Crowd Forecast News Report #304

AD: Revealed: How To Identify Market Moves Up To 3 Days In Advance.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport072119.pdf

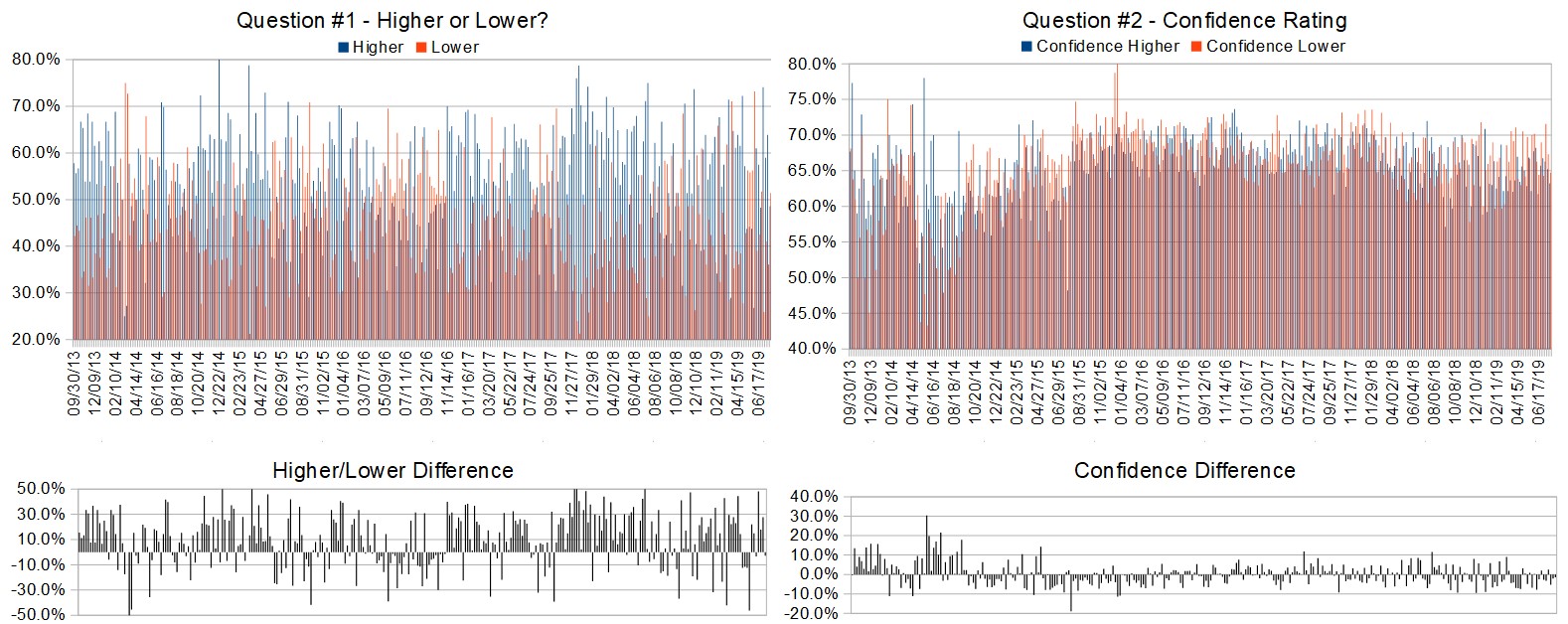

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 22nd to 26th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 48.6%

Lower: 51.4%

Higher/Lower Difference: -2.9%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.0%

Average For “Higher” Responses: 63.2%

Average For “Lower” Responses: 64.7%

Higher/Lower Difference: -1.5%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 37.3

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.9% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 1.36% Lower for the week. This week’s majority sentiment from the survey is 51.4% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 20 times in the previous 303 weeks, with the majority sentiment (Lower) being correct only 40% of the time and with an average S&P500 move of 0.07% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: How to arbitrage value vs time.

