Crowd Forecast News Report #298

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060919b.pdf

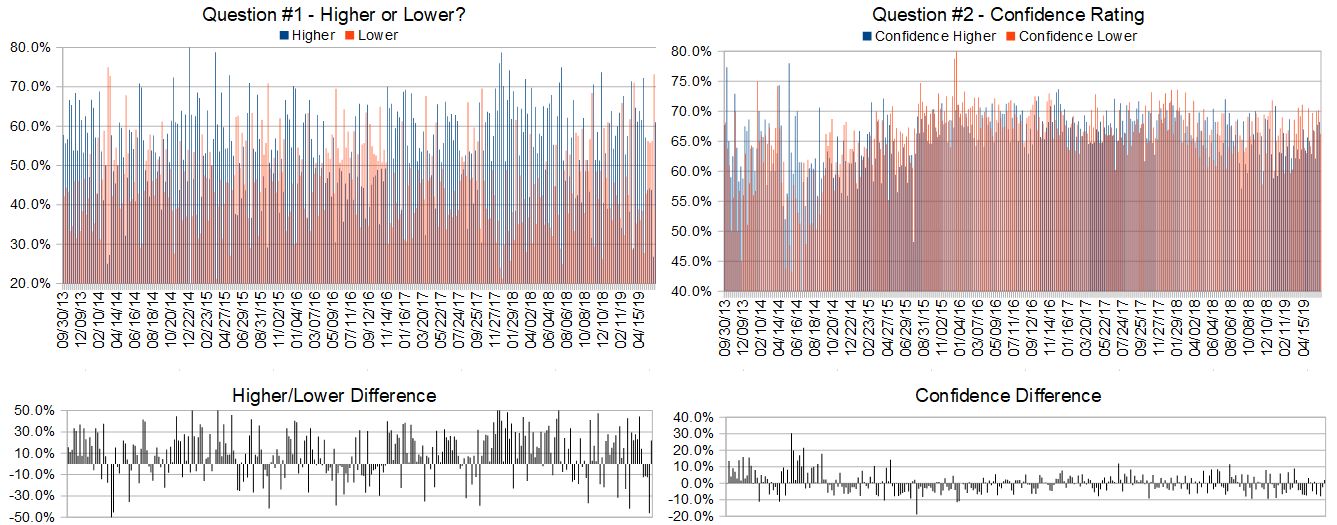

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 10th to 14th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 61.0%

Lower: 39.0%

Higher/Lower Difference: 22.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 68.2%

Average For “Lower” Responses: 66.3%

Higher/Lower Difference: 2.0%

Responses Submitted This Week: 41

52-Week Average Number of Responses: 38.2

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 73.2% Lower, and the Crowd Forecast Indicator prediction was 73% Chance Higher; the S&P500 closed 4.43% Higher for the week. This week’s majority sentiment from the survey is 61.0% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 60 times in the previous 297 weeks, with the majority sentiment (Higher) being correct 58% of the time and with an average S&P500 move of 0.09% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Chart

• wave 5 is real

• I think this is a big short squeeze and its gathering up a lot of retail traders in the uptrend

• Judging from what I’m seeing, investors are anxious, after a dismal May. Institutional investors are starting to get into the market.

• Trade deal with Mexico seem to be moving forward and possibility of future cuts in interest rates.

• up in a “B” wave

• Momentum

• weekly close was strong, possibly a sell the news events

• A quick return to 50 SMA on the daily chart indicates a slight correction at the beginning of the week and then a 50 SMA on the daily chart

• Regained 200 and 50 dma in 1 week. That means this week we will see the rise stall after going higher. Then possible fall for summer swoon.

• Elliott Wave pattern.

• Trade concerns are fading for now.

• Because president trump did not tariff the Mexicans

• Removal of the uncertainty of Mexico tariffs

• relief rally

“Lower” Respondent Answers:

• Tariffs with China and

• Closed below the High; Profit taking and possible bad news over the weekend

• Mr Trump

• Market top absorbed money

• Friday’s rally was exhaustive. Recent lows need to be retested.

• trend is down and DCB over

• up one week, down the next

• series of higher highs, now a regression

• Sell the news

• China

• I’m going with the Oct-Nov 2018 pattern. If that pattern continues, a top was reached on Fri; and the next leg is down.

• resistance levels

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Question #4. What type(s) of trading do you specialize in or focus on? How did you come to that decision?

• Selling credit sreads

• SPY Options Based on chart

• Only Options

• Long term. And swing trading

• Emini S&P 500 index far-out-of-the-money option selling. So I don’t really care market direction.

• trying to decide ..mainly doing options cause of small account size

• Primarily stocks, but have some gold and muni’s.

• Forex. Moves most.

• day trading (income) and position holding (retirement)

• futures. Believe last week was a corrective move.

• Stocks and options. I have some training in options trading.

• stocks, less complex.

• options, less capital

• Intraday trading.

• Quick trades in stocks that have risen or fell due to circumstance, not fundamentals. They sharply reverse then resume their trend.

• Day trading futures. I came to this decision primarily because of market volatility producing larger overnight moves.

• Charts. Follow the price movement

• Very short term with get out trades ready to go prior to initiating trade

• Options

• Options and swing .trading . options I chose because of the lower risk and swing trading because sometimes you can’t use options

• Swing trading; 2-10 days. With my job, I can’t do intraday.

• patterns, price action

• spreads slow but safer

Question #5. Additional Comments/Questions/Suggestions?

• Market will go up and then down

• can you resend out webinar replays?? wasn’t able to attend live session

TimingResearch response: All TimingResearch shows are publicly available immediately after recording on the TimingResearch.com homepage and the TimingResearch YouTube account. I also send an email out with the archive link 2 hours after recording each episode to everyone who is subscribed to the newsletter.

• Am anxious to have our politicos approve the use of marijuana on a national basis. I believe this would unlock untold fortunes, while powering the economy higher.

• None.

• Can we tell from charts when major short selling is happening to a stock; are there any indications that are different to or distinguishable from regular sell offs.

• I think the “SS” by the house this week in an attempt to prove our President Trump obstructed a crime the Mueller report said he didn’t commit, will pull this overbought market lower

• Nothing comes to mind,

Join us for this week’s shows:

Crowd Forecast News Episode #227

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 10th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– John Thomas of MadHedgeFundTrader.com

– Norman Hallett of TheDisciplinedTrader.com (moderator)

Analyze Your Trade Episode #81

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 11th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Bryan Klindworth of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide