- Home

- Archive: March, 2020

Analyze Your Trade Episode #121

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– John Thomas of MadHedgeFundTrader.com

– The Option Professor of OptionProfessor.com (moderator)

Symbols Covered This Episode: BA, AAPL, AMD, SDS, CVX, ROKU, ZM, TSLA, MA, GILD, WMT, SHOP, TDOC, TLT, T

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #258

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #340

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport032920.pdf

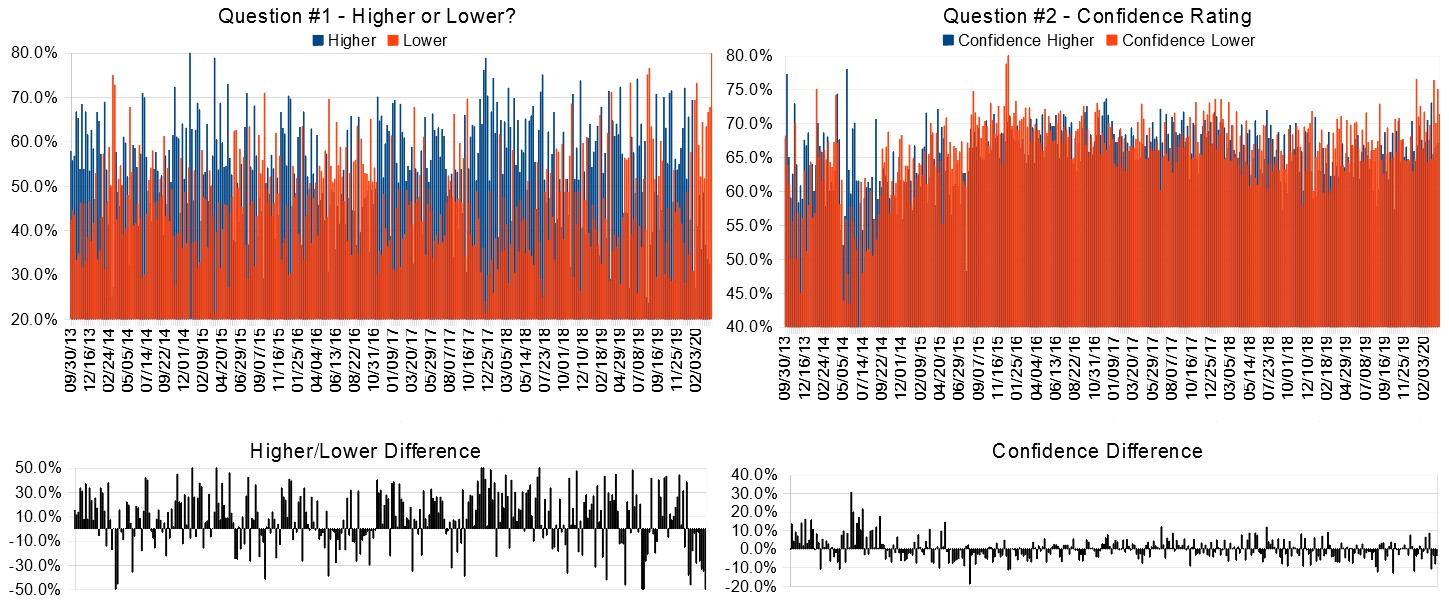

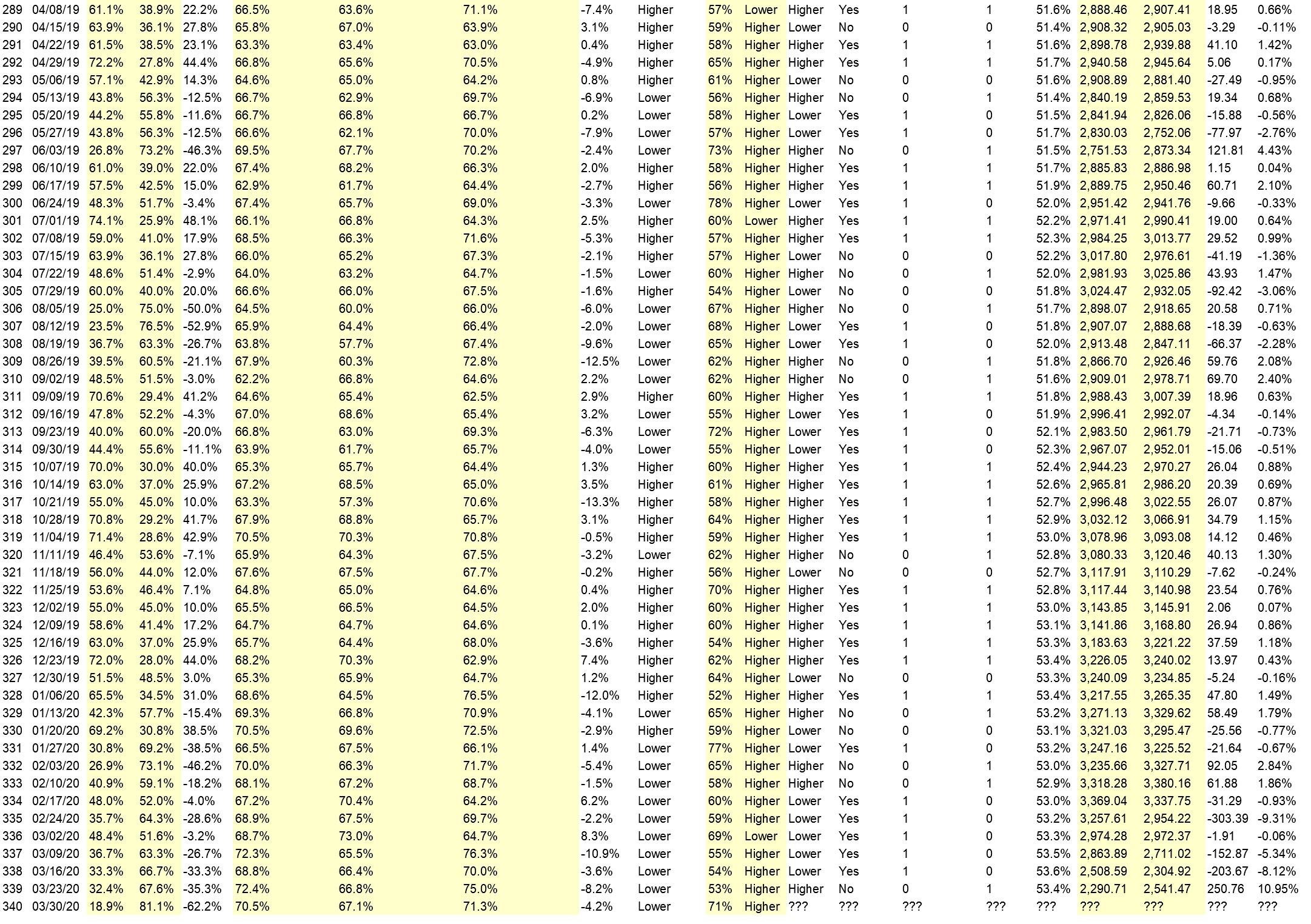

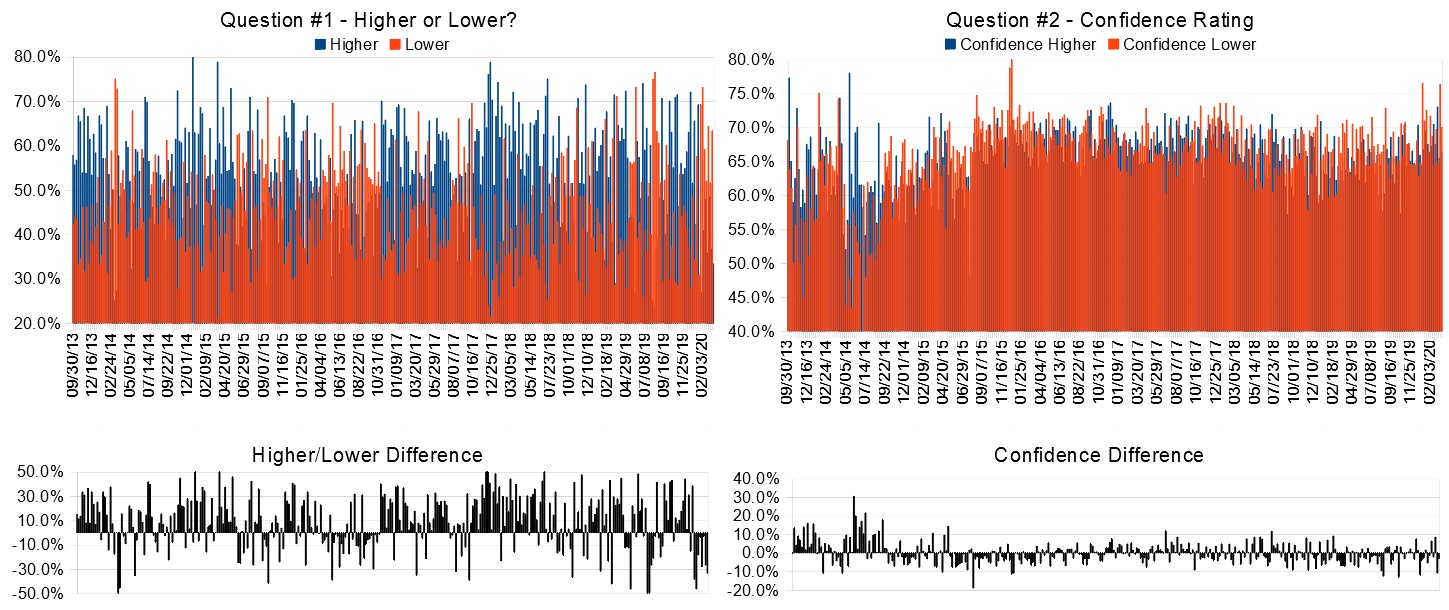

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 30th to April 3rd)?

Higher: 18.9%

Lower: 81.1%

Higher/Lower Difference: -62.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.5%

Average For “Higher” Responses: 67.1%

Average For “Lower” Responses: 71.3%

Higher/Lower Difference: -4.2%

Responses Submitted This Week: 38

52-Week Average Number of Responses: 32.0

TimingResearch Crowd Forecast Prediction: 71% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.6% predicting Lower, and the Crowd Forecast Indicator prediction was 53% chance Higher; the S&P500 closed 10.95% Higher for the week. This week’s majority sentiment from the survey is 81.1% predicting Lower (largest portion ever in the history of this experiment of respondents predicting lower) with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 7 times in the previous 339 weeks, with the majority sentiment (Lower) being correct 29% of the time and with an average S&P500 move of 1.21% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 71% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

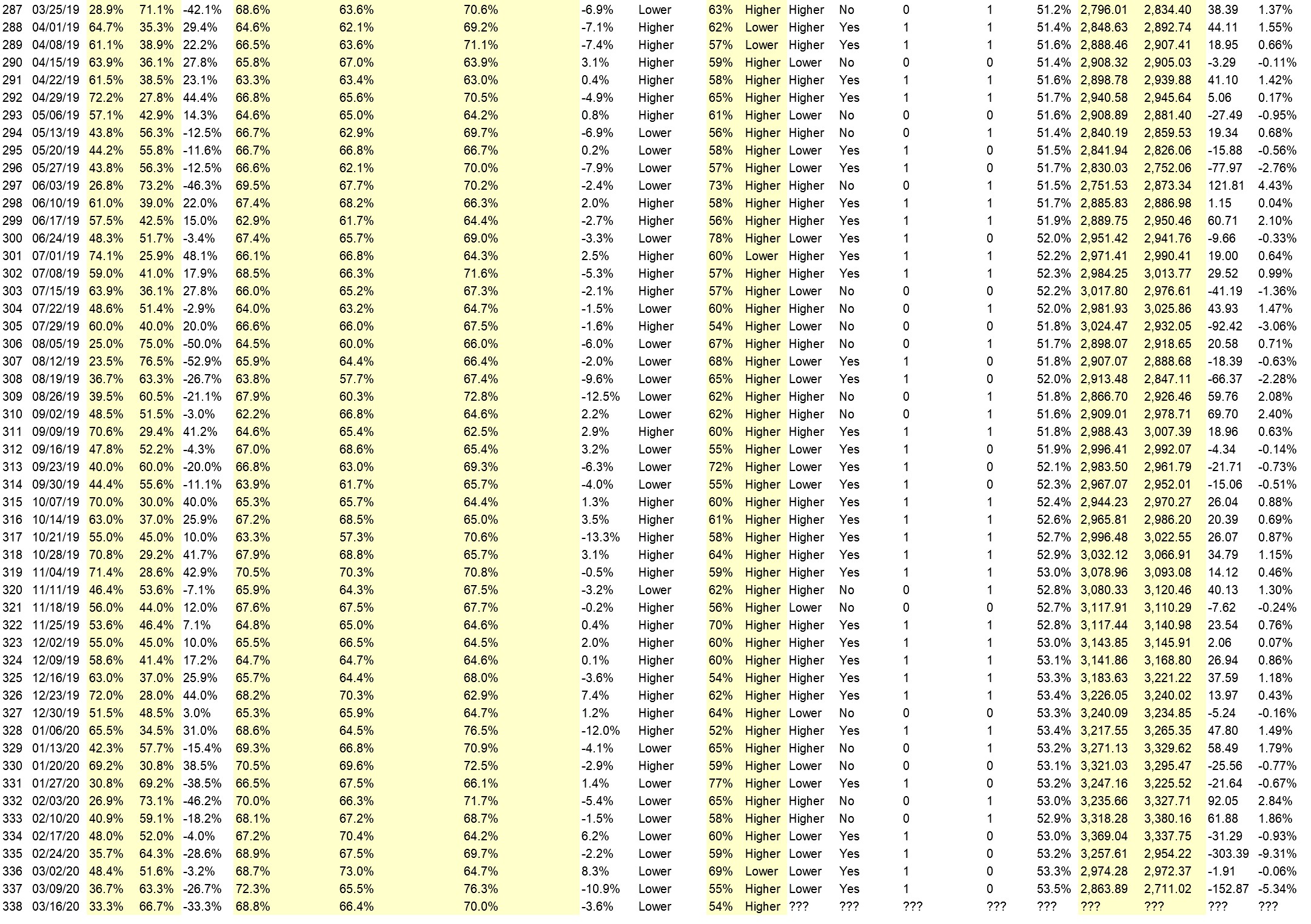

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Still Hasn’t bottomed out in the markets.

• Testing increases, curves flatten in many countries.

• over sold markets. initial selling from pent up panic over the weekend shaking out weaklings followed up by some disciplined money moving back in.

• Choppy market, end of quarter.

“Lower” Respondent Answers:

• test the low

• ….?

• All the feds good news is out. What we have is just the bad until we can get a hold of this and it starts to turn around. Italy is still getting worse with almost 1,000 per day dead. Do we really think we are out of it and will be back to work soon. Not me. I think we have an another 6 weeks to go at least . What do you think that is going to do to the market.

• It should rally a little bit in response to the 2 Trillion$ stimulus then start to stutter with the new unemployment numbers!!

• COVID-19 and his economic consequences

• China Flue spread

• Stimulus completed, bounce last week, and conditions getting worse.

• Corona virus spreading and it will panicking people again.

• bear market now

• We are not yet out of the virus condition

• Lower low coming

• While some stocks may have a lower price point, I believe the uncertainty will cause buyers to hold onto their wallets

• may not stay low but this will have to find a bottom by back and forth by the bulls vs bears and then in summer when the bankruptcies begin to pick up momentum will pick thru whats left

• Corona Virus

• 1. pelosi holdout and wanting another round of giveaways 2. worse actions on isolating areas to keep some from running elsewhere because the cat is out of the bag 3. economy and covid are both raising expectations too much.

• Technicals, COVID, no solution to COVID, COVID lockdowns, full economic impact yet to be felt, no basing yet, too much uncertainty.

• corona virus

• Corona virus worsens in US and globally. Market hasn’t completely priced in businesses being closed through May or longer yet

• More coronavirus, fewer jobs, less spending, heading to bankruptcies and GDP decline.

• Bear trend to continue

• More virus bad news in usa

[AD] PDF: 10 Strategies for Success

Question #4. What procedures do you use for trade management? (e.g. position size, stops, scaling in or out, etc.)

• NONE WORK so I am wondering if I will ever use them again

• Position then scaling

• 10% buys for each position, not predicting bottom

• atm for long term investing its scaling in.

• protective puts

• don t trade anymore

• Today usually 20% maximum into the market at a time as volatility rules market size. If there’s great buying, i’ll go full in and full out. Scaling is something I am considering.

• Position size in percent of amount trading.

• buy puts on good companies when I feel strongly the market will go down

• Raising cash as bottom not in yet

• All of the above.

• trending before mid-afternoon and late afternoon.

• Any.I am going only to clear trades.

• Position size, ATR trailing stops

• Position size, scaling in, still holding lots of cash

• …./

• I’m still working small, and not often at the moment. // The swings are very dramatic for this newer trader.

• position size and maintaining cash position.

• all of the above

• trade futures

Question #5. Additional Comments/Questions/Suggestions?

• Very grateful for this platform and the opportunity to learn and speak, thank you. I believe Prime Minister of Canada Mr. Justin Trudeau and the President of United States of America Mr. Donald Trump are doing a great job, outstanding in their respective posts given the current situation! I will add here Mr. Trump is the best American leader and the USA Economy was robust leading the world until this China Flue hit. This is a war and Mr. Trump will lead us out of it, “Mr. Trump shines of light” and will lead us all to victory and push the economy back to its feet! God Bless AMERICA and God Bless CANADA !!!

• even the chinese do not have the border and reverse border rules down correctlyso they may will get another spike.

• Need to start by investing in companies that can successfully run virtually. Some of Big Tech will be winners depending on their business model

• …now…we are suffer is to know the barrier that shuts each of as away…./ no jobs/ no treatment/ support is to late/ and too many ” WILD” greed people …..

• Thanks for all your insights!!

[AD] PDF: 10 Strategies for Success

Join us for this week’s shows:

Crowd Forecast News Episode #258

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, March 30th, 1PM ET (10AM PT)

Moderator and Guests:

– Jim Kenney of OptionProfessor.com (moderator)

– Jake Bernstein of Trade-Futures.com

– Norman Hallett of TheDisciplinedTrader.com

Analyze Your Trade Episode #121

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, March 31st, 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #12: Tech Wizards 2020 Conference

Date and Time: Thursday-Friday, April 2nd-3rd, 9AM-9PM ET

Presenters: We have over a dozen awesome presentations on the schedule for this event. Click the link below to get the full schedule.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #120

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Michael Filighera of LogicalSignals.com

– The Option Professor of OptionProfessor.com (moderator)

Symbols discussed today: ZM, ROKU, MSFT, GLD, BA, TDOC, AAPL, NFLX, CVX, ILMN, AMD, COUP, PAYC, GILD

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #257

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Anka Metcalf of TradeOutLoud.com

– Neil Batho of TraderReview.net

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #339

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport032220b.pdf

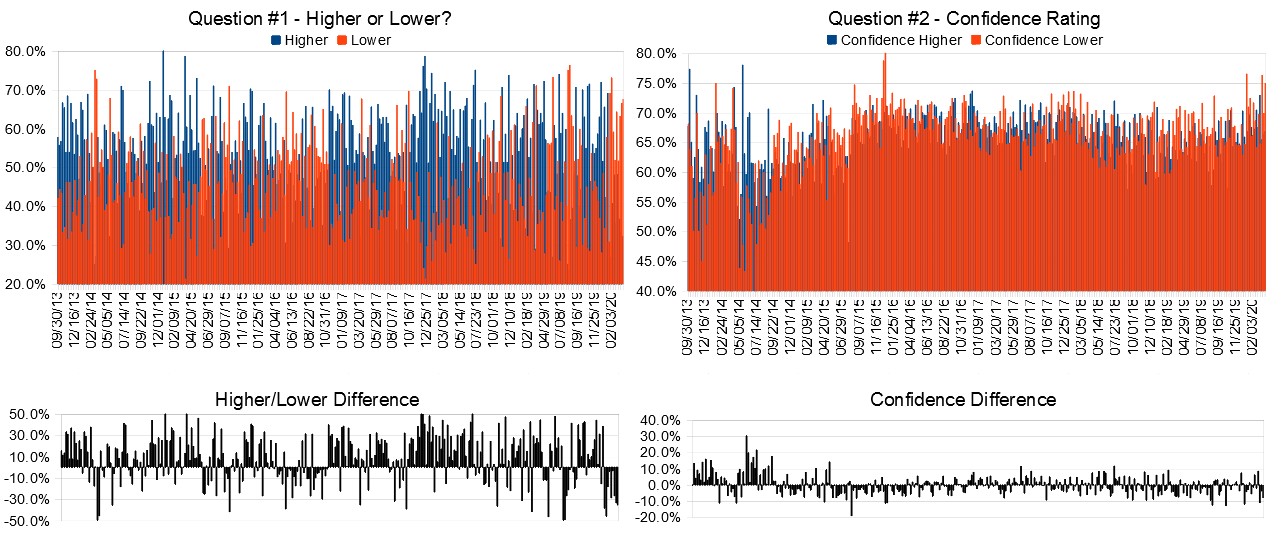

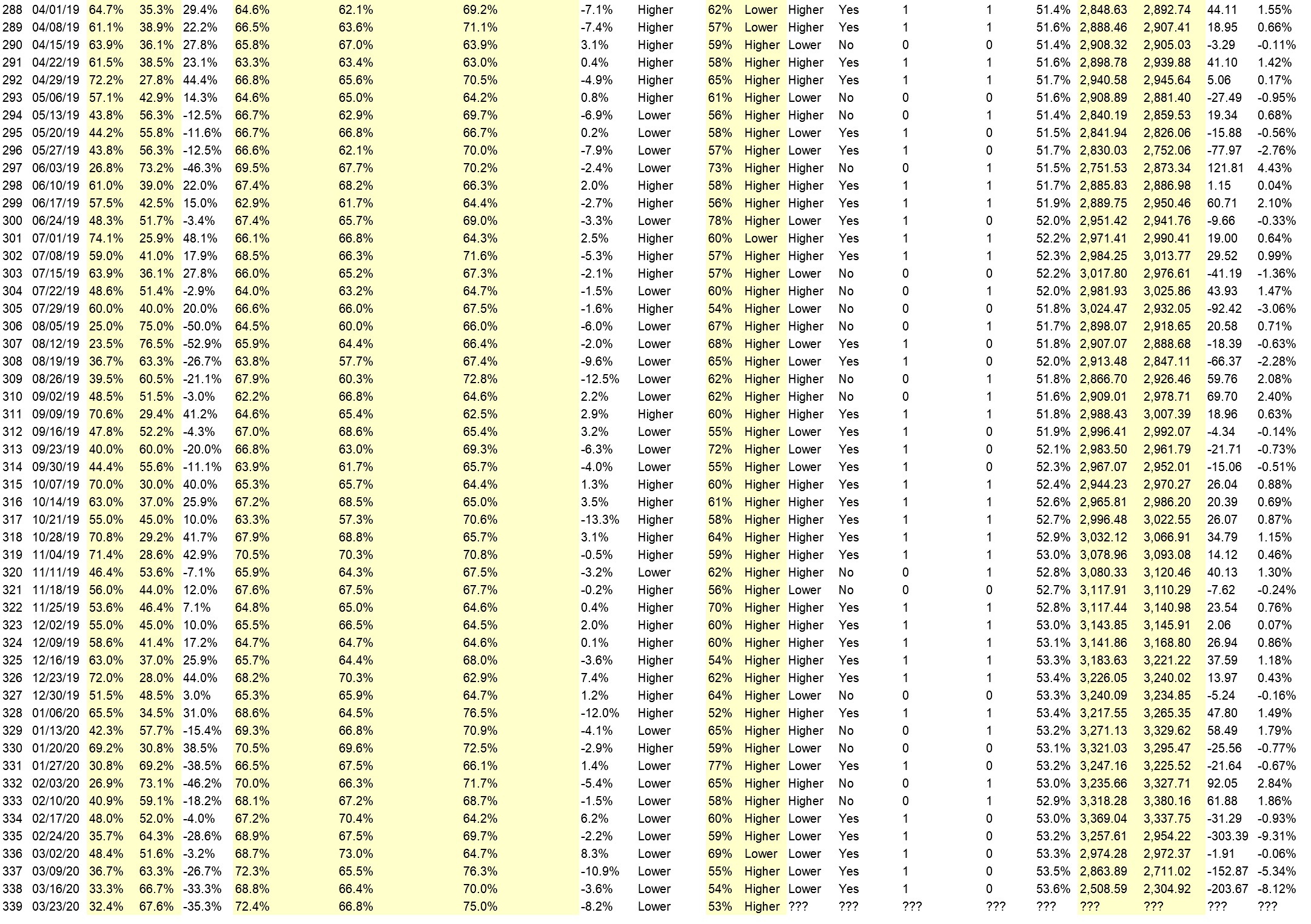

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 23rd to 27th)?

Higher: 32.4%

Lower: 67.6%

Higher/Lower Difference: -35.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 72.4%

Average For “Higher” Responses: 66.8%

Average For “Lower” Responses: 75.0%

Higher/Lower Difference: -8.2%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 32.0

TimingResearch Crowd Forecast Prediction: 53% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 66.7% predicting Lower, and the Crowd Forecast Indicator prediction was 54% chance Higher; the S&P500 closed 8.12% Lower for the week. This week’s majority sentiment from the survey is 67.6% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 49 times in the previous 338 weeks, with the majority sentiment (Lower) being correct 47% of the time and with an average S&P500 move of 0.04% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 53% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.6%

Overall Sentiment 52-Week “Correct” Percentage: 66.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Things will start to calm down

• it is due for a rebound after that big sell off

• I believe after a slower start to the week, I’m hoping that the oil market will start to pick up, carrying other equities with it.

• Overdue bouncback

• With the relief packet issued by federal government, confidence in economy is growing and this should take market upwards.

• We are near all time lows.

“Lower” Respondent Answers:

• Developing financial & social implications of CV.19.

• covi19

• Because the price action pattern is still bearish and also the volume is still above 20MA. The lower probability is because the little money flow divergence

• China Flue

• Virus test results still increasing Too much stress incredit markets

• the friday activity was absolutely brutal.

• worsening coronavirus environment

• market is in a huge bubble

• lack of leadership at the executive branch.

• Accumulation going on but in the very early innings of a turnaround alot more down days ahead

• coronavirus hasn’t been priced into the market yet

• coronavirus

• Bad news, no recovery

• The unemployment rate is expected to increase, as businesses face increasing financial pressures, as the coronavirus pandemic continues into another week.

• Monday will open down. Just not sure there will be anything to push the market back up.

• S&P 500 is on a PE of 17 and Corona virus is going to cut earnings to zero

• oil in a downward move as well as US100 … corona virus Big Airlines may go to bankruptcy … and from a technical point of view no support is seen… and the cash dollar will remain the king … any intervention from the FED may change the view.

• Fear of COVID 19. Then the disruption of products and services to escalate

• High. Vix index

• COvid-19 STORY and thin non-liquid market conditions

[AD] PDF: 10 Strategies for Success

Question #4. What are your top questions for trading experts about current market conditions and how to trade over the next few weeks?

• Knowing the bottom has been put in

• average down or wait for a bottom?

• The fact I quit trading because of Forex brokerage houses scam and fraud and many of my friends got scammed including me

• How do you idiots keep your jobs?

• What do you consider the priorities for selecting shares in the immediate future ?

• why didn’t you guys issue a sell recommendation before then during the selloff? and HOW exactly do you idiots keep your jobs?

• what will you be looking for as the signs of capitulation?

• What stock are hedges against further downside of the Doe and S&P?

• How to trade volatility for next few weeks?

• how would you trade bond ETF’s?

• have you ever seen a financial crisis like this before?

• How to stop shorting the markets?

• none

• Is the market becoming a faster moving entity?, due to all the different factors – algo’s, AI, etc. /// does the little guy stand a chance?

• Well the big question is where is the bottom, are we close to it???

Question #5. Additional Comments/Questions/Suggestions?

• Thank you … Wishing you a great time ahead

• when is the crisis, to the markets, going to end?

• Self isolate

• I heard one commentator mention that what used to take weeks to develop in the markets, now only takes hours. // Is this a valid statement?

Join us for this week’s shows:

Crowd Forecast News Episode #257

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, March 23rd, 1PM ET (10AM PT)

Moderator and Guests:

– Anka Metcalf of TradeOutLoud.com

– Neil Batho of TraderReview.net

– Jim Kenney of OptionProfessor.com (moderator)

Analyze Your Trade Episode #120

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, March 24th, 2020, 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #12

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Thursday-Friday, April 2nd-3rd, 2020, 9AM ET-TBA

Moderator and Guests:

– TBA

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #119

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Anka Metcalf of TradeOutLoud.com

– The Option Professor of OptionProfessor.com (moderator)

Symbols discussed today: MSFT, BA, SQ, XOM, AAPL, GILD, CODX, UVXY, KL, COST, AMD, SPXS, TVIX, BMY, VIAC

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #118

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Mike Pisani of SmartOptionTrading.com

– The Option Professor of OptionProfessor.com (moderator)

Symbols discussed today: UPS, ADBE, MSFT, CRWD, FB, TSLA, TTD, SHOP, AMT, DEAC, COST, T, AMZN, HD, GLD, TLT

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #256

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Neil Batho of TraderReview.net

– Michael Filighera of LogicalSignals.com

– John Thomas of MadHedgeFundTrader.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Report #338

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport031520.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 16th to 20th)?

Higher: 33.3%

Lower: 66.7%

Higher/Lower Difference: -33.3%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.8%

Average For “Higher” Responses: 66.4%

Average For “Lower” Responses: 70.0%

Higher/Lower Difference: -3.6%

Responses Submitted This Week: 35

52-Week Average Number of Responses: 32.1

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.3% predicting Lower, and the Crowd Forecast Indicator prediction was 55% chance Higher; the S&P500 closed 5.34% Lower for the week. This week’s majority sentiment from the survey is 66.7% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 48 times in the previous 337 weeks, with the majority sentiment (Lower) being correct 46% of the time and with an average S&P500 move of 0.13% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.5%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• We are now down pretty far.

• Bounce !!

• stability

• Market is due for a rebound.

• Charts

• Interest Rate Cut

• dead cat bounce

“Lower” Respondent Answers:

• Could go either way here Big money flowed back into the Market Friday and thats building a bottom

• anything can happen now but don’t care big money flowed right back into the market on Friday why/ because Thursday was capitulation

• Business shut down. Reduce commerce, adversity not totally accounted for.

• Corona fall will continue

• companies are shutting down with the virus

• greater outbreak of coronavirus

• Friday’s late rally is making things look rosy for the S&P for now, but it’s probably counter-trend. Fed actions won’t slow the virus or provide test kits. Possibly dismal corporate earnings reports next month are not priced in to this market.

• China Flue, its effects and residual impacts. I believe given the fact where we are and what were faced with, we will trend lower and move sideways in general terms, consolidation. This is true, and really depends on if people self isolate until this passes, partially in all effected countries. This I believe will transpire as we come to the realization we have to put on our “big boy pants” and save the market, these small, medium and large cap companies require our support. What do I mean by this, we must stop shorting everything and help these companies. Yes, the market may drift lower, however its up to us traders to “float the boat”. What was interesting is these bio-tech companies who want to test people for the china flue or other companies R&D creating vaccinations everyone pulled out on later in the week. Why?? Reverse the thought process and we will help these companies. Like the United States President Mr. Donald Trump, Canadian Prime Minister Mr. Justin Trudeau and other leaders are doing with the financial packages to help, we as traders must do our part as well. STOP SHORTING and help stabilize the markets!!

• Corona virus is still growing in the US

• Margin calls will cause more selling, the Fed actions will not be strong enough to overcome the markets’ skepticism.

• Not sure how anyone could be going LONG at this point … just too much unknown unknowns out there. Once there is containment, or a vaccine, or travel bans lifted why would anyone be going LONG?

• There is no support right now to hold it

• Expect 1 – 2 days higher before turning lower for the week. This is a bear trend, so any positive movement is only going to be a retracement.

• Continuation of Virus driven trend

• there are more bad news to come and more next next week option exp on Fri.

• The virus is killing this market and the Federal Government is not helping

• Marriot emailed me that it is a world epidemic

• Fear is still in the markets

[AD] PDF: 10 Strategies for Success

Question #4. What trading software/platform(s) do you use to execute your trades?

• none TD has no longer offered me a trading platform I’m not going to stay with the brokerages that charge commission much longer

• Fidelity

• none TD withdrew the platform that was my last one and it was years ago

• Td Ameritrade

• Schwab, TD Ameritrade

• Fidessa and IB

• Charles Schwab

• thinkorswim,tastytrade

• TOS

• E-Trade

• TC 2000, Think & Swim, ITRADE and RBC Direct Investing.

• TOS

• TradeStation

• Interactive Broker

• NinjaTrader 8.

• I have special software

• ToS

• Spreadbet/CFD

• Think or Swim

• TOS

Question #5. Additional Comments/Questions/Suggestions?

• we are living through history

• I certainly appreciate the opportunity to express my thoughts on the subject matter, thank you. I do not Facebook,. Twitter, etc., however I am grateful to all those who created this platform where I can express my thoughts from time to time. I do appreciate anyone who has ever traded stocks as we all learn from each other, thank you again.

• Sell on rebounds

Join us for these events:

Crowd Forecast News Episode #256

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, March 16th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Michael Filighera of LogicalSignals.com

– John Thomas of MadHedgeFundTrader.com

– Jim the Option Professor of OptionProfessor.com (moderator)

Analyze Your Trade Episode #118

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, March 17th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– Mike Pisani of SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Synergy Traders Event #12

Date and Time:

– Thursday-Friday, April 2nd-3rd, 2020

– Times TBA

Moderator and Guests:

– TBA

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies