- Home

- Uncategorized

10 Years of TimingResearch!

[AD] Report: TSLA Options Trader (Complete Strategy Guide)Ten years ago today was the first episode of the TimingResearch Crowd Forecast News series!

So tomorrow we’re doing a special CFN 10th Anniversary episode; join us Monday, August 26th at 1PM ET.

Also, last week marked the 7th anniversary of the first Analyze Your Trade episode and the 5th anniversary of the first Synergy Traders event. A selection of the top videos from the ST and AYT series are available below.

Thank you,

-David J. Kosmider, Founder of TimingResearch

Synergy Traders Top Videos:

• How To Find The Major Turning Points In The Market with Avi Gilburt

• Trading SunnyBands Short-Term with Sunny Harris

• Some Of My Favorite Trading Indicators with Jake Bernstein

• Get Back to the Basics of Day Trading with Marina Villatoro

• Learn How to Trade Institutional Levels with Anka Metcalf

Analyze Your Trade Top Videos:

• Live Charting with Jason Alan Jankovsky

• Live Charting with Mike Paulenoff

• Live Charting with Hima Reddy

• Live Charting with Harry Boxer

• Live Charting with Rob Roy

[AD] More Awesome Partner Education Offers:

• Report: TSLA Options Trader (Complete Strategy Guide)

• PDF: Overnight SPY Trader Playbook

Analyze Your Trade Episode #78

Watch the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the symbol list for this week’s Analyze Your Trade episode.

New! Listen to this episode as a podcast through iTunes, Podbean, Stitcher, Spotify, and more.

Lineup for this Episode:

– Neil Batho of TraderReview.net

– Mike Pisani of SmartOptionTrading.com

– Jim Kenney of OptionProfessor.com (moderator)

Episode Timeline:

0:00 – Introductions.

3:30 – GILD

6:40 – APC

7:50 – TLT

11:30 – NVDA

14:40 – ZTS

17:00 – GLD

20:30 – CGC

24:10 – BA

27:10 – REGN

30:10 – MRK

31:50 – INTU

38:10 – SLV

43:10 – INTC

47:00 – JPM

50:10 – CRMT

52:50 – Live Audience Question: Best indicator for catching trends.

55:30 – Closing statements.

Guest Special Offers:

From Neil: Enter Your Email for The Best ETF To Hold For the Next 10 Years Already up +75% in Two Years

From Jim: OptionProfessor Weekly Market Update with Jim Kenney

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

AYT052119

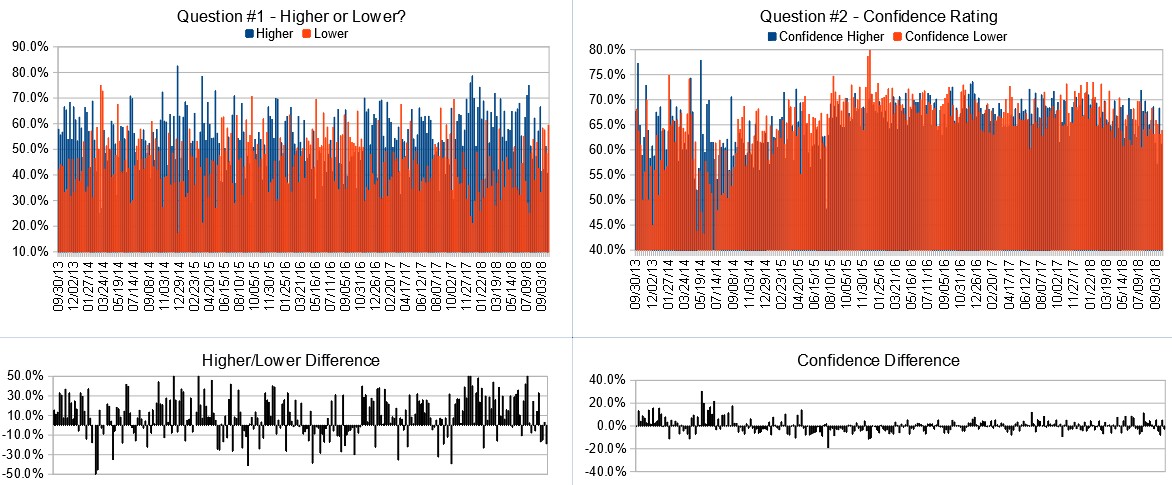

Crowd Forecast News Report #291

AD: Get Access To 3 Top Trading Services

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport042119.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (April 22nd to 26th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 61.5%

