Crowd Forecast News Report #327

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport122919.pdf

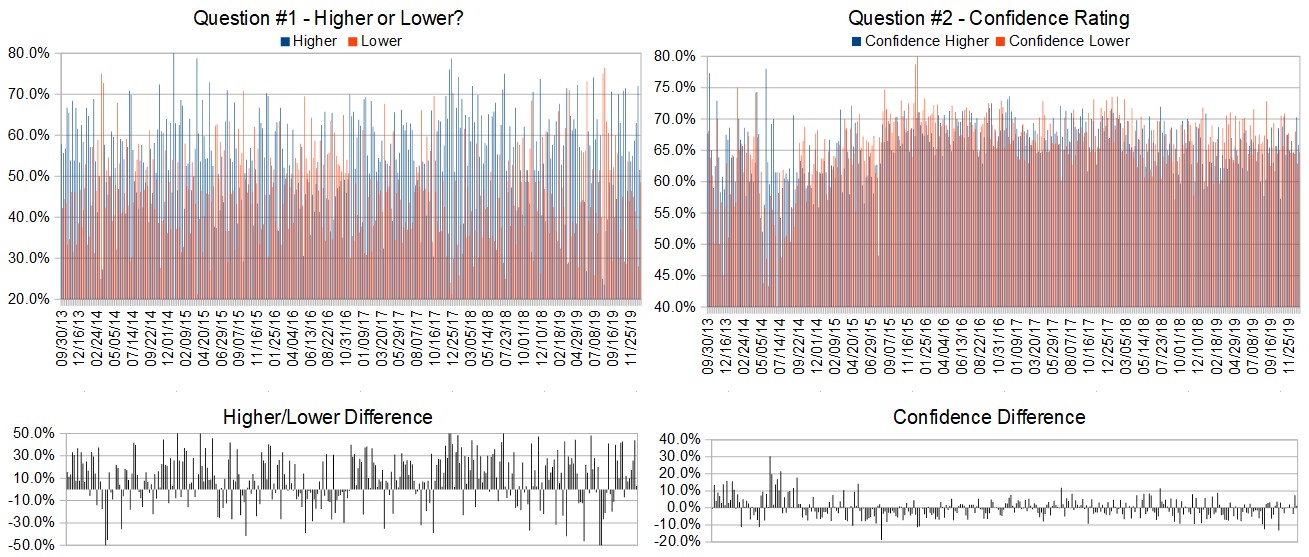

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 30th to January 3rd)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 51.5%

Lower: 48.5%

Higher/Lower Difference: 3.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Responses Submitted This Week: 33

52-Week Average Number of Responses: 33.7

TimingResearch Crowd Forecast Prediction: 64% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

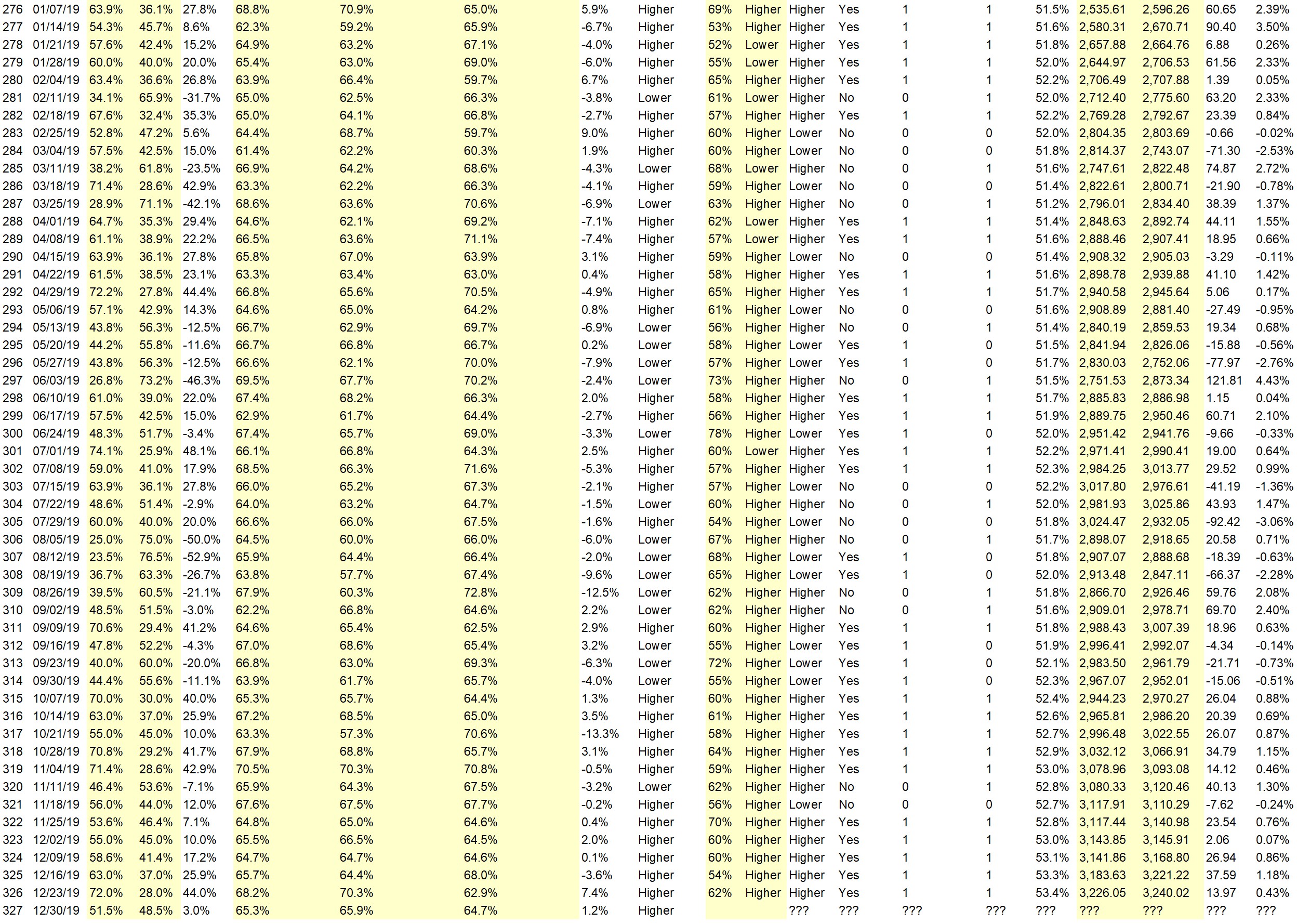

Details: Last week’s majority sentiment from the survey was 72.0% predicting Higher, and the Crowd Forecast Indicator prediction was 62% chance Higher; the S&P500 closed 0.43% Higher for the week. This week’s majority sentiment from the survey is 51.5% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 75 times in the previous 326 weeks, with the majority sentiment (Higher) being correct 64% of the time and with an average S&P500 move of 0.37% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 64% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Trend/Santa rally continues

• seasonality

• “Things” are looking good.

• Follows the trend.

• momentum

• Historically best six months of the year

• holidays

• Year end, New Year

• Seasonality

• wave 5 still continues

• New Normal and the FOMC actions

• Solid uptrend currently…

• Trend

“Lower” Respondent Answers:

• Tax gain selling into new year

• The market looked tired on Friday. Expecting profit taking as we transition into the new year.

• Tax loss selling and profit taking will dominate this week.

• nbr is now off the air wishing this bull market the best of goodbyes

• Nightly Business Report went 0f2f the air Friday

• friday closing finished in the red so i think it will be a pullback for this coming week

• End of year harvesting.

• year end tax sell off

• its time for a pull back .the volume is going down

• Rose too much, too fast, during last several trading days. Market will take a pause here for a few days to consolidate.

[AD] PDF: 10 Strategies for Success

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The CFN show is off for one more week, but back on Jan 6th.)

• value stocks

• gold

• Profits

• Best stocks for 2020.

• Put option use

• The effect of the US-China trade relationship on the market.

• market timing

• How to use news events to profit.

Question #5. Additional Comments/Questions/Suggestions?

• none

[AD] PDF: 10 Strategies for Success

Join us for this week’s shows:

Analyze Your Trade Episode #107 (first TR show of the year!)

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday, January 2nd, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Jake Bernstein of Trade-Futures.com

– Jim Kenney of OptionProfessor.com (moderator)

[AD] PDF: 10 Strategies for Success