Crowd Forecast News Report #309

AD: Need more capital to trade? Click for Futures or Forex.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport082519.pdf

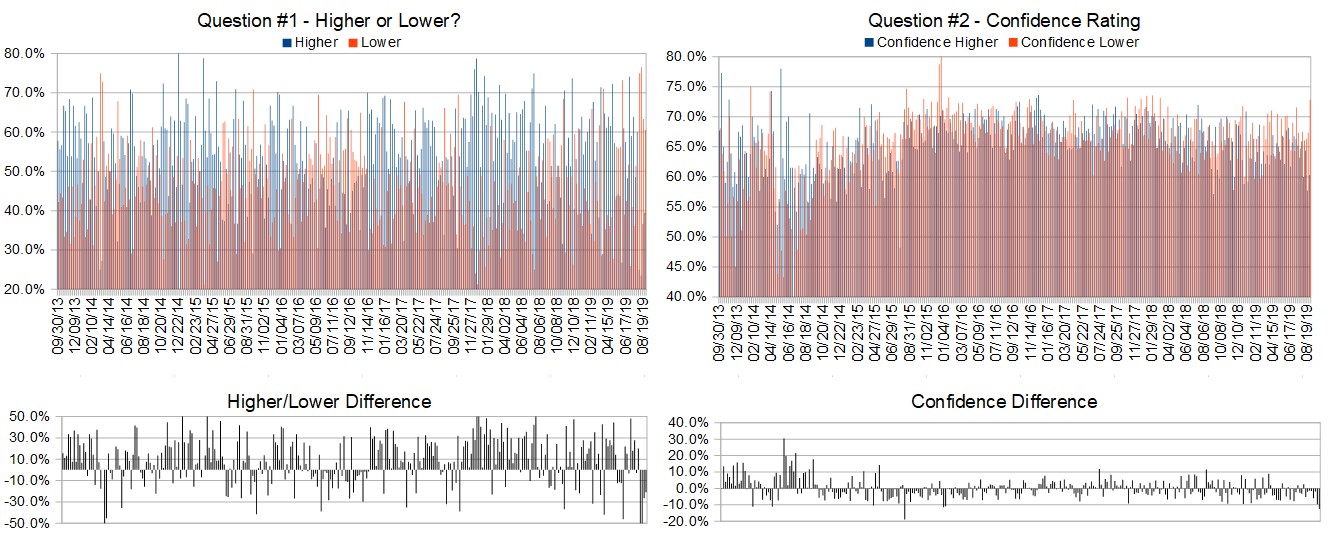

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (August 26th to 30th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 39.5%

Lower: 60.5%

Higher/Lower Difference: -21.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.9%

Average For “Higher” Responses: 60.3%

Average For “Lower” Responses: 72.8%

Higher/Lower Difference: -12.5%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 36.7

TimingResearch Crowd Forecast Prediction: 62% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.3% Lower, and the Crowd Forecast Indicator prediction was 65% Chance Higher; the S&P500 closed 2.28% Lower for the week. This week’s majority sentiment from the survey is 60.5% Lower with a greater average confidence from those who responded Lower. Similar conditions have occurred 21 times in the previous 308 weeks, with the majority sentiment (Lower) being correct only 38% of the time and with an average S&P500 move of 0.32% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 62% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

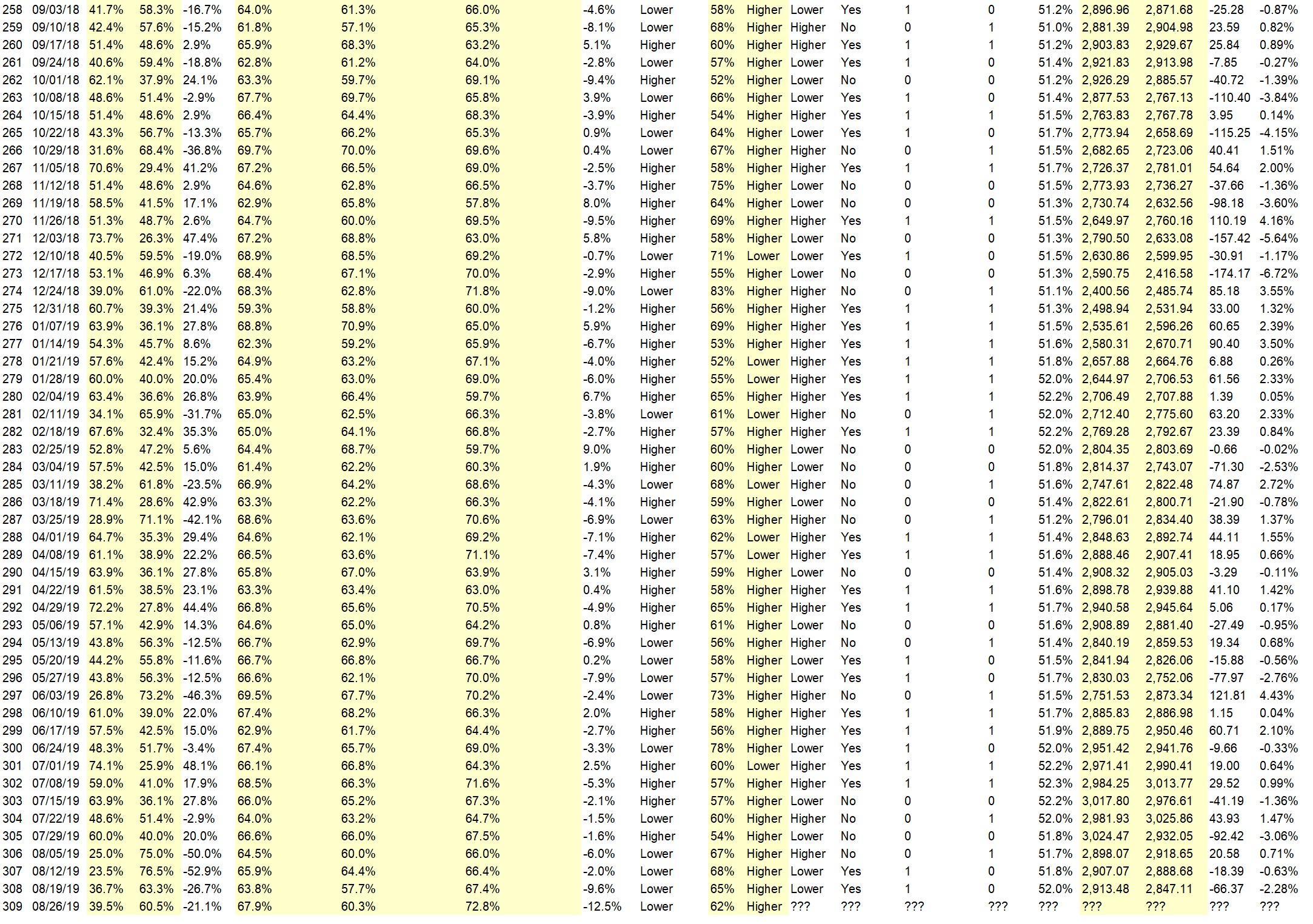

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.0%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Functional QE and strength of the dollar.

• Republican victory in votes counted i read alot more than Democrates

• Markets are oversold

• I think it would go up providing Trump does not say anything stupid this week, like attack the Head of the Federal Reserve or does something different with China

• flushing out the weak hands in a countertrend rally

• 2 try in the weekly chart

• down today

• up week reprieve from down market

• It came down to solid support area and will bounce, unless their is some news to spark the market up, it will not hold..

• tariffs actually impact very little of the overall economy – which is still doing well

• Many time studies and cycles culminate next week so there is going to be highs and lows.

“Lower” Respondent Answers:

• Friday’s fall tariff tweets

• Alignments & Technical Analysis.

• Many sessions it reached Resistance level but couldn’t able to sustain this may lead to break the long term support level 282 eventually in this week.

• tariffs

• RSI from the daily chart and lower are all negative and the weekly is one move away to going south also

• Trade war with China, Recession fears, chart patterns.

• lower lows ..breached spx 2850 on close seems to be headung to spx 2821 .

• The downside correction is accelerating. As long as Trump keeps playing chicken with the Chinese, the market and the economy will continue to falter.

• Market is too high for the expected growth rate of 2.0% for 2nd half of 2019. Tariff nonsense will hurt. Market’s failure to move above 50-day avg last week, along with Friday’s drop, suggests continued dropping, with next major support around 2600.

• Summit won’t produce results. France is stirring up the pot and Japan trade isn’t final

• Fridays tweets WAR is 0n China winning means escalation imminent

• Trade war finally effects market

• Chevron was happy to get here the first time, less so now.

• US – China comercial war!

• Too much uncertainty to cause much of a rally.

• major support broken

AD: Need more capital to trade? Click for Futures or Forex.

Question #4. What sort of hedging or portfolio protection strategies do you implement in your trading?

• secret ones

• Preset ATM to manage trades.

• inverse etf,s such as TZA–SDS-SDOW–SQQQ. VXX weekly calls ,as now i have the VXX 30.00 calls expiry 8 days ,10 contracts.

• I sell

• selling puts/calls

• Sell stay out track favorite stocks buy in on selling climax

• Covered call writing.

• Option spreads

• only tade pullbacks

• Alignments & Technical Analysis.

• Gold/ Silver/ small cap miners

• take my stops and close out postns

• position sizing

• sell covered calks at market

• Use options to limit exposure

• SDS

• none at this time, I do have one hedging account offshore.

• Very little being max intraday action or rarely overnight due to sudden upheaval

Question #5. Additional Comments/Questions/Suggestions?

• do you know of any good automated algo type trading system ,you can reccommend.

• Buy Gold & Silver and a lot of it, mines, stocks, etc..

• I don’t like holding overnight right now..

• As long as we have a weak mind as potus we can have swings in economy and markets

• why can’t my confidence level be below 50%?

TimingResearch Response: It’s a binary choice, Higher or Lower. If you have less than a 50% confidence that the S&P500 is going to move Higher, then you should select Lower. A 30% chance that the index is going to move Higher is the same as a 70% chance that the index is going to move Lower.

Join us for this week’s shows:

Crowd Forecast News Episode #

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, August 26th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Mark Sachs of RightLineTrading.com

– Jake Bernstein of Trade-Futures.com

– Michael Filighera of LogicalSignals.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, August 27th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)