- Home

- Archive: April, 2020

Analyze Your Trade Episode #124

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Jake Bernstein of Trade-Futures.com

– The Option Professor of OptionProfessor.com (moderator)

Symbols discussed today: MSFT, AAPL, ZM, AMD, BA, COUP, SPY, FB, CRM, TLT, LULU, BIDU, T

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #261

[AD] PDF: 10 Strategies for SuccessListen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Neil Batho of TraderReview.net

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

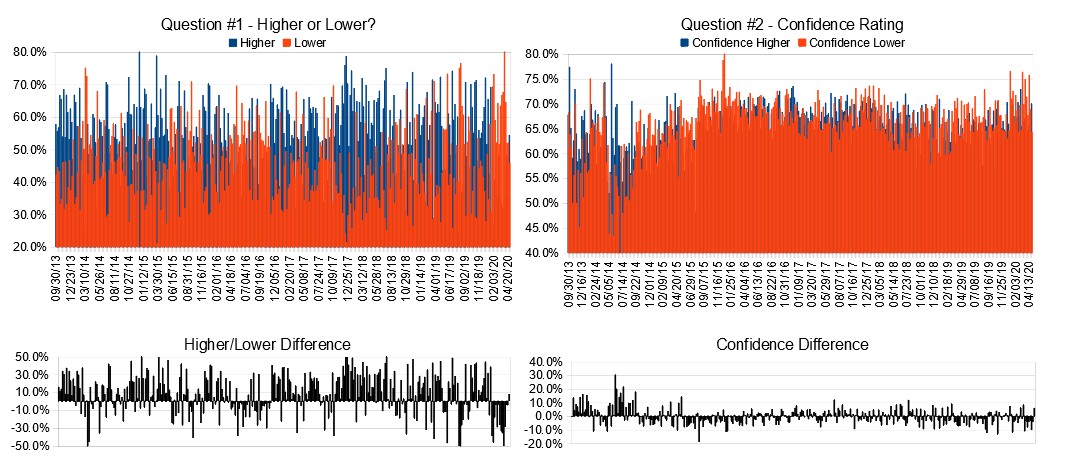

Crowd Forecast News Report #344

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport042620.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 20th to 24th)?

Higher: 54.3%

Lower: 45.7%

Higher/Lower Difference: 8.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 70.0%

Average For “Lower” Responses: 64.4%

Higher/Lower Difference: 5.6%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 31.6

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

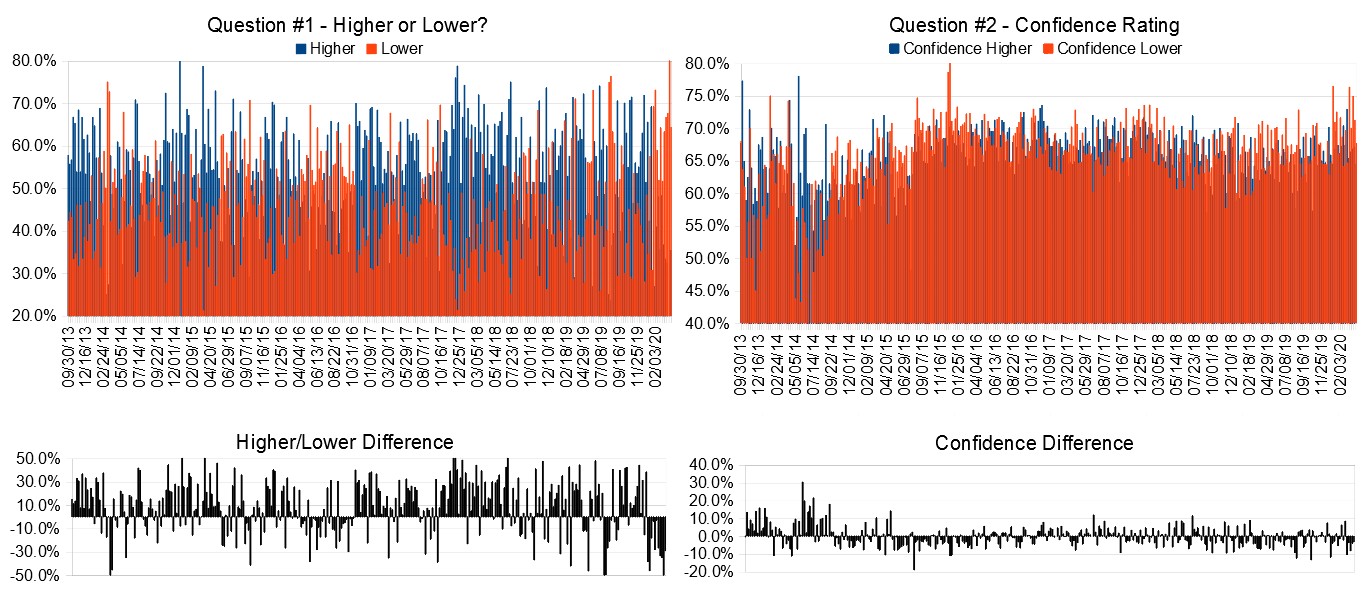

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.0% predicting Lower, and the Crowd Forecast Indicator prediction was 68% chance Higher; the S&P500 closed 0.31% Lower for the week. This week’s majority sentiment from the survey is 54.3% predicting Higher (the first week of majority Higher sentiment since mid-January) with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 29 times in the previous 343 weeks, with the majority sentiment (Higher) being correct 59% of the time and with an average S&P500 move of 0.56% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

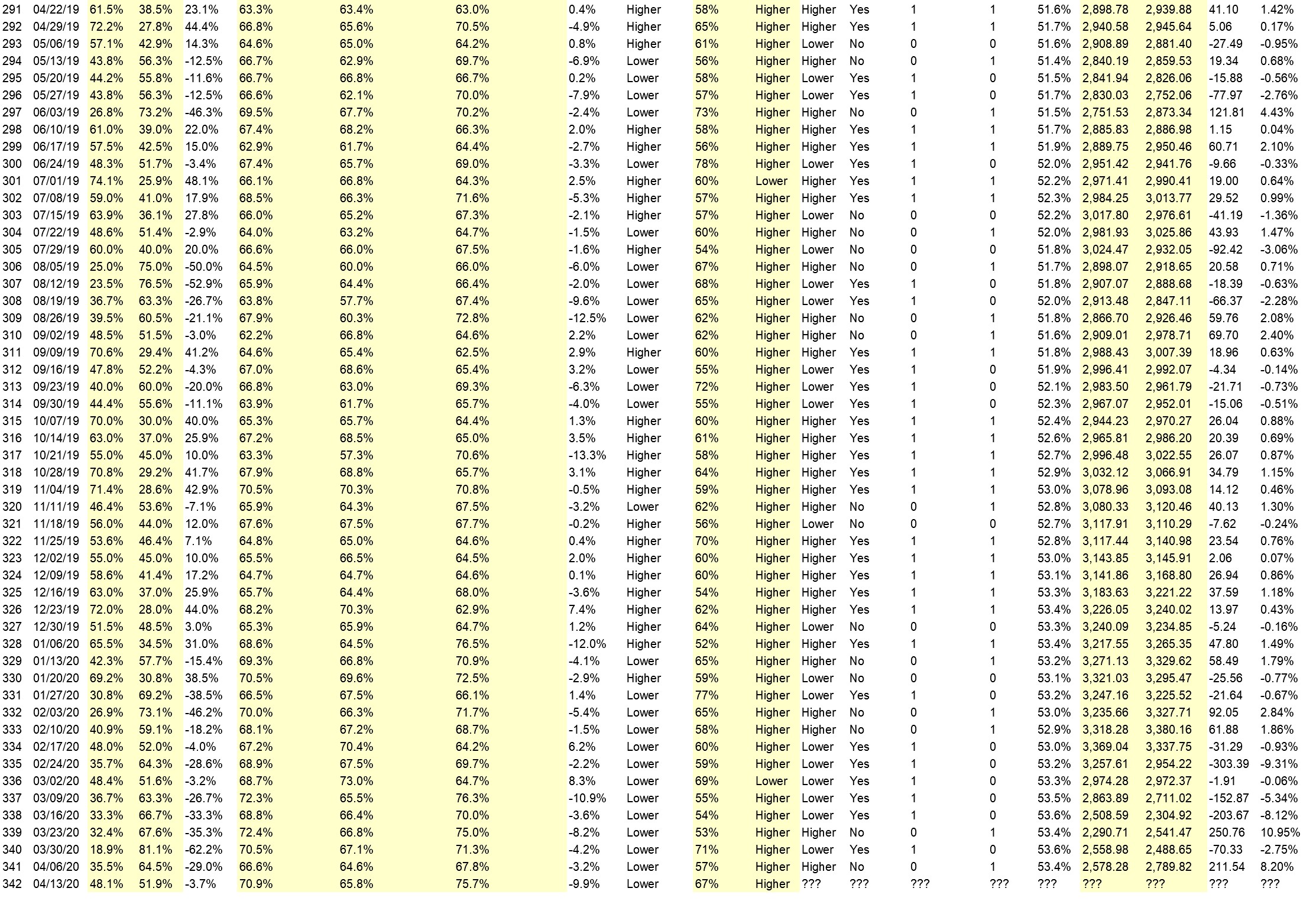

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Markets are opening positive feed from around the world.