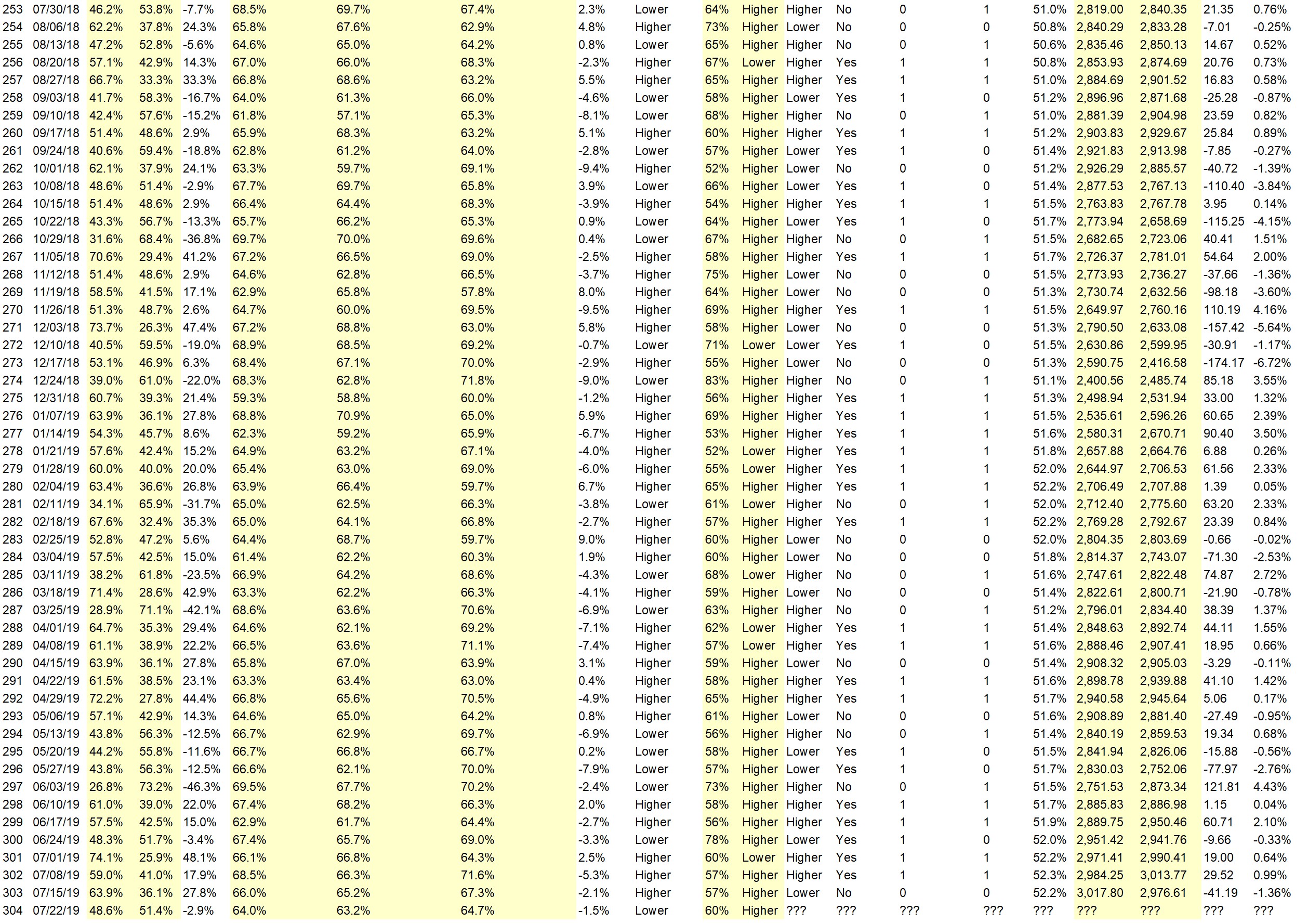

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.2%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• It is the end of the month which is positive for the market, but everything will hinge on the GDP number Friday and if the Fed will cut interest rates. If GDP is low, rates are cut and the market will go up, the opposite is true if GDP is strong.

• extreme low along still trending mkt

• earnings season

• Not sure. Suspect rangebound week.

• Buy the dip Traders/investors push S&P to new high

• Gut feeling

• history

• will go higher into the fed

• trend is up

• Rebound from Friday and positive earnings

“Lower” Respondent Answers:

• Complacent waning volume

• Hurricane barry maybe

• Earnings

• Price did not break the top trend line (wave D in megaphone)

• retracement from highs

• Problems with Iran

• wave 5 may be done

• The market remains overbought and needs some backing and filling to be healthy.

• Summer doldrums

• Your guess is as good as mine-

• World economy. We are at the edge. Anything can happen with Iran – etc and people are becoming more aware of possibilities of rate stagnation and even increase end of July.

• topping fotmation

AD: Revealed: How To Identify Market Moves Up To 3 Days In Advance.

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• Your guess is as good as mine. One of the reasons I don’t participate on a regular basis, is that trying to ” read the market , even 10 minutes into the future ” is an exquisite exercise in futility. The world is better off without a leader, since all we do is wander around aimlessly into the weeds.

• accept losses

• discipline

• a probability mindset

• Know when to get in and out before placing trades and stay in size according to small percentage of capital for his market.

• Take losses

• Taking losses

• Discipline

• Patience, Discipline, Consistency

• Stress profit motive.

• Stick to a plan

• Not to react with fear

• calm

• Patience

• Patience

• calmness

• Believe what I do and wait patiently for my opportunity

Question #5. Additional Comments/Questions/Suggestions?

• No. Have a great week-end.

• Discuss volatility and the importance of understanding the vixx

Join us for this week’s shows:

Crowd Forecast News Episode #231

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, June 22nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Marina Villatoro of TheTraderChick.com

– Bennett McDowell of TradersCoach.com

– Simon Klein of TradeSmart4x.com (moderator)

Analyze Your Trade Episode #86

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, June 23rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com

– Christian Fromhertz of TribecaTradeGroup.com

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

AD: 40 page Sector Report.