Crowd Forecast News Report #308

AD: A “hidden” trade setup finally revealed.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport081819.pdf

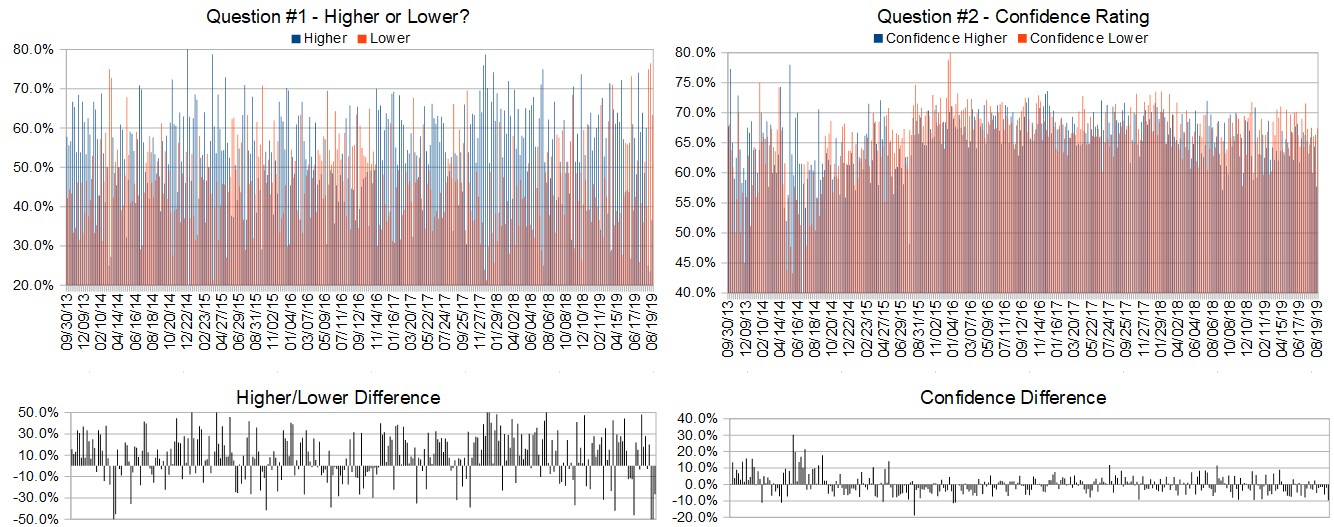

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 19th to 23rd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 36.7%

Lower: 63.3%

Higher/Lower Difference: -26.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.8%

Average For “Higher” Responses: 57.7%

Average For “Lower” Responses: 67.4%

Higher/Lower Difference: -9.6%

Responses Submitted This Week: 32

52-Week Average Number of Responses: 36.7

TimingResearch Crowd Forecast Prediction: 65% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 76.5% Lower, and the Crowd Forecast Indicator prediction was 68% Chance Higher; the S&P500 closed 0.63% Higher for the week. This week’s majority sentiment from the survey is 63.3% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 20 times in the previous 307 weeks, with the majority sentiment (Lower) being correct only 35% of the time and with an average S&P500 move of 0.45% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 65% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

