- Home

- Archive: June, 2019

Crowd Forecast News Report #301

AD: Need more capital to trade? Click for Futures or Forex.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport063019.pdf

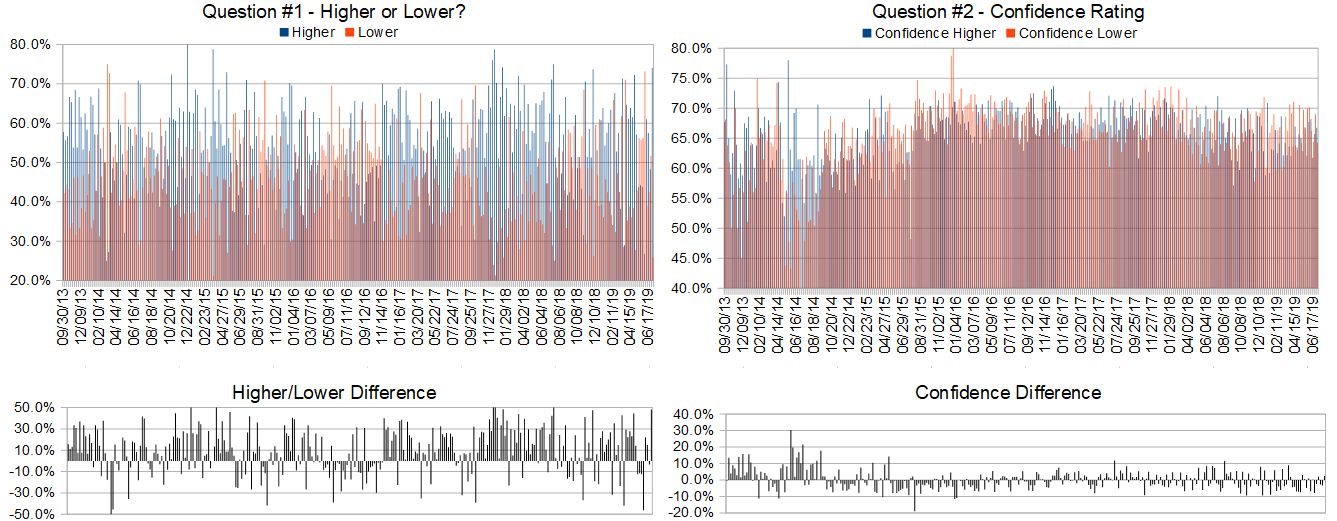

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 1st to 5th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 74.1%

Lower: 25.9%

Higher/Lower Difference: 48.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.1%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 64.3%

Higher/Lower Difference: 2.5%

Responses Submitted This Week: 27

52-Week Average Number of Responses: 37.6

TimingResearch Crowd Forecast Prediction: 60% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.7% Lower, and the Crowd Forecast Indicator prediction was 78% Chance Higher; the S&P500 closed 0.33% Lower for the week. This week’s majority sentiment from the survey is 74.1% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 15 times in the previous 300 weeks, with the majority sentiment (Higher) being correct only 40% of the time and with an average S&P500 move of 0.32% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Lower this coming week.

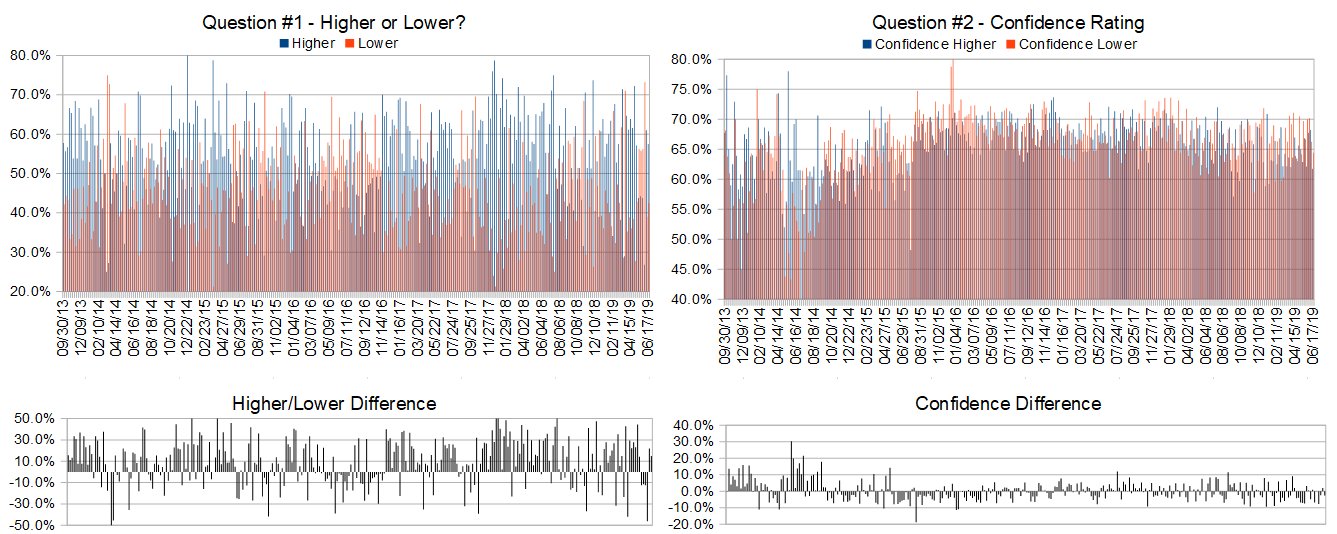

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

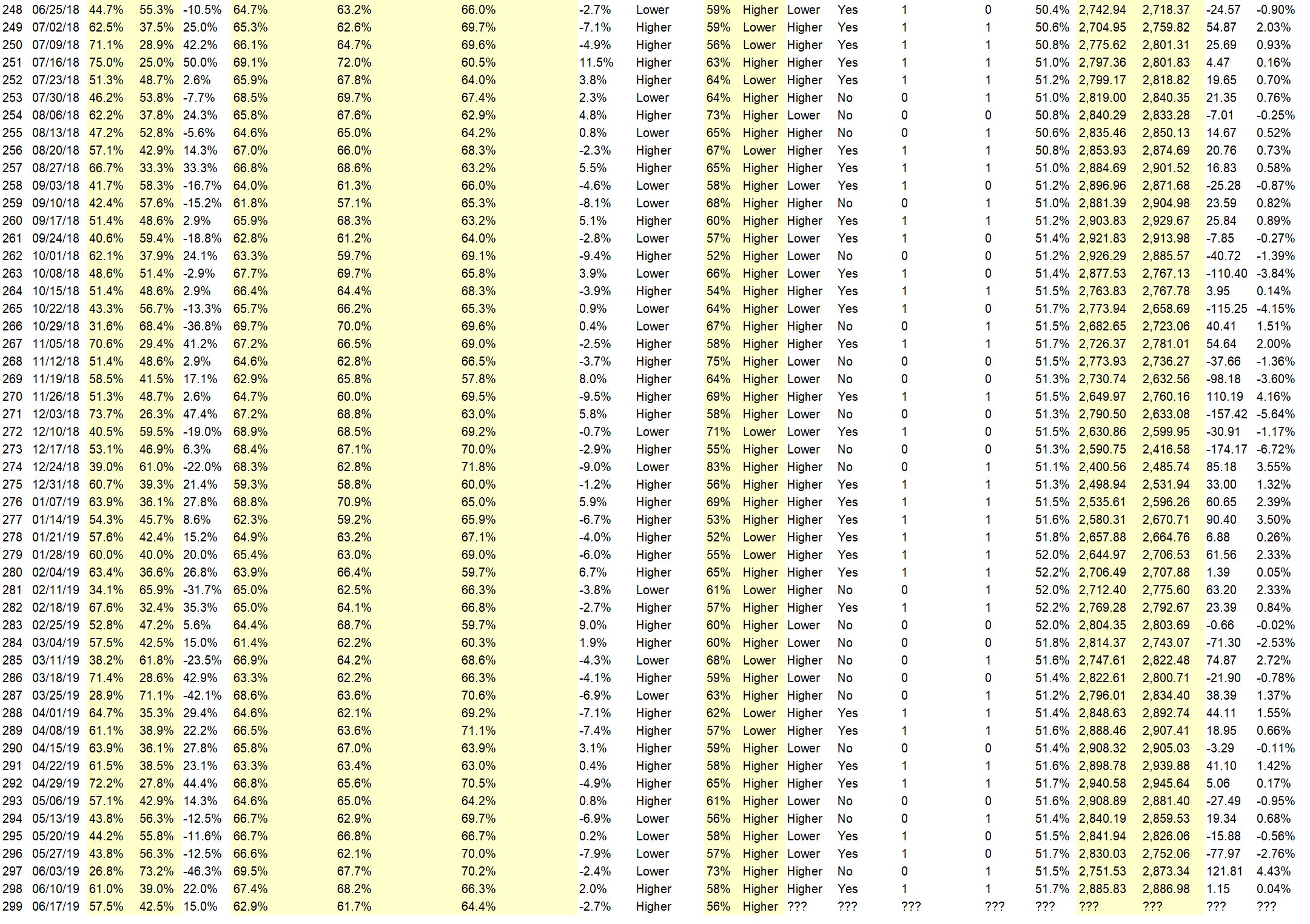

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• China resolution, first of the month and new disposable income coming into the markets. Institutions speculating on the effects of the G-20 meeting.

• wave 5 is still finishing

• new highs coming

• China

• We closed up 40 points last week after a pullback so higher, and the RSI is long.

• continue uptrend until it ends

• Trade talks

• history

• improved momentum

• Trump announcing his bid for the Race

• Holiday trading adjustments

• There’s room to move up to 3000 in the near-term. The US-China trade talks will probably drag on, and therefore not cause the market to drop.

• Talks

• China deal, positive week for next week usually, to much negative sentiment readings

“Lower” Respondent Answers:

• the falling interest rates are causing the herd to panic

• No direction for Trump/China deal

• Panic setting in the herd

• 4th of July Holidays, progress on the Trade Talks somewhat stalled

AD: Need more capital to trade? Click for Futures or Forex.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week, but back on July 8th.)

