Crowd Forecast News Report #344

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport042620.pdf

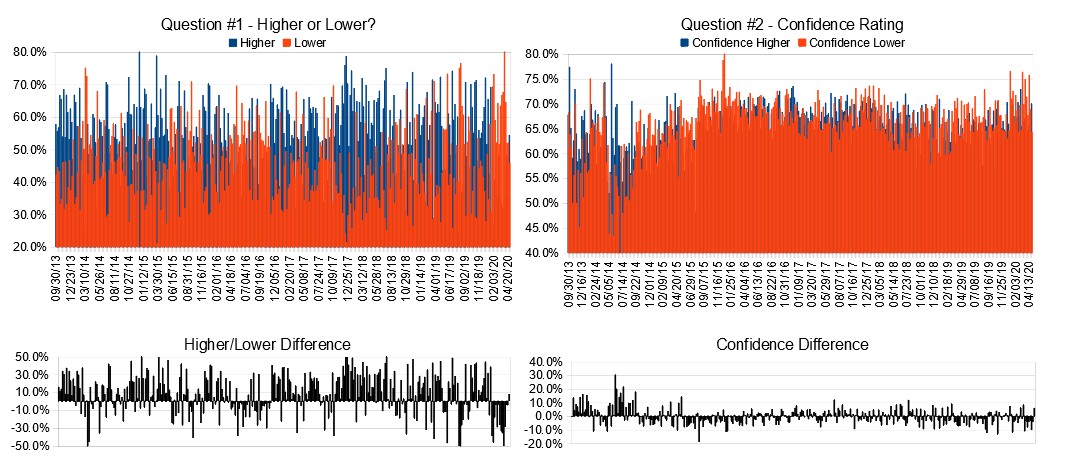

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 20th to 24th)?

Higher: 54.3%

Lower: 45.7%

Higher/Lower Difference: 8.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 70.0%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: 5.6%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 31.6

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.0% predicting Lower, and the Crowd Forecast Indicator prediction was 68% chance Higher; the S&P500 closed 0.31% Lower for the week. This week’s majority sentiment from the survey is 54.3% predicting Higher (the first week of majority Higher sentiment since mid-January) with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 29 times in the previous 343 weeks, with the majority sentiment (Higher) being correct 59% of the time and with an average S&P500 move of 0.56% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)