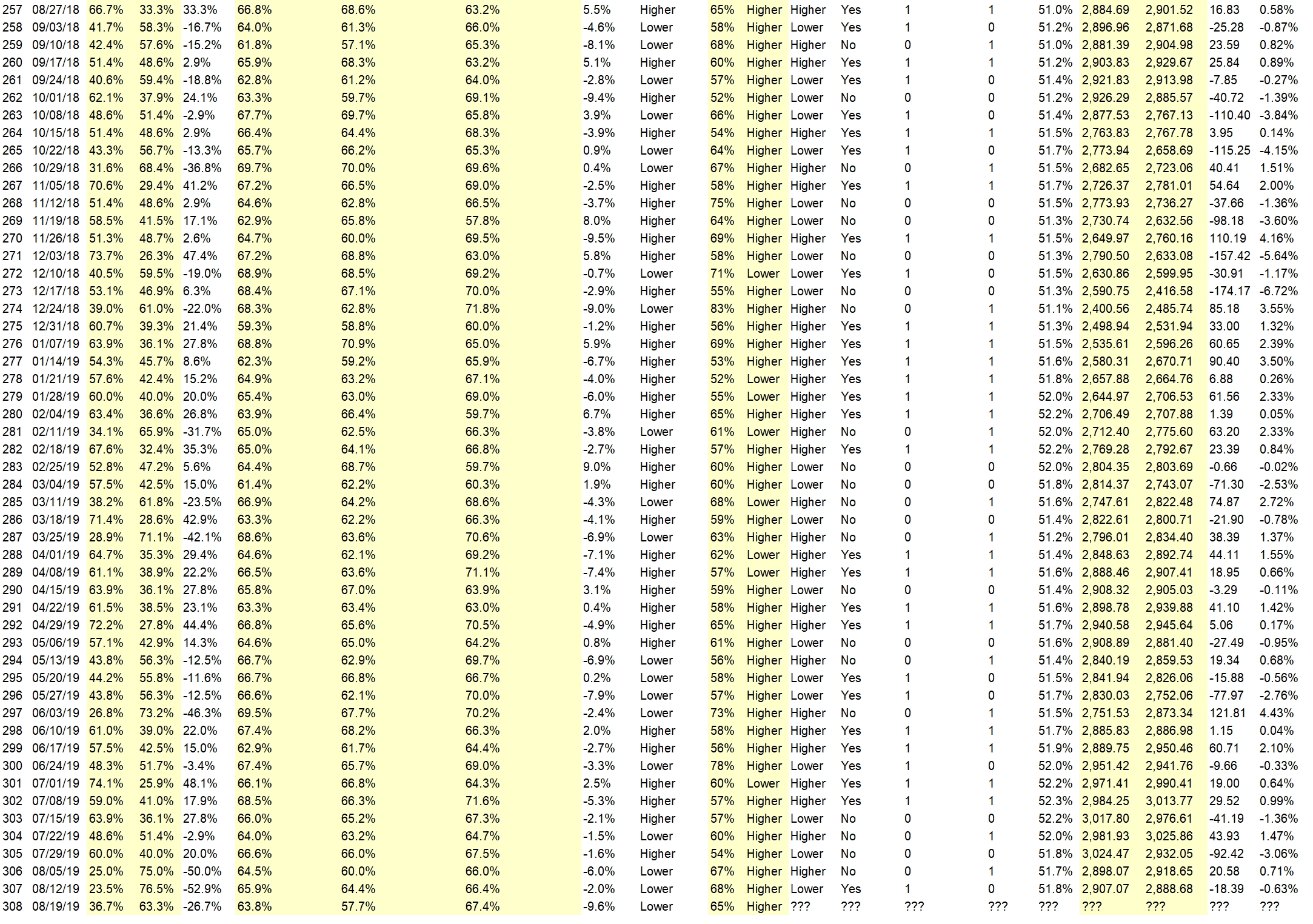

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.8%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Tate Reeves

• mt chart bullishnes

• Trump

• Where else can one earn a return?

• Correction over?

“Lower” Respondent Answers:

• Economic uncertainty, trend

• Tariffs

• Long term moving averages and my cycle analysis.

• Unrest in Hong Kong gets hotter and China’s reaction spooks the markets

• Timing cycles Elliot Wave

• Elliott wave correction on the one hour chart

• retrace wave 5

• Looking for the S&P to hit resistance by Wed, then reverse to down. There’s a negative divergence with the MACD.

• Market top last week Will m0ve side to side

• Bonds are inverted, the market will fail for sure, Band-Aids will not hold it up. Gold & Silver will raise and people will rush to pull money out and find safety in Gold. More and more money is leaving the market. Billion dollar funds don’t know what to do as too much tied up in stocks, slowly , very slowly their liquidating positions before the major fall appears.

• Trade war is not stoped

• Technical analysis shows a dip mid week.

• Daily RSI is heading lower and below the 50 level, the weekly RSI is compressing to go lower. On an H4 chart, we just came off a double top. Unless news moves it higher, we are going lower this week.

• downleg looks invomplete

AD: A “hidden” trade setup finally revealed.

Question #4. What styles of trading or methodologies have you had the most success with?

• Technical

• Long term dollar cost averaging

• Coffee can

• Long term DCA

• History

• Trend trading/following

• Fundao

• both listed above.

• Skimming very short term trades

• Shorter term (1-3 day) trades seem to do better for me than other holding periods.

• selling covered calkes

• Pattern trading and Multi time frame following the RSI.

• pull backs

Question #5. Additional Comments/Questions/Suggestions?

• Wish everyone great success and suggest find Gold where you can more sooner…..

• Don’t get married to one direction, be nimble.

AD: A “hidden” trade setup finally revealed.

Join us for this week’s shows:

Crowd Forecast News Episode #235

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time Released:

– Monday, August 18th, 2019

– 3PM ET (12PM PT)

Moderator and Guests:

– Felix Frey of OptionsGeek.com (first time guest!)

– Jake Bernstein of Trade-Futures.com

– Michael Guess of DayTradeSafe.com

– Mark Sachs of RightLineTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #90

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time Released:

– Tuesday, August 19th, 2019

– 6PM ET (3PM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

AD: A “hidden” trade setup finally revealed.