Crowd Forecast News Report #311

AD: How to Trade the Bobble Pattern (eBook)

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport090819.pdf

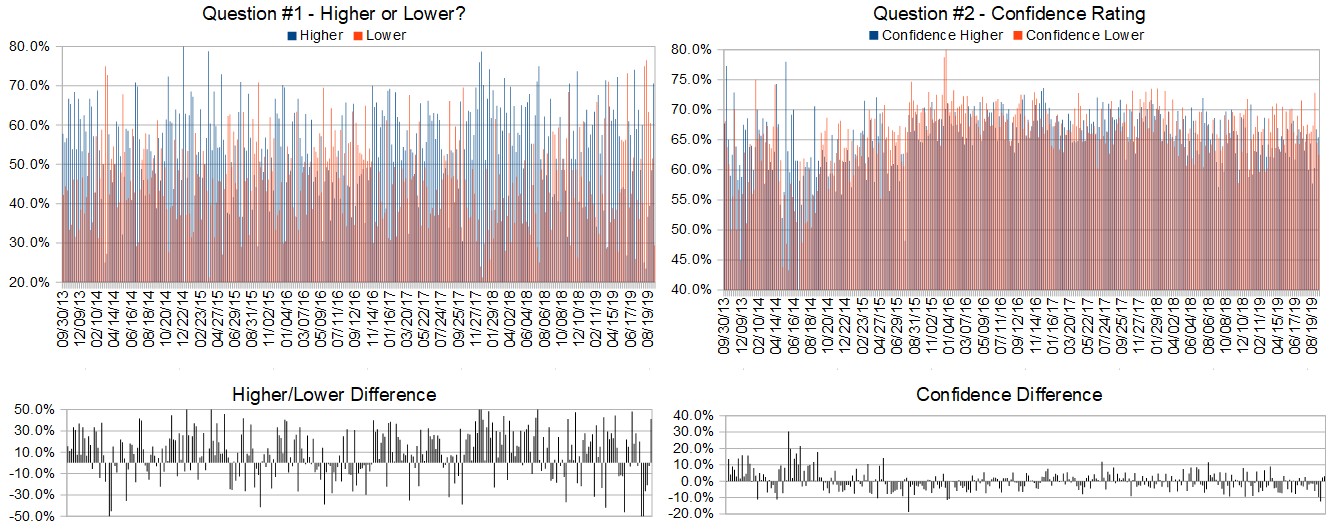

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 9th to 13th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 70.6%

Lower: 29.4%

Higher/Lower Difference: 41.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 64.6%

Average For “Higher” Responses: 65.4%

Average For “Lower” Responses: 62.5%

Higher/Lower Difference: 2.9%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 36.7

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

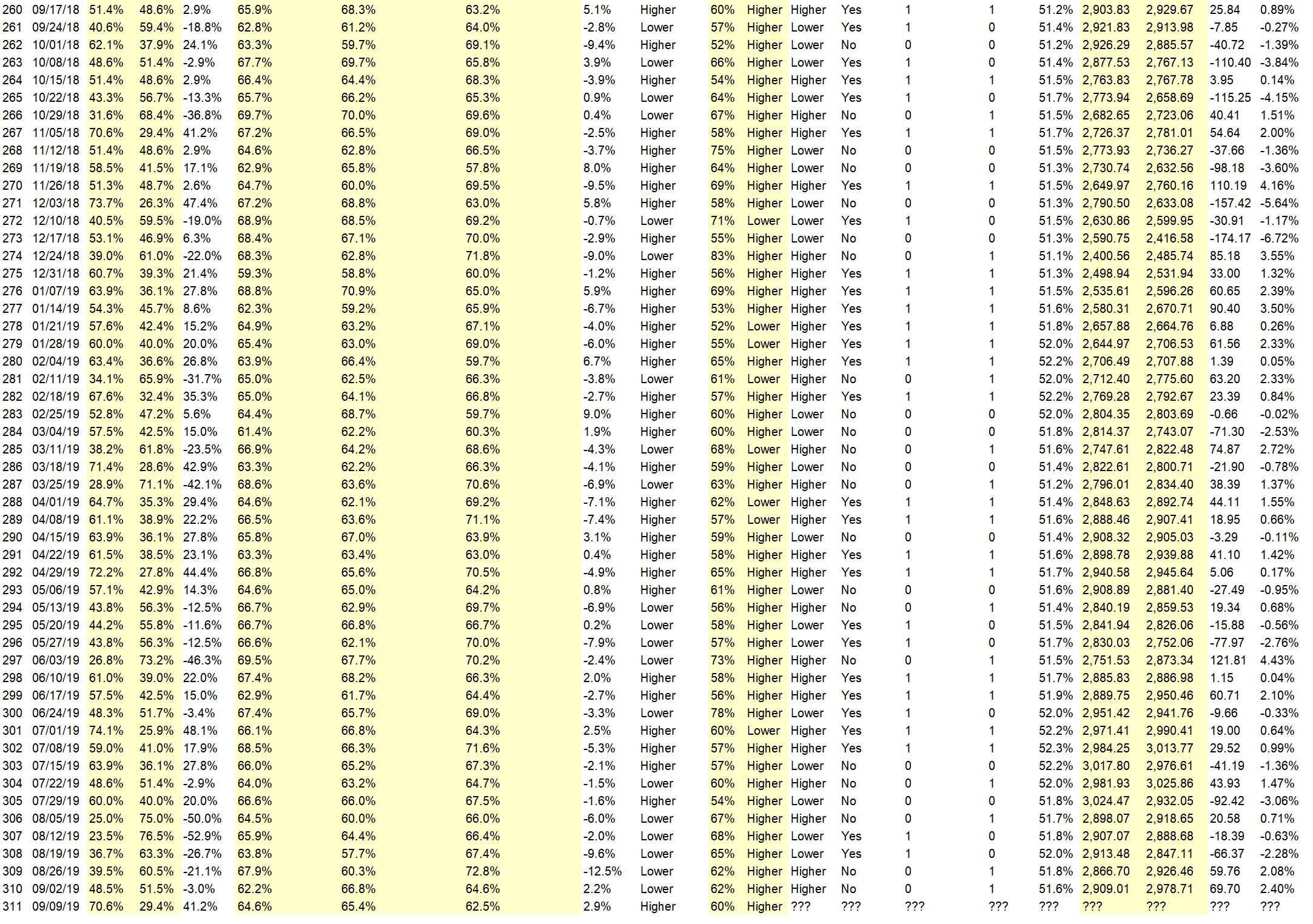

Details: Last week’s majority sentiment from the survey was 51.5% Lower, and the Crowd Forecast Indicator prediction was 62% Chance Higher; the S&P500 closed 2.40% Higher for the week. This week’s majority sentiment from the survey is 41.2% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 62 times in the previous 310 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.10% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: How to Trade the Bobble Pattern (eBook)

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.6%

Overall Sentiment 52-Week “Correct” Percentage: 54.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Institutional Money Managers

• China trade talks should fuel rally

• Bull close today

• Good 4 all

• Theo Trade, VectorVest, Top Gun Options, DTI, Chaikin Analytics , Market Guage, Market Beat, Market Chameleon,

• On D,W,M TF is price above 50 SMA. This week price reaches record high.

• no clue

• Fed to cut rate / Trade talks with China

• weekly wave5 continues

• day and H4 RSI long

• The momentum favors more upside, although it may be a sideways week with upward bias.

• FED WILL cut

• test the highs

• Momentum is with the Bulls

• It broke out to the up

• Hard question. I would risk no more than 1%.

• FED/FOMC drooling

“Lower” Respondent Answers:

• at a reversal point

• Technical analysis

• china will be complaining about the tariff and the hongkong rioting will get worse

• Mkt was up last week

• closing gaps

• Smart money leaving market

• Divergences all over the place

AD: How to Trade the Bobble Pattern (eBook)

Question #4. What indicator influences your trading the most?

• dow industrial

• Interest rates

• todays bull moving a erage ob the SP 500

• Gut

• EMA , Chaikin Money Flow, On Balance, RSI, MACD, S/R , Keltner Channel

• News

• MA, CCI

• rsi and macd overbought

• News, Economic reports, and unfortunately, our crazy gov’t actions.

• Proprietary

• Vantagepoint

• Comparing fast and slow stochastics comparing fast and slow MACD

• 50, 100, 200 MA

• price action

• Approaching election year.

• RSI and price action

• Channels, MACD

• MACD

• Custom

• Rsi

Question #5. Additional Comments/Questions/Suggestions?

• Sell gold (NUGT)

• Gold & Silver pulled back last week., will stabilize this week and start a move back up.

AD: How to Trade the Bobble Pattern (eBook)

Join us for this week’s shows:

Crowd Forecast News Episode #237

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 9th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Jake Wujastyk of TrendSpider.com

– Erik Gebhard of Altavest.com

– Anka Metcalf of TradeOutLoud.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #93

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 10th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Larry Gaines of PowerCycleTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

AD: How to Trade the Bobble Pattern (eBook)