Crowd Forecast News Report #280

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport020319.pdf

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

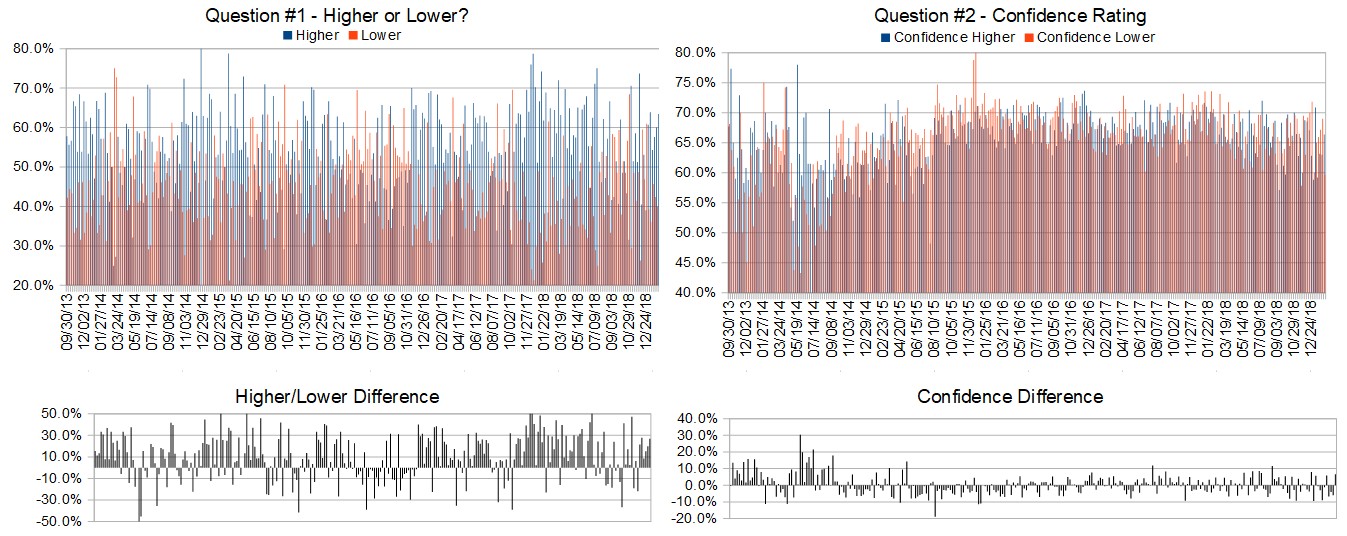

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 4th to 8th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.4%

Lower: 36.6%

Higher/Lower Difference: 26.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.9%

Average For “Higher” Responses: 66.4%

Average For “Lower” Responses: 59.7%

Higher/Lower Difference: 6.7%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 42.0

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 60.0% Higher, and the Crowd Forecast Indicator prediction was 55% Chance Lower; the S&P500 closed 2.33% Higher for the week. This week’s majority sentiment from the survey is 63.4% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 23 times in the previous 279 weeks, with the majority sentiment being correct 65% of the time and with an average S&P500 move of 0.13% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

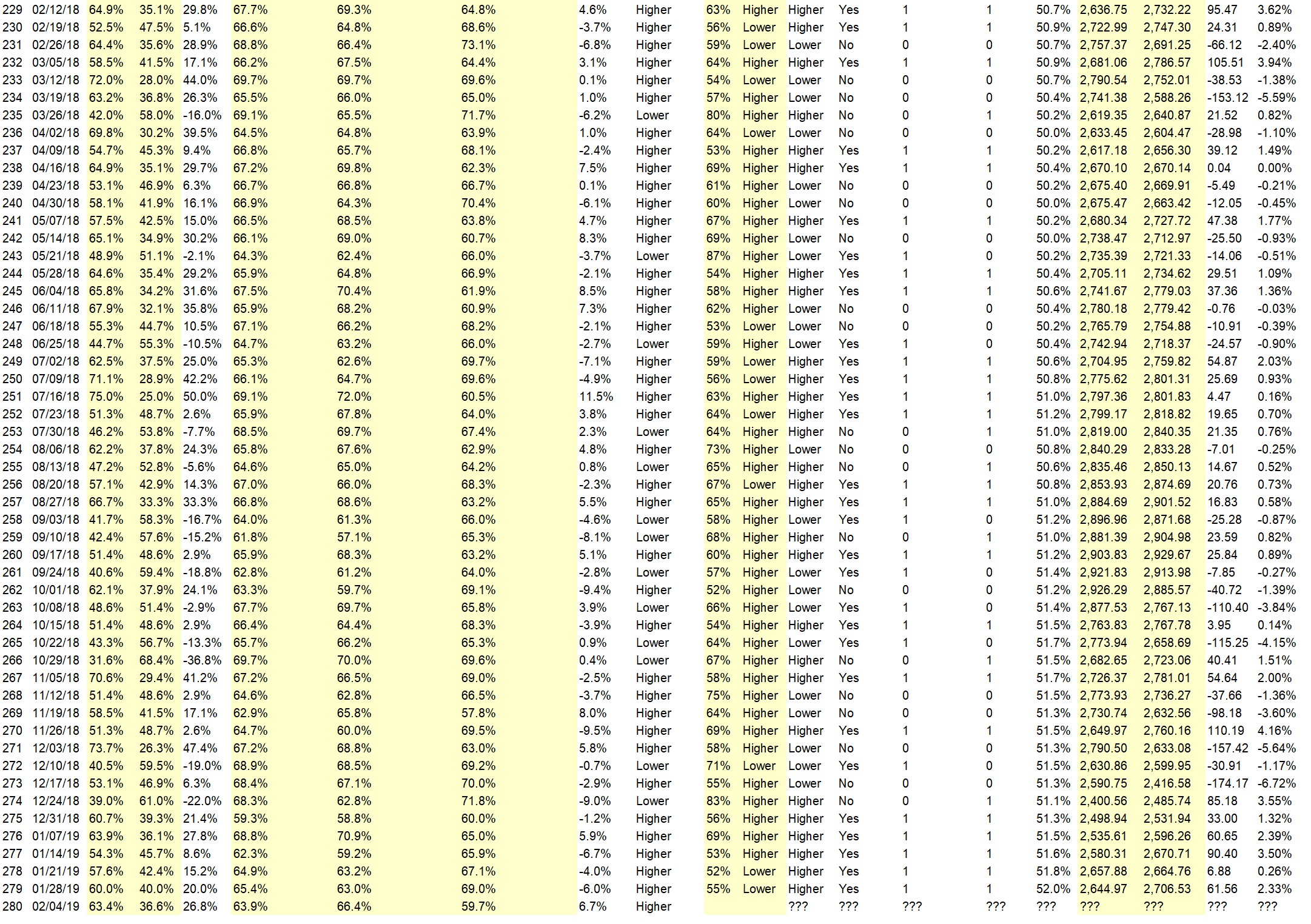

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Higher weekly highs, positive week historically, The Fed is on the side of bulls

• Earnings and Presidential speech

• Tariffs resolved

• earnings have been fair to good [ altho guidance down ]

• Fed Oil workers 3 Yr. agreement Trump’s move against OIL fr. venezuela should cause oil prices to rebound over the next 3 or 4 months. That should draw the mkt. up.

• inverse reticulation of adverse momentum

• Momentum

• Too much talk that it is going down.

• relative strength charts

• chart pattern

• China deal getting coser

• The market moved up strongly last week, with some good earnings reports, and with good breadth, and a more dovish fed. Expecting a continuation now.

• MO

• Momentum of trend and earnings

• the distress in Europe and abroad and the encouragement of our political affairs as well as a generally good economy despite the talking heads of doom

• Wall Street/Washington TV chatter.

• good earnings

• Can see only 3 waves up so far from 2624 to 2717. Still need a wave 4 down (maybe already completed) and then a brief new high this coming week to higher than 2717. I don’t even believe Elliott wave stuff and I’m pretty sure the algos don’t use it. But it’s become so popular that it might be worth mapping.

“Lower” Respondent Answers:

• Oh it’s coming now Inflation rising layoffs here recession begun Not A recovery but a short lived rebound

• High gold oil Huge layoffs Market building a top

• This is the 4th try for S&P to close a move 200dma.

• Technical

• slowing momentum

• Technical analysis

• 2710 to 2720 strong resistance

• Resistance levels to continue to hold. Earnings forecasts continue to be soft.

• possibly weekly over bought ?

• losing momentum, may peak early in week

• time for a pb

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security

Question #4. What type(s) of trading do you specialize in or focus on? How did you come to that decision?

• Options

• Forex and SP500

• spy aapl options

• stocks and options

• Arbitrage

• Swing trading.

• Swing trades on stocks. My schedule doesn’t allow good access to day-trading.

• Growth

• Long term etfs only

• options

• Stocks, options

• options – small account

• option swing trading

• put spreads higher returns

• day

• fundamental as well as charts

• options months to weeks

• worm casting futures

• Swing

• Sell out-of-money ES index options. Why? Because don’t have to bite fingernails.

• Options- calls, puts, verticals earns a greater percentage than buying and selling stocks without the high risk associated

• options and stocks. Greed !!!!

• options & futures

• See Above

• options

• options

Question #5. Additional Comments/Questions/Suggestions?

• love it

Join us for this week’s shows:

Crowd Forecast News Episode #212

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, February 4th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Glenn Thompson of PacificTradingAcademy.com

– Simon Klein of TradeSmart4x.com

– Rob Hanna of QuantifiableEdges.com (moderator)

Analyze Your Trade Episode #64

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, February 5th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Dean Jenkins of FollowMeTrades.com (moderator)

ADVERTISEMENT

Disciplined Trader Mastery Program: Now There’s a Simple and Easy-To-Follow System For Gaining Control of Your Mental Game and Finally Live Your Dream of Independence and Financial Security