Crowd Forecast News Report #263

Partner Offer: Wealth365 starts Monday! Top Financial Speakers Share Strategies Online.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport100718b.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 8th to October 12th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.6%

Lower: 51.4%

Higher/Lower Difference: -2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.7%

Average For “Higher” Responses: 69.7%

Average For “Lower” Responses: 65.8%

Higher/Lower Difference: 3.9%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 46.8

TimingResearch Crowd Forecast Prediction: 66% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details :Last week’s majority sentiment from the survey was 62.1% Higher, and the Crowd Forecast Indicator prediction was 52% Chance Higher; the S&P500 closed 1.39% Lower for the week. This week’s majority sentiment from the survey is 51.4% Lower with a greater average confidence from those who responded Higher. Similar conditions have been observed 35 times in the previous 262 weeks, with the majority sentiment being correct 34% of the time, and with an average S&P500 move of 0.18% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 66% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

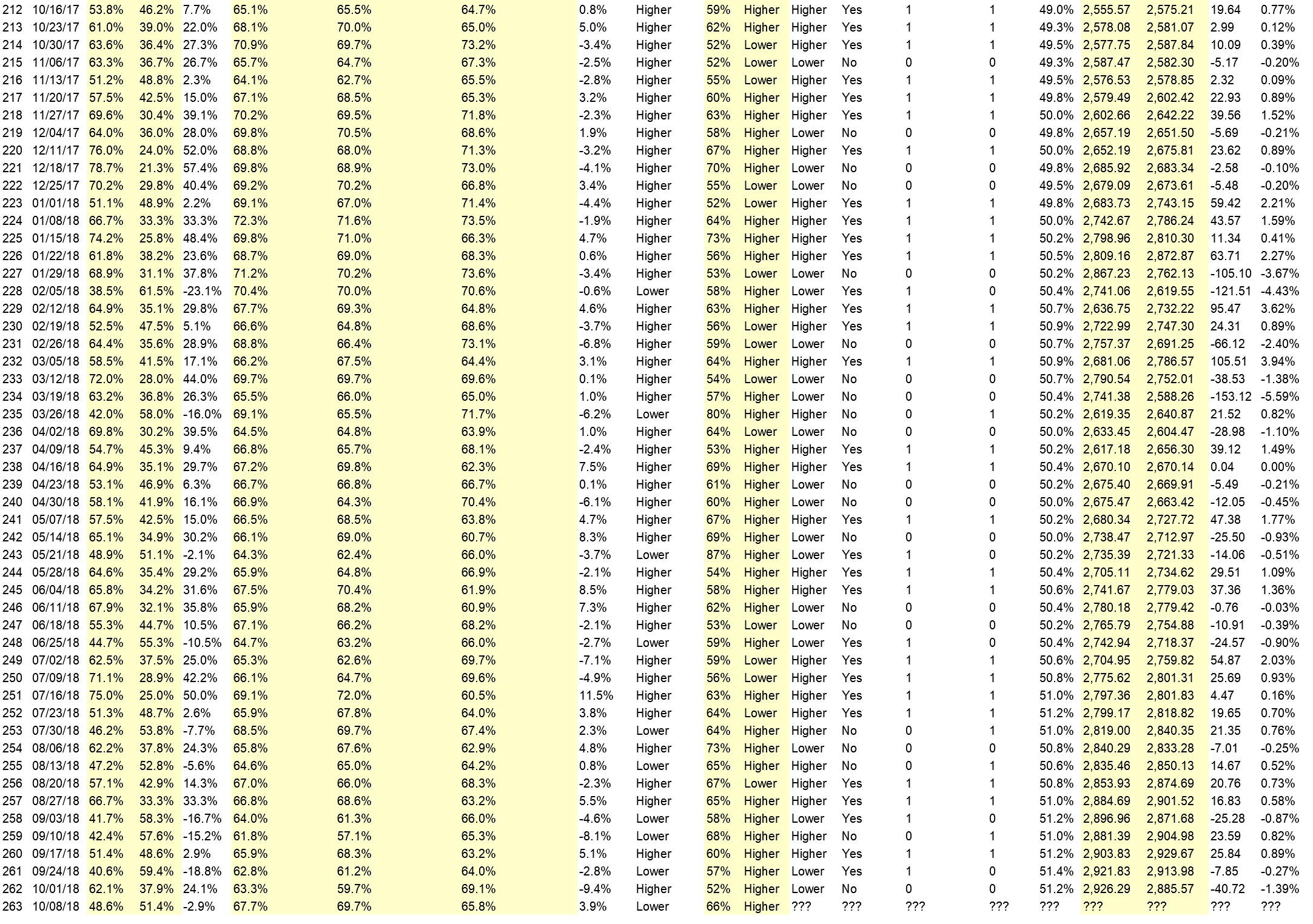

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Equities still best place

• Market is oversold from last week sell off.

• Kava nomination complete

• Seasonality

• bounce back

• still buying

• good earnings

• based on everything that i see

• hit 50dma and bounced

• Correction is underway but it may find a bottom shortly ending the week slightly higher

• Any excuse to continue this upward blowoff. Latest news is Kavanaugh.

“Lower” Respondent Answers:

• lying Donald Trump

• Rising interest rates.

• The market reached a peak on Wednesday with the Presidential tweet warning and has gone on the defensive ever since. The moving averages are being tested and broken.

• Interest rates appear to be destined to rise more. This becomes a problem for those in debt, including the US Govt and many companies. Even bank stocks, which theoretically gain with higher interest rates, are looking weak.

• Told ya

• Seasonal likelihood.

• Gut

Partner Offer, the TimingResearch shows are off this week, check out this instead:

Join thousands of fellow traders for the online-only Wealth365 Summit October 8-13th where you’ll be exposed to more speakers, new topics and hundreds of thousands of dollars worth of free prizes from top wealth experts.

Question #4. What trading-related skills do you want to learn or improve over the next few months? How are you planning on doing this?

• Timing portfolio management

• being to see exactly every 15 minutes what is going to happen

• option spreads.

• follow stop losses

• TIming on exiting positions.

• Gold projections – no plan

• Everything fails if we do not follow some system

Question #5. Additional Comments/Questions/Suggestions?

• i do well but i would like to do better

Partner Offer, the TimingResearch shows are off this week, check out this instead:

The TimingResearch shows are off this week, check out this instead:

Join thousands of fellow traders for the online-only Wealth365 Summit October 8-13th where you’ll be exposed to more speakers, new topics and hundreds of thousands of dollars worth of free prizes from top wealth experts.