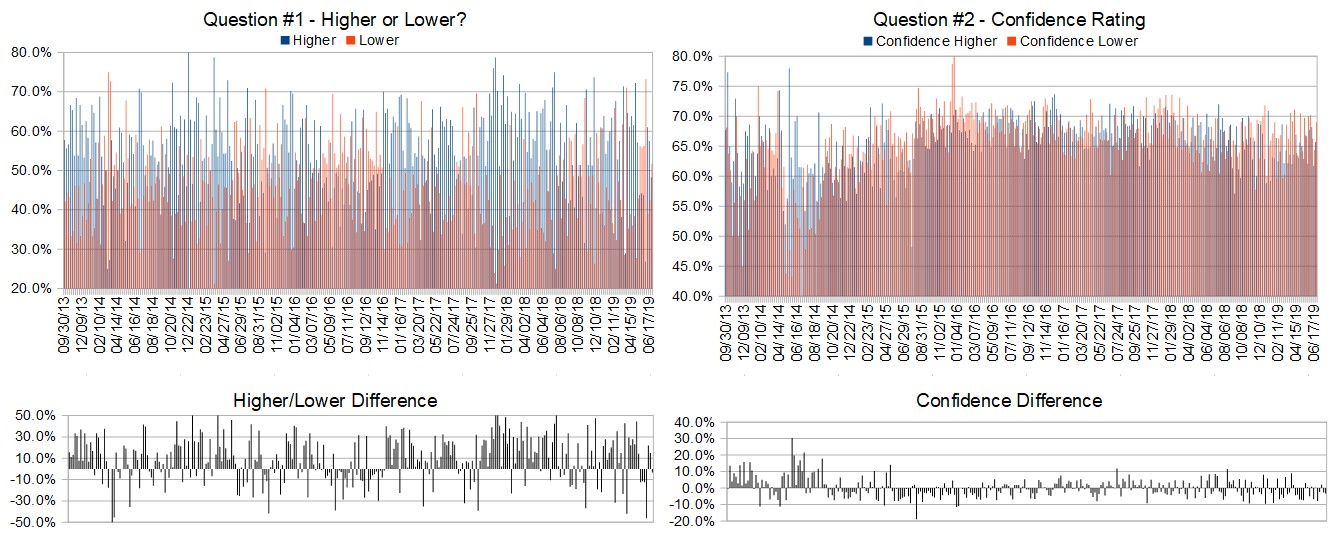

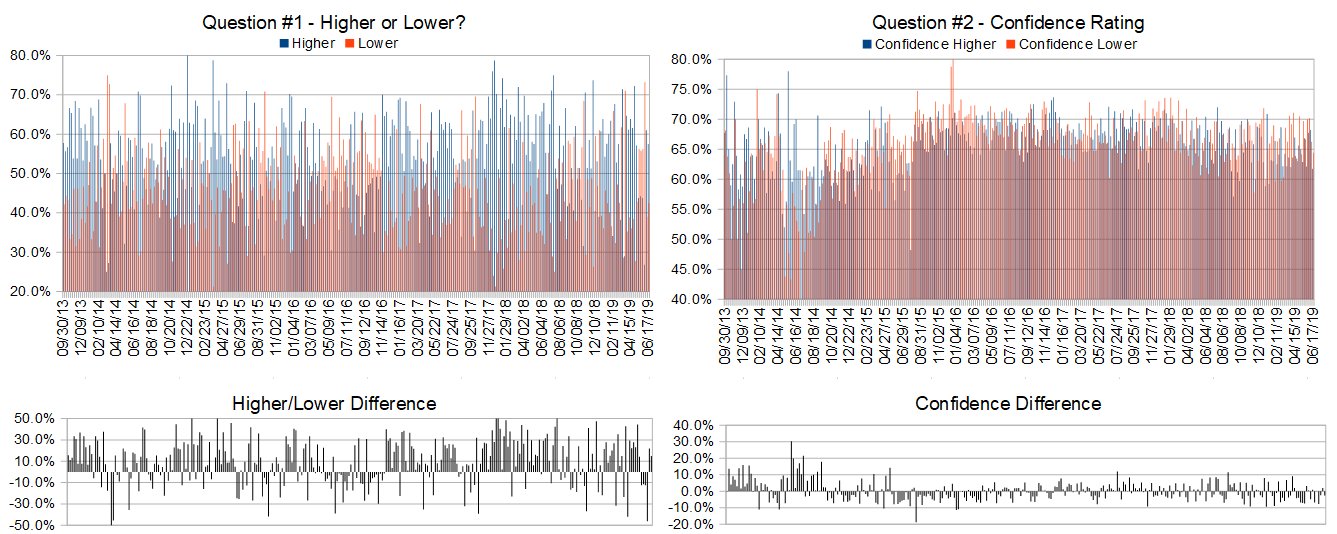

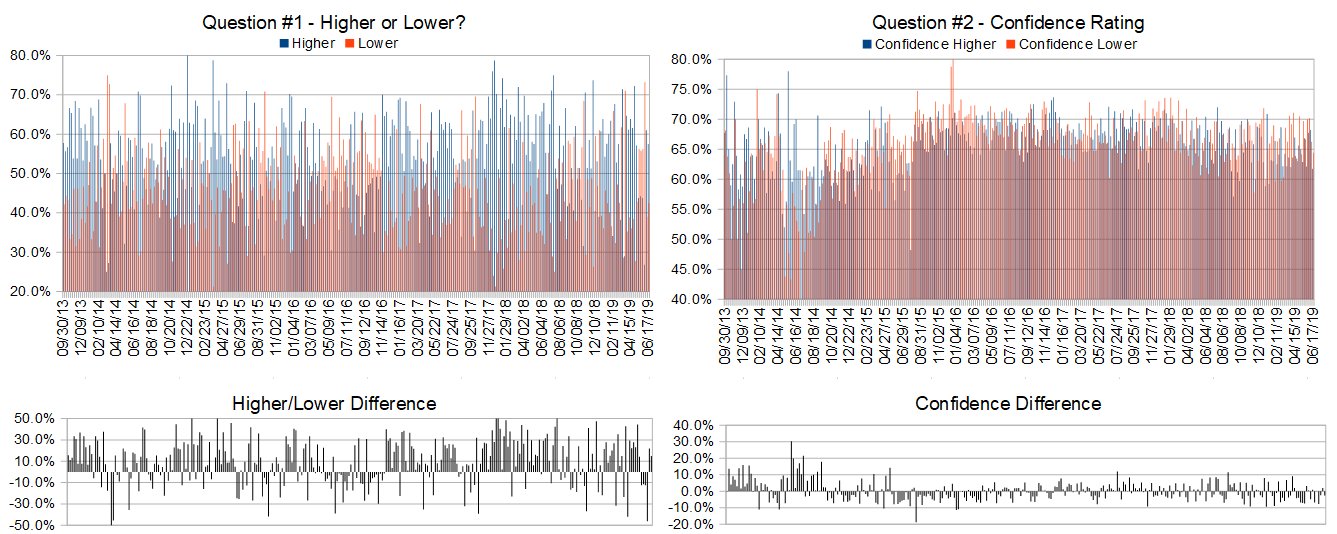

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 17th to 21st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.5%

Lower: 42.5%

Higher/Lower Difference: 15.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.9%

Average For “Higher” Responses: 61.7%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: -2.7%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 38.2

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.0% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.04% Higher for the week. This week’s majority sentiment from the survey is 57.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 61 times in the previous 298 weeks, with the majority sentiment (Higher) being correct 56% of the time and with an average S&P500 move of 0.06% Lower (the market moved Higher more frequently but the average of all moves was Lower) for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

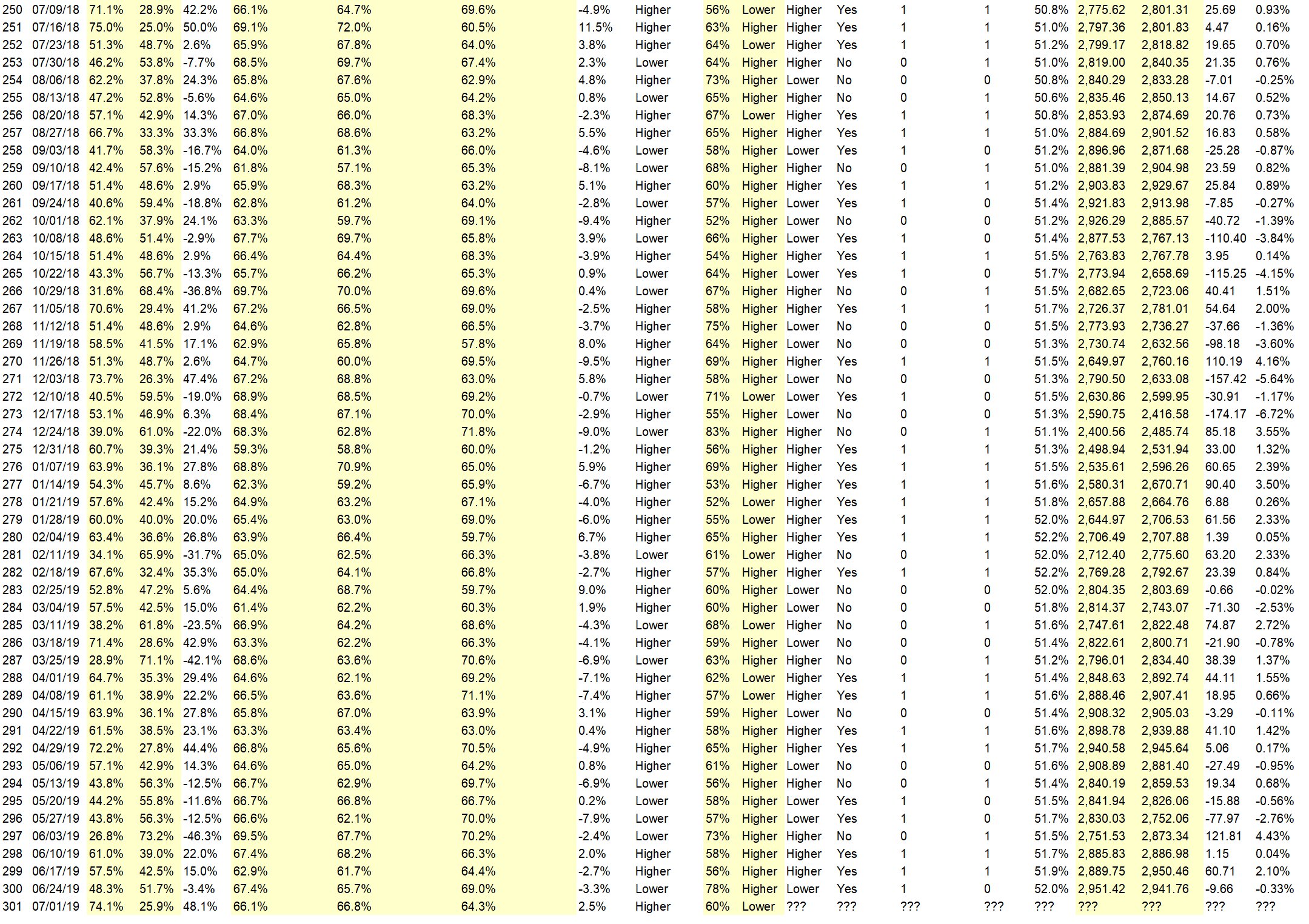

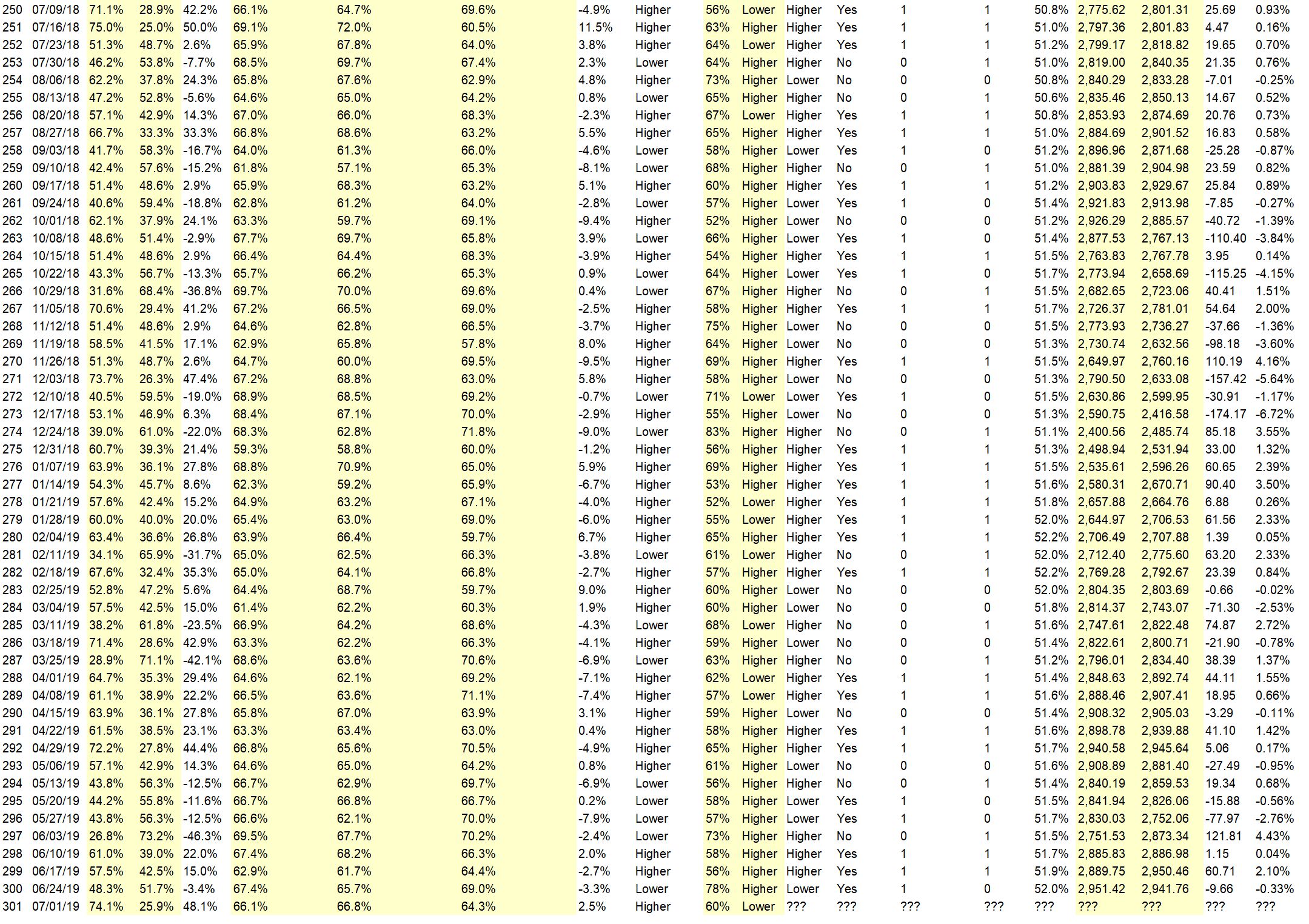

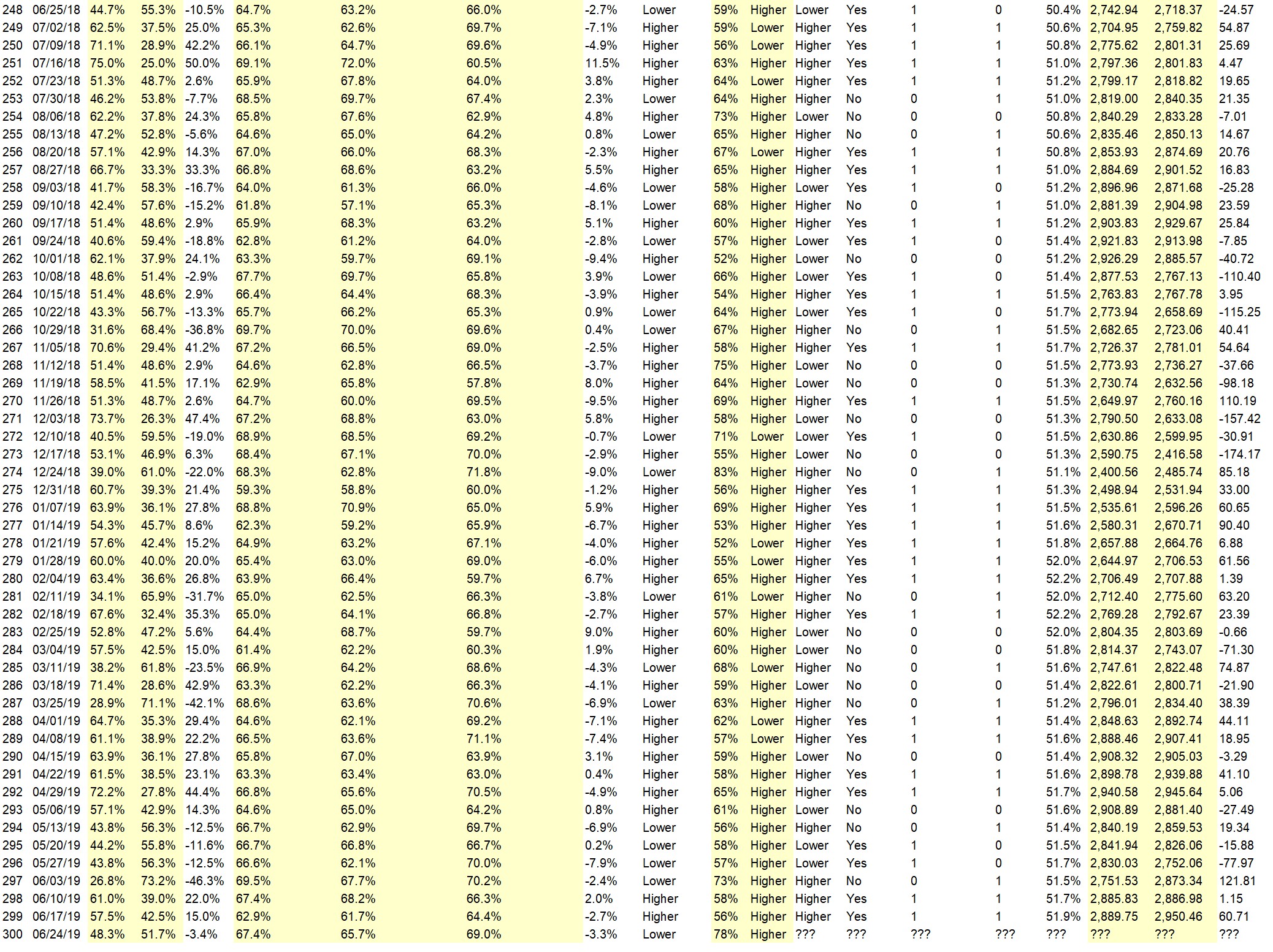

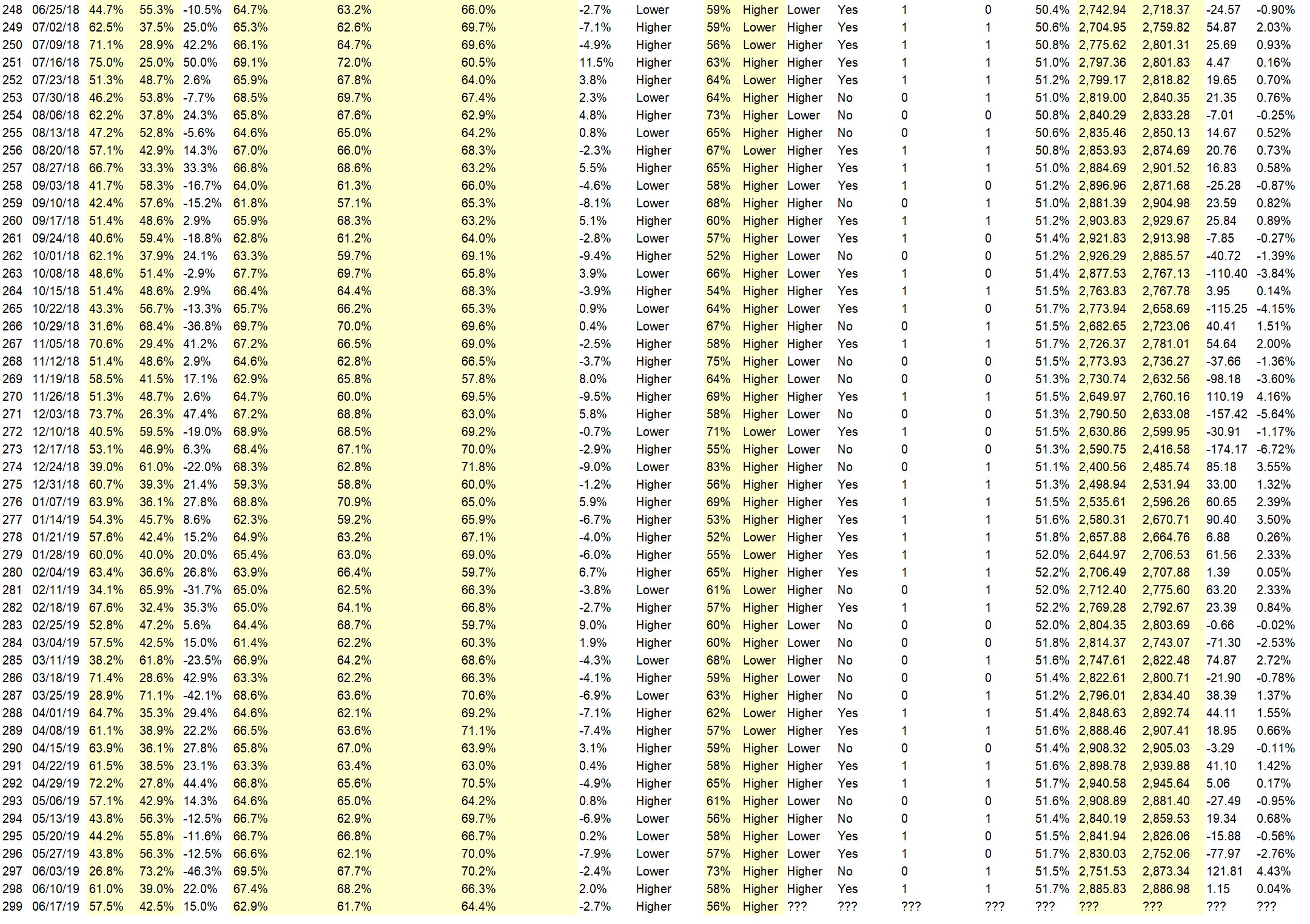

