Crowd Forecast News Report #297

AD: Download Now: Resource Market Millionaire eBook.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport060219.pdf

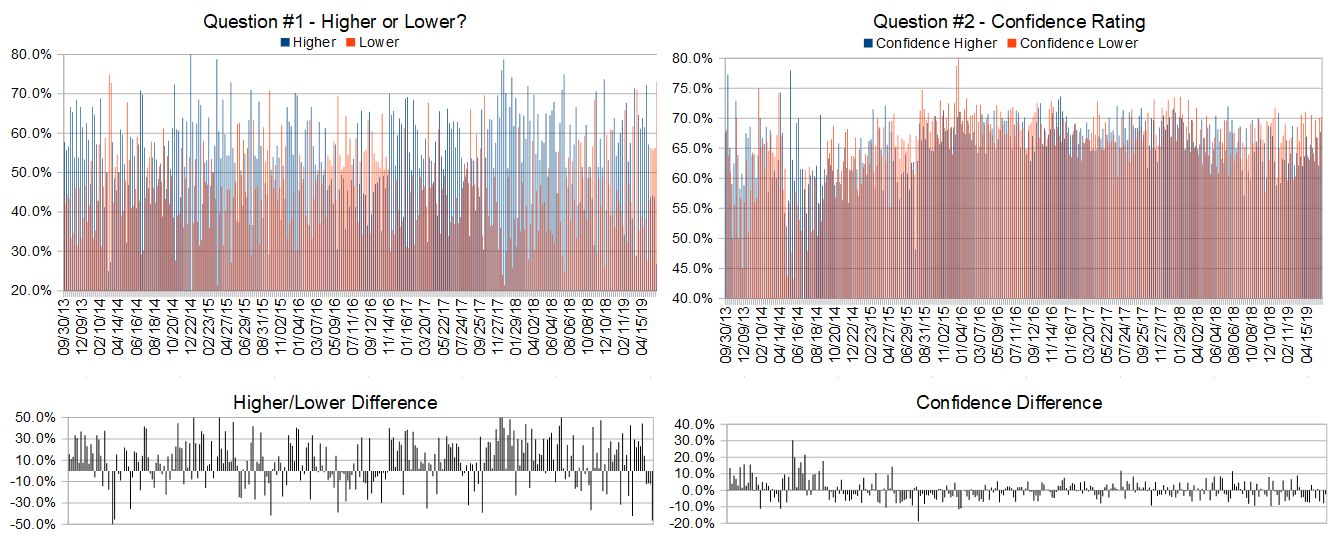

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (June 3rd to 7th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 26.8%

Lower: 73.2%

Higher/Lower Difference: -46.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 69.5%

Average For “Higher” Responses: 67.7%

Average For “Lower” Responses: 70.2%

Higher/Lower Difference: -2.4%

Responses Submitted This Week: 46

52-Week Average Number of Responses: 38.5

TimingResearch Crowd Forecast Prediction: 73% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 56.3% Lower, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 2.76% Lower for the week. This week’s majority sentiment from the survey is 73.2% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 11 times in the previous 296 weeks, with the majority sentiment (Lower) being correct 27% of the time and with an average S&P500 move of 0.53% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 73% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

