Crowd Forecast News Report #250

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport070818.pdf

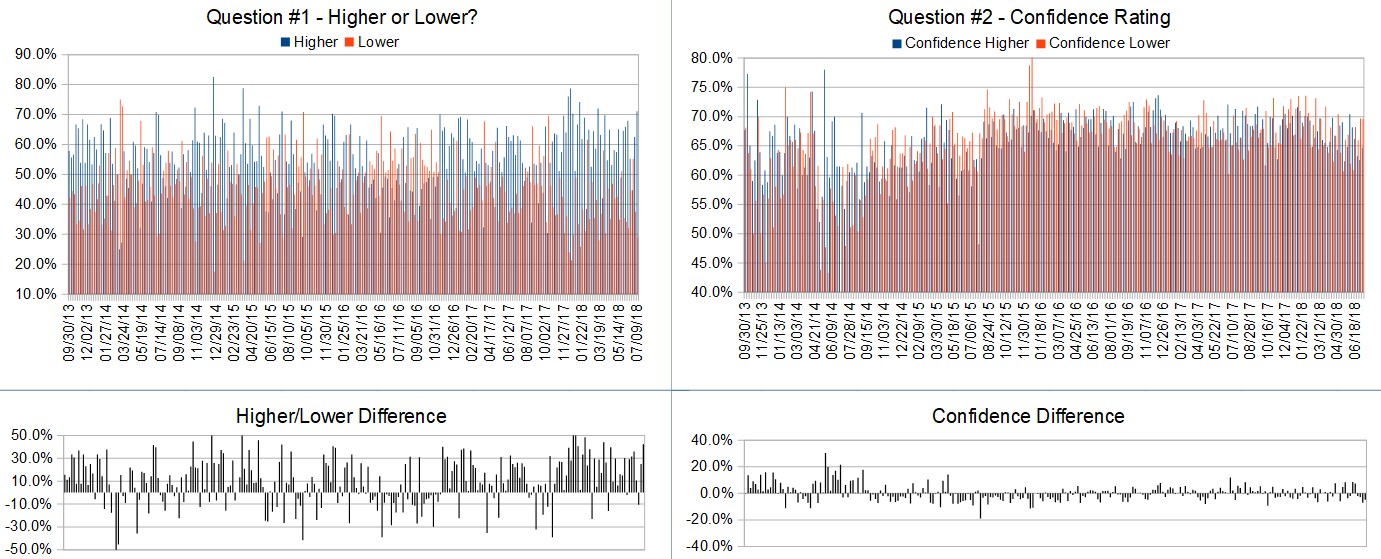

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 9th to June 13th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 71.1%

Lower: 28.9%

Higher/Lower Difference: 42.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.1%

Average For “Higher” Responses: 64.7%

Average For “Lower” Responses: 69.6%

Higher/Lower Difference: -4.9%

Responses Submitted This Week: 48

26-Week Average Number of Responses: 49.0

TimingResearch Crowd Forecast Prediction: 56% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 62.5% Higher, and the Crowd Forecast Indicator prediction was 59% Chance Lower; the S&P500 closed 2.03% Higher for the week. This week’s majority sentiment from the survey is 71.1% Higher with a greater average confidence from those who responded Lower. Similar conditions have been observed 18 times in the previous 249 weeks, with the majority sentiment being correct 44% of the time, with an average S&P500 move of 0.83% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Lower this coming week.

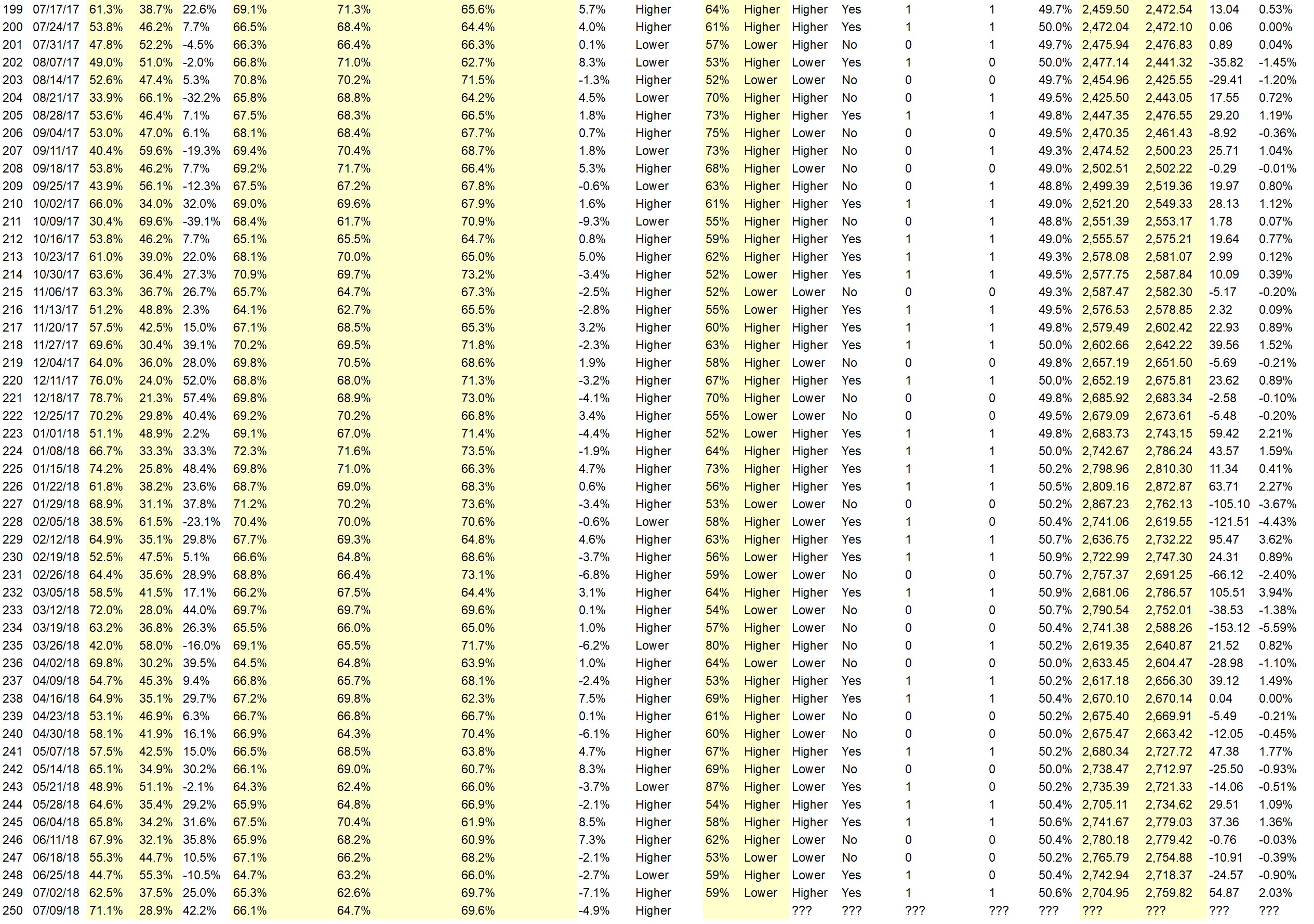

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Summation indexes turning up & market breadth improving. After Friday’s strong movement on low volume; expecting weakness early week, declining to moving averages, and then strengthening into week’s end.

• July up

• A new conservative constitutional Supreme Court nominees bee maybe

• Technicals see rising trend

• Even though all logic is to the contrary, all my momentum and sentiment indicators are not only bullish, they are very bullish so I’m going with the flow. With tariffs, geo-political conflicts, currency problems, emerging market weakness, interest rates rising, this could be a fake move but I think that the market is about to break out anticipating strong earnings on Friday and beyond. Weak hands have been severed and strong market moving hands are in control.

• Positive Earnings

• Tax cut

• The economy is booming, low unemployment.

• still buying

• The S&P was up this past week, showing immunity to all the trade war chatter. So it could very well continue. Next resistance about 2800.

• The current positive market momentum should continue in the coming week. However, there are likely a couple of down days mainly because of tariff war.

• Q’s and Techs are recovering as are small caps.

• got good fundamentals. trade tariffs easing..

• trade war is a good reason to buy the market apparently.

• Trade wars heat up. But Murica’ is self sufficient consumption. Just going to cost a bit more for imports. Who cares…. print it up! Good for the markets!

• Banks own stocks.

• Major negatives have already been priced into a market that has greater than 4% GDP predicted growth.

“Lower” Respondent Answers:

• Tariffs

• Trade war becomes very real with o resolution in sight

• yeses

• tradevwar intensifies

• International Trade Negotiations with China are going poorly for President Trump

• The downside correction will continue until the public says just get me out.

• trade war

• momentum and second derivative of momentum weak

• From High early next week a low should be formed around Friday the 13th

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading or investing?

• Sell covered calls

• Futures

• I took some profits today as well as yesterday. I hope to keep this cash ready when I see some good opportunities. Hopefully I will not miss these opportunities.

• I will put an option hedge on the VXX

• yes

• actual hedging and options

• options on futures positions vs. stops

• option spreads

• I have recently increased my % in JNUG Gold ETFs

• leveraged inverse etfs

• I am holding a few short ETF funds currently in case market goes back to a downtrend.

• Stops based on technical chart pattern

• Longer term options to help keep portfolio close to delta neutral.

• I closely watch the market and act accordingly.

• VXX, SPY puts and futures.

• use of the VIX.

• inverse etf

• Stop Loss Orders

• SPY puts and/or VIX calls

• I don’t

• Sell covered calls

• Selling OTM puts for issues and products I want to own. Going long option spreads in the directions I’m thinking. Having trailing stops combined with limit orders after I take a position. Keeping 1/3 to 1/2 of my accounts in cash until the market makes an extreme move down for me to take advantage of much lower prices. Listen to a wide range of advice but trust NO ONE! Take responsibility for all trades you make.

Question #5. Additional Comments/Questions/Suggestions?

• Unreliable markets all around the world. hanging by a thread

• Tariffs and trade war are completely unnecessary. Economic growth would have continued just fine.The economic advisor Kudlow had previously during Reagan administration seen the negative impact of such tariffs on American economy. Yet he is now willingly agreeing with the current administration on this. I suspect we retail investors/general public are in the dark of much of what is happening, sadly. It is extremely upsetting to see market gyrations, especially if one is not into day trading.

• yes

• Gold to benefit from the ‘flation’. Up we go. The giant H&S target is +320 points from the shoulder.

• Hmm… I like the concept of the system for market decisions !

• Our DOJ looks like it’s patterned out of a “Banana Republic” and why Trump does not order it to comply with the demands of Congress, I do not know and can’t imagine why. At least the new Supreme Court will be committed to following the Constitution and not re-writing it.

Join us for this week’s shows:

Crowd Forecast News Episode #188

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 9th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Dave Landry of DaveLandry.com

– Kirk Du Plessis of OptionAlpha.com (first time guest!)

– Simon Klein of TradeSmart4x.com

– Neil Batho of TraderReview.net

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

Analyze Your Trade Episode #41

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 10th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com

– Christian Fromhertz of TribecaTradeGroup.com

– Jim Kenney of OptionProfessor.com

– Larry Gaines of PowerCycleTrading.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“