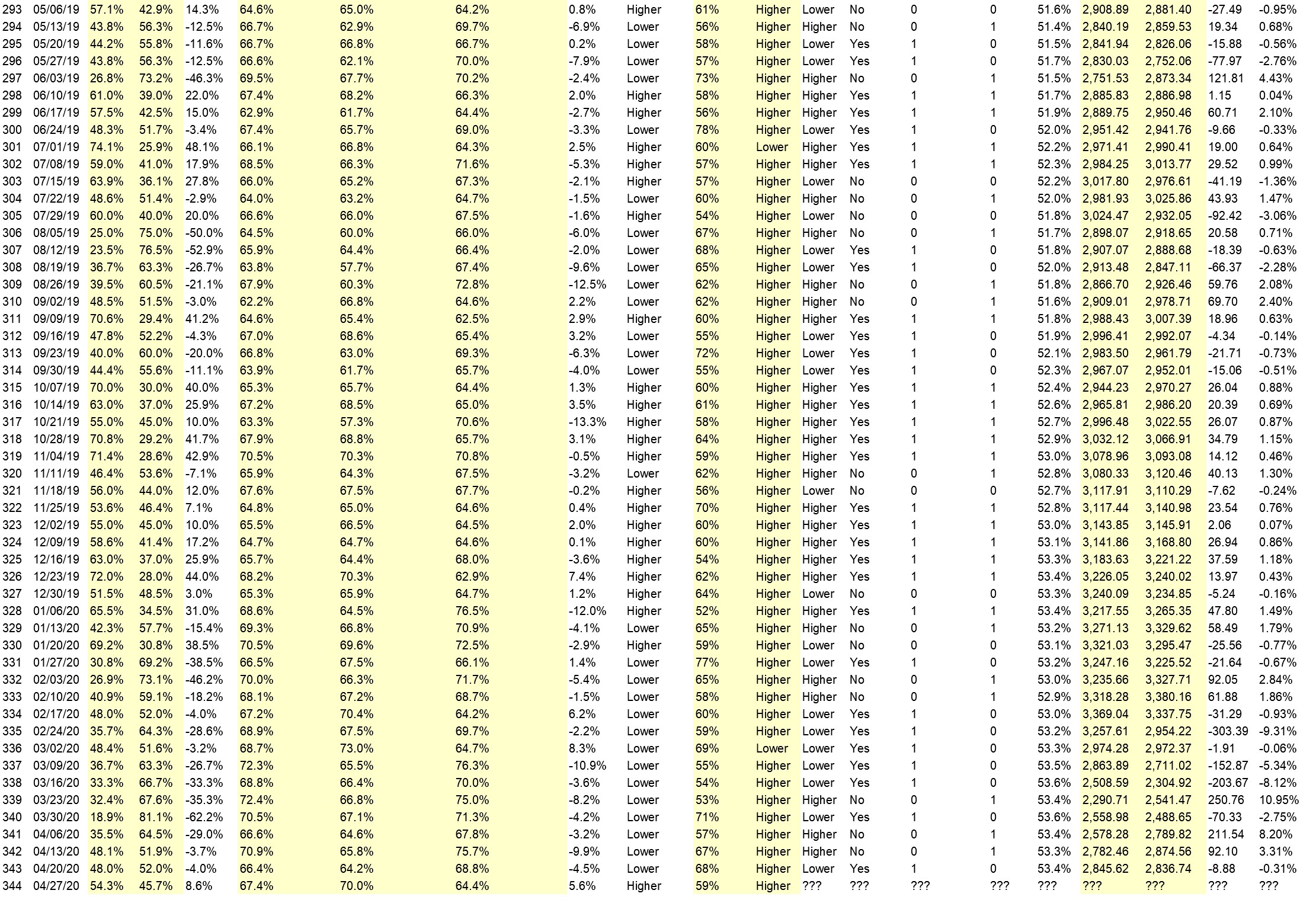

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Markets are opening positive feed from around the world.

• the bullish action from yesterday

• Price on day chart is above 50SMA

• Earnings and people going back to work again

• I cannot understand why it will go higher.

• Bullish market

• Market manipulation

• Things getting better, protests for getting back to work !

• mkt is very low.

• Technical reason.

• short term trend is up

“Lower” Respondent Answers:

• I think the 2nd leg DOWN of the swing that started Feb 19 2020 will start very soon

• …..debt, morgage, VC, coruption, OIL=XsaudisXrusiaXusa, gold+++++, deadly bags………

• Virus

• Both damage to economy and Health are uncertain to underestimated at this time.

• Disappointing earnings

• there is no fundamental reason for the s&p to go up

• slight bias to the downside

• Corona

• because of the economy is not great.

• moon cycle

• The S&P is down only 13% in 2020. This is despite high unemployment, low economic output, earnings guidance lower or being pulled, and worrying mortgage debt.

• Bad earnings number for the big tech stocks that are keeping up the bull market.

• because the economy is getting worse due to corona virus lock down and due to the economy dropping and we are heading into a world wide repression.

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)

Question #4a. What has been most profitable for you to trade over the last couple months?

• Stocks/ETFs – 37%

• Options – 30%

• Other/None – 22%

• Forex/Cryptos – 4%

• Futures – 7%

Question #4b. Why do you think that was most profitable for you?

• Futures – because it is the only thing I trade :)

• Futures – Big volatility

• Options – Leverage

• Options – limited risk

• Options – Options are the only ones that I can afford to trade.

• Options – Selling puts works

• Options – Volatility

• Other/None – all lost money looking at adding futures to sell short I papertraded my way to 1,000,000 Saw the oil collapse

• Other/None – because the market is too volatile at the current time

• Stocks/ETFs – Blood in the streets

• Stocks/ETFs – Buy low sell high intraday.

• Stocks/ETFs – Confidence that markets will come back.

• Stocks/ETFs – Experience

• Stocks/ETFs – It’s the only category that I trade. I’ve been on the right side of the moves most of the time.

• Stocks/ETFs – Scalping pre market and early market hours

• Stocks/ETFs – stocks are all I trade

Question #5. Additional Comments/Questions/Suggestions?

• With 28 million+ outta work in USA, airlines, auto manufactures, Containers, cruise ships, hotels, all at bottom and still the market moves higher???

• whO are you?

[AD] Report: MAGA Stocks (10 Stocks Experts Are Picking to Explode)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies