Crowd Forecast News Report #281

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport021019.pdf

AD: Need more capital to trade? Click here.

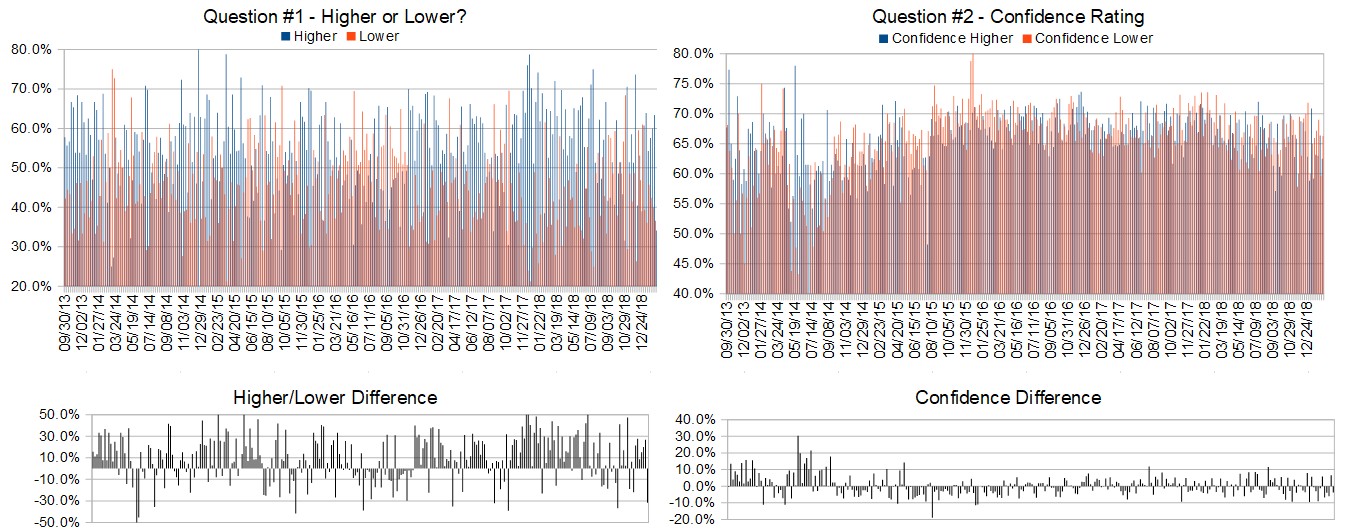

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 11th to 15th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 34.1%

Lower: 65.9%

Higher/Lower Difference: -31.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.0%

Average For “Higher” Responses: 62.5%

Average For “Lower” Responses: 66.3%

Higher/Lower Difference: -3.8%

Responses Submitted This Week: 43

52-Week Average Number of Responses: 41.7

TimingResearch Crowd Forecast Prediction: 61% Chance Lower

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.4% Higher, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.05% Higher for the week. This week’s majority sentiment from the survey is 34.1% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 31 times in the previous 280 weeks, with the majority sentiment being correct 61% of the time and with an average S&P500 move of 0.17% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Need more capital to trade? Click here.