Lower: 38.5%

Higher/Lower Difference: 23.1%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 63.3%

Average For “Higher” Responses: 63.4%

Average For “Lower” Responses: 63.0%

Higher/Lower Difference: 0.4%

Responses Submitted This Week: 28

52-Week Average Number of Responses: 40.1

TimingResearch Crowd Forecast Prediction: 58% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 63.9% Higher, and the Crowd Forecast Indicator prediction was 59% Chance Higher; the S&P500 closed 0.11% Lower for the week. This week’s majority sentiment from the survey is 61.5% Higher with a greater average confidence from those who responded Higher. Similar conditions have occurred 59 times in the previous 290 weeks, with the majority sentiment (Higher) being correct 58% of the time and with an average S&P500 move of 0.06% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 58% Chance that the S&P500 is going to move Higher this coming week.

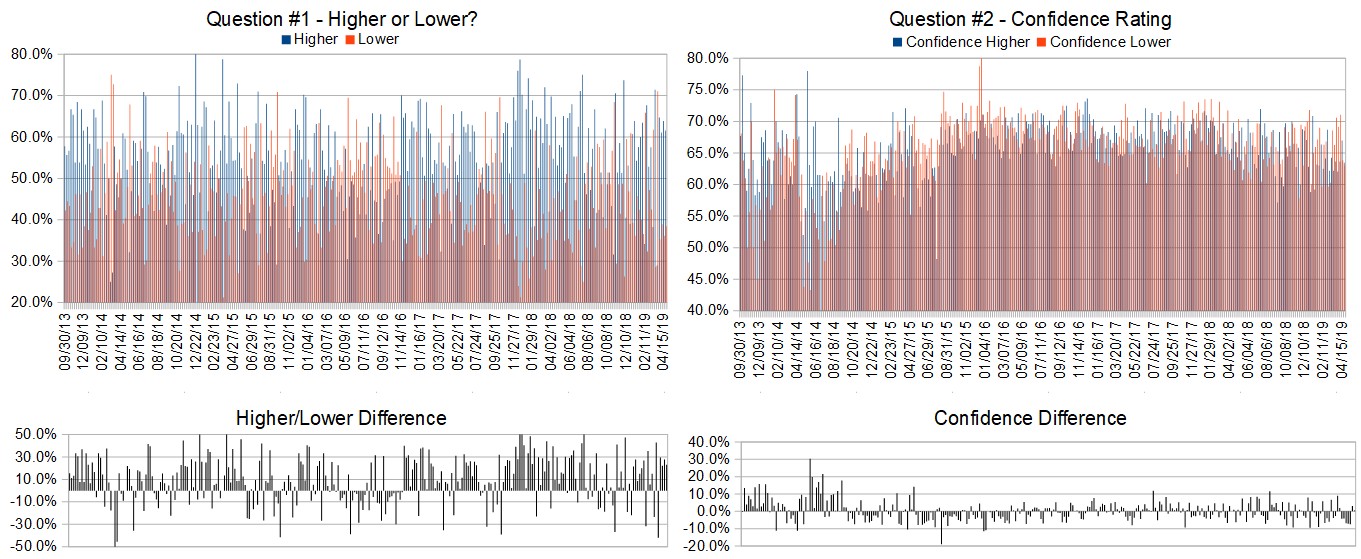

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: Get Access To 3 Top Trading Services

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.4%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 36.4%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• In the short term (days) price is oscillating downwards. The 50day linear regression channels show an upward trend at an equivalent slope of 45% PA

• st trend

• Post holiday seasonality

• Guess

• Mueller case is behind us now.

• still trending up

• ok

• Continues above trend line…

“Lower” Respondent Answers:

• Can’t break resistance

• Bearish Divergences

• Rest time.

• waiting to see if wave 4 is starting

• The S&P has done well for a few weeks. It’s probably time for a mild sideways-to-down spell.

• The market is overbought and needs some downside action. This is the biggest week for earnings reports.

• Ever Increasing % down volume

• There were a key reversal day om yhe s&p 500 the previous week

ADVERTISEMENT

The team at TraderFinds has put together a limited opportunity for you to get trial access to 3 top trading services at no cost or obligation to you.

Any one of these services could help you take your trading to the next level, just click the link to start your test dive: Right Line Trading Live Trading Room, Alpha Shark Trade Alerts Service, Sentiment Timing Market Timing Report.

