Crowd Forecast News Report #246

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061018.pdf

NEW! Watch a brief explanation of this report in the video below or listen in podcast format.

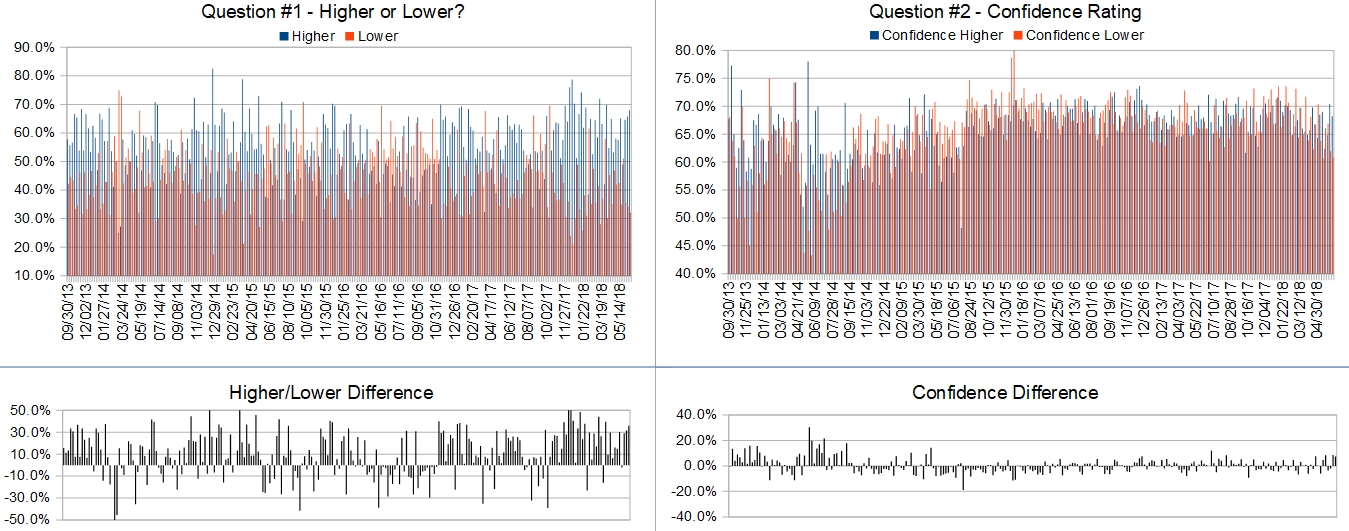

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 11th to June 15th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 67.9%

Lower: 32.1%

Higher/Lower Difference: 35.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.9%

Average For “Higher” Responses: 68.2%

Average For “Lower” Responses: 60.9%

Higher/Lower Difference: 7.3%

Responses Submitted This Week: 57

26-Week Average Number of Responses: 50.1

TimingResearch Crowd Forecast Prediction: 62% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 65.8% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 1.36% Higher for the week. This week’s majority sentiment from the survey is 67.9% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 13 times in the previous 245 weeks, with the majority sentiment being correct 62% of the time, with an average S&P500 move of 0.23% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting an 62% Chance that the S&P500 is going to move Higher this coming week.

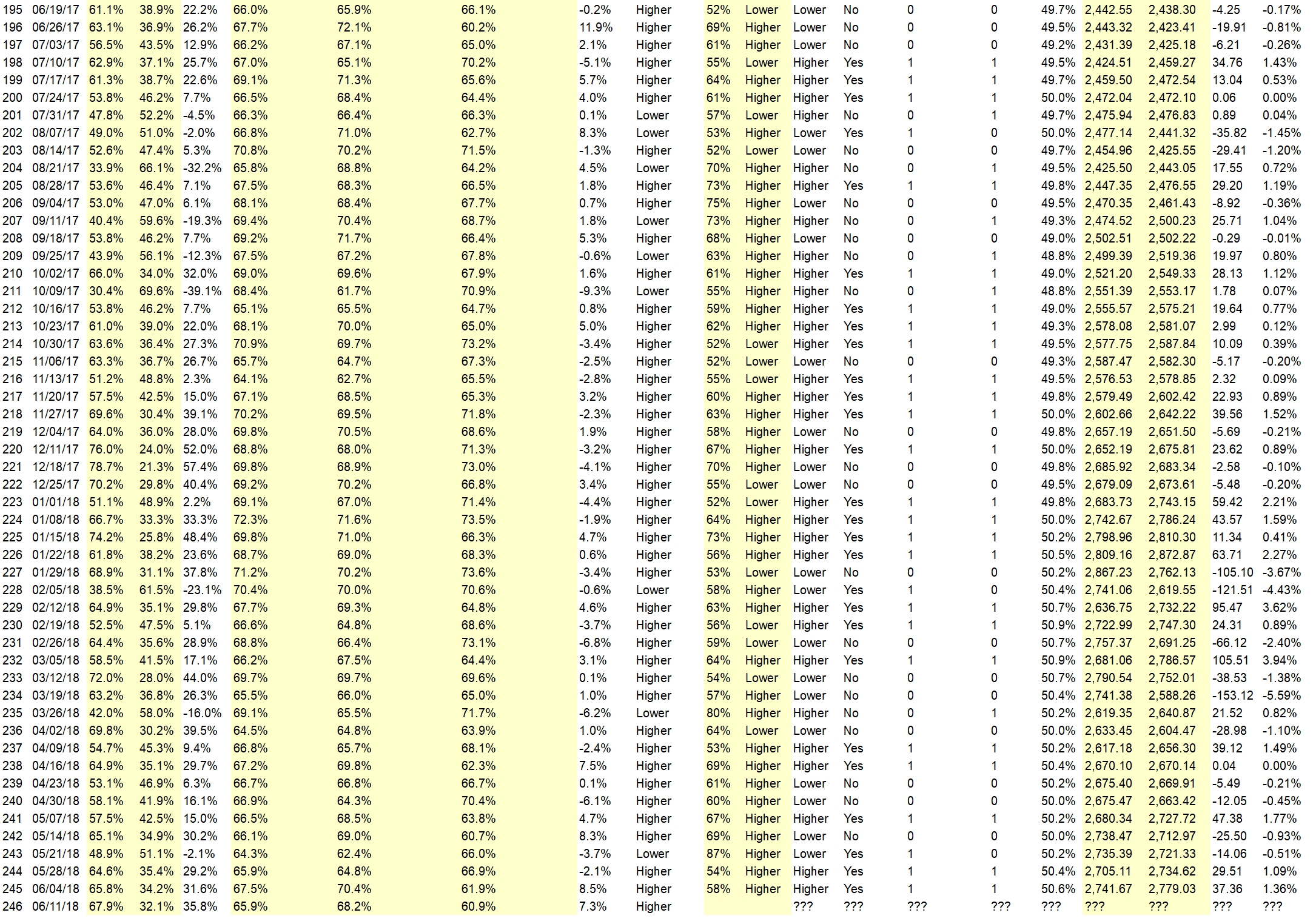

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• According to research done by tastytrade; the S&P performs positively 63% of the time during triple witching. This along with current market strength & the market’s current penchant to ignore the possibility for increased rates & tariffs, seems to indicate a higher close by week’s end.

• Trump getting better trade deals.

• Dividends of 3M Apple were good I think

• Chart pattern suggests /ES will trade above 2807

• potential good new about north korea

• The ECB & BOJ will maintain a loose money policy. The FOMC will raise interest rates the expected amount & will be dovish in their economic assessment. Singapore will go well but only be a political show. Monthly options will expire. Since the market will get some answers that will provide more certainty than it previously had, although still uncertain, the market will react bullishly to the increased level of Central Bank clarity. Amidst the price action, the market will continue to rise.

• Market momentum.

• Fear money leaving Europe .

• The summit that is happening right now and the positive upswing the economy is in.

• elliot wave

• Elliott Wave 5

• S&P closed Friday at its weekly high; momentum still looks upward. Financials look ready to move upward, which would help the S&P.

• Economy currently is doing alright. The stock market traditionally looks at positive side of the state of affairs, while overlooking negative side. The stock market also overlooks any potential negative long term effects of economic policies. The market definitely has a optimistic bias toward events.

• investors are watching the world political leaders with anticipation hopeful that the outcome will be positive for global economy with united states leading

• Just below resistance, but bullish weekly candle last week closing at its high.