• the market direction

• Oil, uranium, hemp/cbd.

• Market direction

• Dividend stocks

• Not sure, I will think of some…………..

• Trading Systems that have a proven ‘Edge’

• Forecast the future

• momentum analysis and second derivative

• profit

• Indicators that really work

Question #5. Additional Comments/Questions/Suggestions?

• Keep playing the game………………

CFN is off this week but back on July 8th, AYT will be back on July 2nd.

Crowd Forecast News Episode #230

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 8th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com (first time guest!)

– Jake Bernstein of Trade-Futures.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #84

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 2nd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #83

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Michael Filighera of LogicalSignals.com

– Jim Kenney of OptionProfessor.com (moderator)

Episode Timeline:

0:00 – Introductions.

2:30 – ALLY

5:50 – SLV

13:30 – TSM

16:20 – FCX

19:40 – BA

23:30 – NUGT

28:30 – MU

32:20 – APPL

38:00 – Individual trade idea.

43:10 – ROKU

47:50 – MGM

51:20 – USMJ

53:30 – GBTC

58:20 – Rapid Fire: NJR, M, T

1:00:00 – Closing statements.

Guest Special Offers:

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

From Michael: CandleLightTrading.com – Lighting the Way to Profitability

Other Partner Offer:

Ultimate Guide to Price Action Trading.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT062519

Crowd Forecast News Episode #229

AD: Ultimate Guide to Price Action Trading.

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Bennett McDowell of TradersCoach.com

– Sam Bourgi of TradingGods.net

– Jake Bernstein of Trade-Futures.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

2:00 – Question #1-3

16:10 – Question #4 – Evaluate progress over time?

26:50 – Guest bios.

32:10 – Gold price action discussion.

39:50 – Trade ideas for the week.

49:00 – Additional thoughts about what to watch for this week in the markets and closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Anka: Subscribe to Anka’s weekly videos on YouTube

From Bennett: Discover How To Earn A Seven Figure Income Trading!

From Jake: Jake’s email updates

From Sam: TradingGods newsletter and free VIX Trading eBook

Other Special Offer:

Ultimate Guide to Price Action Trading.