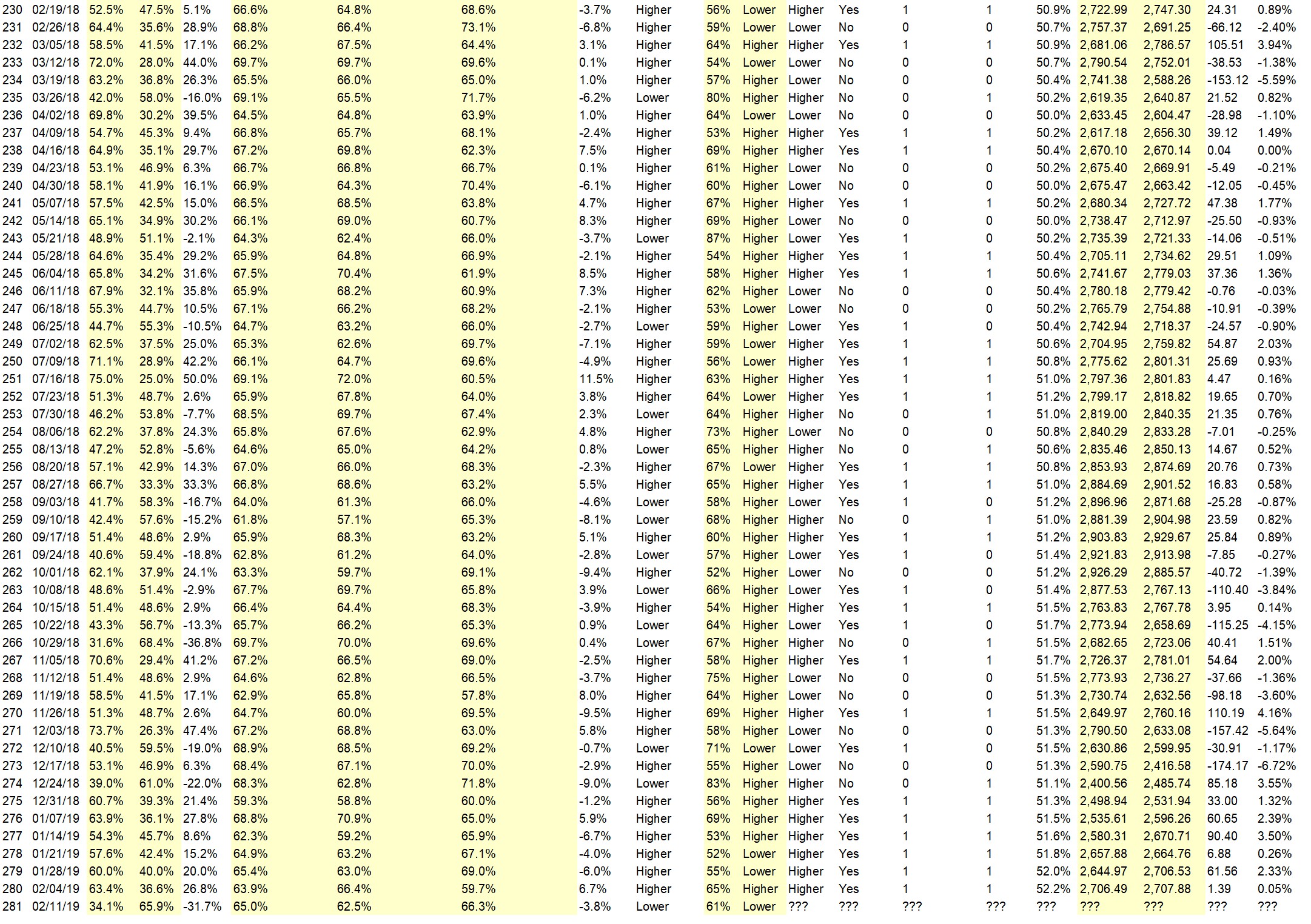

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.2%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• The Bulls seem to be fighting hard to continue melt up

• Seasonality is very favorable this week. Money keeps being pulled from the stock market.

• Best six months of year historically

• China trade talks look positive Meeting w/ NO Korea Trump wants to avoid government shutdown

• technical analysis

• dow stocks DIS FB MSFT held steady to up for week up next week

• Trend of the market remains positive

• history

• Dips are being bought. With the uncertainty, rallies could be sold, so upside appears to be limited.

“Lower” Respondent Answers:

• Topping out

• Government will shut down again

• Vix and order flow

• Reality catches up with algorithmic traders

• Resistance at 200 Day MA

• we hit a reistance area ,spx 2704–rejected now revert back down to thw mean.

• consolidating below 200 day smh

• elliott wave

• Resistance levels will continue to hold. Failure of Congress to deal with China and/or Government Shutdown will weigh on prices.

• overbought

• weak internals, momentum, MACD

• uncertainty over gov’t shut down on 2/15

• Its over

• trade war

• Mkts going to be more range bound

• dynamic yield curve set up (at stock charts.com) With the low vol. in the s&p500 last week . with the crazy news. it seems like is stuck at 2650 2700. . . I see it at 2550. to 2600

• No spectacular earnings.

• Expecting markets to revert to the mean, 50 day moving average

• Down we go. . Stochastics have turned

• Sentiment indicators (fear vs greed) are showing net greed.

AD: Need more capital to trade? Click here.

Question #4. Who have you learned the most from about trading or investing? What about their teaching style or method made them more effective?

• my self . then mostly by far CHAT with TRADERS Aaron Fifield all 167 eps. then Mr. Mike Pisani. . on youtube Rayner Teo. . also The 20 habits of a successful trader. and you all of course

• Trend following turned my p/l

• Keep expectations low

• Al Brooks. He shows, on the chart, what the bulls are thinking and what the bears are thinking. He doesn’t have indicators except for trendlines and a moving average. He emphasizes probability and always has stops.

• Lot of online resources and self study

• Gerald Appel candor, integrity

• I learned that there are many counter intuitive moves and that explanations of market moves often don’t make sense.

• ZIAD JASANI

• Jim Cramer.

• Follow big money flows and interest rates

• Myself

• Friends live on line

• William O’Neil. Follow through days, cutting losses & letting winners run!

• Patience

Question #5. Additional Comments/Questions/Suggestions?

• Keep up the good work. don’t bet on the S&p on my opinion

Join us for this week’s shows:

Crowd Forecast News Episode #213

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, February 11th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Bennett McDowell of TradersCoach.com

– Damon Pavlatos of FuturePathTrading.com

– Mark Sachs of RightLineTrading.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Analyze Your Trade Episode #65

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, February 12th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– George Papazov of TRADEPRO Academy

– Jim Kenney of OptionProfessor.com

– Michael Filighera of LogicalSignals.com (moderator)

AD: Need more capital to trade? Click here.