Crowd Forecast News Report #259

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport090918.pdf

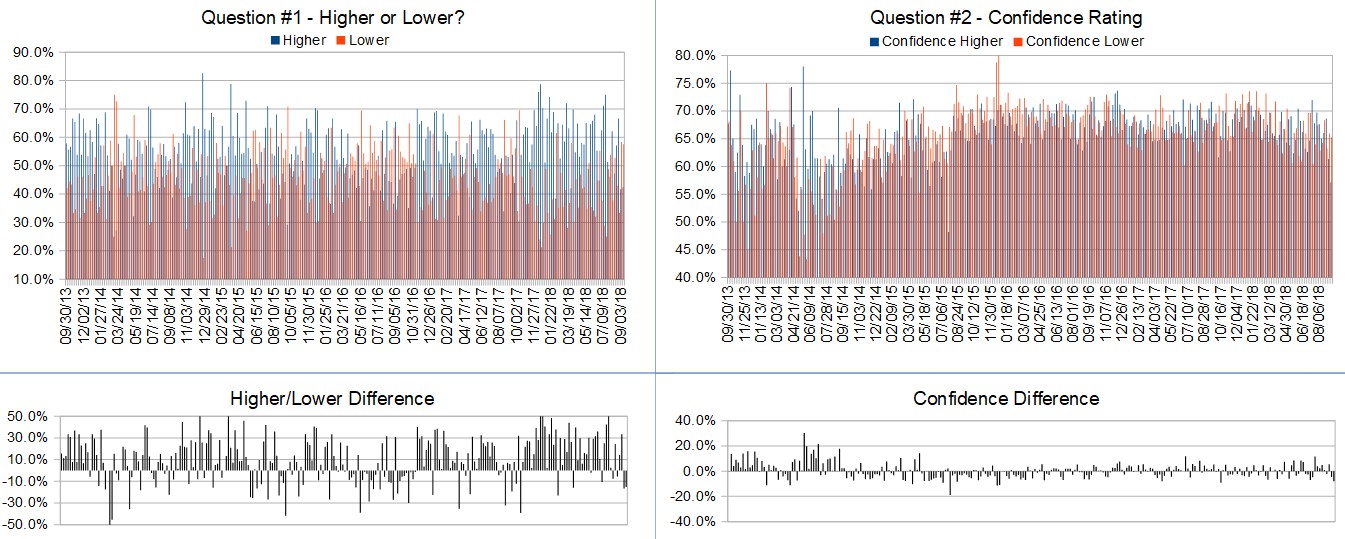

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 10th to September 14th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 42.4%

Lower: 57.6%

Higher/Lower Difference: -15.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 61.8%

Average For “Higher” Responses: 57.1%

Average For “Lower” Responses: 65.3%

Higher/Lower Difference: -8.1%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 47.7

TimingResearch Crowd Forecast Prediction: 68% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 58.3% Lower, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.87% Lower for the week. This week’s majority sentiment from the survey is 57.6% Lower with a greater average confidence from those who responded Lower. Similar conditions have been observed 25 times in the previous 258 weeks, with the majority sentiment being correct only 32% of the time, with an average S&P500 move of 0.42% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 68% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

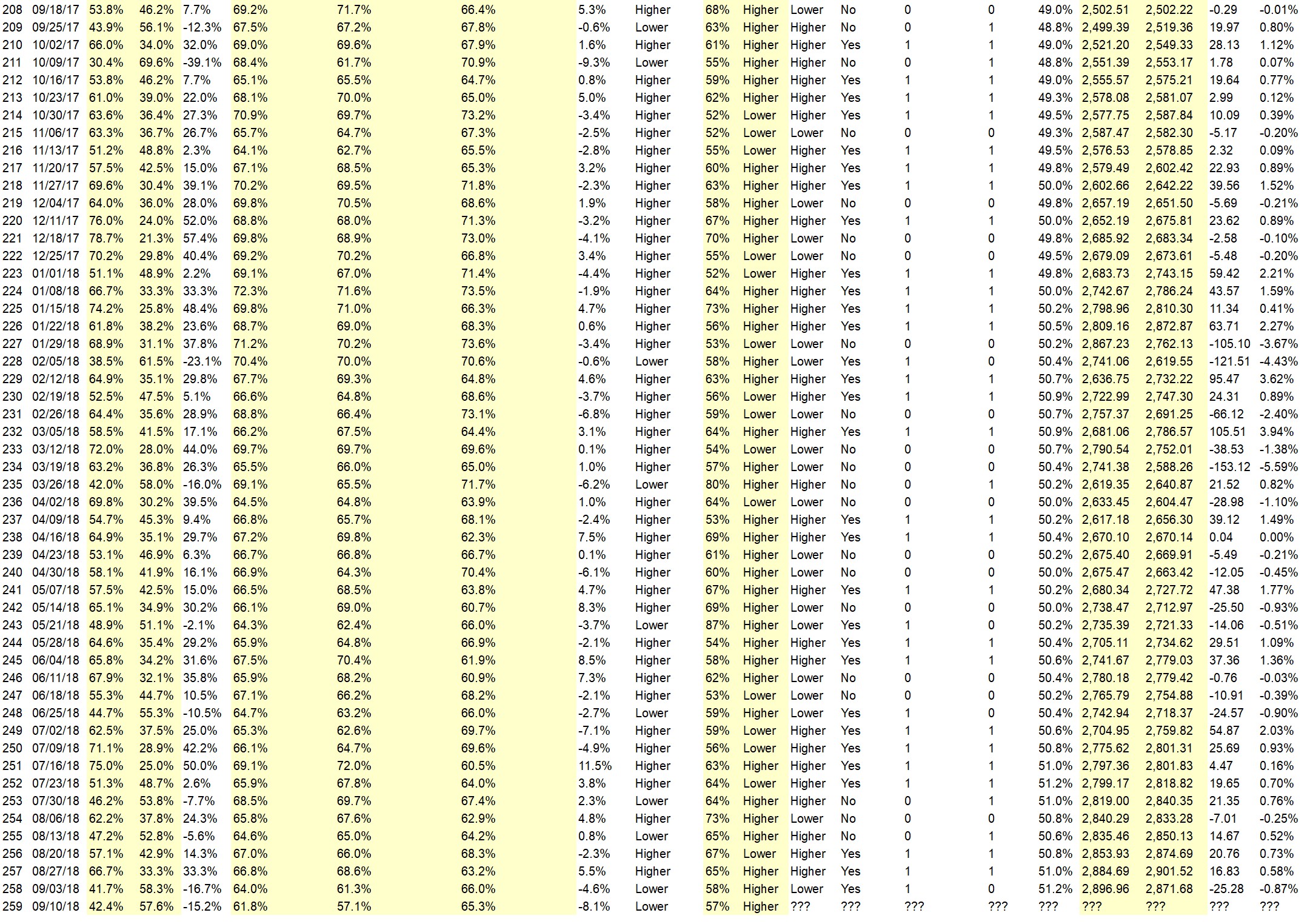

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Donald Trump enthusiasm

• The line on the chart says it all. The trend continues higher after a short hiatus. Inflation from jobs data now solidly will influence the equity markets and gold higher.

• up week following a down week

• Recent history.

• People returning from vacation

• momentum

“Lower” Respondent Answers:

• Ouverbought Market.

• tariffs

• Tariffs are inflationary and are providing a level of uncertainty that is particularly motivating the market to take profits and window dress institutional portfolios for the end of the 3rd qtr although it’s pretty early to do that now. The Fed is going raise interest rates soon and give a press conference that will be a market mover perhaps contributing to the uncertainty. Political and geopolitical hostilities are increasing adding to uncertainty in spite of good economic news otherwise.

• NASDAQ is still jittery and likely to continue down pulling the S&P and eventually the Dow with it.

• There is no reason to create new records in September

• inflation

• TrAde talk/war

• Reality will over take the status quo as the trend remains in the early stages of transitioning from bullish to bearish.

• The market strength is weakening. The September seasonal weakness is getting a grip.

• Since the high on Aug 29, the S&P has been trending down. This trend is likely to continue, especially with the Chinese tariff situation.

• September

• Now the trend is down

• momentum failing support

• It could go anywhere during this volatile season. So I’m simply not going to trade.

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• Annual returns compared

• past history averages

• comparison of results to goals

• I keep a journal but it’s not like a diary. More like unexpected surprises that I should be ready for next time. And new possible ideas for what-if scenarios. Because I trade options, there are lots of what-if’s.

• Acct bal.

• bank account

• increase in overall portofolio

• I keep records

• Profit and Loss Statements.

• Look at net worth

• Still the same procedure – evaluating equity over time

• credit balance

• Profit

• Performance

• When I am successful, I am like a cheetah attaching an injured lamb. When I am unsuccessful, I AM the injured lamb.

• Reviewing of and adherence to my risk management rules.

Question #5. Additional Comments/Questions/Suggestions?

• The political left is so insecure in their beliefs that they feel the need to shut down free speech and an exchange of other ideas through violence like spoiled 2-year-olds. You don’t often see similar behavior from the right even when they are in the minority and don’t get their way. So who do you think is more likely to take away your freedom? Separately, Nike is misguided and is insulting so I will peacefully buy products from its competitors. I’ll just do that instead!

Join us for this week’s shows:

Crowd Forecast News Episode #195

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 10th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

– Fausto Pugliese of CyberTradingUniversity.com

– Anka Metcalf of TradeOutLoud.com

– Jim Kenney of OptionProfessor.com

AYT is off this week but will be back on September 18th!

Analyze Your Trade Episode #49

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 18th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Dean Jenkins of FollowMeTrades.com (moderator)

– Oliver Schmalholz of NewsQuantified.com

– Jim Kenney of OptionProfessor.com

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.