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN062419

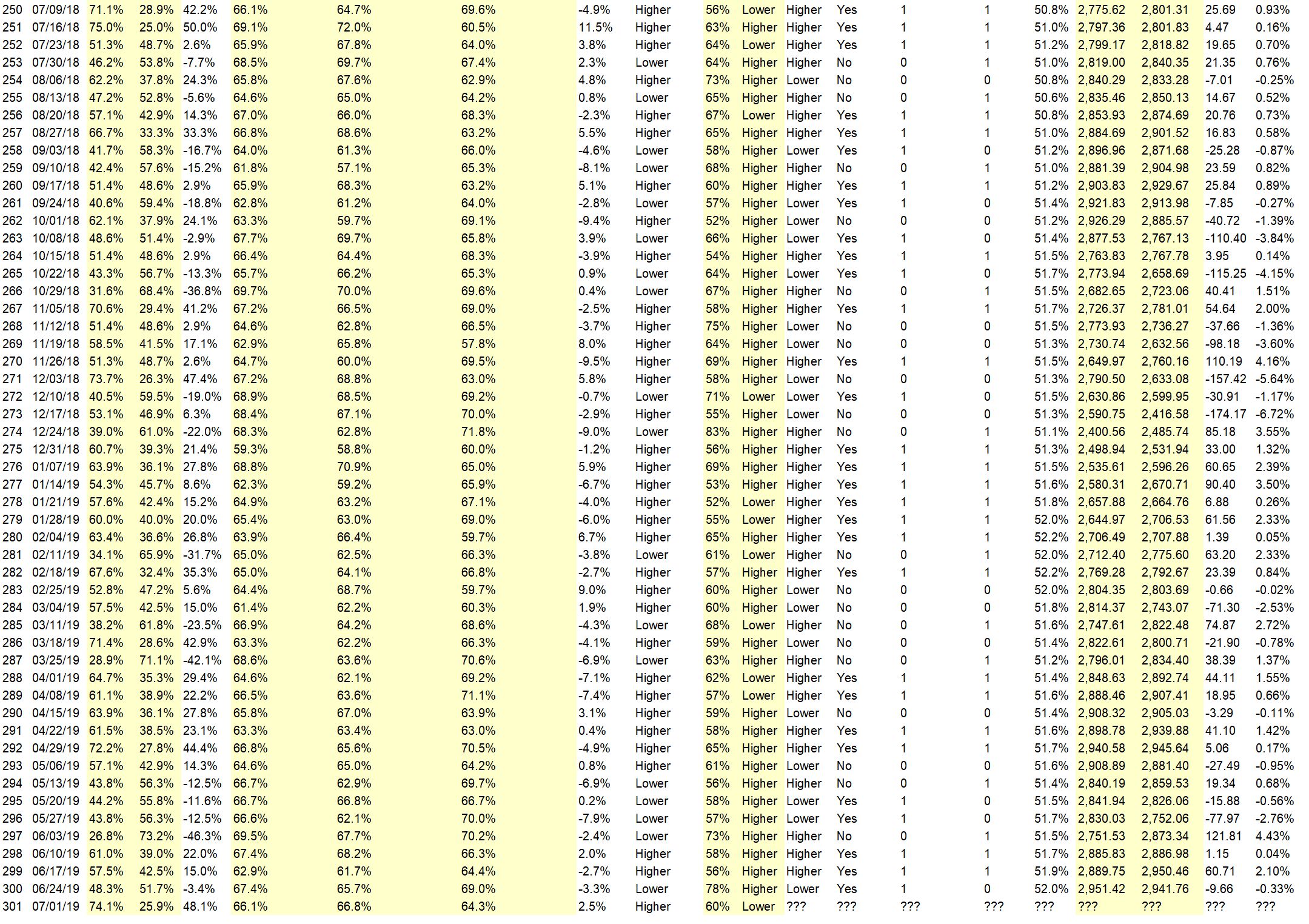

Crowd Forecast News Report #300

AD: The perfect pullback trade (free to download today).

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport062319.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 24th to 28th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.3%

Lower: 51.7%

Higher/Lower Difference: -3.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 65.7%

Average For “Lower” Responses: 69.0%

Higher/Lower Difference: -3.3%

Responses Submitted This Week: 29

52-Week Average Number of Responses: 38.0

TimingResearch Crowd Forecast Prediction: 78% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.5% Higher, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 2.10% Higher for the week. This week’s majority sentiment from the survey is 51.7% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 9 times in the previous 299 weeks, with the majority sentiment (Lower) being correct 22% of the time and with an average S&P500 move of 0.73% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 78% Chance that the S&P500 is going to move Higher this coming week.

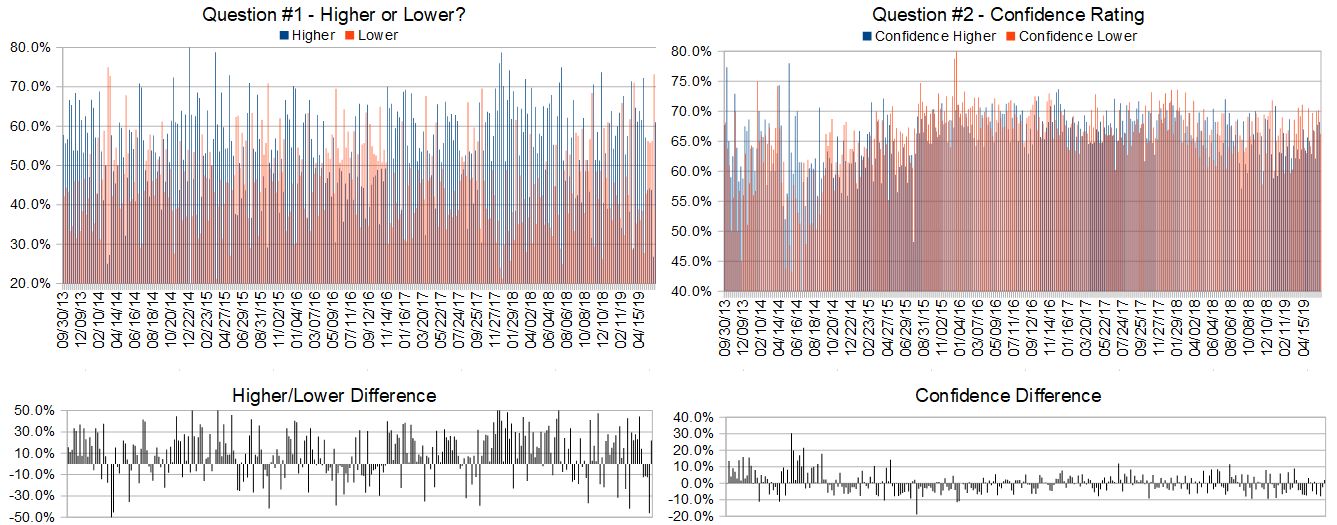

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: The perfect pullback trade (free to download today).

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.9%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Due to the China/US trade war, SPY will go higher

• wave 5 ends in July

• short squeeze

• No reversal yet. Market trading the good news.

• option friday expiration over. short term down then up without macro news

• all time highs broken

• MO & optimism re China trade deal

• RSI on daily H4 and H1 are motoring long in sync. Daily does show divergence but could continue to the end of the month.

“Lower” Respondent Answers:

• Look of the chart – climactic top needs downside correction.

• Once the DTrump and Pres Xi talks are over and DTrump stops tweeting manipulatively motivated predictions that rarely ever occur , I believe the recent gains will begin to fall away. I do not expect a crash but as the reality sets in surrounding the phenom of DTrump tweets done to cause the market to go up, eventually the emperor will be exposed as “having no clothes”/substance. Once this takes root, the market, much of its upward momentum being unwarranted, is likely to readjust downward

• Failure of agreement of trade war at g30

• overbought

• After this week, we are due for a consolidation !