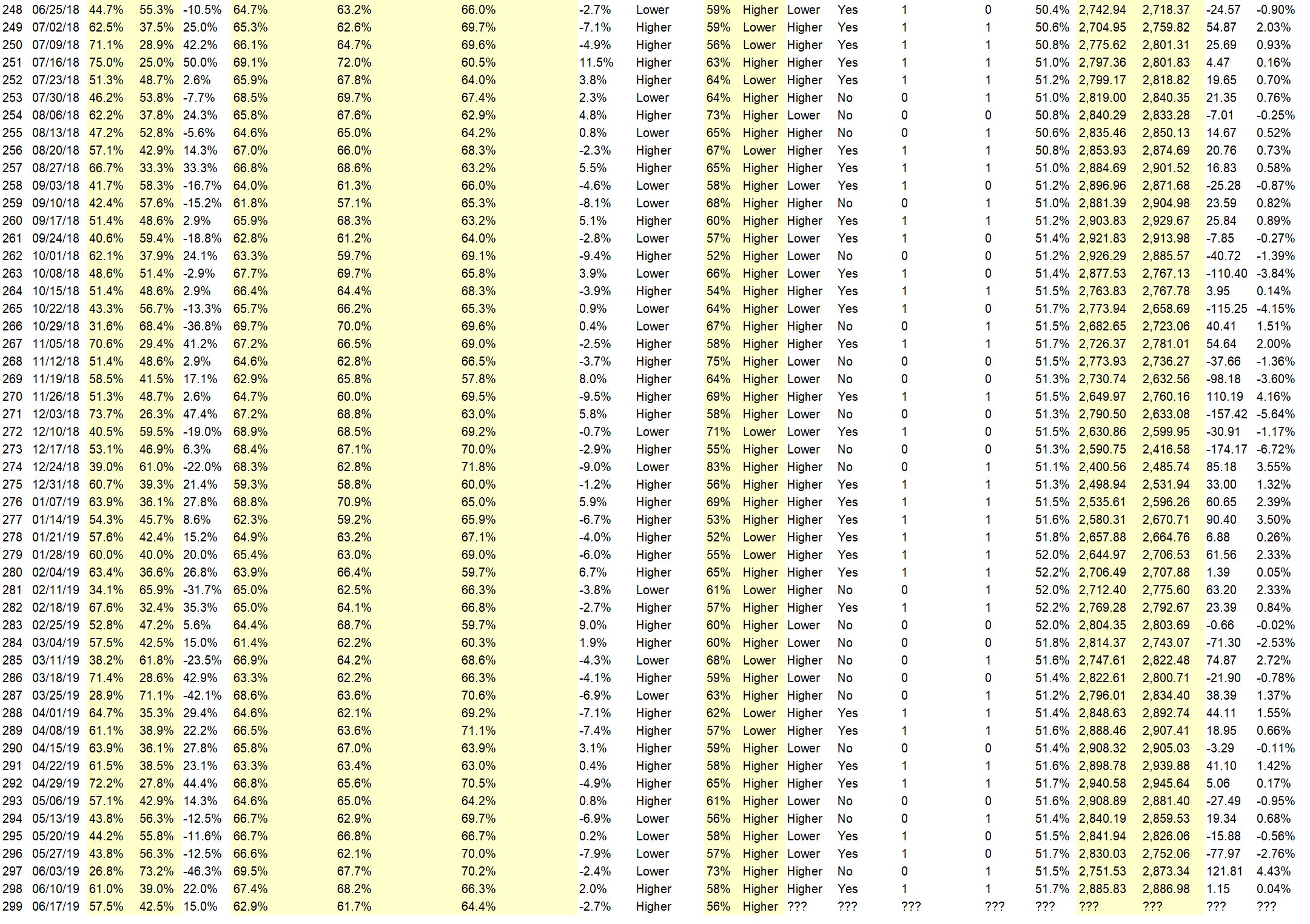

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• fomc maybe

• Everything depends on the Fed this week!

• Seasonal trends, perceived oil disruption, and just intuition..

• World conflict

• The uptrend resumes anew after a horrible month of May.