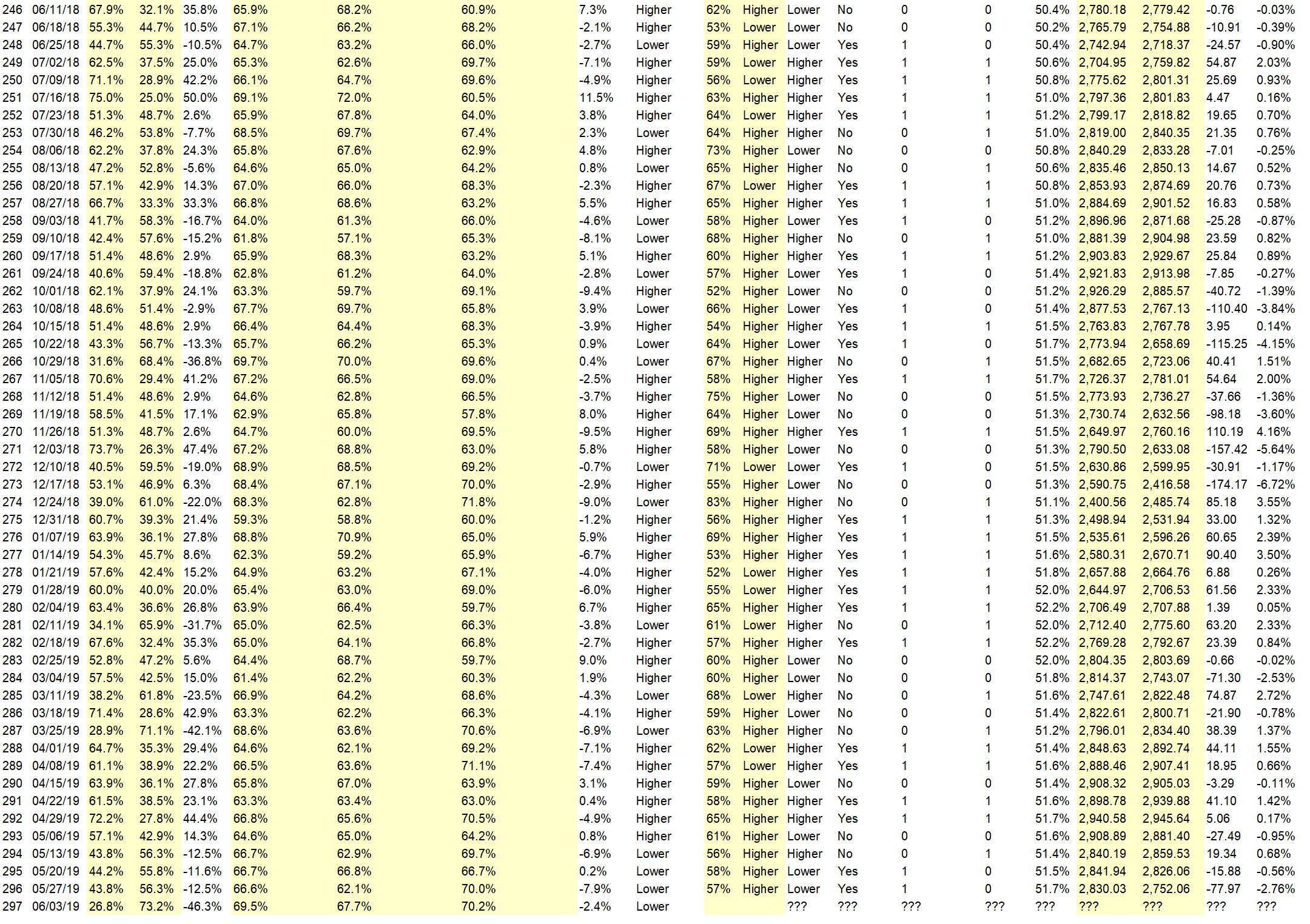

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.7%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• support line may be I think I guess maybe I guess

• Beginning of the month and new money should be hitting the stock market proportionately. We might even get some millennials involved.

• Surprise announcement of a trade deal with China

• Dead cat bounce

• because ts the right thing to do given that the chinese haven’t started a war yet.

• waiting for w4down to finish

• technicals and Put/Call ratio

• Momentum is bearish but there is a probability of a minor spike keeping the indices around 200 sub or above.

• I think the trade between USA-China will reach a small agreement

“Lower” Respondent Answers:

• new tariffs on Mexico, continuing tariffs on China No new news on economy.

• trump

• crowd follow,

• Fridays epic selloff

• I sold my SDS last week near resistance, so of course the S&P will tank this week! LOL

• continue wave 2 down

• technical analysis

• momentum

• orderly correction to 200dma , pricing in rate cuts in dec/2019,bond market pricing it in. Crude big drop also adding to correction ,mexico,best to stand aside and wait for reversal .

• Mexico tariffs.

• The downside correction will continue. Major support lines are being broken.

• If the market acts like it did in Oct 2018, a rebound can come soon. But more likely IMO, with Mexico, China, yield curve inverting, and no infrastructure bill, this market moves downward more like in Jan 2016 and Dec 2018.

• Fib levels show retacement down to december lows, until market turn around

• chart analysis, support levels

• Impulsive POTUS. NO PLANS

• Your kidding? Fridays drop

• Slowing world economy

• Trend is down, trade wars

• Breaching support. Key weekly indicators show lower. Bonds increasing from institution cash.

• New terrific vs. Mexico.

• major support broken internals, momentum weak

• Market doesn’t like uncertainty and there’s SO much of it now.

• Mr Trump

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide

Question #4. What methods or techniques do you use to overcome the emotional aspects of trading?

• That is my biggest issue

• Mood

• I use stops and market timing

• what emotion ?

• Use physical stops

• Keeping my eye on long range objectives, scaling out of positions as the opportunities presents them.

• i haven’t figured a way to not be emotionaly involved in my trades as of yet

• Fibanacia

• Sit it out.

• entry/exit rules

• technicals.

• Stop loss on profits no losses

• Donchian channels and different periodic cycles

• Set lost at the daily movement average and the moment trend

• patterns, price action, correlations, options behavior.

• perspective, patience

• Haven’t found one yet. Any suggestions?

• Are you kidding? I’m very happy when a trade is profitable, and quite disappointed when a trade hits my stop. This is in spite of the risk/reward stuff which is supposed to keep me unemotional because I know that statistically, overall, my method should be profitable. I just accept that cannot keep emotions out of it.

• fixed stops

• fixed stops

• Still wrestle with them. 50/100/200 day MA.

• journaling

• algotrading

• Still trying after 20 years…Rely more on charts, money management, and separating trading from investments.

• Take some time, examine several charts before making a move.

• Try to follow a proven system but at end we succumb and fall to emotional flares.

• Talk with friends

Question #5. Additional Comments/Questions/Suggestions?

• No technical data looks positive

• this is a great survey

• What is the best to find stocks that are trending up? With over 12000 stocks seems impossible.

• Market wants to go higher but it’s being news driven down by Trump.

• Trading is no longer productive unless we have a real plan on certain time frames.

Join us for this week’s shows:

Crowd Forecast News Episode #226

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 3rd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

– Dave Landry of DaveLandry.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #80

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 4th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jerremy Newsome of RealLifeTrading.com

– Michael Filighera of LogicalSignals.com (moderator)

Partner Offer:

He lives over 2,400 miles from Wall Street and he doesn’t have an MBA. But thanks to an incredible – yet little-known – market niche, he’s turned a teacher’s salary into a huge personal fortune.

To get started right away, Click Here to Unlock Your Guide