Crowd Forecast News Report #295

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport051919b.pdf

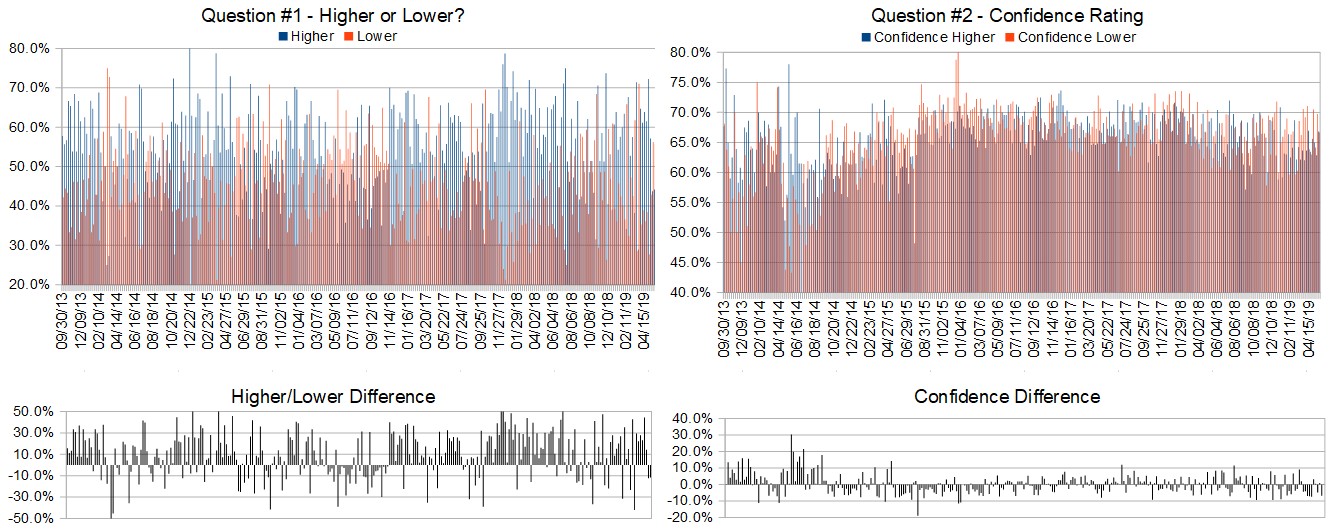

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 20th to 24th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 44.2%

Lower: 55.8%

Higher/Lower Difference: -11.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.7%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 66.7%

Higher/Lower Difference: 0.2%

Responses Submitted This Week: 45

52-Week Average Number of Responses: 38.8

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 56.3% Lower, and the Crowd Forecast Indicator prediction was 56% Chance Higher; the S&P500 closed 0.68% Higher for the week. This week’s majority sentiment from the survey is 55.8% Lower with a greater average confidence from those who responded Higher. Similar conditions have occurred 24 times in the previous 294 weeks, with the majority sentiment (Lower) being correct 42% of the time and with an average S&P500 move of 0.19% Lower for the week (this is a rare instance where the market went Higher more frequently but the average move of all similar instances was Lower). Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

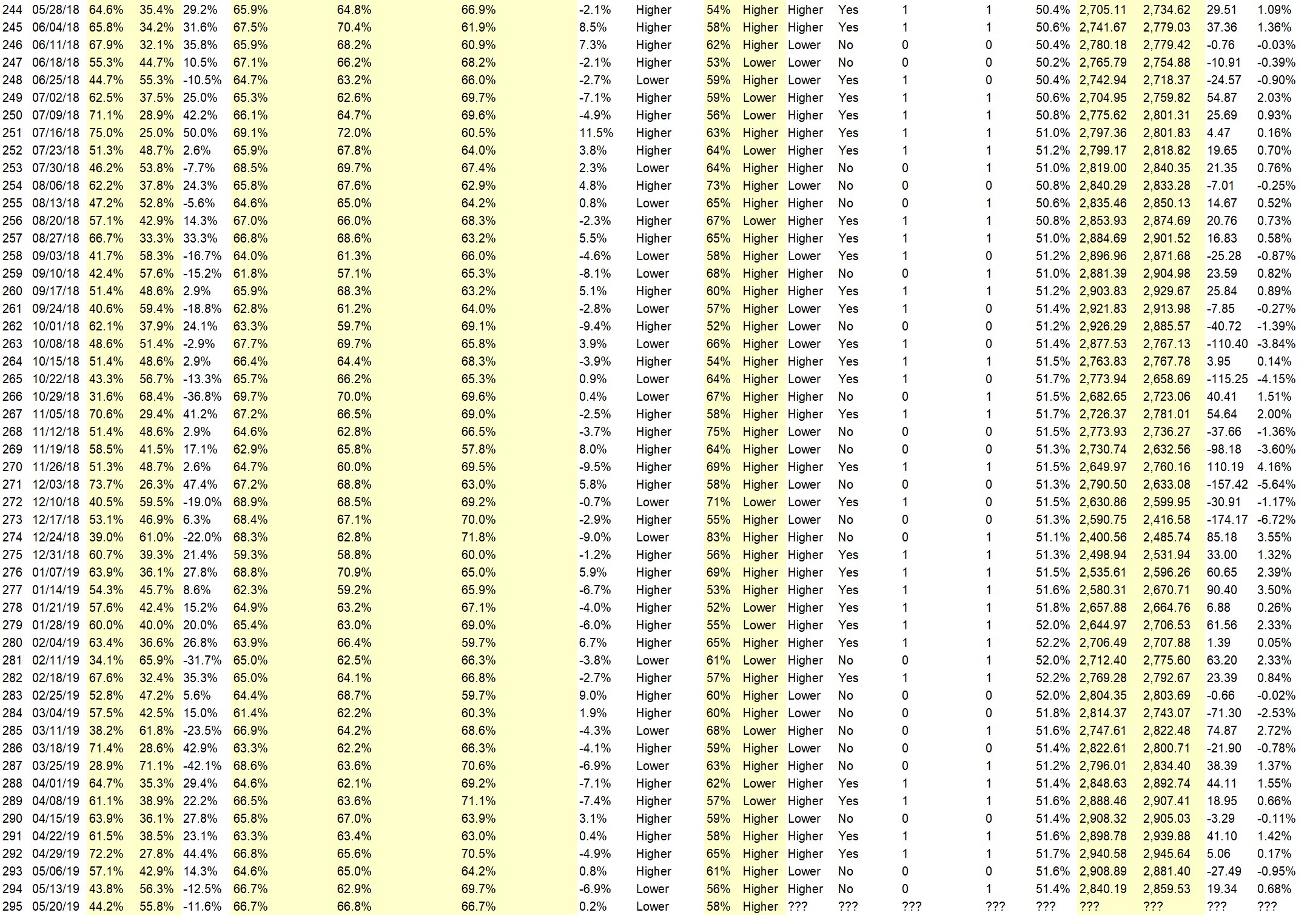

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.4%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• NH-NL Index and the % of Negative investors.

• China trade relations will improve causing the markets to rebound. Consumer confidence will increase.

• The Iran situation is calming.

• Strong economy, foreign money moving to the US stocks.

• lt trend

• End of month computer buying/re-balancing

• tech will fill in HUAWEi ban

• Uptrend remains intact

• I believe Pres. Trump.will get us closer to.a deal w/China!

• Stable this past week, push higher for next !

• NAFTA and China

• trend is up

“Lower” Respondent Answers:

• 3M

• Trade war hype is overblown, but the media will still push it, making people trade on that. Anything that sounds like it could cause a Recession will be talked up, trying to cause a self-fulfilling prophecy. Market participants will react to some of this, causing volatility.

• China and the yuan

• suckers rally runs its course look at all the overconfidence

• “sell in May and go away”

• Trump’s lunacy

• looks like we are going to break below spx 2800–lower low,s lower hi,s .

• Tarriffs

• unclear elliott wave 4

• The downside correction started last week will continue.

• The bounce last week on Tues-Wed-Thurs appears to be over; direction restarted downward on Fri. US-China trade talks not looking good. China may retaliate to Trump’s tariffs.

• Historically worst six months

• overvalued and uncertainty with China trade and Iran terrorism

• Suckers rally will run its course then drop into summer

• weak internals

• All the same fundamental reasons as before. Sentiment indicators (eg put:call ratios) finally turning -ve for the ES. Up volume vs down volume is -ve for the ES.

Question #4. Which trading platforms or brokers do you like the best for executing your trades?

• Tradestation

• Interactive Brokers

• Trade Station

• schwab street smart

• I’ve only used Optionsxpress now Schwab.

• Sogo

• S0G0

• Yours

• E*Trade!

• Merrill Edge/TD Ameritrade

• Ninja , thinkorswim

• Schwab

• Tradestation

• MT4

• Interactive Brokers

• SOGO

• No preference but I’ld like to hear what others prefer. I use Fidelity

• TOS

• atp at fidelity

• E-Trade

• TOS, as it has what I need to trade with, along with analysis tools.

• SAXO Bank

• platform Fidessa, broker ADM

• Interactivbrokers. Tradingview

• e*trade

• Fidelity

• Tradestation

Question #5. Additional Comments/Questions/Suggestions?

• Sell gold

• I am almost ready for this stampede for the door, wait n see what is said, inverse ETFs etc.

• Show & Teach simple trading startegies

Join us for this week’s shows:

Crowd Forecast News Episode #225

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, May 20th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Mark Sachs of RightLineTrading.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #78

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, May 21st, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)