Crowd Forecast News Report #345

[AD] PDF: 10 Strategies for SuccessThe new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport050320.pdf

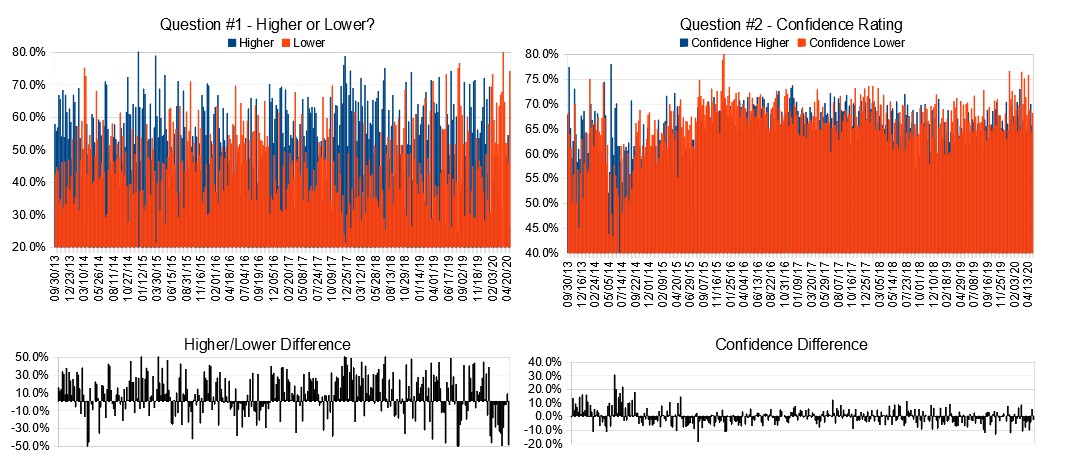

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (May 4th to 8th)?

Higher: 25.8%

Lower: 74.2%

Higher/Lower Difference: -48.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 67.4%

Average For “Higher” Responses: 65.6%

Average For “Lower” Responses: 68.0%

Higher/Lower Difference: -2.4%

Responses Submitted This Week: 31

52-Week Average Number of Responses: 31.7

TimingResearch Crowd Forecast Prediction: 54% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 54.3% predicting Higher, and the Crowd Forecast Indicator prediction was 59% chance Higher; the S&P500 closed 0.84% Lower for the week. This week’s majority sentiment from the survey is 74.2% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 52 times in the previous 344 weeks, with the majority sentiment (Lower) being correct 46% of the time and with an average S&P500 move of 0.28% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 54% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] PDF: 10 Strategies for Success

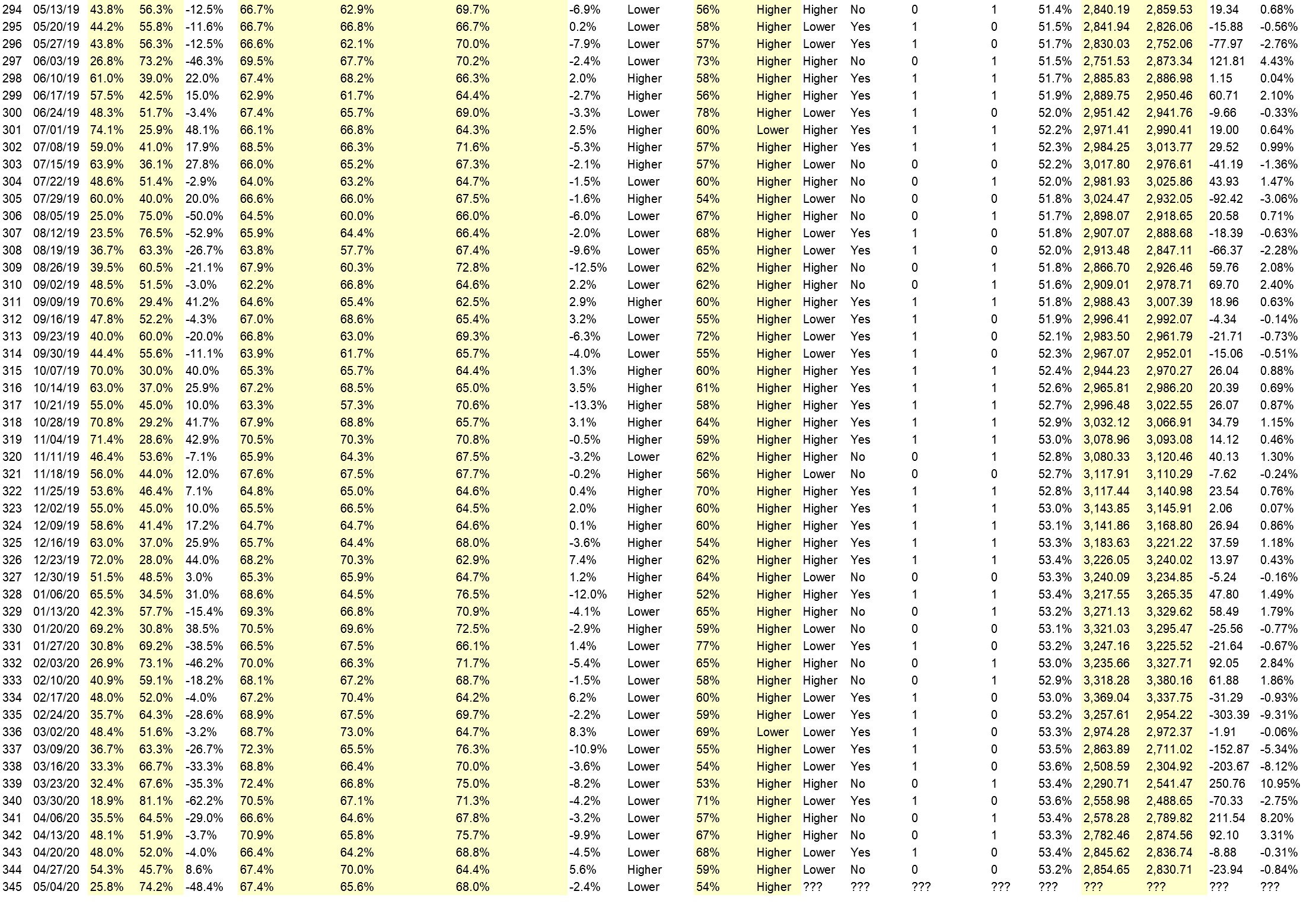

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.2%

Overall Sentiment 52-Week “Correct” Percentage: 62.7%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Pull back in the short term up trend

• Mkt very low now.

• low interest rates accomodative Fed

• Holding their noses and buying?

• Earnings will not be as bad as expected but companies are better not forecasting future earnings

“Lower” Respondent Answers:

• Market consolidating and beginning mean reversion move

• Risk off sentiment, profit taking and a key reversal on the chart.

• Fed stimulus tsunami slowing. Reality of covid-19 slow recovery setting in.

• The rally over the past weeks did not have much volume, far less than the volume on the way down before that. The stock market has to be wary of the continued effect of the virus on many businesses; too soon to look past that.

• The downturn will be the next part of the “W” for our charts.

• Economic slowdown

• For the month of April jobs number

• Market over stretched, consolidation, trend down….

• if the coronavirus drug works s&p will go higher if not it will go lower

• I just believe it is time for a pause of the recent move and for the “reality” of the economic situation to kind of kick in.

• Real economic data be reported will continue to deteriorate. Companies will refrain from buying their own stock, withdrawing a major support to markets. Seasonal “Sell in May”. Lower earnings and guidance or no guidance. Continued confusion/chaos in Washington.

• The Spys are starting to break downCharting

• Next week is a terrible week historically for the stock market. In addition, Friday was terrible and the potential for a trade war with China is not good.

• $sox which has been the leader is now rolling over.

• The stock market was expensive and overbought. The stock market started to weaken last week.

• Ugly coronavirus will force the market to follow up on Thursday and Friday’s sale

[AD] PDF: 10 Strategies for Success

Question #4. What methods or techniques do you use to overcome the emotional aspects of trading?

• Charting

• I set stops

• What emotion ? This is a business.

• Don’t listen to noise

• Fixed rules for each portfolio

• rules proven by back tested statistics

• Stay calm and don’t jump to conclusions.

• Meditation, get grounded..

• I always go according to the CCI, volume indicators, if I have doubts I turn off the PC.

• Rule 1 When investing,remember Rome was not built in a day. Rule 2 When trading, remember Hiroshima/ Nagasaki were destroyed in a day. Trade the market that is, not the one you think should be.

• Take time off the computer screen. Have other hobbies.

• I use profits whether I set a dollar amount or a percentage gain.

• I try to keep the ups and downs in perspective and watch the trends.

• Indicators

Question #5. Additional Comments/Questions/Suggestions?

• People tired of hearing about China Flue. People know flue stage has run its course. On with the POSITIVE show now, let’s go team!!

• New here, looking forward to seeing your platform.

• Follow the crowd until it’s time not to follow the crowd.

[AD] PDF: 10 Strategies for Success

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies