Crowd Forecast News Report #319

AD: Don’t risk your capital! Trade with other people’s money.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport110319.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (November 4th to November 8th)?

Higher: 71.4%

Lower: 28.6%

Higher/Lower Difference: 42.9%

The order of possible responses to this question on the survey were randomized for each viewer.)

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.5%

Average For “Higher” Responses: 70.3%

Average For “Lower” Responses: 70.8%

Higher/Lower Difference: -0.5%

Responses Submitted This Week: 22

52-Week Average Number of Responses: 35.3

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

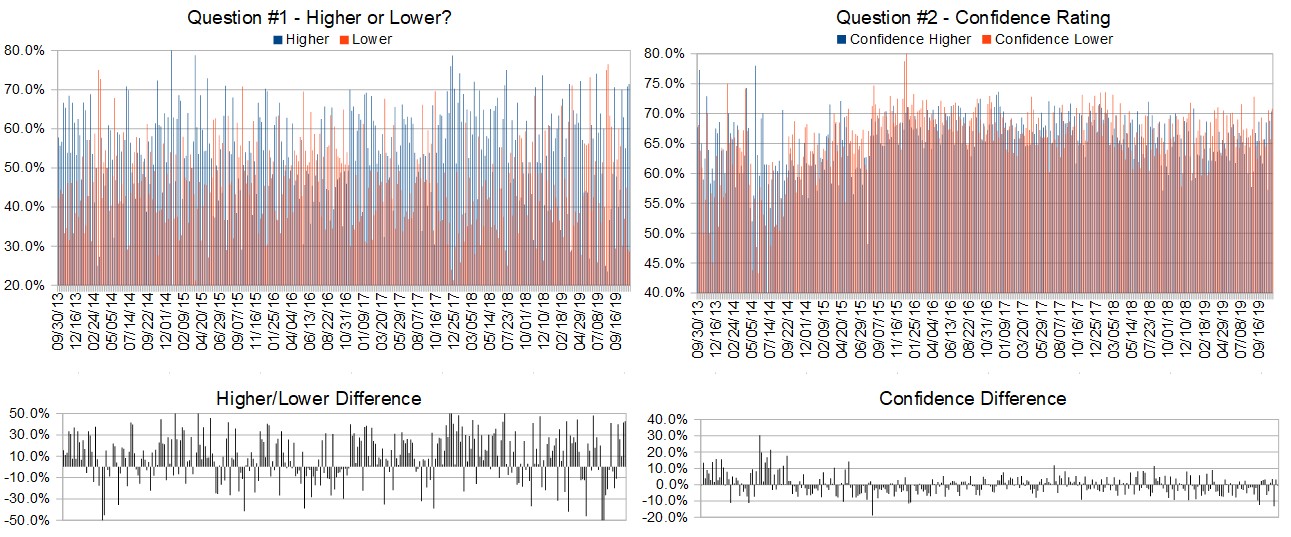

Details: Last week’s majority sentiment from the survey was 70.8% Higher, and the Crowd Forecast Indicator prediction was 64% Chance Higher; the S&P500 closed 1.15% Higher for the week. This week’s majority sentiment from the survey is 71.4% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 32 times in the previous 318 weeks, with the majority sentiment (Higher) being correct 59% of the time and with an average S&P500 move of 0.16% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.9%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Employment strong

• daily AND weekly Elliott waves – still arriving at targets for wave 5 finish

• momentum

• QE and positive earnings will attract investors.

• new highs

• Friday’s move up looks like it could lead to more of a breakout from the congestion around 3000. Also, The Fed looks like they will pause on lowering interest rates, suggesting that they think that the economy will do better than expected.

• trend

• Gearing up for holiday season

“Lower” Respondent Answers:

• Market overbought needs a breather

AD: Don’t risk your capital! Trade with other people’s money.

Question #4. What are the most important mental and emotional characteristics for traders to develop?

• When you find out let me know.

• Manage stressEmployment

• Discipline and mental clarity

• patience

• Disciplined approach.

• Don’t get tied to a losing position, hoping against hope, that the direction will reverse.

• Attention and patience

• Mental toughness with emotions breakdown.

Question #5. Additional Comments/Questions/Suggestions?

• Donald Trump greatest President since JFK!! Go Donald GO!!

Join us for this week’s shows:

Crowd Forecast News Episode #244

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, November 4th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Erik Gebhard of Altavest.com

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #101

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, November 5th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

AD: Don’t risk your capital! Trade with other people’s money.