• the bullish action from yesterday

• Price on day chart is above 50SMA

• Earnings and people going back to work again

• I cannot understand why it will go higher.

• Bullish market

• Market manipulation

• Things getting better, protests for getting back to work !

• mkt is very low.

• Technical reason.

• short term trend is up

“Lower” Respondent Answers:

• I think the 2nd leg DOWN of the swing that started Feb 19 2020 will start very soon

• …..debt, morgage, VC, coruption, OIL=XsaudisXrusiaXusa, gold+++++, deadly bags………

• Virus

• Both damage to economy and Health are uncertain to underestimated at this time.

• Disappointing earnings

• there is no fundamental reason for the s&p to go up

• slight bias to the downside

• Corona

• because of the economy is not great.

• moon cycle

• The S&P is down only 13% in 2020. This is despite high unemployment, low economic output, earnings guidance lower or being pulled, and worrying mortgage debt.

• Bad earnings number for the big tech stocks that are keeping up the bull market.

• because the economy is getting worse due to corona virus lock down and due to the economy dropping and we are heading into a world wide repression.

[AD] PDF: 10 Strategies for Success

Question #4a. What has been most profitable for you to trade over the last couple months?

• Stocks/ETFs – 37%

• Options – 30%

• Other/None – 22%

• Forex/Cryptos – 4%

• Futures – 7%

Question #4b. Why do you think that was most profitable for you?

• Futures – because it is the only thing I trade :)

• Futures – Big volatility

• Options – Leverage

• Options – limited risk

• Options – Options are the only ones that I can afford to trade.

• Options – Selling puts works

• Options – Volatility

• Other/None – all lost money looking at adding futures to sell short I papertraded my way to 1,000,000 Saw the oil collapse

• Other/None – because the market is too volatile at the current time

• Stocks/ETFs – Blood in the streets

• Stocks/ETFs – Buy low sell high intraday.

• Stocks/ETFs – Confidence that markets will come back.

• Stocks/ETFs – Experience

• Stocks/ETFs – It’s the only category that I trade. I’ve been on the right side of the moves most of the time.

• Stocks/ETFs – Scalping pre market and early market hours

• Stocks/ETFs – stocks are all I trade

Question #5. Additional Comments/Questions/Suggestions?

• With 28 million+ outta work in USA, airlines, auto manufactures, Containers, cruise ships, hotels, all at bottom and still the market moves higher???

• whO are you?

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

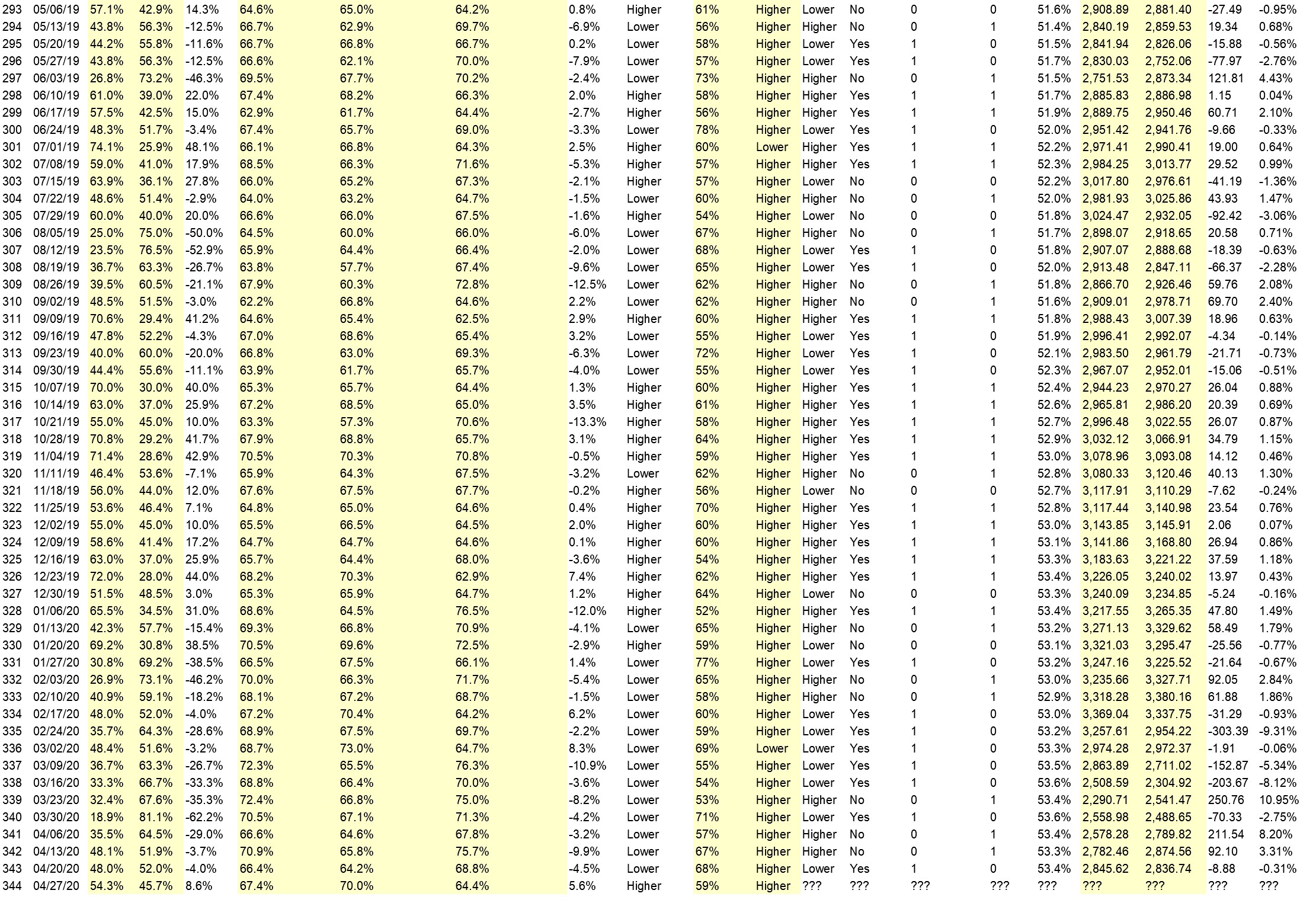

Crowd Forecast News Report #343

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport041920.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 20th to 24th)?

Higher: 48.0%

Lower: 52.0%

Higher/Lower Difference: -4.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.4%

Average For “Higher” Responses: 64.2%

Average For “Lower” Responses: 68.8%

Higher/Lower Difference: -4.5%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 31.7

TimingResearch Crowd Forecast Prediction: 68% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.9% predicting Lower, and the Crowd Forecast Indicator prediction was 67% chance Higher; the S&P500 closed 3.31% Higher for the week. This week’s majority sentiment from the survey is 52.0% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 22 times in the previous 342 weeks, with the majority sentiment (Lower) being correct 32% of the time and with an average S&P500 move of 0.46% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 68% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

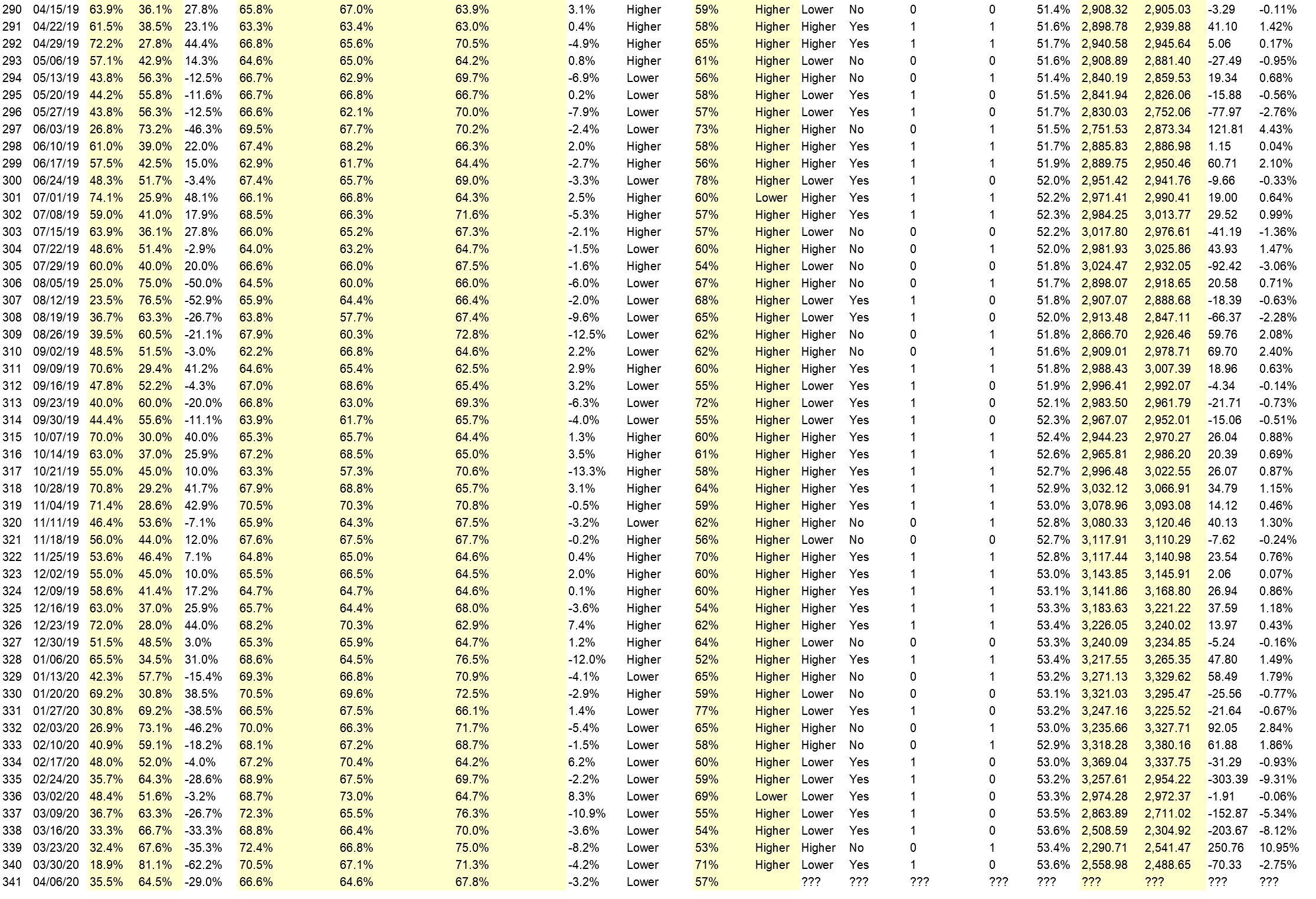

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.3%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Bull Open Range

• FED buying the market indirectly.

• Markets will open partially

• Market will inch higher anticipating some positive news coming from stabilization of virus pandemic

• Why not go higher. I think people are tired of the china HK flue… The Greatest President since JFK, President of The United States Donald Trump will ensure Governor’s get workers back to work NOW!

• On track to recovery, especially since there are protests against lockdowns,

• We broke above 50% retracement. If that holds on the 3 major indexes, we are going higher.

• Mkt is very low now

“Lower” Respondent Answers:

• rise of this week will profit take by end of week as people realize opening U S is too early

• selloff early then rebound may close slightly higher but so what Market to seesaw until further notice

• I’ve got to be right at sometime :)

• got to be right sometime.

• market temporarily overbought

• the markets took a big dive down then went up for no apparent reason

• Too far, too fast

• It looks like the next S&P Fibonacci level is about 2930 (1.9% up from now), likely the next major resistance. That could occur soon. Consider the negativity of these: 2nd quarter GDP could drop 38% (Morgan Stanley), unemployment could rise to 32% (St L Fed), and retail sales down 8.7% in March.

• Many overbought indicators need a breather. Oil is not going to get better anytime soon and they might have to stop pumping or risk not having anywhere to put barrels. Still lots of slow down economy out there for a while.

[AD] PDF: 10 Strategies for Success

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week for Wealth365, but back on April 27th.)

• up to date news- hedges using Puts ans Calls

• buying in tranches?

• Financial institutes Master card visa

• How can the governments in the world pay for the stimulus plans

• N/A

Question #5. Additional Comments/Questions/Suggestions?

• What oil stocks or pharmacy stocks will be good.

• Are we heading for chaos in world economy

• Let’s get workers back to work this week!!!

The TimingResearch shows are off this week so you can attend Wealth365 instead!

Wealth365 is the largest free online trading and investment conference in the world. Join us and discover the best tips & strategies, directly from celebrity personalities, financial advisers, champion traders, and business thought leaders. You’ll increase your knowledge, grow your skills, and be prepared to take the next step in your financial future.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #123

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Anka Metcalf of TradeOutLoud.com

– The Option Professor of OptionProfessor.com (moderator)

Symbols discussed today: ZM, MSFT, FB, AAPL, CRM, LULU, TLT, BLK, TSLA, SQ, ROKU, WM, NFLX, BA, CLX

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #260

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Michael Filighera of LogicalSignals.com

– The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

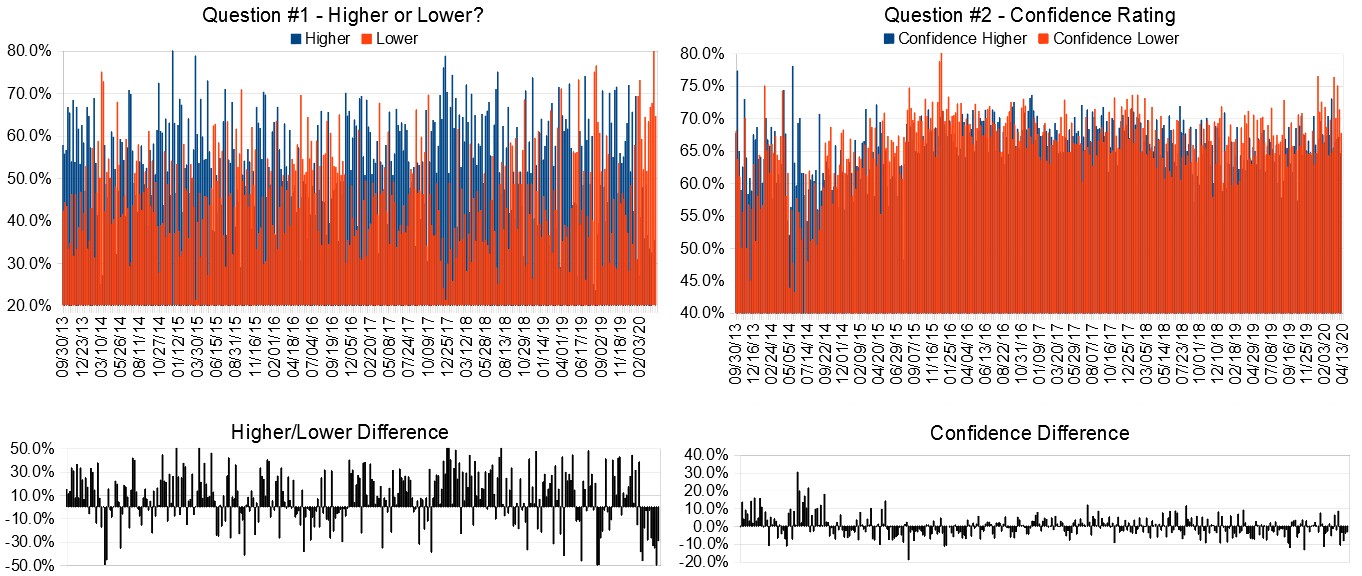

Crowd Forecast News Report #342

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport041220.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 13th to 17th)?

Higher: 48.1%

Lower: 51.9%

Higher/Lower Difference: -3.7%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.9%

Average For “Higher” Responses: 65.8%

Average For “Lower” Responses: 75.7%

Higher/Lower Difference: -9.9%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 31.7

TimingResearch Crowd Forecast Prediction: 67% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 64.5% predicting Lower, and the Crowd Forecast Indicator prediction was 57% chance Higher; the S&P500 closed 8.20% Higher for the week. This week’s majority sentiment from the survey is 51.9% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 21 times in the previous 341 weeks, with the majority sentiment (Lower) being correct 33% of the time and with an average S&P500 move of 0.33% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 67% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.4%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• I’m assuming Pelosi and Shumer stay off the bottle and for once work with congress regarding the PPP.

• liquidity infusion by the FED

• The Market has had enough of the Hong Kong Flue, it is time to move on.

• Good news on CV

• Momentum is climbing

• The major bank stocks rallied on Thursday because of the Fed, but also in front of earnings. I am going with this momentum, looking for the financial sector to keep the S&P from falling, and for the S&P to move up to the next Fibonnaci level.

• they are pumping another $2.3 trillion into the market

• Pre holiday trade pattern until wednesday then sideways or down

• Don’t Fight the FED

“Lower” Respondent Answers:

• price pattern

• poor earnings

• CORONA

• This a dcb which is now becoming frothy.

• catch those last sellers trying to get even

• Reaching time and price area for reversal.

• Nothing but bad news. Until the virus is resolved, the market will head down. High Unemployment, no business growth at all. Earnings will be disappointing.

• technical analysis

[AD] PDF: 10 Strategies for Success

Question #4. Have you changed your trading or investing strategies over the last couple months to cope with the increased volatility? If so, how?

• reducing exposure, trading more options than stock, tightening stop losses

• No, I day trade the spi options.

• no still in cash

• yes rebalanced portfolio

• Listen more, talk less and support the DOW!

• More LEAPS

• 10% buys

• Reduced the size of orders to 20-50% and doubled, tripled the size of my stops.

• Yes I have been buying stocks

• yes, small trade take profit before they disapear

• Yes, mostly trading the micro e-mini’s.

• yes have sold almost everything

• Prepared for decline Feb 24 by buying puts early March

• No , 30% invested since Jan.2020

• yes. MYOB

Question #5. Additional Comments/Questions/Suggestions?

• I hope the Dems go to HELL.

• the virus will continue take earnings down. this could last up to a year.

• It is time for the people of North America to mask up and back to work, enough is enough! President Donald Trump will lead this great American endeavor and all Americans will follow. Canada will follow the southern neighbor recovery and the HK flue will dissipate, through Europe.

• Stupid mistakes earlier this year. This decline helped me achieve almost 300% appreciation. Bear rally caught me off guard because I did not believe my own charts and lost 20% of my gains.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Analyze Your Trade Episode #122

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube:

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– E. Matthew “Whiz” Buckley of TopGunOptions.com

– Jim Kenney of OptionProfessor.com (moderator)

Symbols discussed today: MSFT, TDOC, AAPL, MGM, DPZ, BA, COUP, SPY, AMD, DXCM, PYPL, SMH, BNS, DIA, KBH

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

Crowd Forecast News Episode #259

[AD] PDF: 10 Strategies for SuccessWatch here or on YouTube (Note, this is an audio-only episode):

Listen to the audio-only version here or your favorite podcast network:

On this episode you can listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the most recent Crowd Forecast News report.

Lineup for this Episode:

– Jim, The Option Professor of OptionProfessor.com (moderator)

You can download this week’s and all past reports here.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

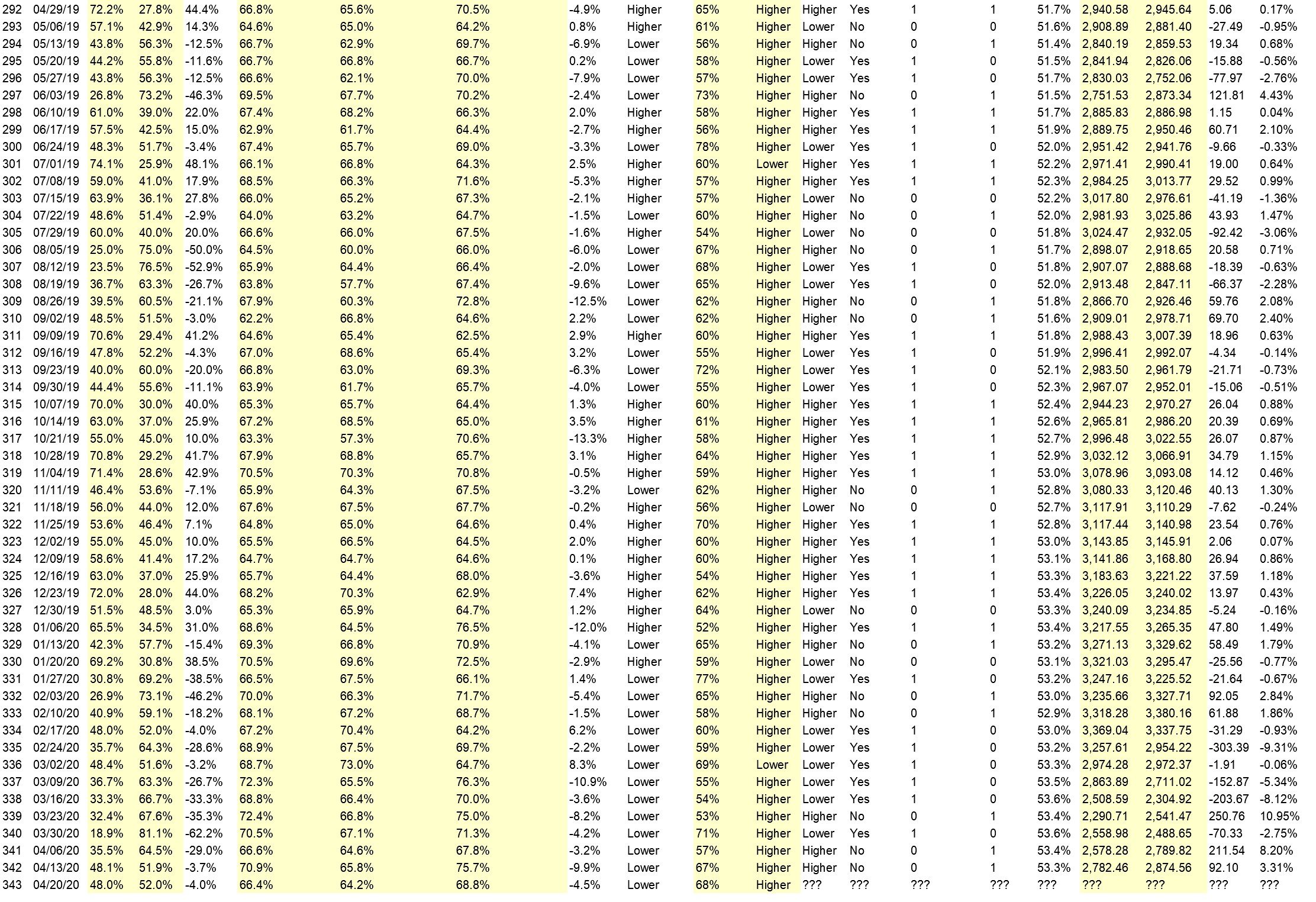

Crowd Forecast News Report #341

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport040520.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 6th to 10th)?

Higher: 35.5%

Lower: 64.5%

Higher/Lower Difference: -29.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.6%

Average For “Higher” Responses: 64.6%

Average For “Lower” Responses: 67.8%

Higher/Lower Difference: -3.2%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 31.8

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 81.1% predicting Lower, and the Crowd Forecast Indicator prediction was 71% chance Higher; the S&P500 closed 2.75% Lower for the week. This week’s majority sentiment from the survey is 64.5% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 28 times in the previous 340 weeks, with the majority sentiment (Lower) being correct 43% of the time and with an average S&P500 move of 0.10% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.6%

Overall Sentiment 52-Week “Correct” Percentage: 64.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Moved up after touching support

• When I say lower, it goes higher so I think it will go higher.

• the corona rate is begining to flaten out

• The OPEC oil issue will probably be worked out, which the market will like this week. Unemployment, debt, bankruptcies are big issues, but may hold off for another time to do their damage.

• because it dropped by more than 20% this week, there for a its due for a correction upwards but then it will drop a lot more mid week onwards

• The chines will have no choice but let it go to fix

“Lower” Respondent Answers:

• in a depression

• Fib retracement

• we are losing the battle with the virus

• The economy shut down.

• because there is a possible Head and shoulder pattern in the weekly chart

• People are trading in fear. This is a good time to find buys with many stocks bottomed out.

• Well, maybe the China Flue numbers growth in USA..

• accelerating corona cases

• Continued coronavirus bad news

• Curves are gradually flattening.

• too many companies shut down, too many people are out of work

• Most of the financial information shows greater negativity each week of this “stay in place” order.

• Can’t see direction but bias toward down.

• It is too early to say the market S&P 500 has hit a bottom. Who knows what Trump will say next?

• Trend is still down

[AD] PDF: 10 Strategies for Success

Question #4. What procedures do you use to monitor and evaluate your trading results and progress over time?

• bottom line number

• i use advanced trading software

• look at charts, and indexes

• I enter the “history” of each stock periodically to see how I’m doing. On a daily basis I compare my accounts with the results of the major markets–was I higher or lower then they are?

• Gains and losses

• I write down my trades in an excel spreadsheet

• Normal market TSE

• Spreadsheet

• I use excell spreadsheet..

• several

• Analyzing Moving Averages and On Balance Volume

• I am a Stockcharts subscriber and have investments with TD Webbroker . I watch the market a;; day.

• p&L

Question #5. Additional Comments/Questions/Suggestions?

• what is your predictions?

• the 900 point drop after the stimulis was a pie in the face

• Don’t scare so many of popple

• Thankful for this platform. I value everyone’s opinion. God Bless Canada and USA!!