Crowd Forecast News Report #247

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061718.pdf

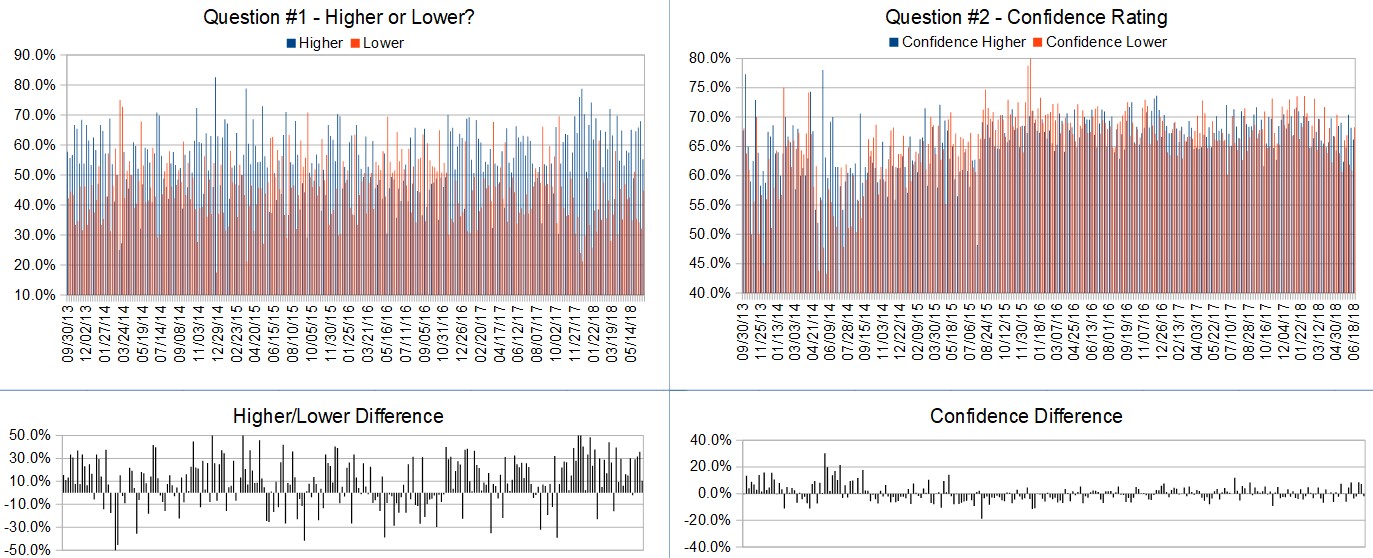

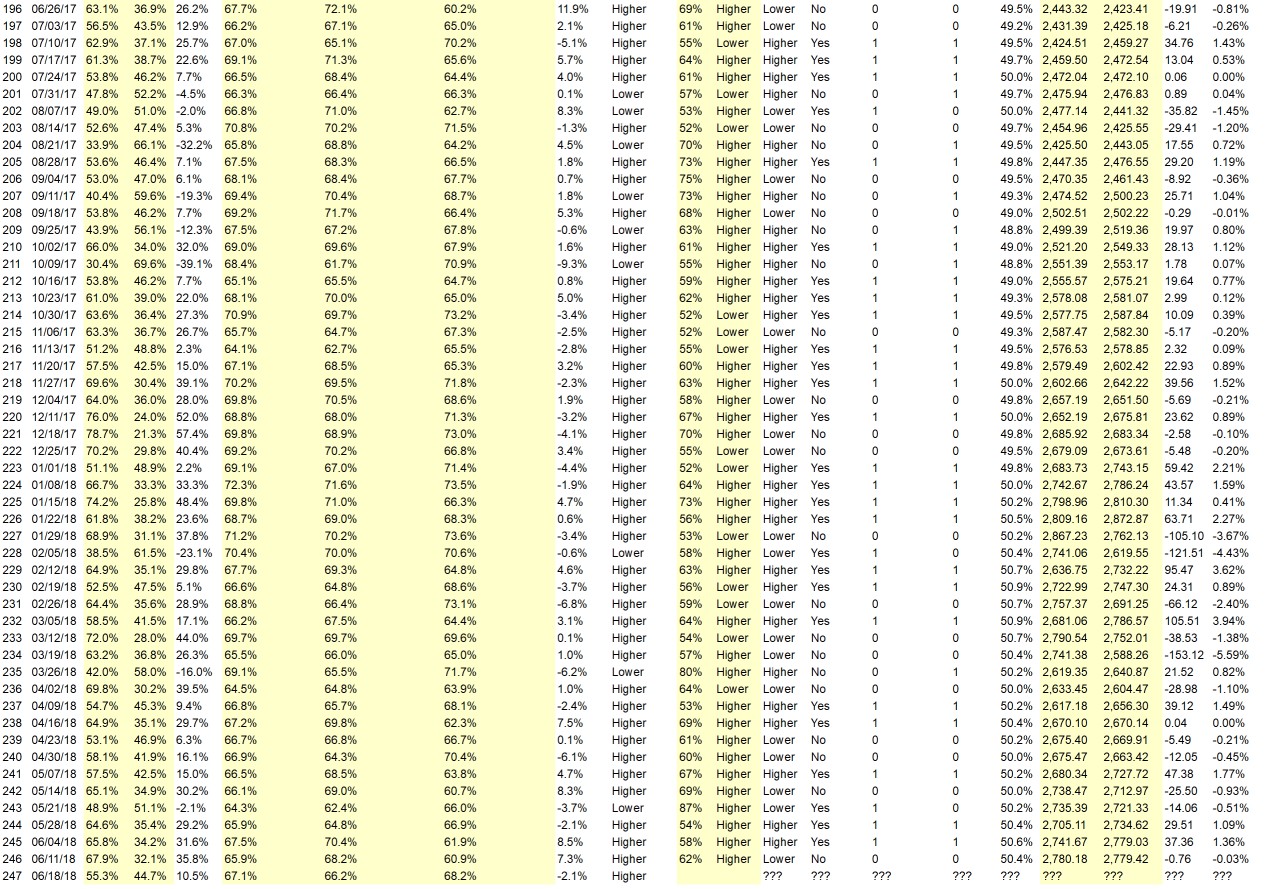

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 18th to June 22nd)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 55.3%

Lower: 44.7%

Higher/Lower Difference: 10.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.1%

Average For “Higher” Responses: 66.2%

Average For “Lower” Responses: 68.2%

Higher/Lower Difference: -2.1%

Responses Submitted This Week: 41

26-Week Average Number of Responses: 49.9

TimingResearch Crowd Forecast Prediction: 53% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 67.9% Higher, and the Crowd Forecast Indicator prediction was 62% Chance Higher; the S&P500 closed 0.03% Lower for the week. This week’s majority sentiment from the survey is 55.3% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 15 times in the previous 246 weeks, with the majority sentiment being correct 47% of the time, with an average S&P500 move of 0.31% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 52.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• 1 Cost 2 0.25 rate done

• Overall bullish attitude of the market

• Trade war smade war? Gold core ts into a buy zone. Why is silver on fire?

• Had a pull back and found support @ the 257.60 level, by the end of week should be about 285.00 level.

• History, and the economy.

• Low – High then a mid week low and then BTD ending slightly up

• Continued grind higher

• Dovish Draghi

• Breadth

“Lower” Respondent Answers:

• Markets short term overbought & history suggests there is a > 50% probability that the market will be lower the week after triple witching.

• After obtaining “clarity” from FOMC, ECB, BOJ & G-7, we are still left wondering what it really means. After talks with NK, the imposition of tariffs by the US & others, we are wondering where this will go for earnings even if Q2 earnings coming up are good. The VIX is low but uncertainty is high.Tech supported the SPX last week so if it pauses, the SPX is certain to drop a little as it consolidates. There is little inspiration until NFP & earnings weeks away. M&A will help, otherwise down.

• The trade war is heating up and I think that every day will hold a negative surprise as a result.

• Whitehouse nincompoopery prevails.

• elliott wave

• sell in May and stay away

• weak buying

• The S&P couldn’t make it up to the March peak before it started to fade. The financials lack energy, and the tech stocks appear to be close to a peak.

• Trade war BS is totally counter productive and will hurt US industry and slow down the economy.

• The market is overbought and needs to have a downside correction.

• Tariffs Bollinger band snap back candlestick

• summer top fed will raise again

• Fear of trade tariffs and retaliation. That situation is volatile and can change at any moment.

• Trends down to support then up we go.

• trade war

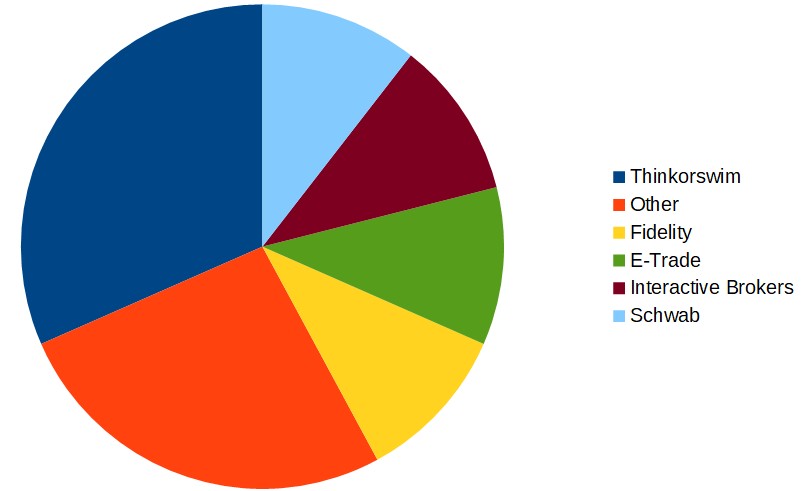

Question #Which trading platform or broker do you like the best for executing your trades?

• TOS

• Still looking. Most suck for options traders.

• thinkorswim

• Trade Station

• Schwab for stocks and options

• Bookmap

• TOS

• TOS

• Fidelity

• schwa

• i am unhappy with all of my brokers ALL OF THEM

• profitable ones

• e*trade

• Interactive Broker for my stock trades (can set up trades & go away) & tastyworks for options (best & most cost effective options trading platform out there).

• Sink or swim

• I like Fidelity but haven’t tried others

• E-Trade

• Interactivebrokers

• TOS

• Ninja Trader & Firetip

Question #5. Additional Comments/Questions/Suggestions?

• The FBI IG report was incomplete. For example, Attorney #1 wasn’t named. I guess it was Horowitz himself. If not, name the parties. I give the writing a D- and that is generous. This is another example of the corrupt FBI. It’s like an episode of “24” where the bad guys are in power and there is nothing you can do, no place you can go to get justice.

• This is the week which which can be bearish but despite all bearishness it will end up higher even if it is not much.

Join us for this week’s shows:

Crowd Forecast News Episode #185

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 18th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com

– Simon Klein of TradeSmart4x.com

– Neil Batho of TraderReview.net

Analyze Your Trade Episode #39

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 19th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Jim Kenney of OptionProfessor.com

– Todd Mitchell of TradingConceptsInc.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“