Crowd Forecast News Report #274

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport122318.pdf

Scroll down for the full web version of the report.

Partner Offer:

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

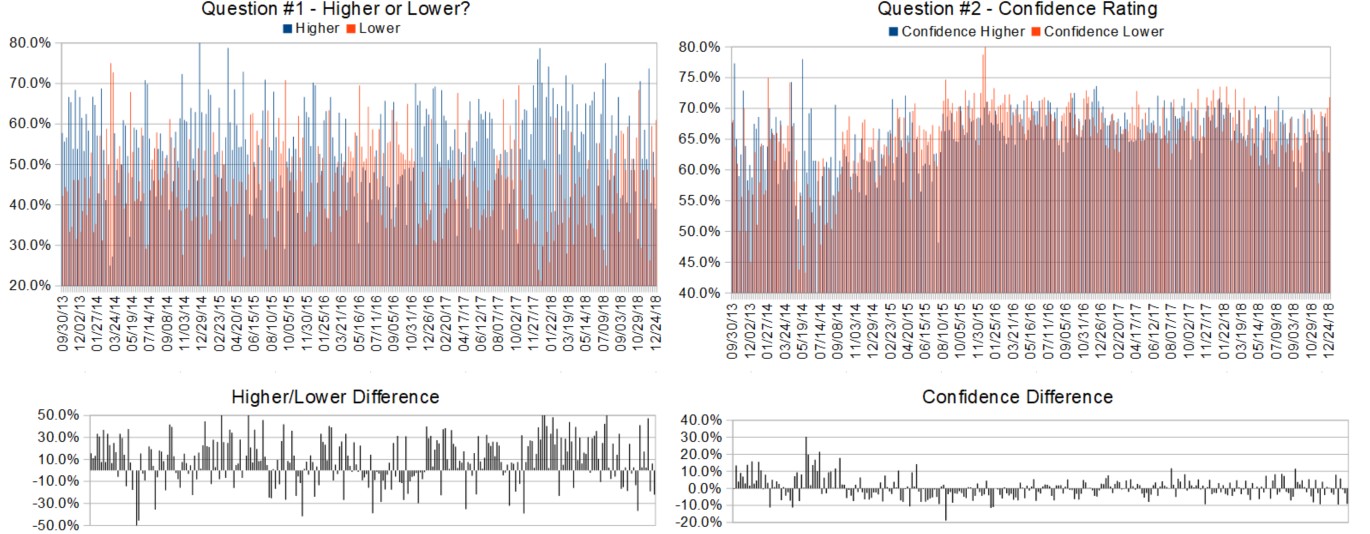

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 24th to 28th)

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 39.0%

Lower: 61.0%

Higher/Lower Difference: -22.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.3%

Average For “Higher” Responses: 62.8%

Average For “Lower” Responses: 71.8%

Higher/Lower Difference: -9.0%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 44.2

TimingResearch Crowd Forecast Prediction: 83% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 53.1% Higher, and the Crowd Forecast Indicator prediction was 55% Chance Higher; the S&P500 closed 6.72% Lower for the week. This week’s majority sentiment from the survey is 61.0% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 12 times in the previous 273 weeks, with the majority sentiment being correct only 17% of the time and with an average S&P500 move of 0.67% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 83% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

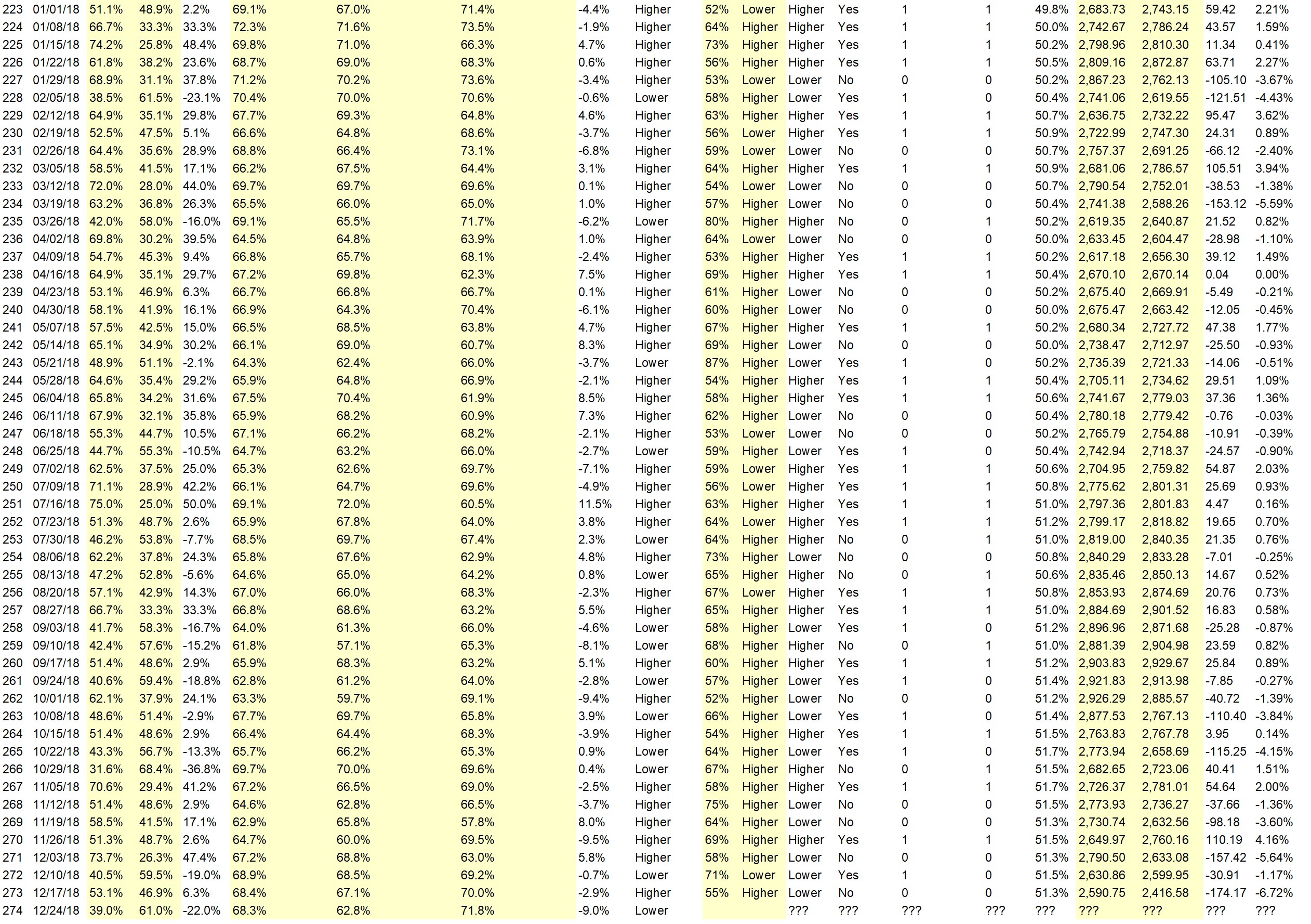

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.3%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Year end rally

• Retracement and then further down

• time for a pause in the slaughter

• We are very low now.

• Spy 240 held Build from here

• Correction to the upside. A lower low will follow in the following week.

• Dead cat bounce/santa rally

• I see it as a pullback. Getting ready for another bigger downward plunge in New Year.

• Institutions have to rebalance. Will pick up undervalued stocks going into new year.

• short term : CBOE Equity put/call ratio closed too high. longer term: fundamentals are ok. Market is concerned only because of China and uncertainty with U.S. politics.

“Lower” Respondent Answers:

• redemption of funds by managers closing the books and washing their slate clean investor sentiment

• Sentiment

• Tariffs, government shutdown, interest rates

• More panic selling to continue

• So many uncertainties which the market usually hates and the recent weakness shows no signs of abating

• according to the sentiment of the market the price will go to support 1800 (in about 2 months)

• Continued down trend

• It’s hard to fight the direction of the market.

• There’s no meaningful S&P support until somewhere below 2300. No Santa rally showing up. Pres. Trump must be angry at Santa, but he can’t fire him.

• I no longer believe a CRASH is going to occur and now believe we are simply in a fairly intense bear market and when this ends the market will take off again and surpass highs of the recent past, possibly breaking 30K, maybe even 40K DOW and then when the US is about the only nation that has not seen its markets crash, It will happen here, probably in the next 2 to 4 years at which point the world will go into a depression lasting at least a decade, possibly 2.

• The downside correction continues.

• Gov’t shutdown

• SPX is in bearish market and just experience the “death cross”.

• No serious buyers

• Everyone is bearish now and all bulls are being wiped out

• The Market is oversold. The companies have bought back billions of their own shares. They have shorted their own stocks with covered calls.

• support broken McClellen oscilator

• Big money never Trumpers trying to sink American economy.

Partner Offer:

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

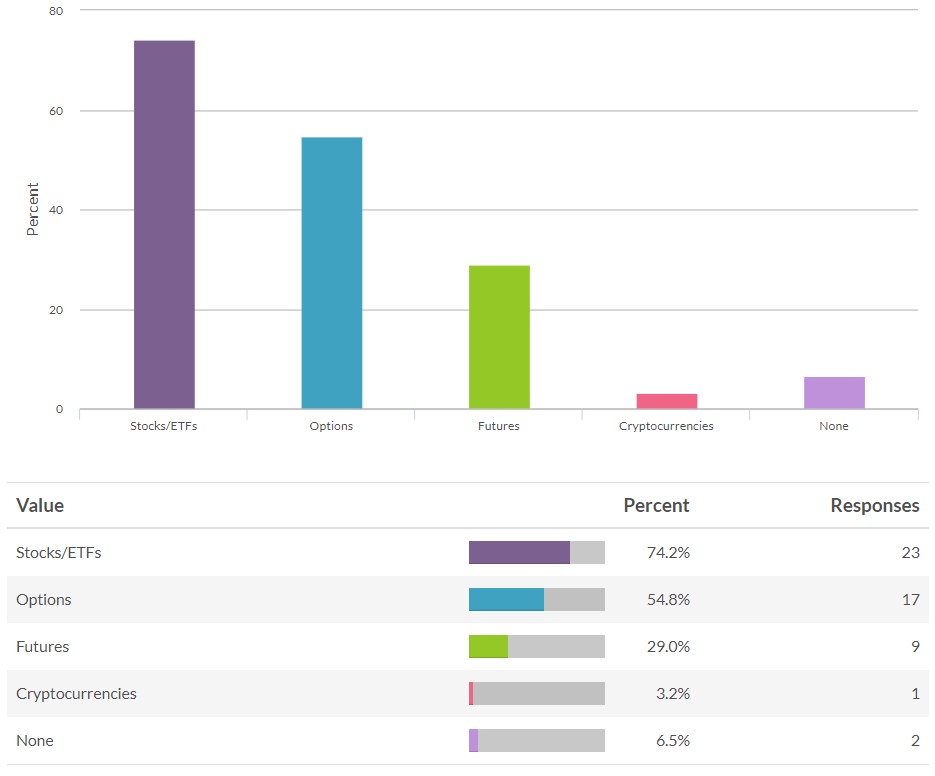

Question #4a. Which of these have you traded in the last year?

Question #4b. Which software programs and/or platforms have you used to execute your trades?

(For those who responded to #4b their answers to #4a are shown below before their #4b asnwer.)

• Stocks/ETFs, Options, Futures – Streetsmart Pro 3T Futures

• Stocks/ETFs, Options – Interactivbrokers

• Stocks/ETFs – Fidelity TC2000

• Stocks/ETFs – Think or Swim

• Stocks/ETFs, Futures – TD

• Options – Schwab

• Stocks/ETFs, Options – TradeStation

• Options – thinkorswim

• Options, Futures – Interactive Brokers. Fills are awesome even though their margining is difficult.

• Futures – Ninja Trader Platform. No software only look at price.

• Stocks/ETFs, Futures – TD

• Stocks/ETFs, Options, Futures – SAXO trader

• Futures – GCI fin., X-station, MT4

• Stocks/ETFs, Futures – interactivebrokers/fidessa

• Options – TOS

• Stocks/ETFs, Options, Cryptocurrencies – Options house

• Stocks/ETFs – E-Trade

Question #5. Additional Comments/Questions/Suggestions?

• Trade tensions, tariffs, Powell Put, too much uncertainty coming out of Washington

• What’s coming is something different, something most will not expect. A drop of epic proportions..

The shows are off for the next couple weeks but join us again on January 7th!

Crowd Forecast News Episode #209

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 7th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– John Hoagland of TopstepTrader.com

– Jim Kenney of OptionProfessor.com

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

Analyze Your Trade Episode #61

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 8th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– TBA

Partner Offer:

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security