Crowd Forecast News Report #253

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport072918.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 30th to August 3rd)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 46.2%

Lower: 53.8%

Higher/Lower Difference: -7.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.5%

Average For “Higher” Responses: 69.7%

Average For “Lower” Responses: 67.4%

Higher/Lower Difference: 2.3%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 50.0

TimingResearch Crowd Forecast Prediction: 64% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.3% Higher, and the Crowd Forecast Indicator prediction was 64% Chance Lower; the S&P500 closed 0.45% Higher for the week. This week’s majority sentiment from the survey is 53.8% Lower with a greater average confidence from those who responded Higher. Similar conditions have been observed 33 times in the previous 252 weeks, with the majority sentiment being correct 36% of the time, with an average S&P500 move of 0.15% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

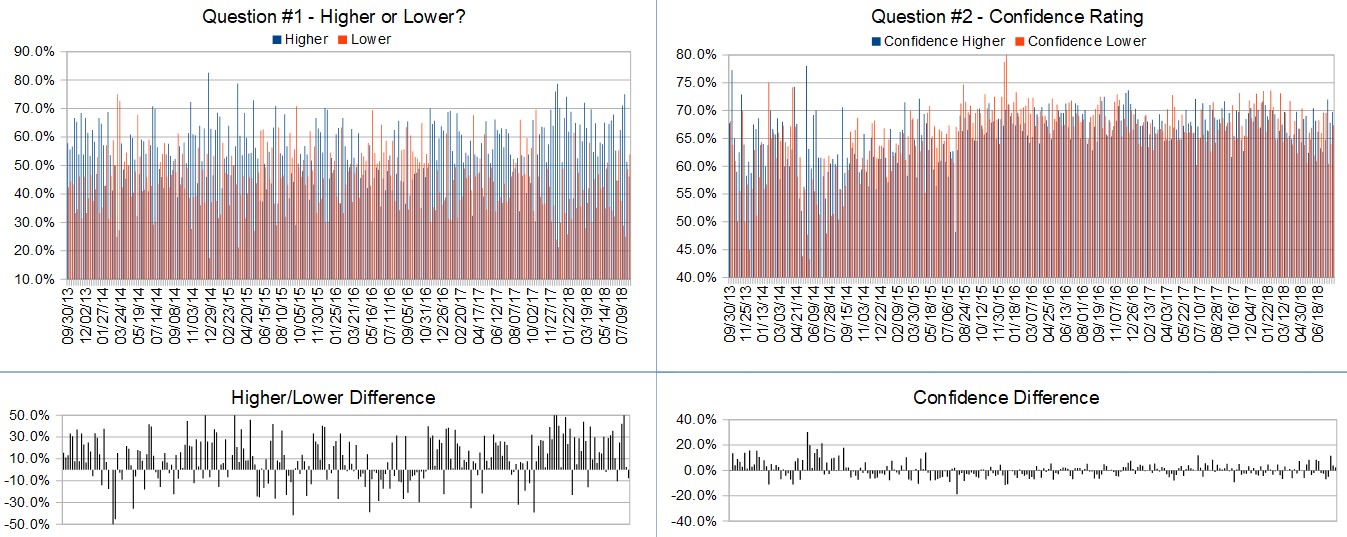

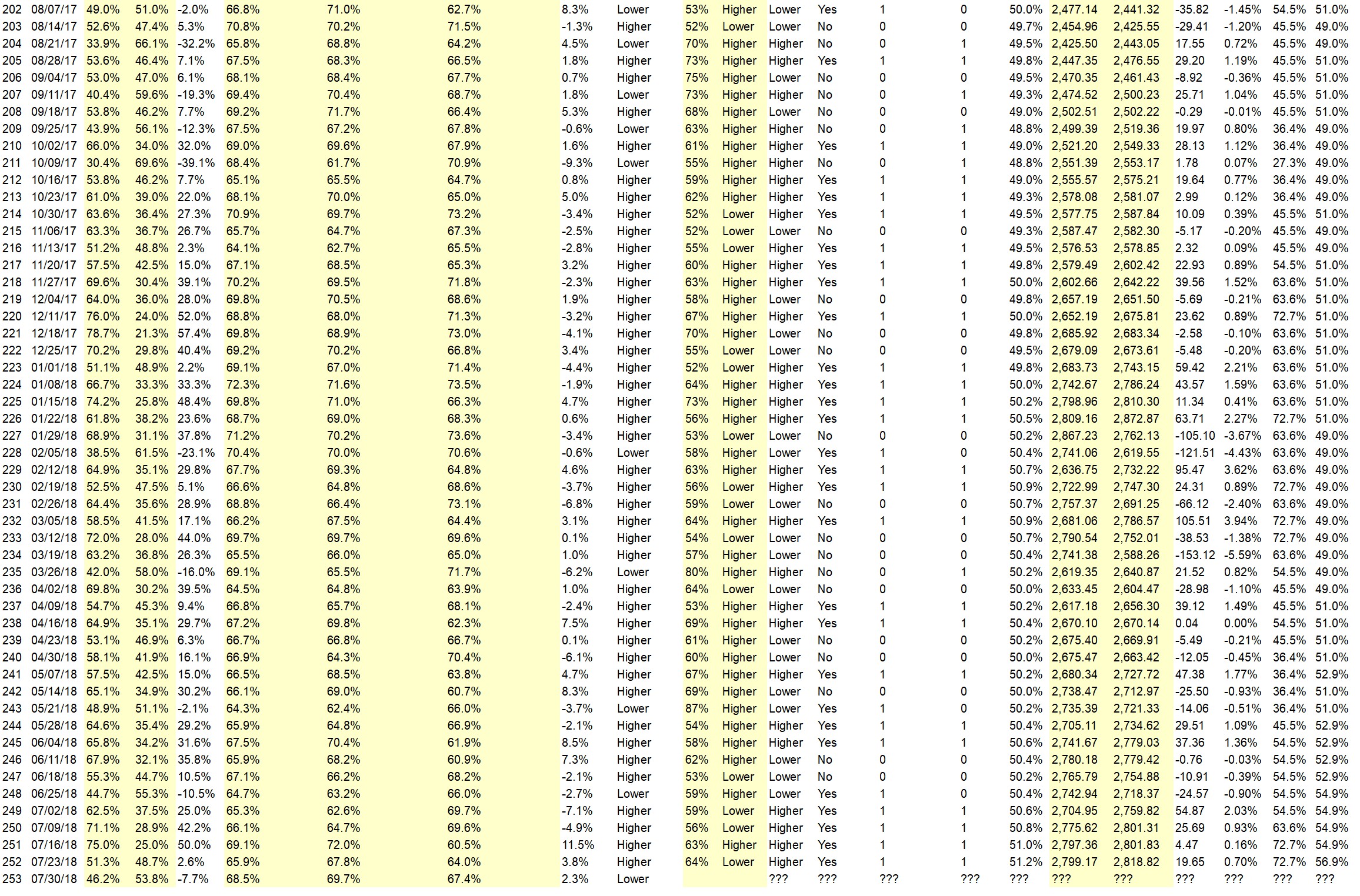

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.0%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Despite a good pullback in the SPX on Friday, and the NASDAQ & RUSSELL getting whacked, market internals (stocks > their 50d ma & advance/decline, etc.) are still positive. Also, while the S&P broke below it’s 10d ema, it ended up closing above it – another positive sign. Overall, most companies are still easily beating earnings expectations, so looking for more of the same next week.

• Earning

• High momemtum

• The nomination of Judge Kavanaugh and proceedings might influence a positive move maybe I guess

• Expect general bullish trend to continue based on anticipated positive earning reports and other news.

• slight positive momentum

• earnings

• Because I did all anyone can do and took a guess. Hopefully I’m right but it doesn’t really matter to me as long as there is movement in one direction or the other

• Good economy

• GDP 4.1%

• Trump is winning. His style is getting results even if the mainstream media hates it. No more excuses now that economic data is showing positive results. All that could happen is to have oil sky rocket too fast it’s on its way up as a result of global economic growth.

• I’m clueless this week!

“Lower” Respondent Answers:

• Tougher earnings season.

• Tariffs

• My technical indicators are down reacting to the mixed to down response to tech earnings & guidance. The Fed this week will say nothing that will be encouraging & XLF will sell off. AAPL will disappoint & the NFP will be less strong than last month. End of month & beginning of month portfolio adjustments will confuse the situation further. However, the VIX & IV is saying that there is nothing to worry about yet but they are not bullish either. For now, momentum is down & it’s time to raise cash.

• too many stocks selling off

• Over bought. Retracement needed. Seasonal slow down. Bearish news out there

• wave

• Technical and tired mkt even good news is getting sold Few names have pulled it higher now they’re failing

• Elliott Wave

• The downside correction of the market continues. The FANG stocks are beginning to crack and many of the institutional favorites are turning down after earnings and disappointing outlooks.

• The market drop on Friday after a favorable GDP appears to mark a reversal to the upward trend. There’s more room to drop.

• please note this is the 2nd time I’m filling this out but you seem to be unaware I’ve already submitted this, I believe on Friday.

• Historically not a good month

• wave 3 down has begun pseudo-tech stocks deflating

• Seasonal, technical & defusing enthusiasm may create sell offs. There could be still two to three bullish days.

• no reasons for the market to go up

• Overbought market

Question #4. Who or what first inspired you to become a trader?

• Dr. Elder’s book “Trading for a Living”. Laid out the three necessary pillars (detailed trade plan, money management, & psychology) in an easy to understand format.

• Wall Street Week

• Mom

• The desire to generate income by other means than a conventional job.

• interest in chart watching

• Not sure. I’ve always been somewhat interested in the markets. Although seeing pit trading in the movies is pretty cool.

• My grade 11 economics class. Played the fake market game. Exciting. OptionEtics introduced me to options and I never looked back.

• Unfortunately it was ElliottWave because I got caught up in the number magic of math. It took me YEARS to realize that EW does NOT predict the market.

• Time to write a novel

• My friend who told me that’s how people become rich.

• Necessity became the mother of invention for me.

• Larry Williams

• love to gamble– better odds than cards

• Money

• I was a commodity broker for 17 years and when I decided to leave that realm, I decided that I would trade stocks for myself.

• I had a natural interest in the trading game while I was a teenager, and before I had the money to trade.

• My dad

• To recover a lost capital for a business and now I lost literally all capital I had. I think not 90 but 96% of traders fail at some point and lose their capital.

• bitcoin

• The lure of increasing my savings faster than average.

Question #5. Additional Comments/Questions/Suggestions?

• Buy low, sell high or sell high, buy low.

• Oil rising as demand side moves it up. Precious metals will rise as does yuan and inflation as a result of growrh5.

• An Optimist says, “IT JUST CAN’T GET ANY BETTER THAN THIS!!!!!!!” Unfortunately, a pessimist says the same thing. So that’s what happened to tech this past week. Expect the sell off to continue on Monday and if it’s enough, Friday could actually be higher than Monday’s open but expect August trading not to be “Too Damned Hot”.

• What can you do for me?

• Even good news is getting sold

• All this is speculatory and requires lot of luck, hard work, focus and care to preserve original capital.

Join us for this week’s shows:

Crowd Forecast News Episode #190

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 30th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com (moderator)

– A.J. Brown of TradingTrainer.com

– Neil Batho of TraderReview.net

– Jane Gallina of SeeJaneTrade.com

Analyze Your Trade Episode #43

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 31st, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

– Jim Kenney of OptionProfessor.com

– Steven Brooks of StevenBrooks.co

– Steven Place of InvestingWithOptions.com

Partner Offer:

TopstepTrader has funded more than 1,800 traders just like you with live trading capital. They take all the risk. You keep the first $5,000 in profits and 80% thereafter.