• Good news.

• Momentum towards earnings. Interest rate hike factored in.

• Markets are coming off from a lower low and trying to hit all time highs

• should be a volatile week

• Martin Armstrong

• Uptrend cintinues..

• Oil starts heading up. So up goes the markets. Watching 2750 support and expecting break up and out of 2780 to continue. Oil co tinues its basing and moves towards 66.80

“Lower” Respondent Answers:

• tariffs

• Poor reaction to the G-7 outcome and a disappointment from the meeting with North Korea

• graph shows top of channel for now. must hedge all trades

• Seasonality and technical.

• cautious optimism

• Bad news from G7 meeting and N. Korea summit

• Market is currently overbought and needs to back and fill.

• Market up major stocks down

• Summer building a top

• It looks like exhausted and profit taking

• dd

Question #4. What are your primary trading and/or investing goals for the 2nd half of 2018?

• Bullish trading

• Make money

• To make an income

• stocks and to beat S&P

• options hedging puts and calls

• 20%

• Consistancy

• To recuperate losses of FEB March

• Safty

• —-Monthly income thro’ options —-dividend growth stocks w/ 2-4 investment term — learn more about short term trading- using more complex orders to capture shorter term gains & stop loss limits for limiting losses.

• make money

• Profit

• Avoid drawdowns..

• Continued ~3.5% gains / month

• Being positive

• Continue successful growth.

• 2% RISE

• With the market rising now on the same news that caused it to fall previously, my goal is to reevaluate how much risk I want to take prior to the next manic depressive move. I’ve trimmed my expectation now to only 40% of the gains that I thought were possible in January.

• Beat the S&P.

• income investment

• Continue to do as during the 1st half. Cntinue to learn and reduce mistakes more.

• Preserve capital in front of volatile announcements or happenings.

• Be in the market and try to make use of fundamentals with use of technical direction

• Make the plan. Stick to the plan. Lose the bad habits!

• To sell a stock I’ve owned since last summer

• Minimum 30% up.

• I am cautiously optimistic so I will maintain about 65% in options and the rest in cash.

• Take profits more often

• I plan to add funds a little at a time any time the market is down, because I feel confident that eventually it will up and I can get returns on the invested funds.

• Avoiding any significant drawdowns

• Increase daily PnL target by $200

• Broaden trading strategies.to be better able to adapt to changing circumstances be it the market, health or personal life style choices.

Question #5. Additional Comments/Questions/Suggestions?

• Make money with survey

• There may be a more equitable distribution of wealth in the world. some countries dump and dump their products into poor countries thereby killing infant indigenous industries in its infancy. Spreading wealth.does not decrease prosperity of the rich. it rather increases consumption of the poor thereby bringing social harmony and political unity

• Thanks great service brother

• What sectors are going to gain in 2H. What resources do U use to trade/invest more profitably ? What options strategies do U use most often & why ?

• Silver wowed last week. COT looks bullish. May drag gold along.

• I hope that the FBI IG reveals the details and the proof of what has been obvious for the last two years and that AG Sessions goes back to work. We all are sorry that Charles Krauthammer is near death and will be gone soon. His lust for life, his courage, his dignity dealing with his misfortune, and his intellect are an inspiration to us all and should underscore how lucky we are to be sound of body and to see what is possible if we don’t give up.

• The midterm elections will tell a lot. Hedge your investments.

• Re: #4: It not just about the money. Some traders seek to maximize profits while others may seek to minimize the need for adjustments.Both approaches have value. However, combining the two is the real goal! zzz

Join us for this week’s shows:

Crowd Forecast News Episode #184

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 11th, 2018

– 1PM ET (10AM PT)

Guests:

– Jim Kenney of OptionProfessor.com

– Jane Gallina of SeeJaneTrade.com

Moderator:

– Michael Filighera of LogicalSignals.com

Analyze Your Trade Episode #38

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 12th, 2018

– 4:30PM ET (1:30PM PT)

Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

Moderator:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

Partner Offer:

See The Hottest Stocks For Free

Did you expect Adobe (ADBE) & Netflix (NFLX) to start roaring higher once the new year began?

Financhill did. Click here to learn more.