Crowd Forecast News Report #336

[AD] Report: TSLA Options Trader (Complete Strategy Guide)The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport030120.pdf

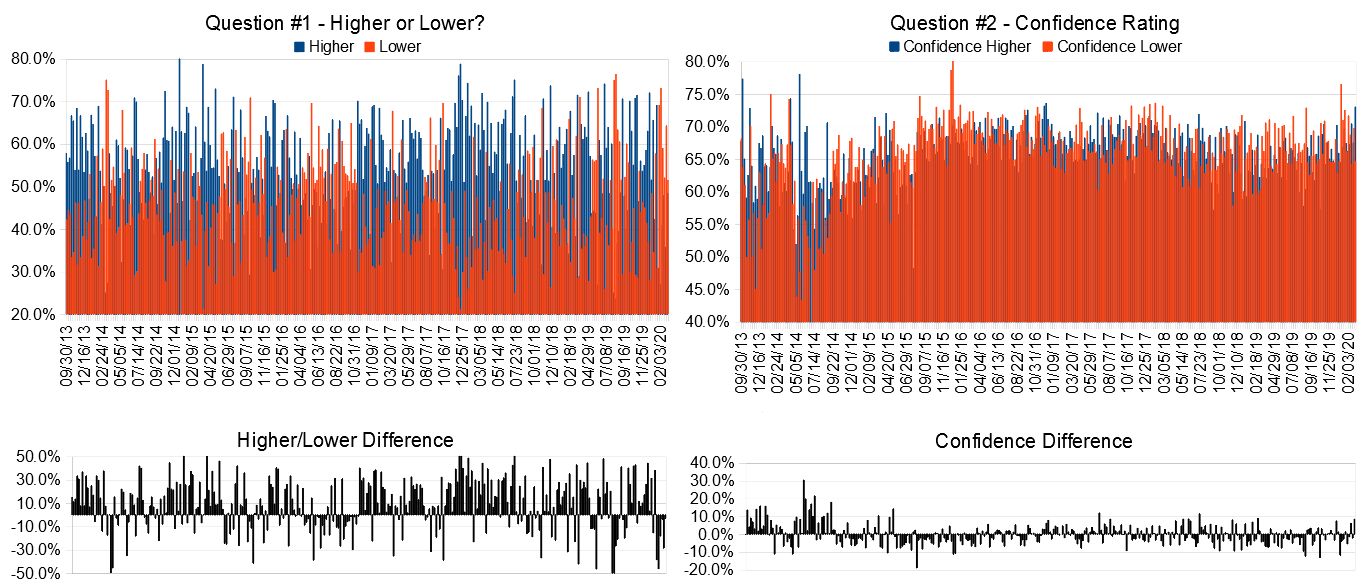

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (March 2nd to 6th)?

Higher: 48.4%

Lower: 51.6%

Higher/Lower Difference: -3.2%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.7%

Average For “Higher” Responses: 73.0%

Average For “Lower” Responses: 64.7%

Higher/Lower Difference: 8.3%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 32.4

TimingResearch Crowd Forecast Prediction: 69% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 64.3% predicting Lower, and the Crowd Forecast Indicator prediction was 59% chance Higher; the S&P500 closed -9.31% Lower for the week. This week’s majority sentiment from the survey is 51.6% predicting Lower with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 16 times in the previous 335 weeks, with the majority sentiment (Lower) being correct 69% of the time and with an average S&P500 move of 0.50% Lower for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 69% Chance that the S&P500 is going to move Lower this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

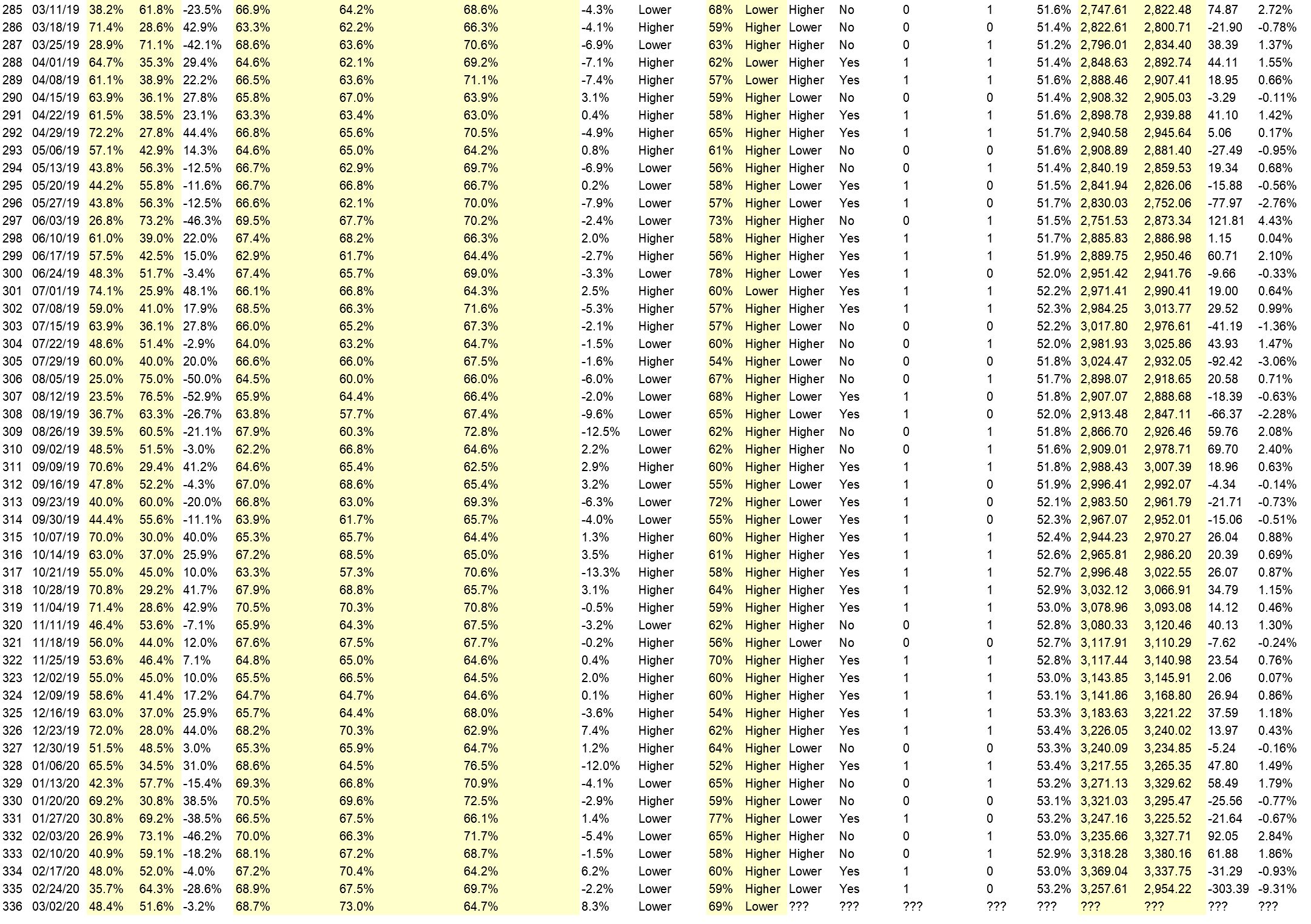

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Bounce after record falls, maybe supported by the Fed.

• I think it correct higher from the positive close on friday.

• Friday reversal of oversold market

• History

• The decline was to fast and bearish sentiment increased

• Bounce off last week

• Too much fear last week. Fed will step in when needed.

• Bounce back time

• I think spy going to307.53

• Just a rebound after a huge, almost panic drop.

• The market is over sold and due to a rebound.

“Lower” Respondent Answers:

• Viruses

• More Corona Virus worries

• The recent down move has had a lot of momentum, suggesting to me that there’s more downside left. Most market analysts are expecting a bounce; so the bounce could be of short duration, then sold into. The virus effects should significantly slow growth in China, with this growth effect likely spreading elsewhere.

• this did a lot of damage this week so yes we can bounce for 2-4 days and then come down again.

• High volatility at this level until a lower strong support will be formed. Virus’ news and fed interference will give the tempo. It’s interesting to see whether a V respond, like 2018, will be developed. I’m not so optimistic on that.

• coronavirus

• I believe the virus accelerated the great recession that will occur in less than 12 months due to the extraction of consumer wealth to the rich much like it did with Robber Barons of the 1920’s resulting in the depression of 1929. Next could be a pull back in the market decline. Therefore, I have only 55% chance the market will be up next week.

• Coronavirus

• CoronaVirus

• Mainly the China flue and some reporting on future effects thereof. One magnifier, the media! The last 2 months seems to be reporting of pullback, etc.. I noticed this intensified 2 weeks ago.. However, the flue is a issue for sure..

• People are starting to freak out about the Coronavirus and it’s growing numbers and fist death here in the US. Slowdown will hopefully be brief. Hoping for an early spring because it’s harder for viruses to continue.

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show and/or which experts would you like to see on the show who haven’t been guests yet? (The show is off this coming week for the next Synergy Traders event, but back on March 9th.)

• Actions to take under unusual conditions such as the Crono virus problem.

• How to trade futures.

• The way the billionaire’s hold the consumer wealth causing a slow in business activity.

• recession proof portfolio

• Will the Fed rescue the market?

• don’t know

• what & how to trade bear markets

• Favorite indicators and how you use them

• Day trading Futures.

• market internals

• Provide real working systems

Question #5. Additional Comments/Questions/Suggestions?

• spy not finish going down look to 283.75

• So here we are today, if we are not closing the North American boarders for a month of so, then we must prepare. This I suggest the most effected will be the larger metro areas where people seem to be living on the streets. Large numbers such as 5,000 plus.. If we remember the New Orleans floods, there was 1 weeks notice and as we know the response and support critically failed in many ways, in the aftermath the state did the best it could and we all now this! Yes we know you did…. RE: This China flue, USA, Canada and other countries “NOW have time to prepare” the larger areas where the street masses are. If this fails, the hospitals will be over-run, and all will be taxed to beyond the fullest extent…. It is time for the provinces, states, city’s to prepare to help those who will be in need. Those who are wealthy, please step up and take the lead, you already know what to do, show yourself what you are :)

• what about TESLA, APPLE & FAANG-Stocks? All crashing down? How far??

CFN and AYT are off this week so you can join us for this instead:

Synergy Traders #11 — Women Teach Trading and Investing: Opportunities for Everyone in Today’s Markets: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Monday-Thursday, March 1st-5th, 2020

[AD] Report: TSLA Options Trader (Complete Strategy Guide)

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies