Crowd Forecast News Report #294

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport051219.pdf

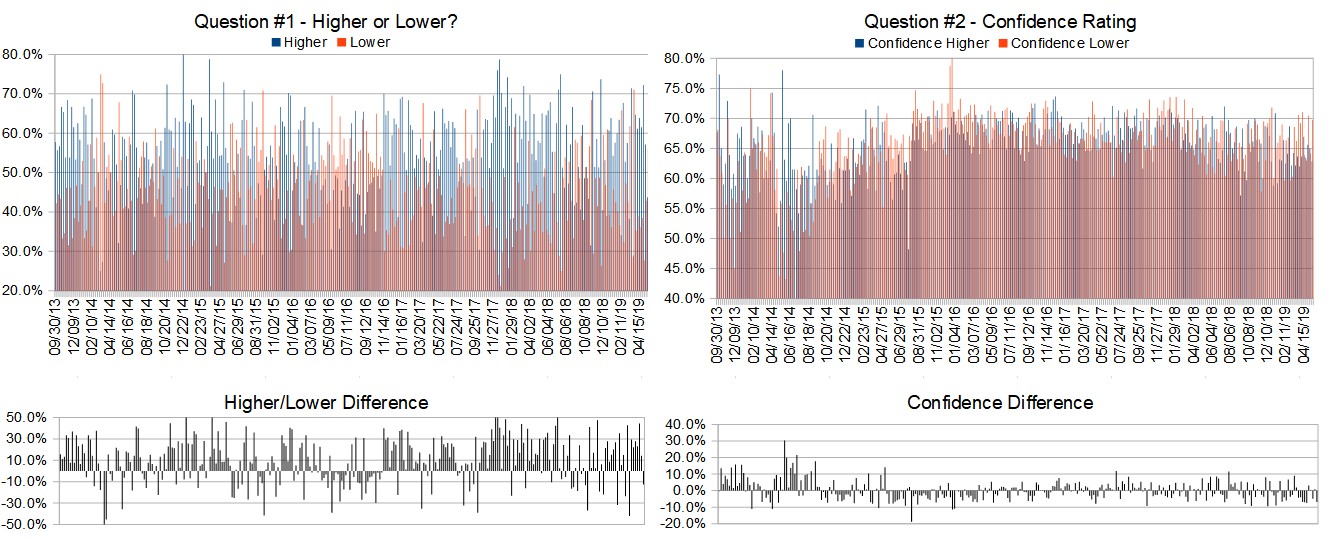

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 13th to 17th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 43.8%

Lower: 56.3%

Higher/Lower Difference: -12.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.7%

Average For “Higher” Responses: 62.9%

Average For “Lower” Responses: 69.7%

Higher/Lower Difference: -6.9%

Responses Submitted This Week: 34

52-Week Average Number of Responses: 38.8

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 57.1% Higher, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 0.95% Lower for the week. This week’s majority sentiment from the survey is 56.3% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 36 times in the previous 293 weeks, with the majority sentiment (Lower) being correct 44% of the time and with an average S&P500 move of 0.29% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

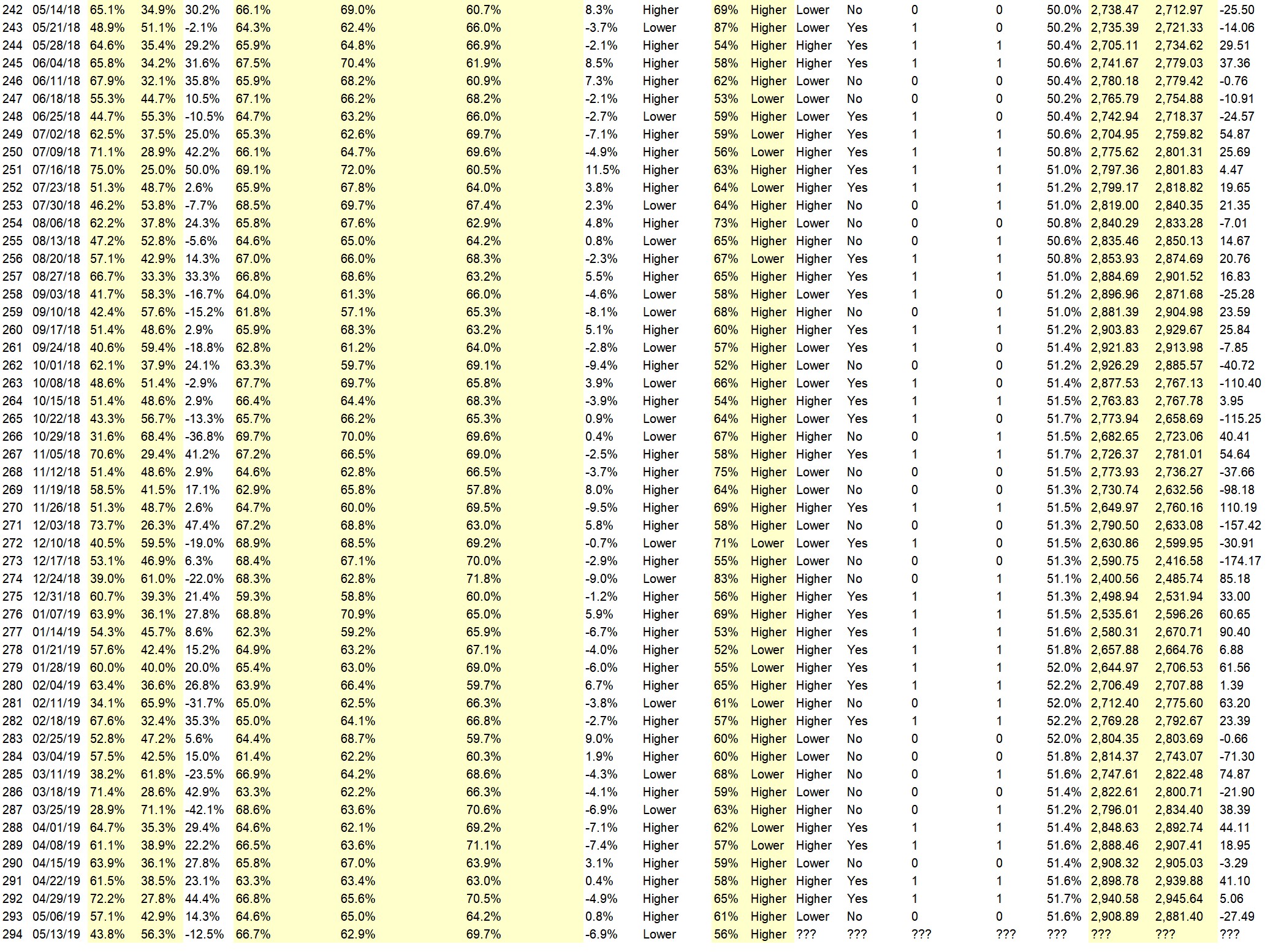

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.6%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Cycles and the momentum that has been spawned by the political arena.

• sell gold

• A nice bounce after a steep drop.

• The chart is showing, it is going to go up

• Current decline looks completed.

• Trend continues

“Lower” Respondent Answers:

• Trade war with China

• Trade uncertainty

• macd is down

• When I’m long, the S&P decreases

• Trade war

• russell still strugging, few stocs tradingocer 20dma in s/p 500

• elliott wave 4 underway and oscillator has not yet turned

• The market is entering a downside correction faze.

• The market hit an all-time high in late April, and isn’t far below that now, i.e. the market is still high. With that, and considering all the uncertainty about tariffs and growth, the downward path is the more likely one.

• Last week’s market volatility soared as indexes fell

• Its over sucker rally dead ahead

• fibo

• Still in downtrend from beginning of May. Altho Friday looks like upward recovery, ES retraced only 50% up, and only enough so indicators are no longer oversold.

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• Discipline

• Consistency removing emotion from trade.

• Use a workable trading plan so you don’t trade with your emotions….

• Ability to stick to their thesis, despite what the outside media is falsely proclaims.

• Common sense

• probability mindset, discipline wait for yr setup and take yr stops

• Detachment.

• ambivalence to trend

• disciple

• thick skin

• buy on strength

• alles

• Remember overall stats of your system and don’t get involved over individual losses or wins.

• Recognize when emotions are getting in the way of good trading; then focus on using techniques that ignore those emotions.

• Mental focus and recognizing emotional impact on decisions

Question #5. Additional Comments/Questions/Suggestions?

• none

Join us for this week’s shows:

Crowd Forecast News Episode #224

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, May 13th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Fausto Pugliese of CyberTradingUniversity.com

– Bennett McDowell of TradersCoach.com

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com (moderator)

Analyze Your Trade Episode #77

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, May 14th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Andrew Keene of AlphaShark.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com