Click here to learn more and join.

Question #4. What is your best piece of advice for trade management?

• Use your best I dicator and shepherd each trade.

• Understand the Industry you are investing in.

• Strict control

• only bet 50% of your wins each time. Ghost trade if you make a loss, at the first win revert to real money

• stops

• ok

• Manage your sizing

• Position size – scale in and scale out

• Don’t stick with a losing stock trade too long. It’s usually a better to switch that position into a better percentage play.

• Trailing Stop

Question #5. Additional Comments/Questions/Suggestions?

• Ok

Join us for this week’s shows:

Crowd Forecast News Episode #221

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, April 22nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Michael Filighera of LogicalSignals.com (moderator)

Analyze Your Trade Episode #74

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, April 23rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– A.J. Brown of TradingTrainer.com

– Jim Kenney of OptionProfessor.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com (moderator)

ADVERTISEMENT

The team at TraderFinds has put together a limited opportunity for you to get trial access to 3 top trading services at no cost or obligation to you.

Any one of these services could help you take your trading to the next level, just click the link to start your test dive: Right Line Trading Live Trading Room, Alpha Shark Trade Alerts Service, Sentiment Timing Market Timing Report.

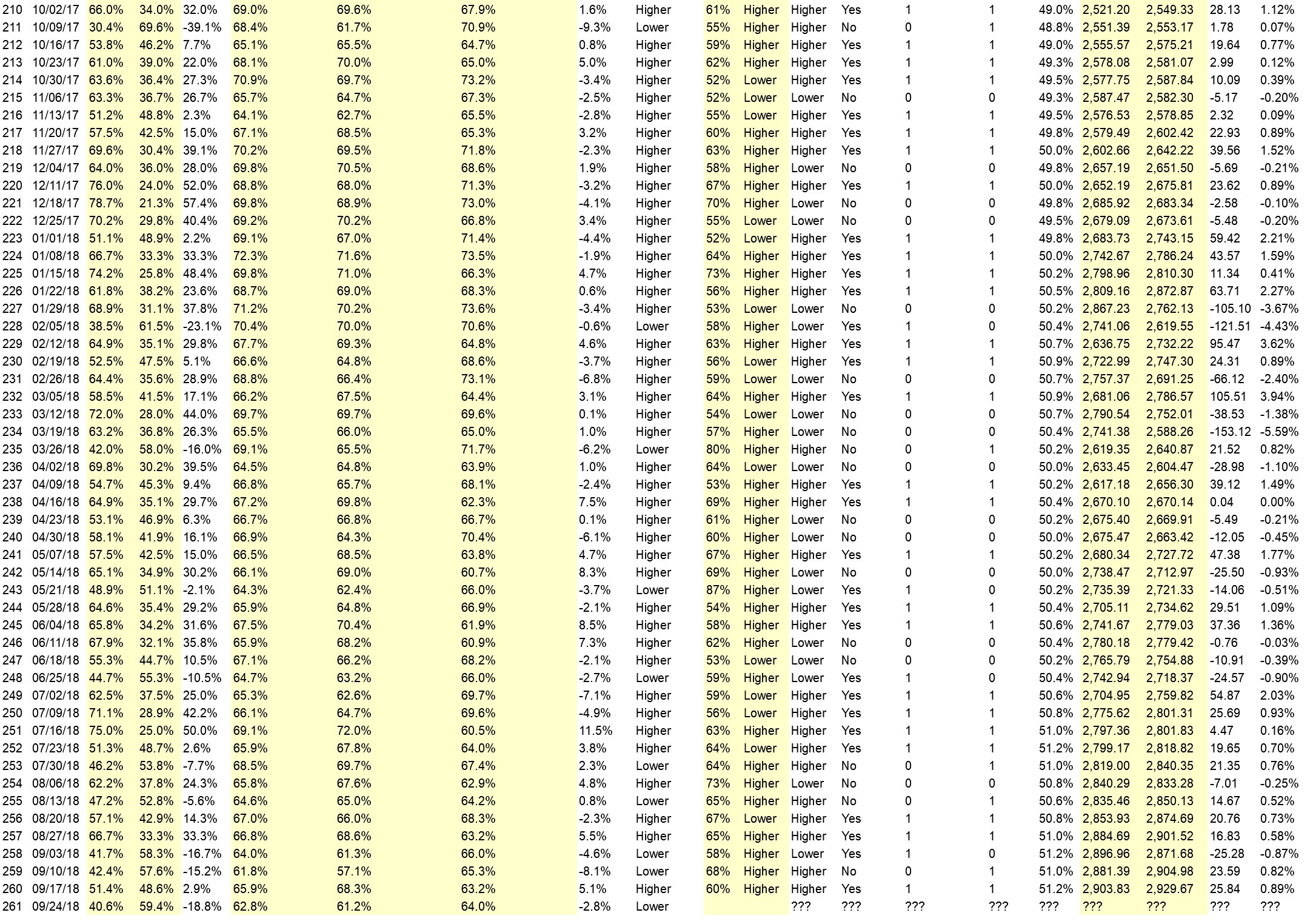

Crowd Forecast News Report #261

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport092318.pdf

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (September 24th to September 28th)?

(The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 40.6%

Lower: 59.4%

Higher/Lower Difference: -18.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 62.8%

Average For “Higher” Responses: 61.2%

Average For “Lower” Responses: 64.0%

Higher/Lower Difference: -2.8%

Responses Submitted This Week: 34

52-Week Average Number of Responses: 47.1

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 51.4% Higher, and the Crowd Forecast Indicator prediction was 60% Chance Higher; the S&P500 closed 0.89% Higher for the week. This week’s majority sentiment from the survey is 59.4% Lower with a greater average confidence from those who responded Lower. Similar conditions have been observed 47 times in the previous 260 weeks, with the majority sentiment being correct 43% of the time, with an average S&P500 move of 0.14% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

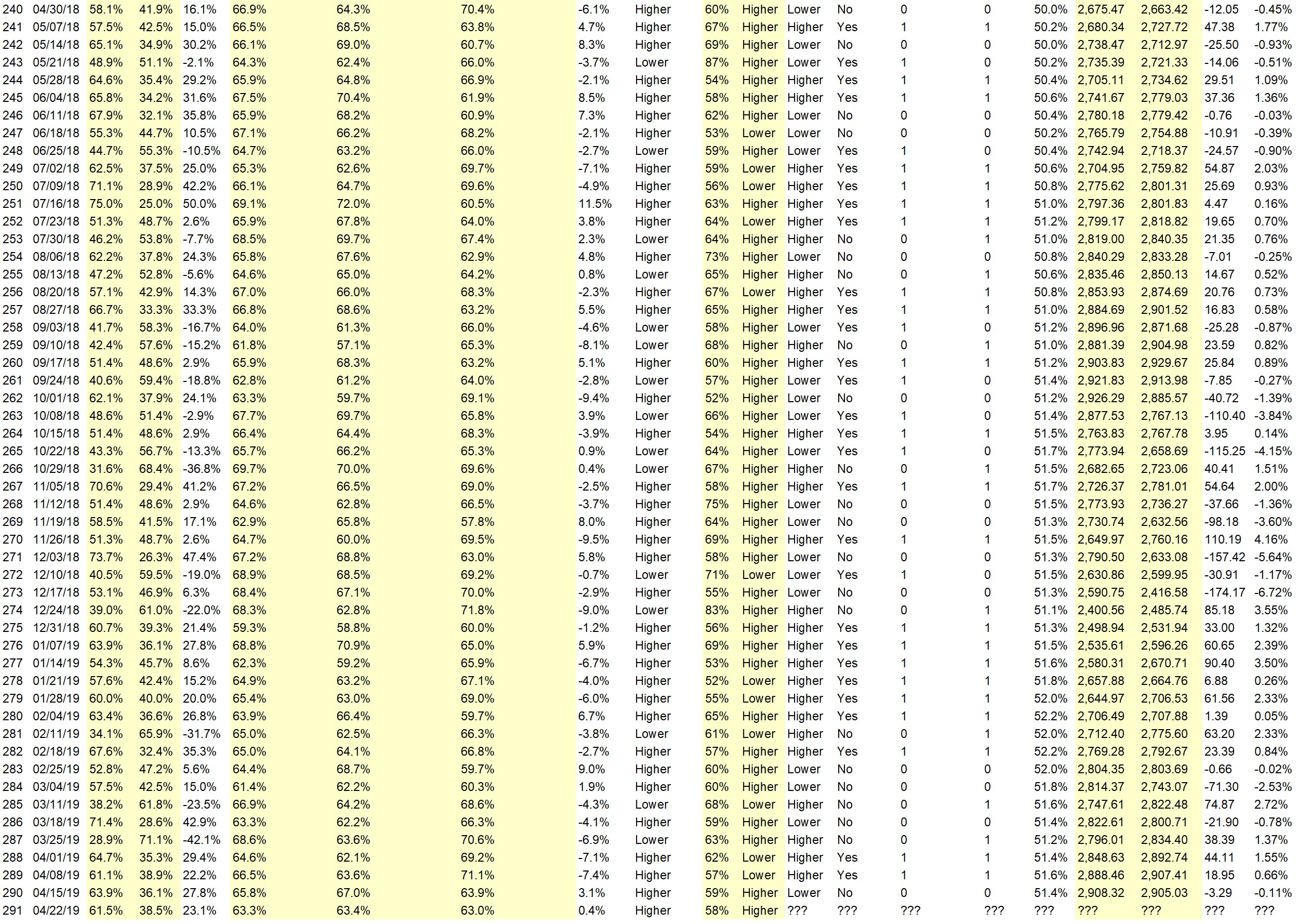

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.2%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 63.6%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Trump enthusiasm

• Bull Market., Climbing the wall of worry!

• Pre-Mid Term Election Sentiments

• Recent history.

• I really think the administration is going to do everything within their power to keep an overall positive market till mid-term elections.

• Very volatile week. Low and then high. End of next week may slide down.

“Lower” Respondent Answers:

• Tariffs War

• tariffs

• After making new all time highs the markets are set up for profit taking to finish the quarter.

• yes

• Trade discussion breakdown with China Very poor breadth as markets have been heading up Small caps leading down

• the Fed raises interest rates

• The market seemed to have a different tone on Friday and I think that will continue, at least early in the week

• Technical exhaustion ahead of both Fed meeting (rate hike) and end of quarter (lock in profits).

• The S&P has been in a rising channel since early April. It’s close to the channel top, and may decide to revisit 2900 before moving higher again.

• Rise over 3percent 10 t bill

• excess sentiment, bad breadth

Partner Offer:

Top Gun Options is Kicking Off the INDUSTRY Leading Full Throttle Training Program LIVE Tuesday Sept 25th at 1 PM

Question #4. Which indicator influences your trading the most?

• White candlestick are still there on the S&P 500 occasionally maybe a few intraday

• Moving averages

• RSI

• Seasonality

• no

• VIX New high / New Lows

• Bollinger band, with assistance from volume, MACD

• MACD

• Fibonacci ratios, Stochastic, and Elliott Wave

• Price

• 200ma

• Price

• Elliott Wave

• Past history.

• RSI

• Macd

• Stock price increases with much higher volume than normal.

• macd

Question #5. Additional Comments/Questions/Suggestions?

• This is a great service! Thank you for providing it.

• yes

• The tech has been weak during September. Should we expect it to recover and strengthen in October?

Join us for this week’s shows:

Crowd Forecast News Episode #197

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, September 24th, 2018

– 1PM ET (10AM PT)

Moderator and Guests:

– Mike Pisani of AlphaShark.com & SmartOptionTrading.com (moderator)

– Lee Harris of EmojiTrading.com

– Jim Kenney of OptionProfessor.com

– Roy Swanson of SteadyTrader.com

Analyze Your Trade Episode #50

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, September 25th, 2018

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Michael Filighera of LogicalSignals.com (moderator)

– Anka Metcalf of TradeOutLoud.com

– Larry Gaines of PowerCycleTrading.com

Partner Offer:

Top Gun Options is Kicking Off the INDUSTRY Leading Full Throttle Training Program LIVE Tuesday Sept 25th at 1 PM

Crowd Forecast News Report #235

The new TimingResearch report for the week has been posted, click on the link below to view the full report including the update on sentiment numbers.

Click here to download the report: TRReport032518.pdf

TimingResearch Crowd Forecast Prediction: 80% Chance Higher

This indicator prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment was 63.2% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 5.59% Lower for the week. This week’s majority sentiment from the survey is 58.0% Lower with a greater average confidence from those who responded Lower. Similar conditions have been observed 10 times in the previous 234 weeks, with the majority sentiment being correct 20% of the time, with an average S&P500 move for the week of 0.64% Higher during those weeks. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting 80% Chance Higher for this coming week.

You can download any past report here.

Join us for this week’s shows:

Crowd Forecast News Episode #175

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, March 26th, 2018

– 1PM ET (10AM PT)

Guests:

– Glenn Thompson of PacificTradingAcademy.com

– Neil Batho of TraderReview.net

– Roy Swanson of SteadyTrader.com

Moderator:

– Michael Filighera of LogicalSignals.com

Analyze Your Trade Episode #28

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, March 27th, 2018

– 4:30PM ET (1:30PM PT)

Guests:

– Christian Fromhertz of TribecaTradeGroup.com

– Mike Pisani of AlphaShark.com

– TBA

Moderator:

– Dean Jenkins of FollowMeTrades.com

Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.

Crowd Forecast News Report #234

The new TimingResearch report for the week has been posted, click on the link below to view the full report including the update on sentiment numbers.

Click here to download the report: TRReport031818.pdf

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This indicator prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment was 72.0% Higher, and the Crowd Forecast Indicator prediction was 54% Chance Lower; the S&P500 closed 1.38% Lower for the week. This week’s majority sentiment from the survey is 63.2% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 30 times in the previous 233 weeks, with the majority sentiment being correct 57% of the time, with an average S&P500 move for the week of 0.26% Higher during those weeks. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting 57% Chance Lower for this coming week.

Analyze Your Trade Episode #25

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the stocks submitted by people who registered to view this episode.

– Oliver Schmalholz of NewsQuantified.com

– Christian Fromhertz of TribecaTradeGroup.com

– Dean Jenkins of FollowMeTrades.com

Download the show audio in MP3 (podcast) format: AnalyzeYourTradeEpisode25.mp3

Download the show video in MP4 format: AnalyzeYourTradeEpisode25.mp4

Episode Timeline (click the times to watch that segment on YouTube):

Guest Special Offers:

From Christian: Elite Trader Package, 2-week free trial

From Dean: “Beyond the Noise” FREE Weekly Newsletter

From Oliver: Don’t Miss Out On The Next BIG Stock Move

Other Partner Offer:

It looks like a little “fish hook” on the charts…

Whenever Jason Bond spots this weird pattern, he dips his line on the water. Most of the time, he reels in a profit.

AYT022718

Crowd Forecast News Episode #171

Listen to the following guests, along with David J. Kosmider, the creator of TimingResearch.com, discuss the stocks submitted by people who registered to view this episode.

– John Thomas of MadHedgeFundTrader.com

– Glenn Thompson of PacificTradingAcademy.com

– Anka Metcalf of TradeOutLoud.com

– E. Matthew “Whiz” Buckley of TopGunOptions.com

John’s prediction: Unchanged

Glenn’s prediction: Higher

Anka’s prediction: Higher

Matt’s prediction: Higher

(watch now to get all the details)

Timeline (watch on YouTube.com):

0:00 – Introductions.

10:00 – Question #1 and #2, Higher or Lower and Confidence?

20:00 – Why?

39:00 – Question #4, single or multiple strategies?

51:00 – Trade ideas of the week.

1:00:00 – Closing statements.

Download the show audio in MP3 (podcast) format: CrowdForecastNewsEpisode171.mp3

Download the show video in MP4 format: CrowdForecastNewsEpisode171.mp4

You can download this week’s and all past reports here.

Guest Special Offers:

From Matt: Get Our Market SITREP (Situation Report) In Your Inbox Every Trading Day

From John: Diary of a Mad Hedge Fund Trader

From Anka: Receive exclusive content: Market Analysis, Video Lessons, Trade Ideas & Trade Reviews

From Glenn: Join for their free webinars

Other Partner Offer:

CFN022618

Crowd Forecast News Report #222

The new TimingResearch report for the week has been posted, click on the link below to view the full report including the update on sentiment numbers.

Click here to download the report: TRReport122517.pdf

TimingResearch Crowd Forecast Prediction: 55% Chance Lower

This indicator prediction is an attempt by the editor of this newsletter to use the full 4+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment was 78.7% Higher, and the Crowd Forecast Indicator prediction was 70% Chance Higher; the S&P500 closed 0.10% Lower for the week. This week’s majority sentiment is 70.2% Higher with a greater average confidence from those who responded Higher. Similar conditions have been observed 11 times in the previous 221 weeks, with the majority sentiment being correct 45% of the time, with an average S&P500 move for the week of 0.23% Lower during those weeks. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting 55% Chance Lower for this coming week.

You can download any past report here.