• weakening momentum

• Market held up correction occurs as summer sets in

• contrarian

• Market tippy 1 more FED rate cut keeping market up temporarily

• Negatives – Inverted yield curve, tariff wars, S&P earnings vs. previous quarter may be negative. G20 summit coming up – not expecting much,

• Market is overbought and looking tired. Some downside action is needed.

AD: The perfect pullback trade (free to download today).

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• Subjective journalling and lots of what-if scenarios with PC-SPAN.

• The stock market in general

• my brain

• recordkeeping

• factor spreadsheets

• Check the balance.

• Cash amounts up or down. stocks option activity. Trade war news. black swan events

• p&l

• Track positions daily make improvements. In record keeping

• Daily follow market

• P & L

• A custom weighted multi-timeframe RSI with BB’s and a couple of MA’s

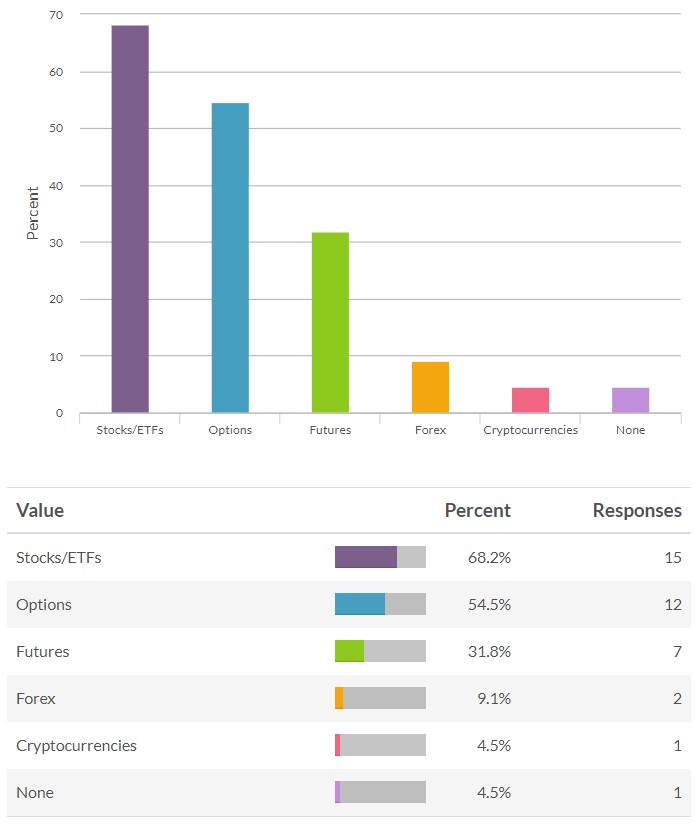

BONUS: Which of the following have you traded with real money so far this year? (check any that apply)

Question #5. Additional Comments/Questions/Suggestions?

• I say the stock market has a lot of up room (compared to Dec 2018) left before the bottom falls out.

• look out below

• credit spreads

• Never give up on your trading, learning it and get good at it.

AD: The perfect pullback trade (free to download today).

Join us for this week’s shows:

Crowd Forecast News Episode #229

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 24th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Bennett McDowell of TradersCoach.com

– Sam Bourgi of TradingGods.net

– Jake Bernstein of Trade-Futures.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Analyze Your Trade Episode #83

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 25th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Michael Filighera of LogicalSignals.com

AD: The perfect pullback trade (free to download today).

Analyze Your Trade Episode #82

AD: Thursday: How To Beat The Market Investing Just Once A Week.

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Michael Filighera of LogicalSignals.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Episode Timeline:

0:00 – Introductions.

3:00 – BHP

8:40 – NVDA

11:20 – ABT

14:00 – AMZN

16:40 – MCD

19:30 – GOLD

22:40 – TWTR

26:20 – SPGI

29:30 – XOM

35:50 – FVRR

38:30 – AM

41:00 – ACB

44:40 – FB

50:30 – TWLO

57:00 – TGT

57:50 – Closing statements.

Guest Special Offers:

From Michael: CandleLightTrading.com – Lighting the Way to Profitability

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

Other Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

AYT061819

Crowd Forecast News Episode #228

AD: Thursday: How To Beat The Market Investing Just Once A Week.

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Marina Villatoro of TheTraderChick.com

– Michael Guess of DayTradeSafe.com

– Andrew Keene of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Timeline (click to watch on YouTube.com):

0:00 – Introductions.

3:00 – Question #1; Higher or Lower?

10:40 – Question #4; What procedures do you use for trade management?

16:20 – Question #3 and additional discussion.

44:00 – Trade examples from today.

56:00 – Closing statements.

You can download this week’s and all past reports here.

Guest Special Offers:

From Michael: Achieve Up To 86.7% Accuracy In Your Entries and Never Risk More Than $100 Per Contract

From Andrew: Master the Skills You Need to Trade Full Time!