• Price is above 50 SMA on day chart. Top price before 7 weeks is very near

• I think the U.S./China tariff deal will have positive signs of a deal.

• FOMC meeting

• Possibility of reduced interest rates and china trade deal.

• Holding pattern with upward bias

• wave 5 continues into July

• because profits were higher than thought.

• Iran, China, Mexico?????

• reversion

• momentum and hopefully dirth of new negatives

“Lower” Respondent Answers:

• China & iran

• Fed disappoint the market, unrest in Middle East.

• iran

• received email stating 2 reasons why S&P could drop 250 points from reliable source.

• Seek the rate news on Wednesday

• sideways to lower move in slow summer market

• The market has lost momentum. The path of least resistance should be down.

• It looks like the tariffs will hang around more. Also, only a 20% chance that the Fed cuts rates this week, according to the Fed funds futures.

• Good news priced in FED stalling

• Can’t break resistance, slowing momentum

• Range Bound now

• new high new low divergence

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

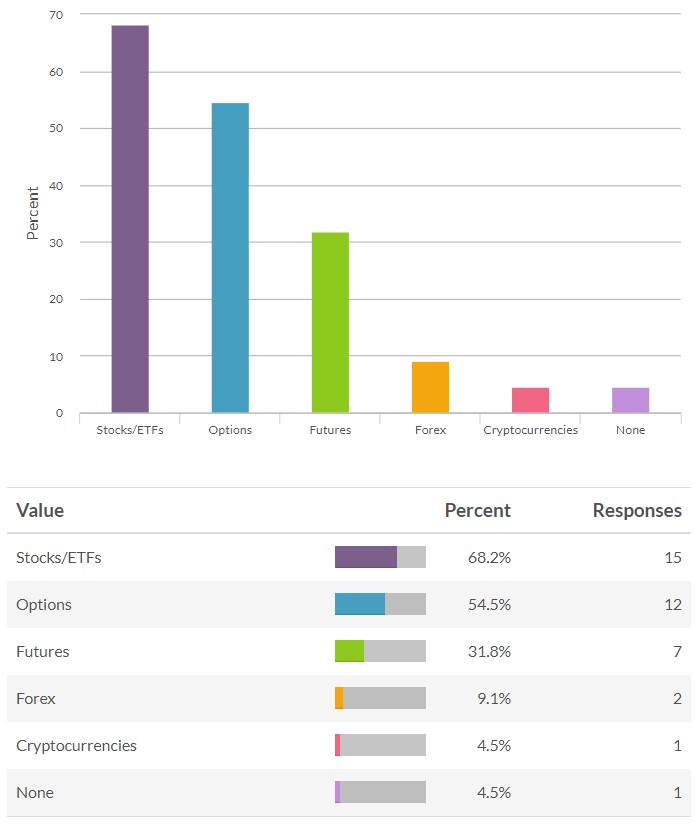

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• Wiege board

• position sizing and stops

• Scaling in and taking profits when a position hits at least 100%. Usually take about a quarter of the position in profits and let the rest ride.

• Ak

• All

• Position size and scaling.

• stops, position size

• 2% of size acc.

• set stops

• Stability.

• Limits in buying and selling

• position size

• Set St0ps

• Position size – usually about equal for each stock.

• scaling both ways

• trend, sma 3 and 10, MACD, 1/10 of protfolio its a 10% stop lost. Or daily moving average.

• I use time of day a lot for position sizing, (e.g. bank openings and bank closings) Then I also very often take 1. st profit after 3-4 pips (scaling out)

• short term moving average: 10 days, 15 days depending on fund volatility.

Question #5. Additional Comments/Questions/Suggestions?

• June strong July flat Aug. Down on DOW

• Yeah herd stampede last week they get picked 0ff this week

Join us for this week’s shows:

Crowd Forecast News Episode #228

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 17th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Michael Guess of DayTradeSafe.com

– Andrew Keene of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Analyze Your Trade Episode #82

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 18th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.