0

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport022320.pdf

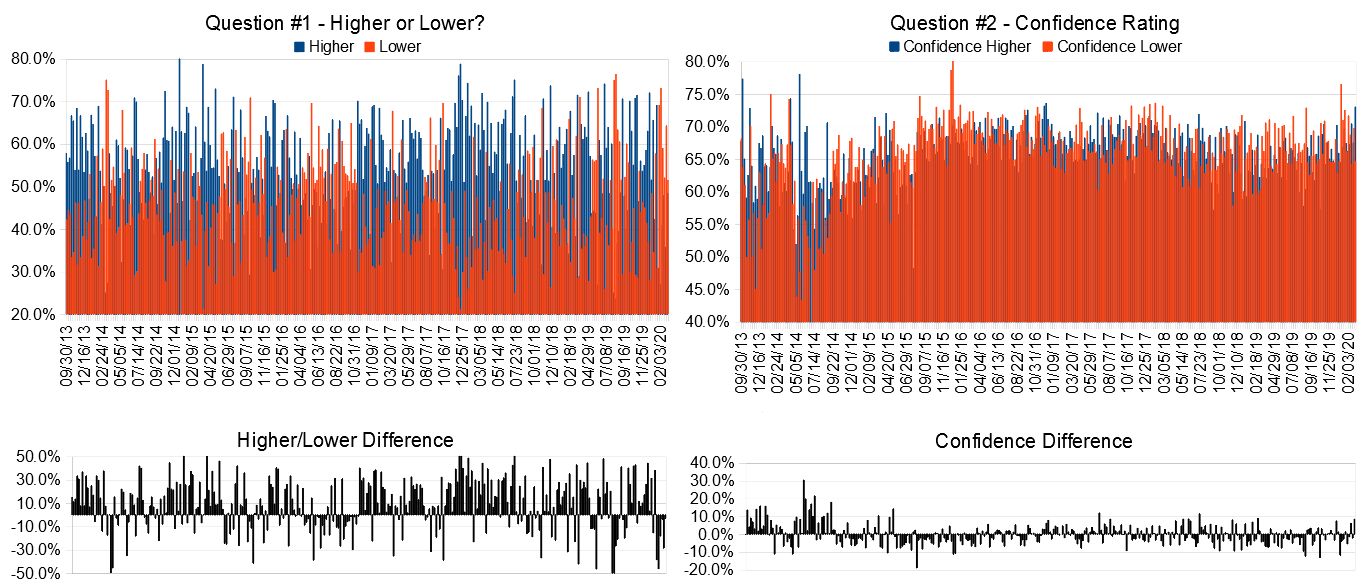

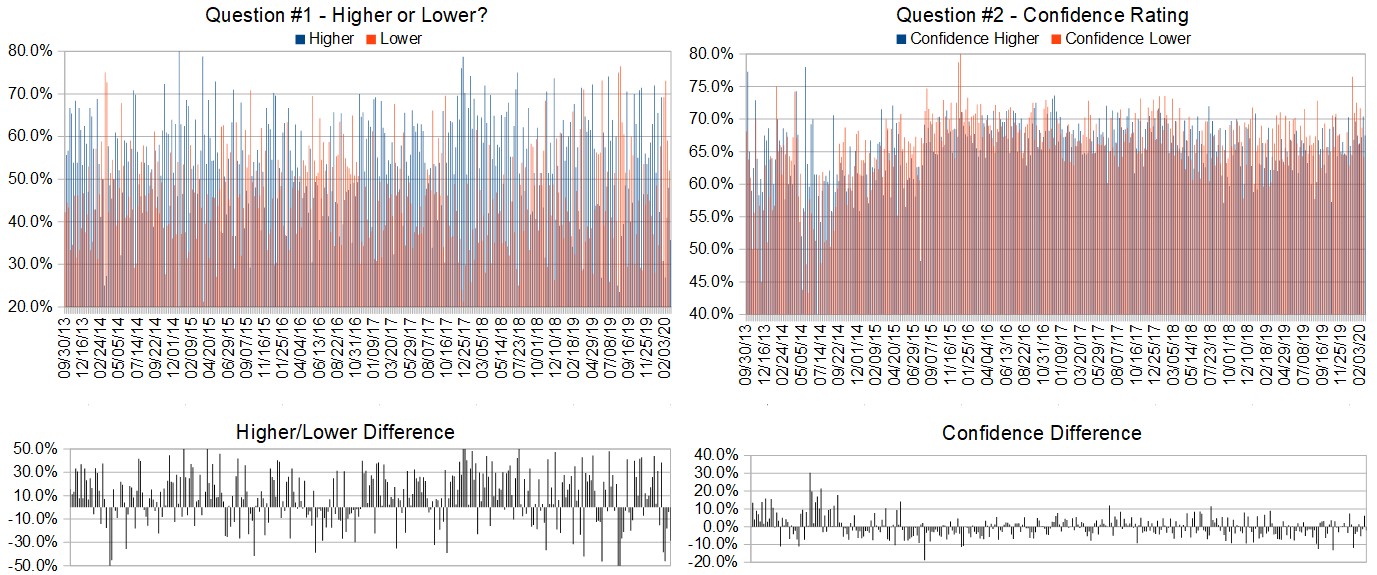

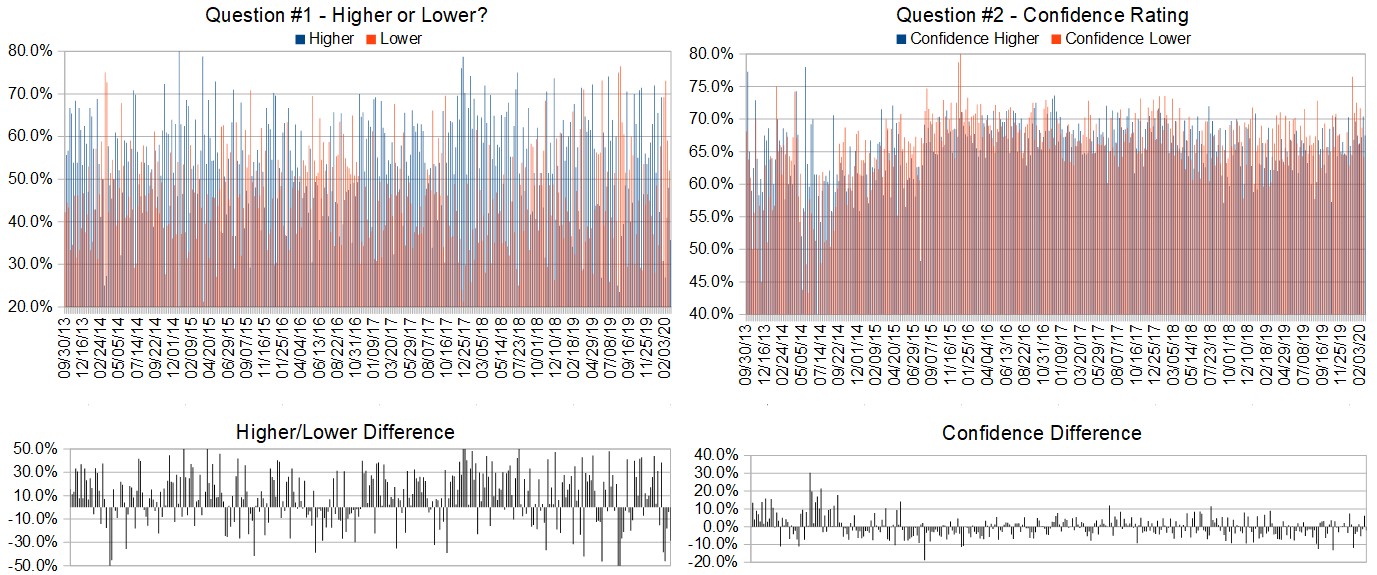

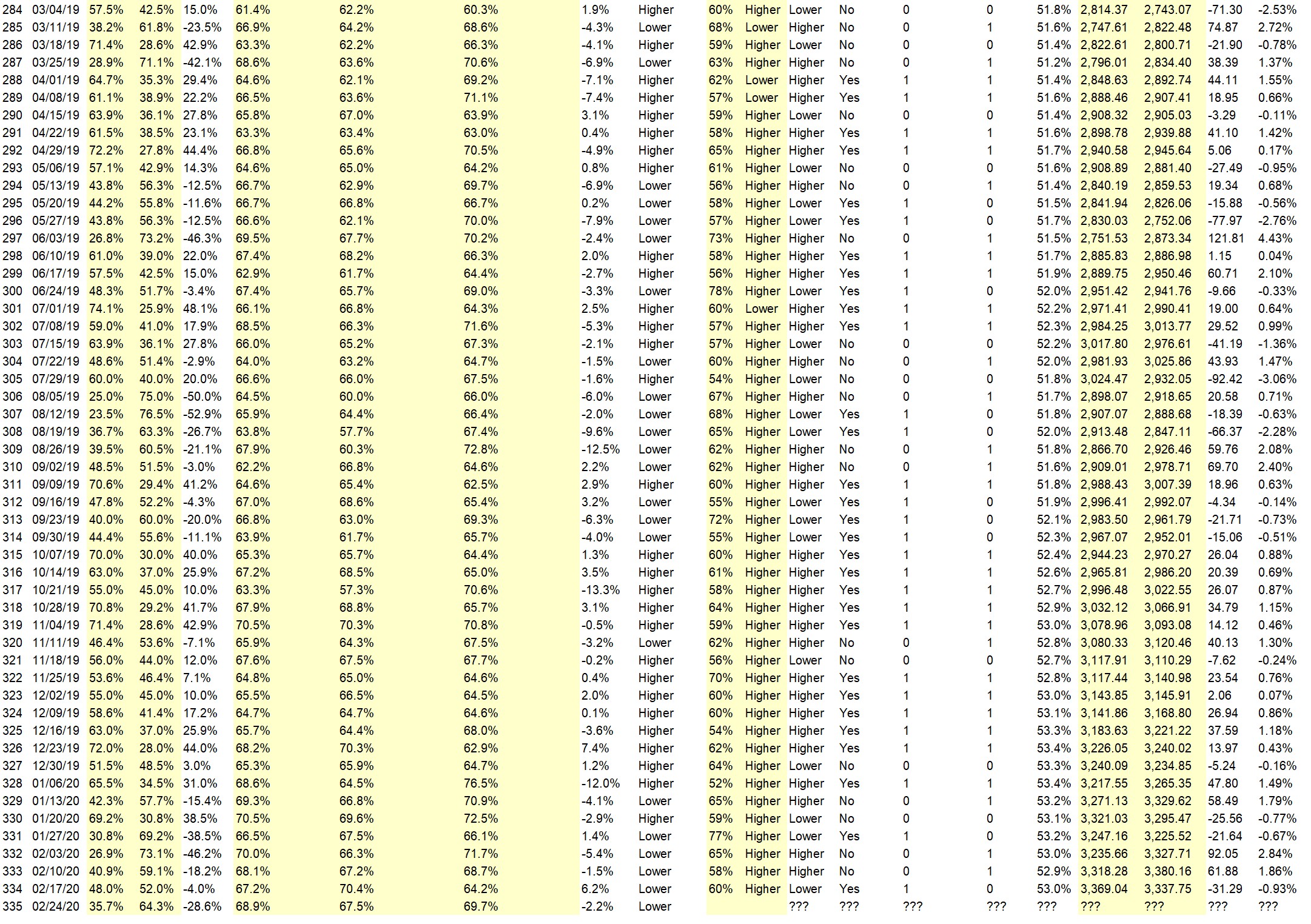

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (February 24th to 28th)?

Higher: 35.7%

Lower: 64.3%

Higher/Lower Difference: -28.6%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 68.9%

Average For “Higher” Responses: 67.5%

Average For “Lower” Responses: 69.7%

Higher/Lower Difference: -2.2%

Responses Submitted This Week: 30

52-Week Average Number of Responses: 32.6

TimingResearch Crowd Forecast Prediction: 59% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 6+ year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 52.0% predicting Lower, and the Crowd Forecast Indicator prediction was 58% chance Higher; the S&P500 closed 0.93% Lower for the week. This week’s majority sentiment from the survey is 64.3% predicting Lower with a greater average confidence from those who are predicting Lower. Similar conditions have occurred 68 times in the previous 334 weeks, with the majority sentiment (Lower) being correct only 41% of the time and with an average S&P500 move of 0.37% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 59% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

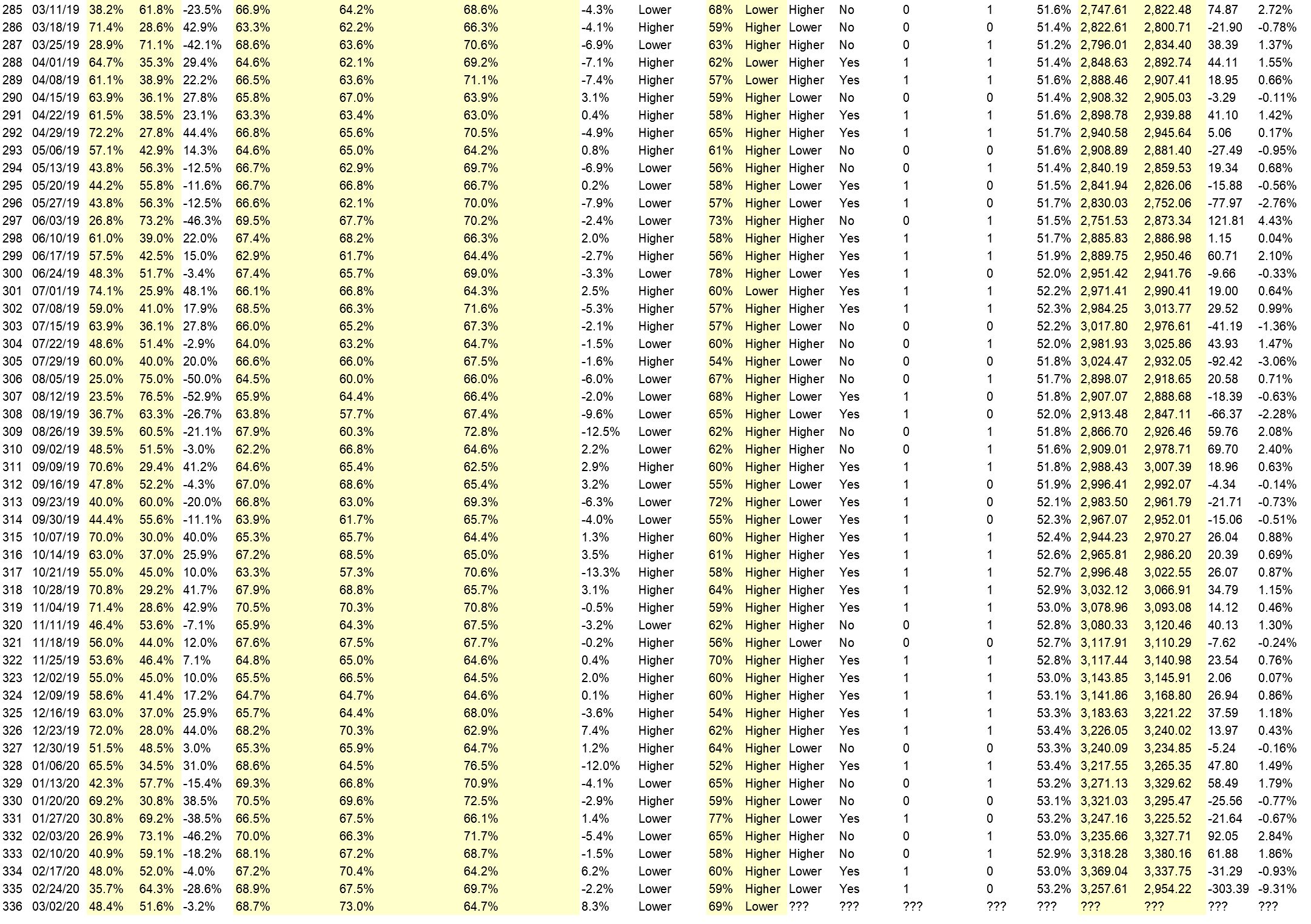

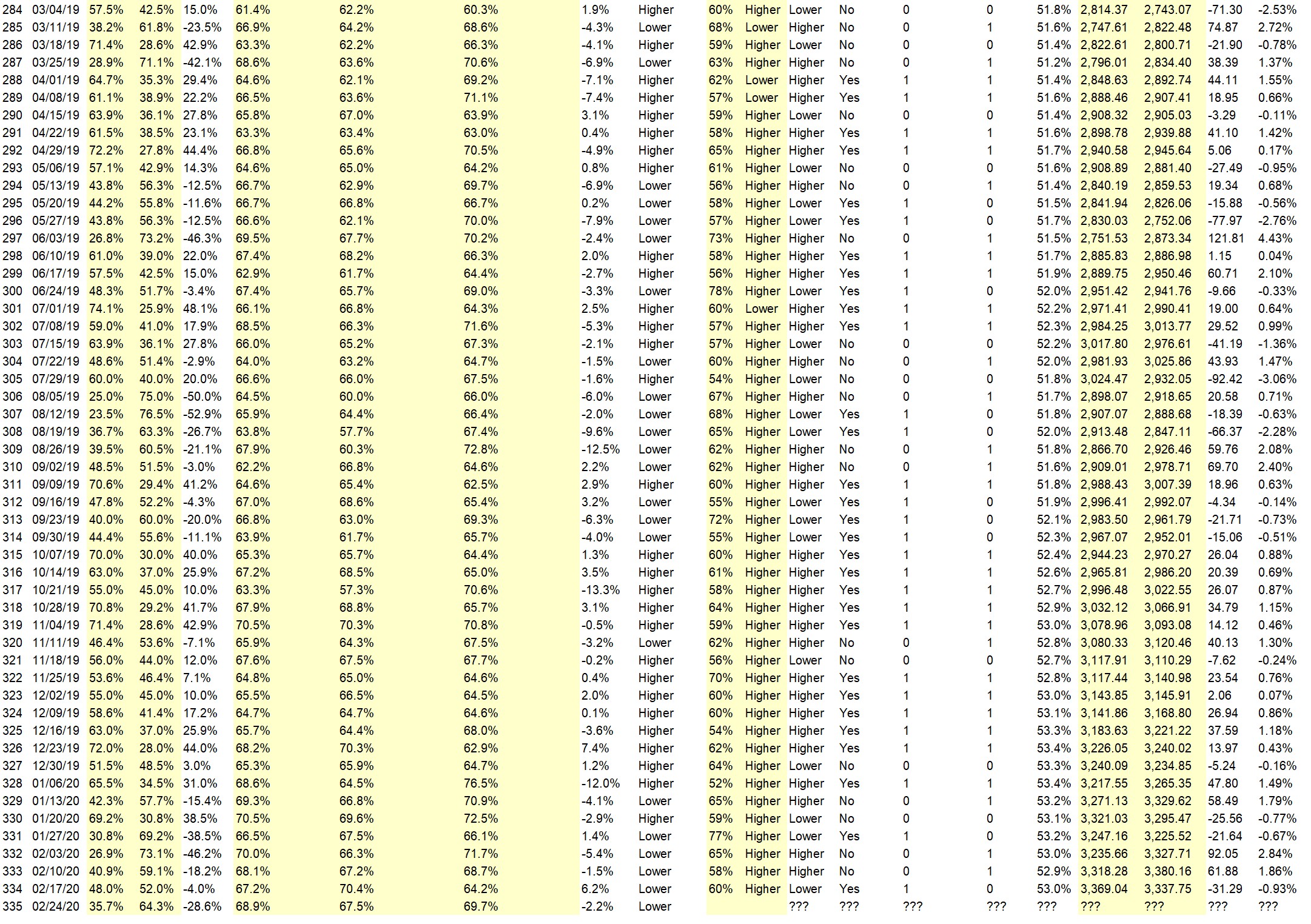

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 53.0%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 54.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Than you very much for this question yes it work like that due t to the way the market move

• FOMC

• qe

• LT Trend

“Lower” Respondent Answers:

• I think the initial reaction to the corona virus was over quickly. Now we will enter a period of time where the market will be reacting to the economic effects of virus on the economy of several countries, especially the Chinese economy. While I try to remain optimistic, I have reserved some cash for bargain hunting, hedged some positions we wish to keep and allow more “room” in our put writing for a possible correction

• Many overbought stacks, some correction needed.

