Crowd Forecast News Report #330

[AD] Report: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport012020.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Tuesday’s open to Friday’s close (January 21st to 24th)?

Higher: 69.2%

Lower: 30.8%

Higher/Lower Difference: 38.5%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 70.5%

Average For “Higher” Responses: 69.6%

Average For “Lower” Responses: 72.5%

Higher/Lower Difference: -2.9%

Responses Submitted This Week: 42

52-Week Average Number of Responses: 33.5

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 69.2% predicting Higher, and the Crowd Forecast Indicator prediction was 65% chance Higher; the S&P500 closed 1.79% Higher for the week. This week’s majority sentiment from the survey is 69.2% predicting Higher with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 34 times in the previous 329 weeks, with the majority sentiment (Higher) being correct 58.8% of the time but with an average S&P500 move of 0.002% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

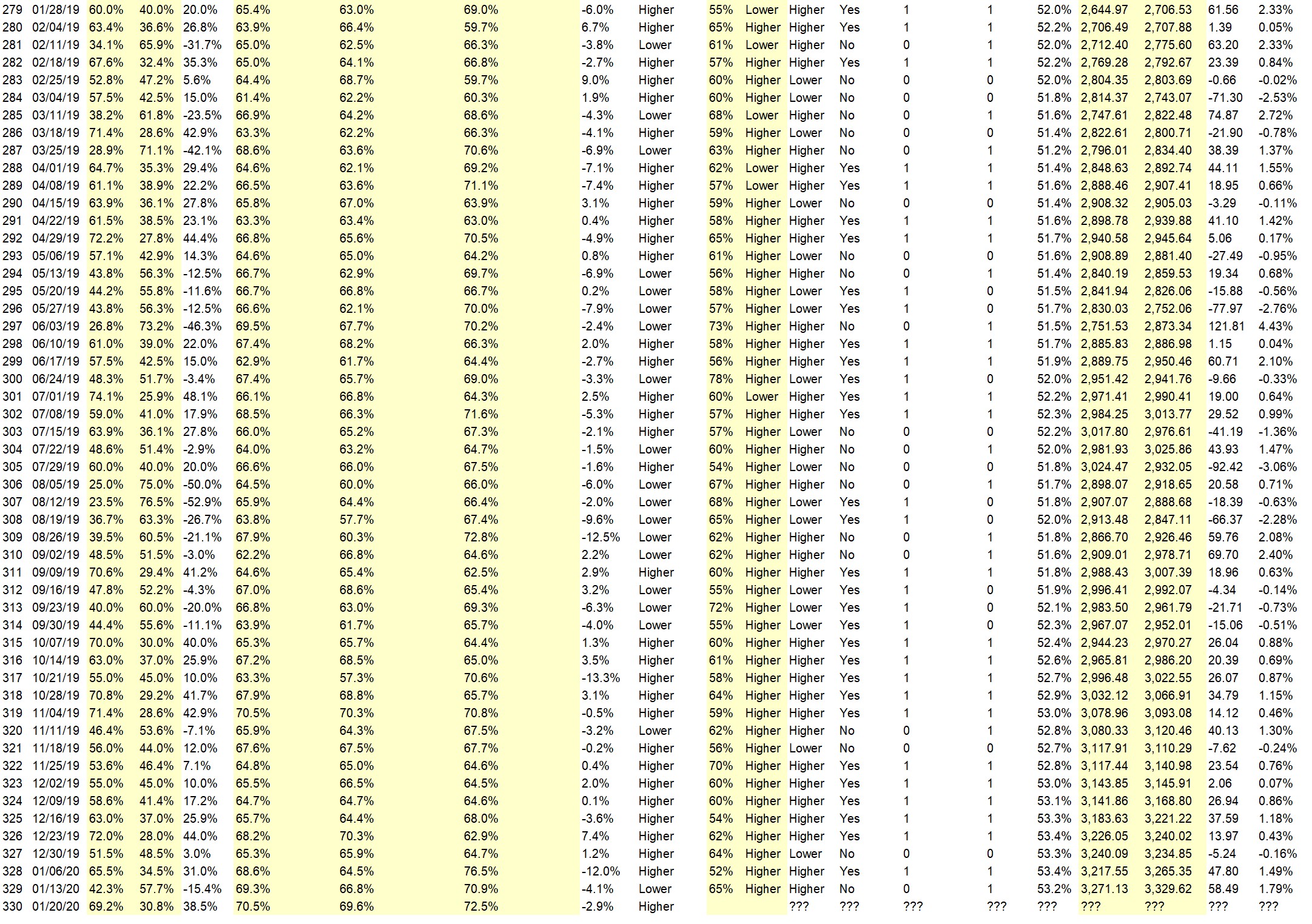

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• From a Canadian perspective, Donald Trump is President!!

• Fed announced continue purchase in repo market until April, lack of fear in the markets by continuation of buying the dips. Dumb money continues to flow in and FOMO.

• news is positive no surprises

• trend

• Trend is up this January. Trade deals have been signed between USA China mexico and canada.

• it is on a healthy uptrend with short wicks

• On the fence. Correction sometime?????

• Euphoric optimism

• Tariff’s resolved and impeachment resolved

• best six months of the year historically

• market heading for a meltup garbage stocks rallying huge upside then craaaaaaaaaaaaaaaaaaaaaash!!!!!!!!!!!!!

• momentum

• history

• Expecting favorable earnings to help maintain the uptrend for a bit longer.

• Good earnings reporting influences market.

• Breaking out to new highs, dips are bought

“Lower” Respondent Answers:

• Impeachment Trial Of the President of the United States starts and this ( may ) have an effect on the Markets , maybe !

• Market is overbought. Profit-taking to continue into earnings season.

• It’s up soo much. Probably consolidates her for awhile until it decides which direction it wants to move based on economic data. If numbers keep coming out positive then it will move higher. Technically it hasn’t broken any of my moving averages, so can’t say it will move higher.

• profit taking

• I know it will be higher as TRUMPs men mnuchin and his group is using Feds flood of cash to buy buy buy. They are destroying the market even though nobody real seems to be buying

• Market is short term overvalued driven by extreme complacency and greed on part of the traders. Hence, the market is overdue for a pullback or at least consolidation.

• Correction coming

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week, but back on January 27th.)

• A honest discussion on how the very small option trader can win

• Good trading strategies.

• gold,facebook,tesla

• Monthly income with options

• What is a melt-up

• Topics about option programs such as calendar spreads, iron condor options, diagonal spreads,delta neutral portfolios.

• How high will debt have to grow before it will start affecting the markets and government policies?Cannabis and Cannabis related Stocks – Talk to the CEO’s , Company Leaders – which way are they going to go ? – Predictions with a possible another 15 States may go Legal in 2020 ?

• How to trade gap on S&P500 (SPY) or E mini. Thanks.

• How they destroy the US markets by never letting it to be natural free flowing market.

• rotation

Question #5. Additional Comments/Questions/Suggestions?

• The last stock episode was very good. Harry Boxer explained very clearly and I would like to see him more.

• I am becoming so tired of US markets that i will rather move to another country and open CFD accounts to do trading with other instruments that are NOT USA manipulated

Join us for this week’s shows:

Crowd Forecast News Episode #252

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 27th, 2020

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Analyze Your Trade Episode #110

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 28th, 2020

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Synergy Traders Event #10

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Friday-Saturday, Jan 31-Feb 1st, 2020

– TBA

Moderator and Guests:

– TBA

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies