Crowd Forecast News Report #264

Partner Offer: Do you have enough capital to trade? If not, click here.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport101418.pdf

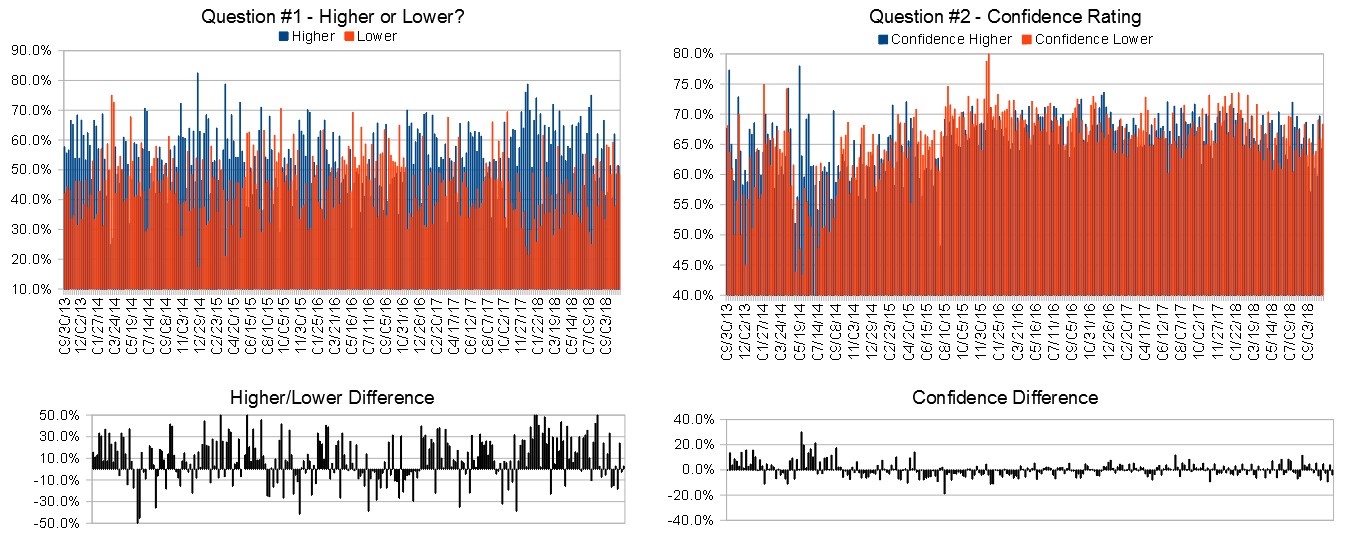

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (October 15th to October 19th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 51.4%

Lower: 48.6%

Higher/Lower Difference: 2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.4%

Average For “Higher” Responses: 64.4%

Average For “Lower” Responses: 68.3%

Higher/Lower Difference: -3.9%

Responses Submitted This Week: 37

52-Week Average Number of Responses: 46.5

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.4% Lower, and the Crowd Forecast Indicator prediction was 66% Chance Higher; the S&P500 closed 3.84% Lower for the week. This week’s majority sentiment from the survey is 51.4% Higher with a greater average confidence from those who responded Lower (this just happens to be the exact opposite of last week). Similar conditions have been observed 26 times in the previous 263 weeks, with the majority sentiment being correct 54% of the time, and with an average S&P500 move of 0.06% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer: In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

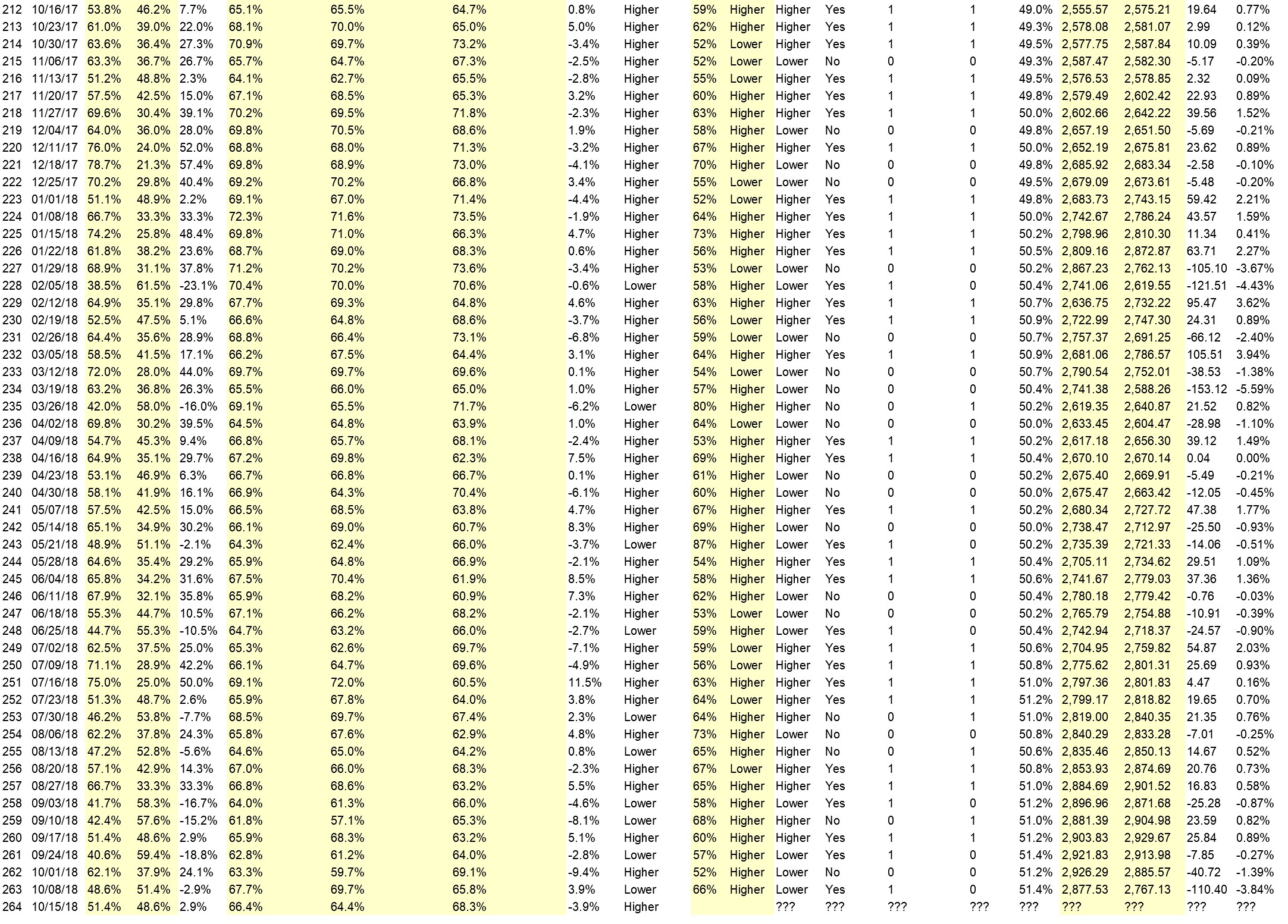

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.4%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Whether S&P will go higher this week depends on earning reports from NFLX and PG. It depends especially on future guidance indicated by these companies.

• Market has corrected, and is ready to move on up.

• I think things are still leaning Republican and it may stay bullish or go back up some maybe I guess

• weak bounce, bearish flad

• Friday afternoon’s rally off of support gave us a hammer. Continued upside is expected. Next resistance could be at 2885-90, the midpoint of the Bollinger band.

• I believe the market is manipulated to some degree by Wall Street. The some for the silver market (J.P. Morgan, etc.)

• Rebound time.

• Market is extreme oversold.

• Bounce off resistance

• done selling

“Lower” Respondent Answers:

• broken trend lines on bigger tech stocks as well as macro events going on short term. Economy stable for earnings reports starting should consolidate markets in month ahead

• The big question after Wed/Thurs drop is 1) is this just a correction, or 2) is this the crash so many were expecting. We’re not going to know the answer to the above until the data is in at the end of next week. I suspect it’s a “correction” and the next crash will come inside the next 1 to 3 years during which there could be several more corrections. So next week I’m expecting the sell off to continue but reach some point of consolidation / stabilization. After that the markets could continue upwards with a bit more volatility than was occuring prior to this week.

• Interest rate rise uncertainty

• The downtrend that started after the Presidential emergency tweet on that Wednesday 10 days ago will continue. It will end when the public says “just get me out”.

• Retest of the recent low

• too much debt economic instability consumer spending wanes stocks will be affected negatively

• October swoon

• Lower highs & lower lows & below 100 day moving average & at 200 day moving average

• Overvalued market

• History shows this as a bad week.

• I really dont know y but that s wut i think it will b

• High volatility and big downdrafts make the markets look risky to the downside right now

• Appears to have entered “a” wave

• Last week drop

No Prediction:

• I gave no answer because the market has been on such a roller coaster ride that I don’t even want to hazard a guess for such a short term.

Partner Offer: In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“

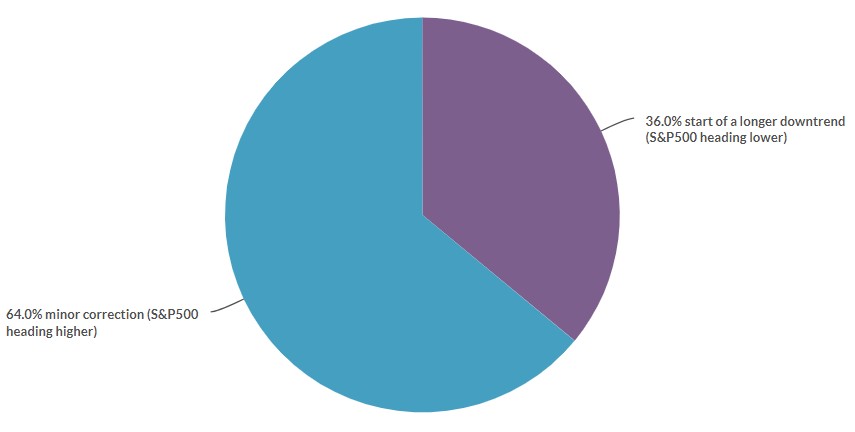

Question #4a. Do you think the drop in the markets this week were the start of a longer downtrend or a minor correction on the way to new highs (i.e. 6 months from now do you think the S&P500 will be higher or lower than today)?

Question #4b. Why?

“Minor correction (S&P500 heading higher)” Respondent Answers:

• October typically has been a volatile month for the stock market. Additionally, there have been pullbacks to some extent prior to earning season. Investing community is a bit more wary prior to this earning season because of potential warnings which companies might issue because of tariffs and the trade war. I am hoping the market can digest any of these warnings and continue its climb up. Especially tech stocks such as Apple, AMZN, & Microsoft.

• Republicans will be victorious in my opinion are better candidates say especially against Baria

• explained in previous comment

• Got a feeling

• nothing changed fundamentally

• In previous instances of these bounces off of support, the market has moved up for a month or more. After that, it gets quite unpredictable.

• Market was overbought to the max. The downtrend will continue and will end when the public says “just get me out”. Then the market can return to new highs.

• Earnings & economy are strong.

“Start of a longer downtrend (S&P500 heading lower)” Respondent Answers:

• too much debt currency will suffer trade war bonds, pensions, banks will suffer less consumer spending and lose confidence

• If trade war with China, inflation will go higher & lower profits which will cut P/E ratios.

• Interest rate increases, and perception the mid-year election results are obvious.

• .atket overvalued for too long and inverters are moving to safe havens

• Over priced stocks

• Bull is too long in the tooth

Question #5. Additional Comments/Questions/Suggestions?

• The big CRASH I’m expecting still has 1 to 3 years to occur and I believe it will occur after the offshore money coming into the US markets begins drying up. The US will be the last stop in the search for a safe haven. That’s when what is happening that’s beginning to occur in troubled economies around the world begins finally to occur here. At that point the economic crisis will be worldwide. No more safe havens to flee too.

Join us for this week’s shows:

Crowd Forecast News Episode #199

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, October 15th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– George Papazov of TRADEPRO Academy (first time guest!)

– Brad Powell of ETFDynamics.com (first time guest!)

– Toni Hansen of ToniHansen.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

Analyze Your Trade Episode #52

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, October 16th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Jim Kenney of OptionProfessor.com

– Neil Batho of TraderReview.net

Partner Offer: In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“