From Marina: Day Trading for Beginners GET FREE Mini Course NOW

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

Other Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

CFN061719

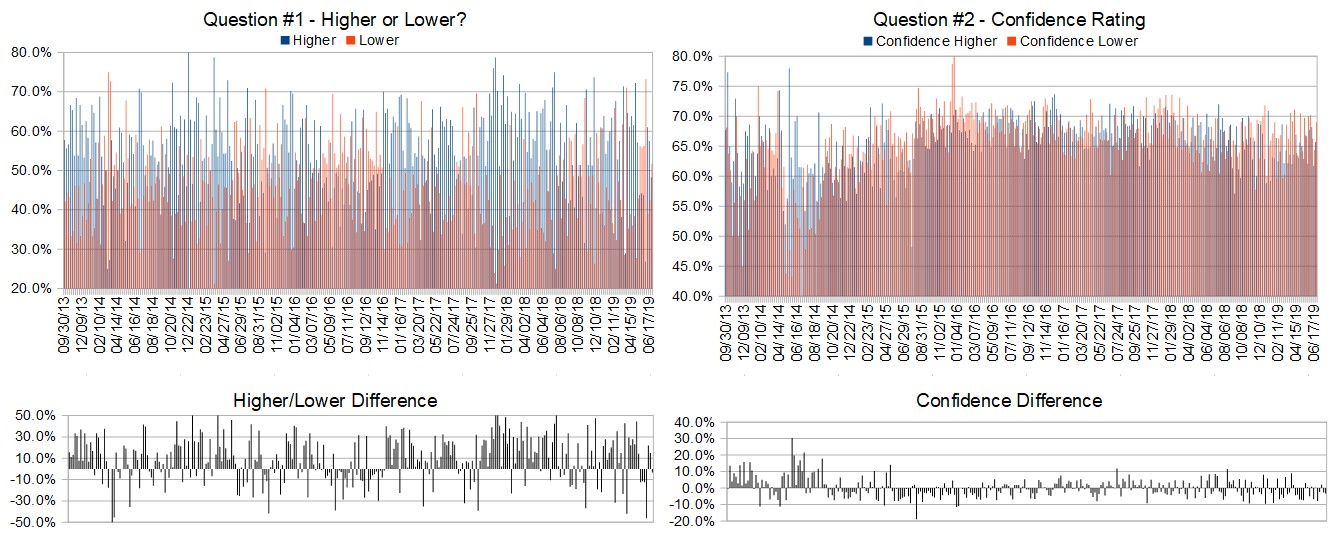

Crowd Forecast News Report #299

AD: Thursday: How To Beat The Market Investing Just Once A Week.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport061619.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 17th to 21st)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 57.5%

Lower: 42.5%

Higher/Lower Difference: 15.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.9%

Average For “Higher” Responses: 61.7%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: -2.7%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 38.2

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.0% Higher, and the Crowd Forecast Indicator prediction was 58% Chance Higher; the S&P500 closed 0.04% Higher for the week. This week’s majority sentiment from the survey is 57.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 61 times in the previous 298 weeks, with the majority sentiment (Higher) being correct 56% of the time and with an average S&P500 move of 0.06% Lower (the market moved Higher more frequently but the average of all moves was Lower) for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• fomc maybe

• Everything depends on the Fed this week!

• Seasonal trends, perceived oil disruption, and just intuition..

• World conflict

• The uptrend resumes anew after a horrible month of May.

• Price is above 50 SMA on day chart. Top price before 7 weeks is very near

• I think the U.S./China tariff deal will have positive signs of a deal.

• FOMC meeting

• Possibility of reduced interest rates and china trade deal.

• Holding pattern with upward bias

• wave 5 continues into July

• because profits were higher than thought.

• Iran, China, Mexico?????

• reversion

• momentum and hopefully dirth of new negatives

“Lower” Respondent Answers:

• China & iran

• Fed disappoint the market, unrest in Middle East.

• iran

• received email stating 2 reasons why S&P could drop 250 points from reliable source.

• Seek the rate news on Wednesday

• sideways to lower move in slow summer market

• The market has lost momentum. The path of least resistance should be down.

• It looks like the tariffs will hang around more. Also, only a 20% chance that the Fed cuts rates this week, according to the Fed funds futures.

• Good news priced in FED stalling

• Can’t break resistance, slowing momentum

• Range Bound now

• new high new low divergence

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• Wiege board

• position sizing and stops

• Scaling in and taking profits when a position hits at least 100%. Usually take about a quarter of the position in profits and let the rest ride.

• Ak

• All

• Position size and scaling.

• stops, position size

• 2% of size acc.

• set stops

• Stability.

• Limits in buying and selling

• position size

• Set St0ps

• Position size – usually about equal for each stock.

• scaling both ways

• trend, sma 3 and 10, MACD, 1/10 of protfolio its a 10% stop lost. Or daily moving average.

• I use time of day a lot for position sizing, (e.g. bank openings and bank closings) Then I also very often take 1. st profit after 3-4 pips (scaling out)

• short term moving average: 10 days, 15 days depending on fund volatility.

Question #5. Additional Comments/Questions/Suggestions?

• June strong July flat Aug. Down on DOW

• Yeah herd stampede last week they get picked 0ff this week

Join us for this week’s shows:

Crowd Forecast News Episode #228

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 17th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Michael Guess of DayTradeSafe.com

– Andrew Keene of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #82

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 18th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Partner Offer:

What Separates The 1% Investor From The 99%?

This coming Thursday, Steven Brooks, who you’ve seen on the TimingResearch shows, is planning on sharing a brand new and unique strategy that he found where you can eliminate the amount of time you spend investing and potentially DOUBLE or even TRIPLE your returns…

By investing just one day out of the week!

And what’s even cooler about this strategy is that anyone, beginner or pro, can EASILY follow this strategy in as little as 5 minutes a week and start profiting immediately following Steven’s training.

Analyze Your Trade Episode #81

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Marina Villatoro of TheTraderChick.com

– Bryan Klindworth of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Episode Timeline (links open on YouTube):

0:00 – Introductions.

3:40 – IGT

9:10 – WYNN

15:30 – HSY

22:00 – WMT

26:00 – BOX

29:00 – TDOC

32:40 – CRM

36:40 – KHC

39:20 – WWE

44:00 – CXO

45:20 – SYK

47:10 – BABA

50:00 – TLT

52:10 – ZM

55:50 – TSLA

57:00 – Trade ideas and closing statements.

Guest Special Offers:

From Bryan: Master the Skills You Need to Trade Full Time!

From Marina: Day Trading for Beginners GET FREE Mini Course NOW

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT061119

Crowd Forecast News Episode #227

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Mark Sachs of RightLineTrading.com

– John Thomas of MadHedgeFundTrader.com

– Norman Hallett of TheDisciplinedTrader.com (moderator)

You can download this week’s and all past reports here.

Guest Special Offers:

From Mark: My 3 Simple & Fundamental Strategies To Trading that Give Me an Edge Every Day in the Markets

From Norman: The Disciplined Trader Mastery Program (Free Trial)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch. Enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