• markets are still wary of the impact of the corona virus

• vires

• People are concerned – that few in China will be allowed to go to their jobs in factories, producing their plastic pieces, etc. /// Maybe the world can apply some pressure to install scrubbers on factory smoke stacks, and implement humane work conditions for the masses. Pipe dreams allowed. /// Can the playing field ever be leveled?

• FED just won’t cut the virus is getting worse but there is nothing positive to boost the market when even low interest rates no longer prevent money from flowing out of the market / lower FED won’t lower and 30 year low on interest rates is no longer preventing an outflow of money from the markets

• China Flue totally out of control in China! Percentages getting higher, ratios moving up, not good!

• uncertainty

• Continue Friday’s reverse.

• corona sickness in more countries

• technicals + post Op-expiration

• Consolidation !

• The market is losing momentum. Virus headlines continue. More earnings reports to weigh on the market.

• With the coronavirus situation looking more like a pandemic, with numerous negative consequences, I can’t think of a reason to buy the market at this level. The S&P drop in July-Aug 2019 was 7%. The current drop has justification to be at least as much.

• Corona Virus finallt taking its toll

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

Question #4. What indicator influences your trading the most?

• I resist being an “indicator addict” but I do follow the common things we all know that industry people use such a 200 day M/A and shorter term M/A crossovers.

• bull/bear markets

• vwap

• interest rates dow

• MAs

• it is Forex trading

• earnings

• interest rates

• Support/resistance levels, MACD.

• In order: Price Action, Candlestick, Volume, EMA.

• Volume.

• Price action.

• Japaneese Candlesticks in the United States

• China’s manipulated market imploding in on itself. World events move too fast now, the GOV can’t control things much longer. No one will be at the Olympics – not even the athletes. The world’s spotlight is shining brightly on a flawed model, and the will of the people & progress can’t be held behind a curtain much longer. Alright, political rant is over >> have a great week guys.

• sma.

Question #5. Additional Comments/Questions/Suggestions?

• Thank you very much for this Thank you john peterson

• China Flue major spread in Italy. Raises concerns, eventually effect all of Europe. North American borders must tighten to NO travel beyond oceans!

• China is a few years away from big change.

Join us for this week’s shows:

Crowd Forecast News Episode #254: This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time: Monday, February 24th, 2020, 1PM ET (10AM PT)

Lineup for this Episode:

– Melissa Armo of TheStockSwoosh.com (first time guest!)

– Marina Villatoro of TheTraderChick.com

– Mercedes Van Essen of MentalStrategiesForTraders.com

– Anka Metcalf of TradeOutLoud.com (moderator)

Click here to find out more!

Analyze Your Trade Episode #115 (special episode): When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 15 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 24th, 2020, 4PM ET (1PM PT)

Lineup for this Episode:

– Jim Kenney of OptionProfessor.com (moderator)

– John Thomas of MadHedgeFundTrader.com

Click here to find out more!

Analyze Your Trade Episode #116: When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 15 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time: Tuesday, February 25th, 2020, 4PM ET (1PM PT)

Lineup for this Episode:

– Jeffrey Gibby of MetaStock.com (first time guest!)

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Synergy Traders Event #11 — “Women Teach Trading and Investing: Opportunities for Everyone in Today’s Markets”: Join us for this huge week-long event. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time: Monday-Friday, March 2nd-6th, 2020, 4PM ET (1PM PT)

Moderator and Guests: Full schedule to be announced: Over 20 women financial professions and educators have confirmed to participate.

Click here to find out more!

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies