Crowd Forecast News Report #256

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081918.pdf

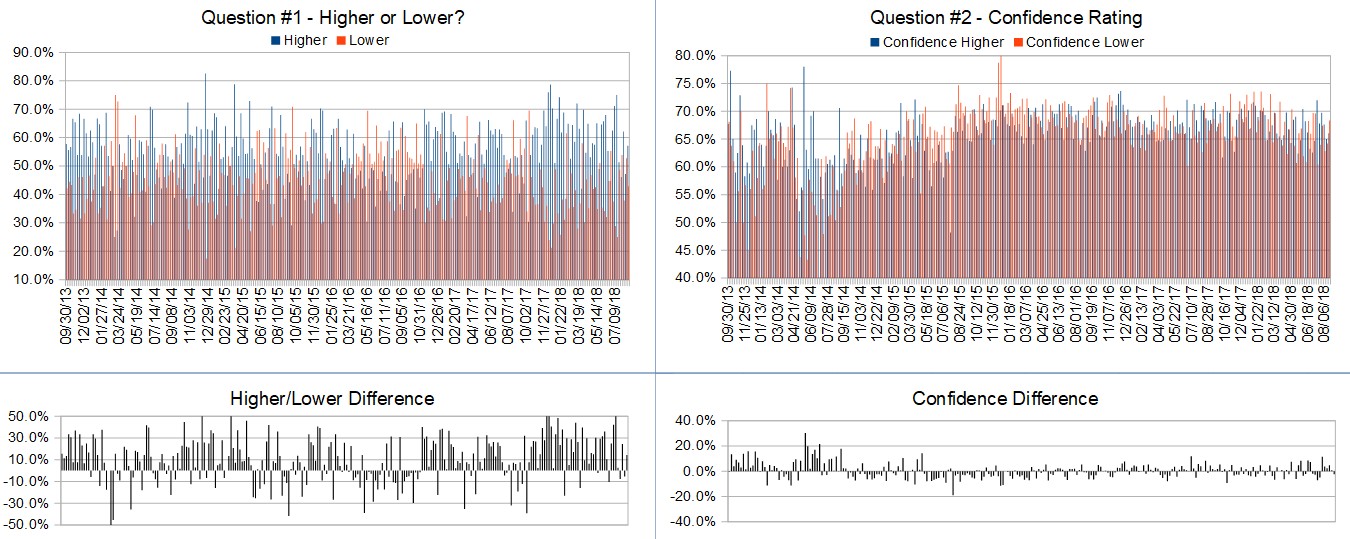

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 20th to August 24th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.1%

Lower: 42.9%

Higher/Lower Difference: 14.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.0%

Average For “Higher” Responses: 66.0%

Average For “Lower” Responses: 68.3%

Higher/Lower Difference: -2.3%

Responses Submitted This Week: 44

52-Week Average Number of Responses: 49.1

TimingResearch Crowd Forecast Prediction: 67% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

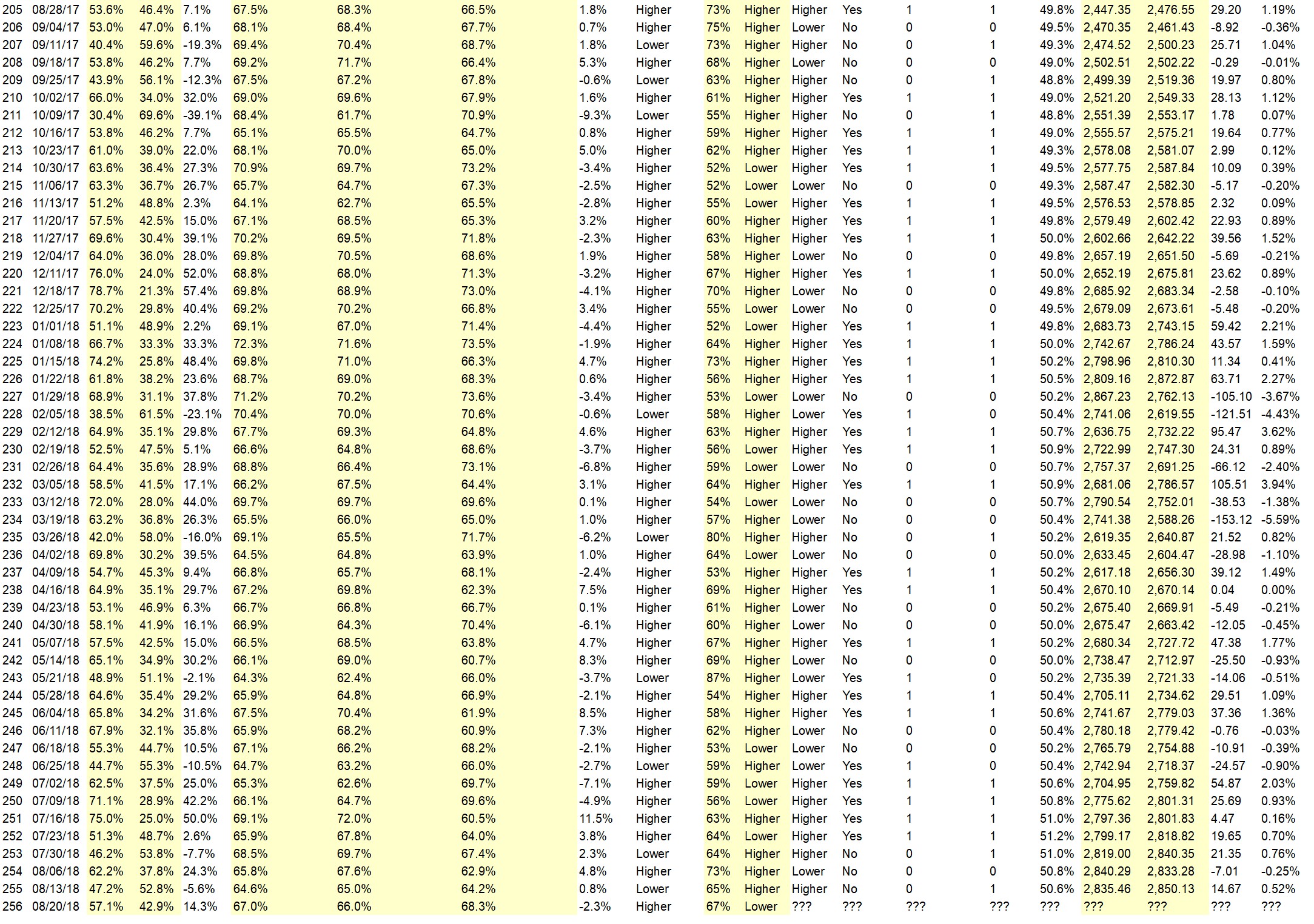

Details: Last week’s majority sentiment from the survey was 52.8% Lower, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.52% Higher for the week. This week’s majority sentiment from the survey is 57.1% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 9 times in the previous 255 weeks, with the majority sentiment being correct 33% of the time, with an average S&P500 move of 0.63% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Lower this coming week.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 50.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• momentum still there

• put call ratio

• trade talks usa and china

• Traders Commitment

• positive news on trade sparks test of new high.

• Momentum Economic growth Trade parity with China

• Contrarian view

• The declines have been lessening.

• still buying

• Tarriff will be negated

• I think it will be another slow week for stocks.

• We are not seeing lack of demand at highs over the past few weeks.

• bargain before September

• Pivotal week? Lower by weekend?

• I can’t help wondering if it’s manipulated. After all, banks buy stocks don’t they.

“Lower” Respondent Answers:

• Resistance should be looked at as a possibility as more selling pressure than buying could happen maybe

• I have bad record and lost money. This makes me last person should say where market is going.

• Tariffs

• topping out in Wave 2

• slowing momentum and global uncertainty

• yes

• still within the “Sell in May and go away” period

• Elliott wave 4

• The downside correction in most major stocks continues. The FANG stocks are showing major technical problems.

• The S&P is near an all-time high. ButTech stocks are weak; retail stocks have been strong, but have no reason to move higher.

• No upside left

• dead cat bounce this week

• seasonal drop

• Trade talks will not produce results

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• don’t get too greedy

• Profit

• Total zero. Don’t think.. Just price is king

• Patience

• confidence in what they are doing and listen to no one else when you have your plan that works

• learn how to loose

• patience, discipline and managing risk

• yes

• patience

• Patience & Consistency

• patience

• Fearlessness, apathy, resiliency

• Let go of loses Do not let loses control your emotions Don’t try to get even with a stock you just a lot money trading

• Flexability.

• Discipline is key—-stick to the plan that your system dictates.

• Don’t get emotionally attached to a stock or sector.

• Read Traders Kryptonite for answers

• Watch the earnings

• calm focus

• Discipline of sticking to a trading plan, avoiding overtrading and taking losses at predetermined levels or in response to a change in sentiment.

• patient

• education, not psyche, is what makes a trader

• Patience and clear thinking. Decisiveness.

• Set buy and sells and stick with them

• Gotta keep your sense of humour. Don’t trade if you’ve just had an argument with your mom — even if you think you’ve put it out of your mind.

Question #5. Additional Comments/Questions/Suggestions?

• buy American

Join us for this week’s shows:

Crowd Forecast News Episode #193

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 20th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Norman Hallett of TheDisciplinedTrader.com (first time guest!)

– Lee Harris of EmojiTrading.com (first time guest!)

– Damon Pavlatos of FuturePathTrading.com (first time guest!)

– Dave Landry of DaveLandry.com (moderator)

Analyze Your Trade Episode #46

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 21st, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Jim Kenney of OptionProfessor.com

Partner Offer:

In 2015, he claimed exactly $838,353 in capital gains. In four years – he turned $15,253 into $2,855,475. Watch Kyle Dennis’ presentation:

“Learn the 3-Step Plan I Used to Turn $15,253 into $2,855,475 Trading Biotech Stocks!“