CFN061019

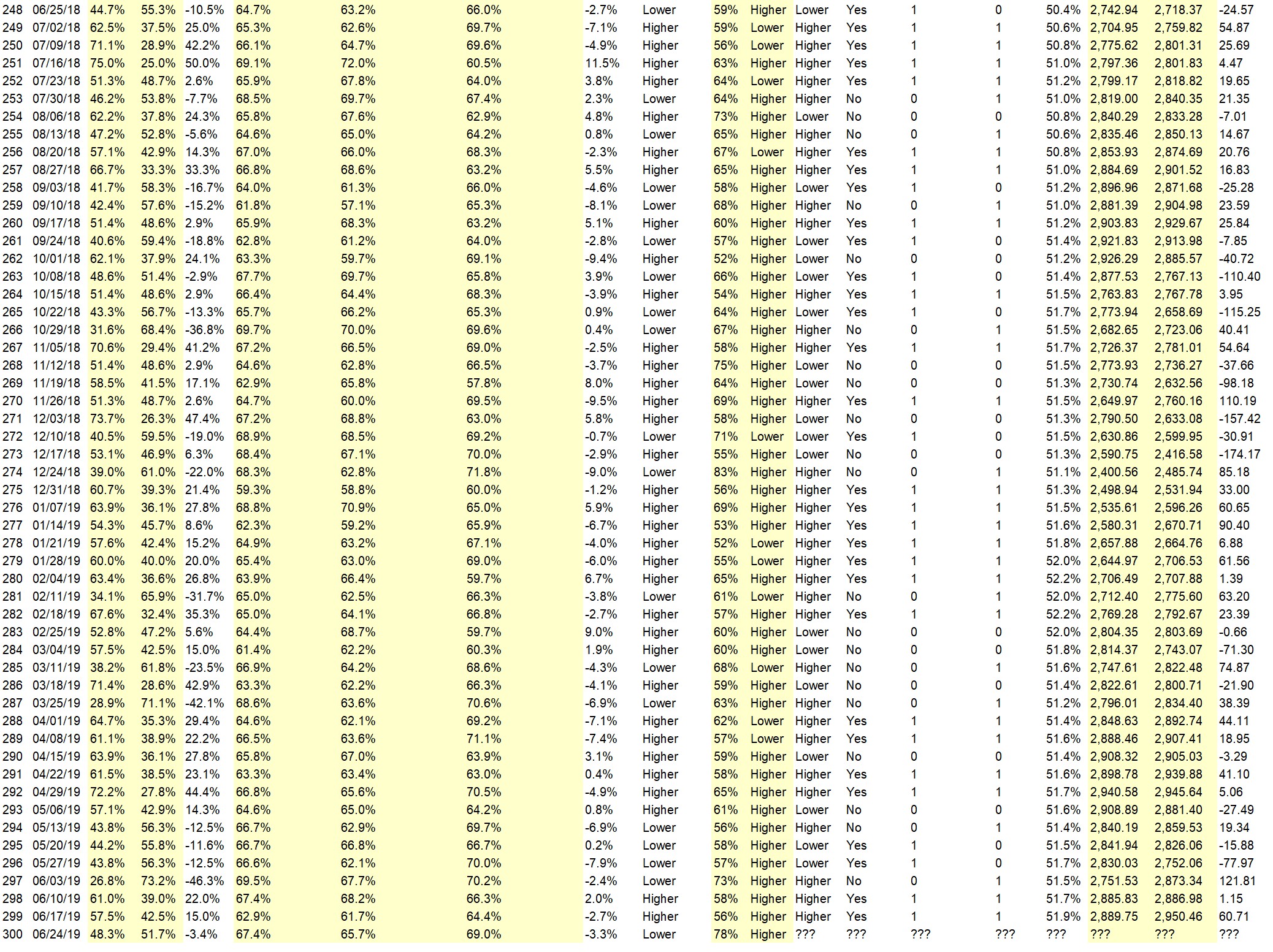

Crowd Forecast News Report #298

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060919b.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 10th to 14th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 61.0%

Lower: 39.0%

Higher/Lower Difference: 22.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 68.2%

Average For “Lower” Responses: 66.3%

Higher/Lower Difference: 2.0%

Responses Submitted This Week: 41

52-Week Average Number of Responses: 38.2

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 73.2% Lower, and the Crowd Forecast Indicator prediction was 73% Chance Higher; the S&P500 closed 4.43% Higher for the week. This week’s majority sentiment from the survey is 61.0% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 60 times in the previous 297 weeks, with the majority sentiment (Higher) being correct 58% of the time and with an average S&P500 move of 0.09% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.5%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Chart

• wave 5 is real

• I think this is a big short squeeze and its gathering up a lot of retail traders in the uptrend

• Judging from what I’m seeing, investors are anxious, after a dismal May. Institutional investors are starting to get into the market.

• Trade deal with Mexico seem to be moving forward and possibility of future cuts in interest rates.

• up in a “B” wave

• Momentum

• weekly close was strong, possibly a sell the news events

• A quick return to 50 SMA on the daily chart indicates a slight correction at the beginning of the week and then a 50 SMA on the daily chart

• Regained 200 and 50 dma in 1 week. That means this week we will see the rise stall after going higher. Then possible fall for summer swoon.

• Elliott Wave pattern.

• Trade concerns are fading for now.

• Because president trump did not tariff the Mexicans

• Removal of the uncertainty of Mexico tariffs

• relief rally

“Lower” Respondent Answers:

• Tariffs with China and

• Closed below the High; Profit taking and possible bad news over the weekend

• Mr Trump

• Market top absorbed money

• Friday’s rally was exhaustive. Recent lows need to be retested.

• trend is down and DCB over

• up one week, down the next

• series of higher highs, now a regression

• Sell the news

• China

• I’m going with the Oct-Nov 2018 pattern. If that pattern continues, a top was reached on Fri; and the next leg is down.

• resistance levels

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Question #4. What type(s) of trading do you specialize in or focus on? How did you come to that decision?

• Selling credit sreads

• SPY Options Based on chart

• Only Options

• Long term. And swing trading

• Emini S&P 500 index far-out-of-the-money option selling. So I don’t really care market direction.

• trying to decide ..mainly doing options cause of small account size

• Primarily stocks, but have some gold and muni’s.

• Forex. Moves most.

• day trading (income) and position holding (retirement)

• futures. Believe last week was a corrective move.

• Stocks and options. I have some training in options trading.

• stocks, less complex.

• options, less capital

• Intraday trading.

• Quick trades in stocks that have risen or fell due to circumstance, not fundamentals. They sharply reverse then resume their trend.

• Day trading futures. I came to this decision primarily because of market volatility producing larger overnight moves.

• Charts. Follow the price movement

• Very short term with get out trades ready to go prior to initiating trade

• Options

• Options and swing .trading . options I chose because of the lower risk and swing trading because sometimes you can’t use options

• Swing trading; 2-10 days. With my job, I can’t do intraday.

• patterns, price action

• spreads slow but safer

Question #5. Additional Comments/Questions/Suggestions?

• Market will go up and then down

• can you resend out webinar replays?? wasn’t able to attend live session

TimingResearch response: All TimingResearch shows are publicly available immediately after recording on the TimingResearch.com homepage and the TimingResearch YouTube account. I also send an email out with the archive link 2 hours after recording each episode to everyone who is subscribed to the newsletter.

• Am anxious to have our politicos approve the use of marijuana on a national basis. I believe this would unlock untold fortunes, while powering the economy higher.

• None.

• Can we tell from charts when major short selling is happening to a stock; are there any indications that are different to or distinguishable from regular sell offs.

• I think the “SS” by the house this week in an attempt to prove our President Trump obstructed a crime the Mueller report said he didn’t commit, will pull this overbought market lower

• Nothing comes to mind,

Join us for this week’s shows:

Crowd Forecast News Episode #227

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 10th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– John Thomas of MadHedgeFundTrader.com

– Norman Hallett of TheDisciplinedTrader.com (moderator)

Analyze Your Trade Episode #81

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 11th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Bryan Klindworth of AlphaShark.com

– Jim Kenney of OptionProfessor.com (moderator)

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide