0

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport120119.pdf

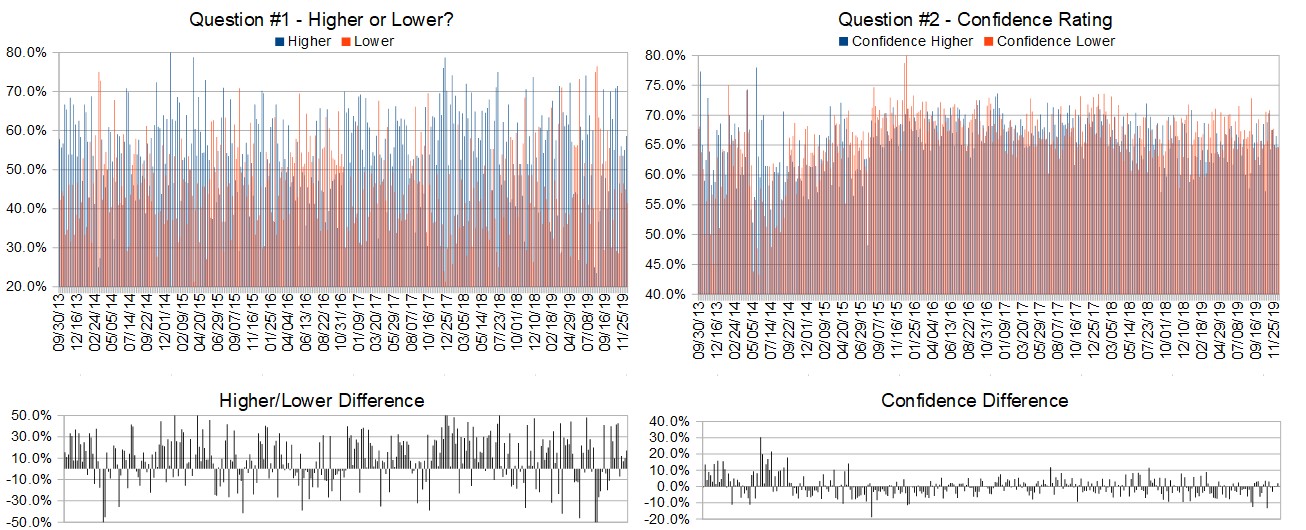

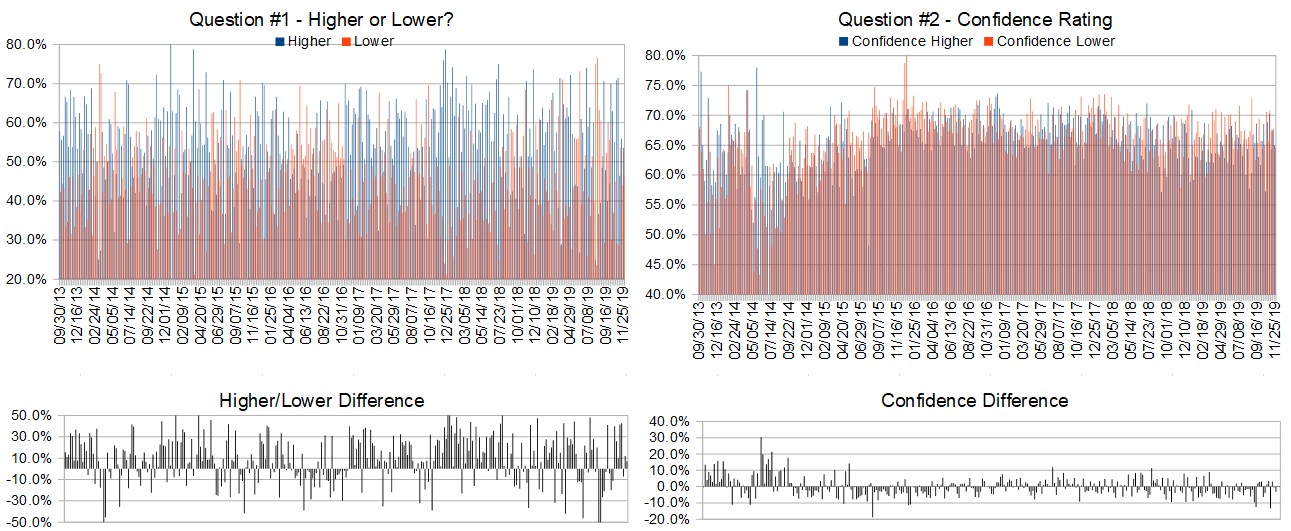

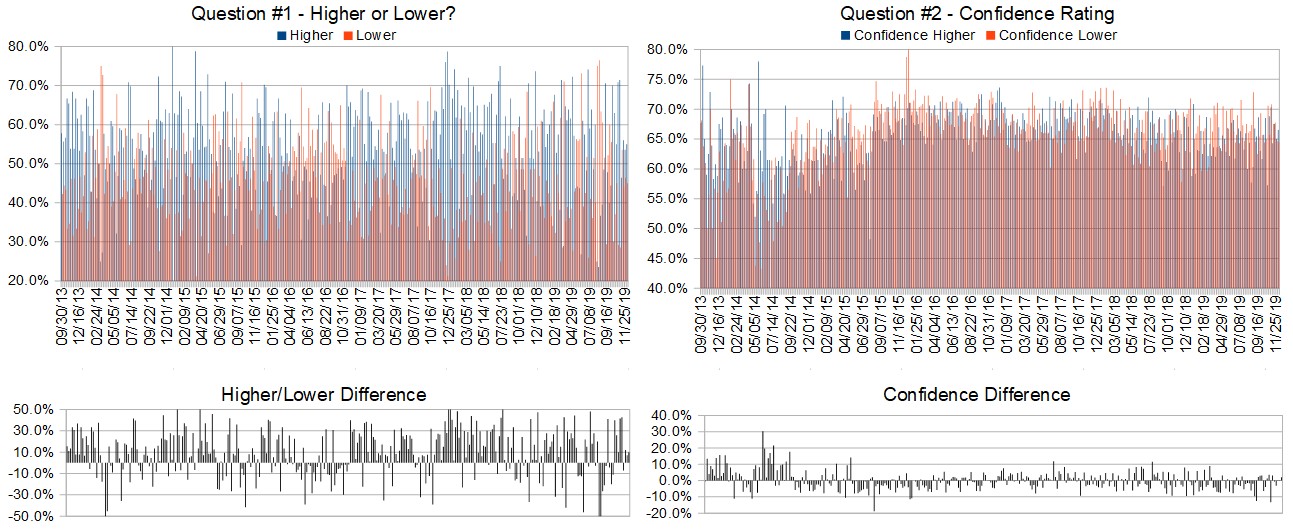

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 2nd to 6th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 55.0%

Lower: 45.0%

Higher/Lower Difference: 10.0%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 65.5%

Average For “Higher” Responses: 66.5%

Average For “Lower” Responses: 64.5%

Higher/Lower Difference: 2.0%

Responses Submitted This Week: 20

52-Week Average Number of Responses: 34.2

TimingResearch Crowd Forecast Prediction: 60% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

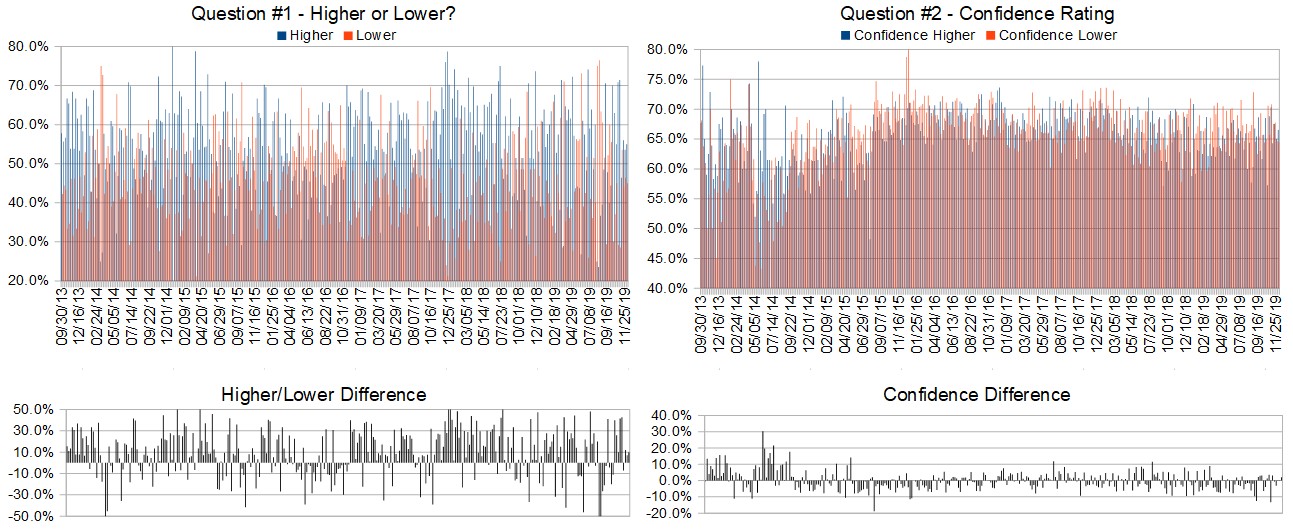

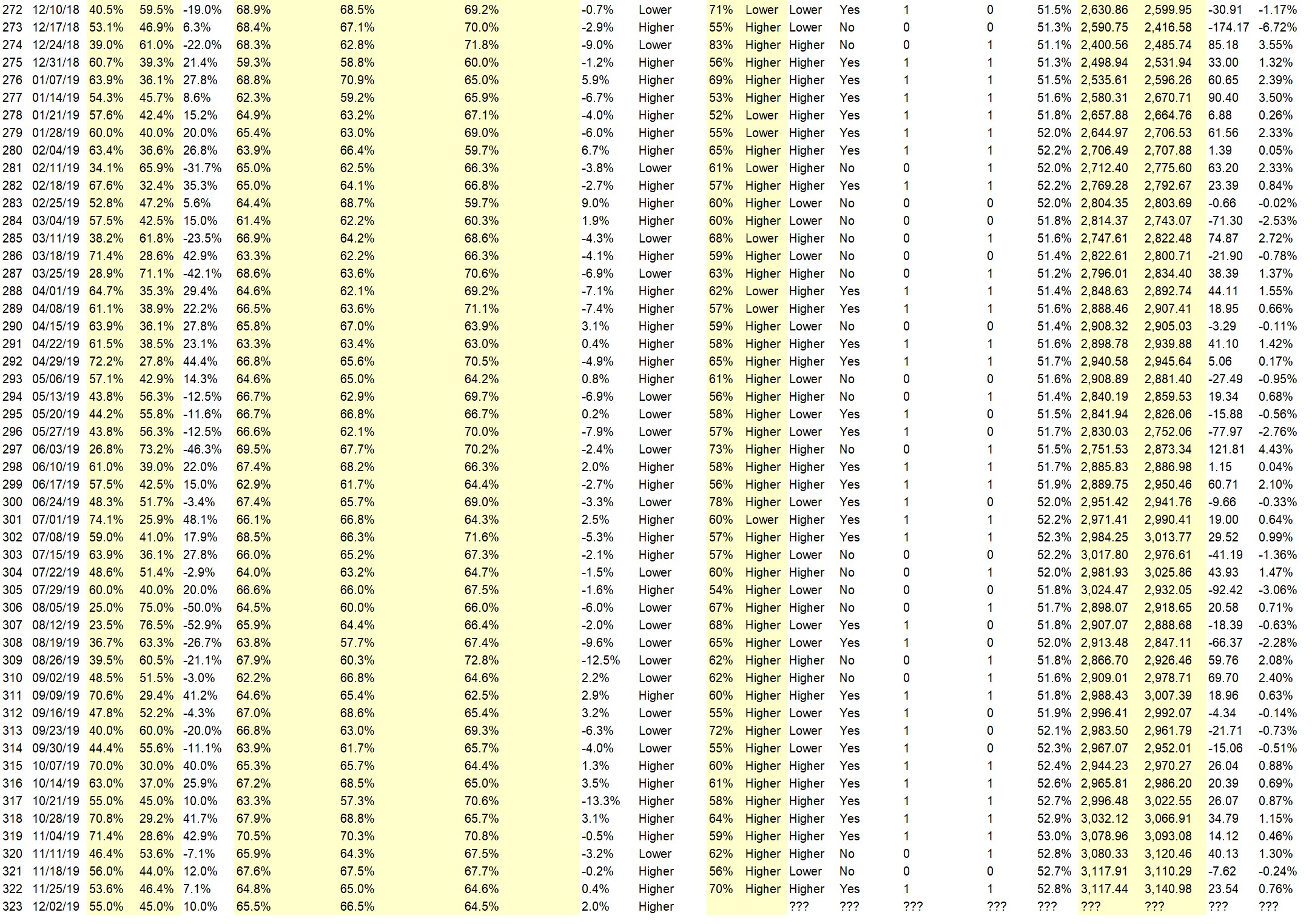

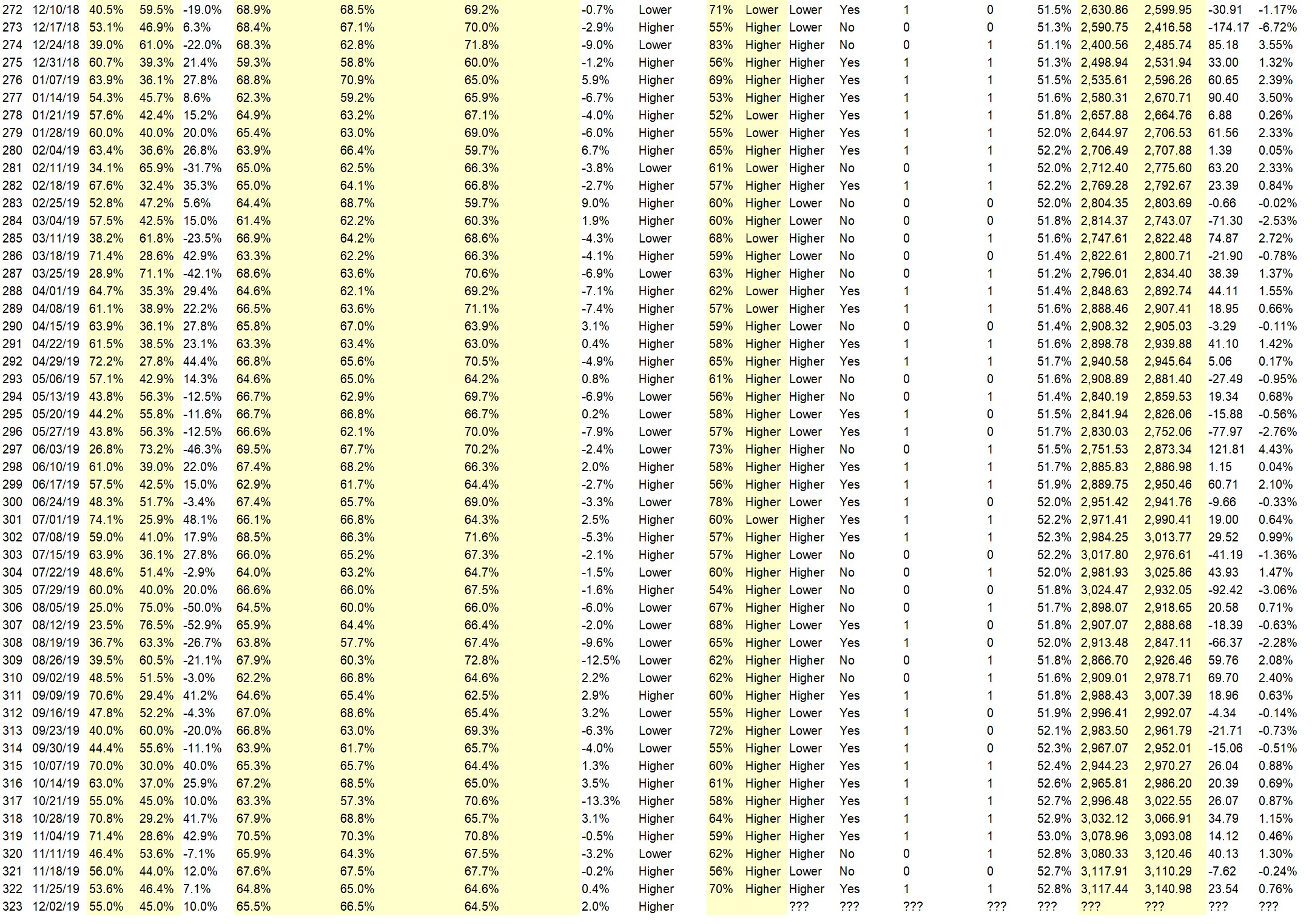

Details: Last week’s majority sentiment from the survey was 53.6% Higher, and the Crowd Forecast Indicator prediction was 70% Chance Higher; the S&P500 closed 0.76% Higher for the week. This week’s majority sentiment from the survey is 55.0% predicting Higher with a greater average confidence from those who are predicting Higher. Similar conditions have occurred 52 times in the previous 322 weeks, with the majority sentiment (Higher) being correct 60% of the time and with an average S&P500 move of 0.24% Higher for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 60% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets

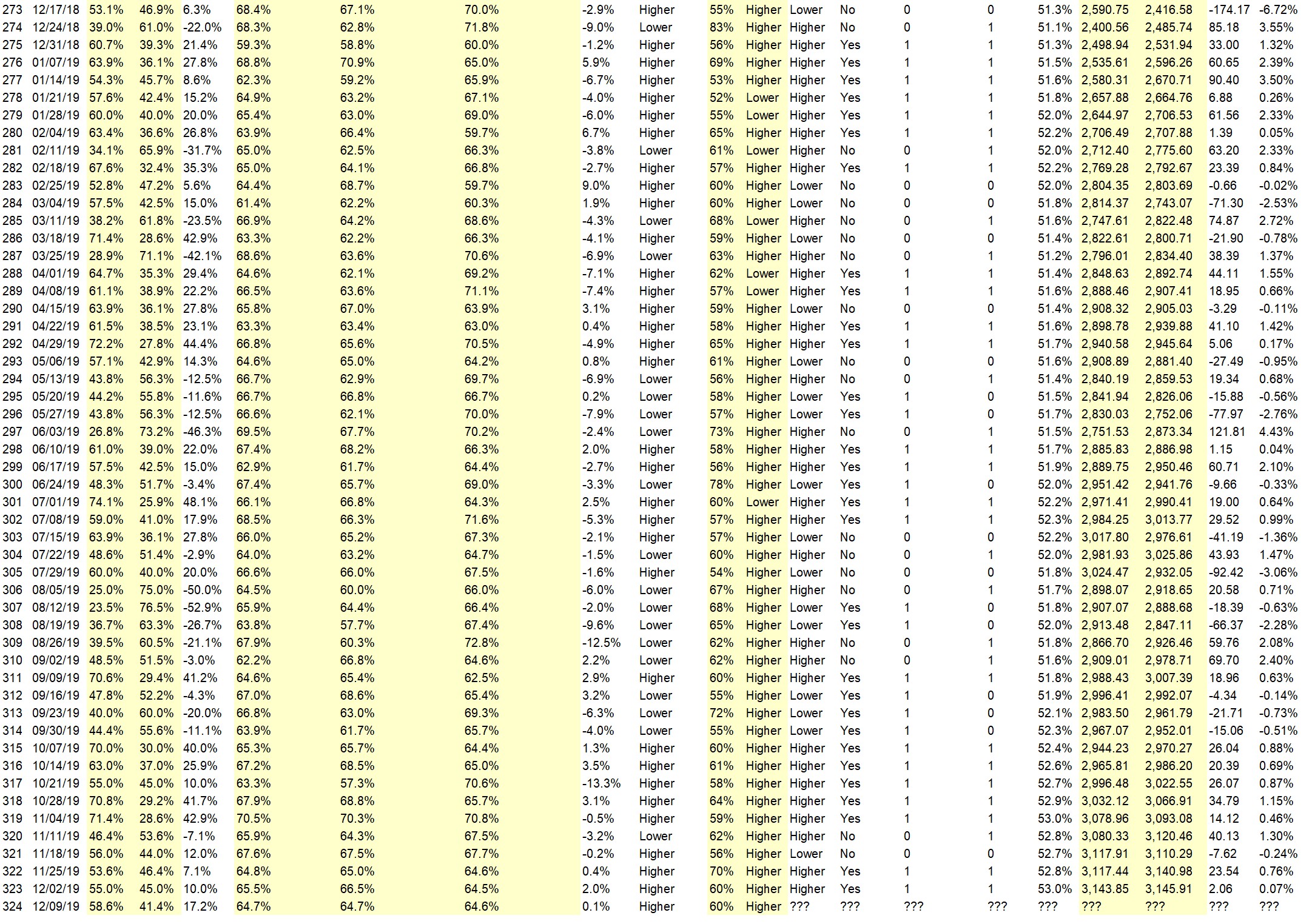

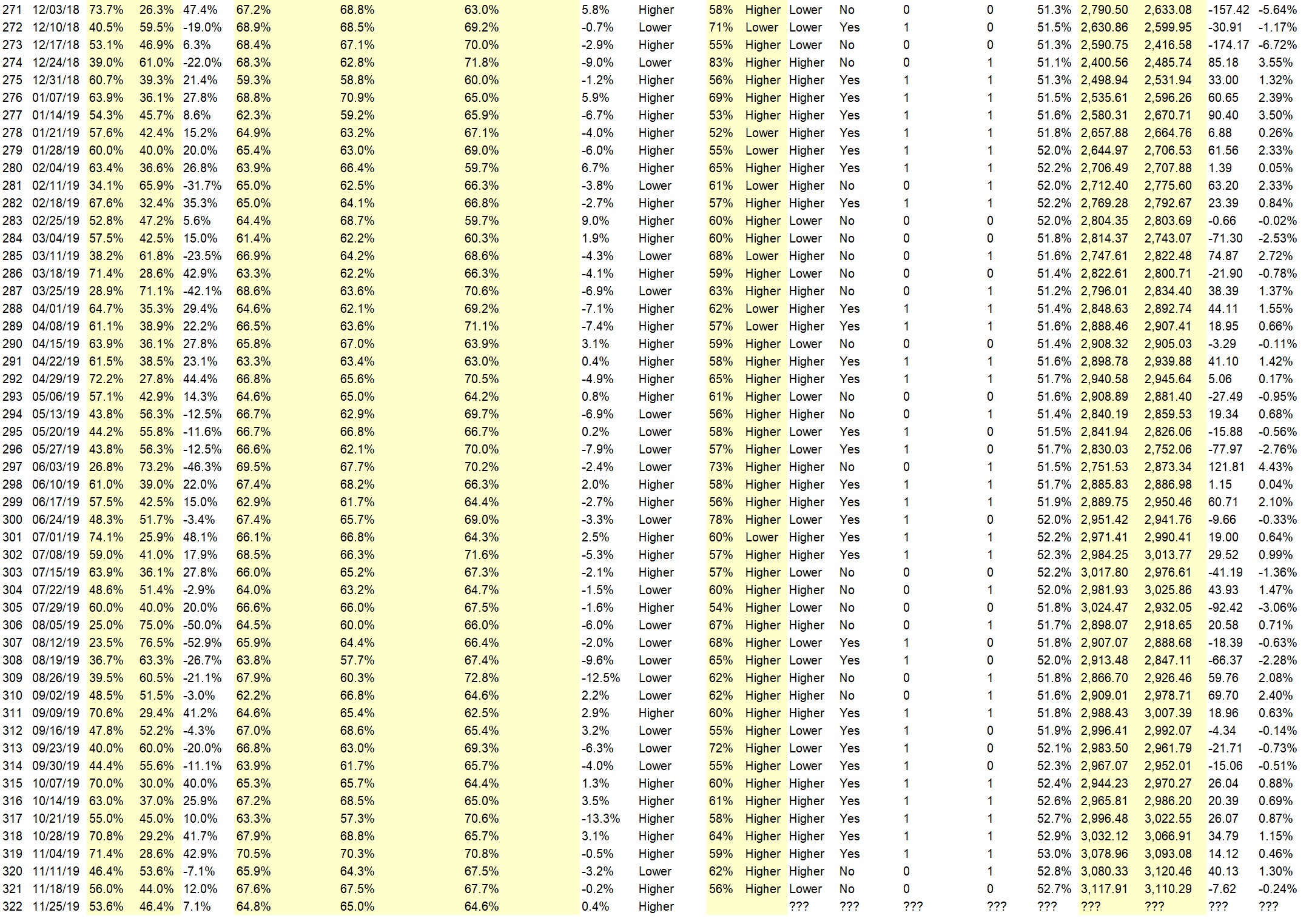

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.8%

Overall Sentiment 52-Week “Correct” Percentage: 60.8%

Overall Sentiment 12-Week “Correct” Percentage: 81.8%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your best email here:

By signing up you agree to receive newsletter and marketing emails. You can unsubscribe at any time.

Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Rally for the next three weeks !!

• trend

• The Federal Reserve mentioned a new normal’ I think maybe is ok i guess maybe

• This weekend NOV 30 2019 is of course, as usual, pivotal, we must see what global factor does what, and some more concrete metrics of the Friday and Saturday shopping results, Friday evening Beijing reported rather increased productivity numbers, out of the high 49 area, now at the 54 area, of course is it real, so let’s say it is, that’s a positive, however other corner of mouth calls the resolution ‘meddling’ while millions are cordoned into the electroperimeter up in the NW as if its just fine, and we have magnificent citizens walking together in HK with their held high USA Flags, a rather amazing tribute to just how blessed we are, and held in such esteem, while our Beijing leaning candiodates promote Fidel style ‘progressive_ism, a rather OxyMoronic as two photos would go together HK with flags of USA and BS EW etc calls to conduct financial vasectomies on those such as Leon Cooperman who grew up as a plain simple kid in Brooklyn and used smarts to build his multibillion company, he took the ‘buffet giving pledge’ many years ago and has given hundreds of millions already, and yet he and similar are decried as selfish… uh the total opposite of selfish is the thankful corporation creators that bring wonderful jobs and develop and refine the best products and services anywhere… ….so, in perspective, we see what next.. if we get more of same as full month, its continuation flow a go.

• Build on momentum.

• End of year tax loss selling

• Historical.

• Consumer Spending

“Lower” Respondent Answers:

• We need a retrace this wk

• end of year tax loss selling and portfolio rebalancing to continue

• 3 bar reversal

• China noise

• S&P at top of 10-month channel, as seen in early May & late July, suggesting that a decline is on tap.

• Trend has moved to sideways. China talks stall over Hong Kong.

AD: Don’t risk your capital! Trade with other people’s money.

Question #4. Who or what first inspired you to become a trader?

• money,unfortunately I didn’t make any

• Money!

• Larry Williams

• to get a part time job.

• My father.

• Mom

• My dad r.i.p. had little to invest and yet found a way to do so, although he hadn’t learned of other than buy and hold into the pain zones.. still I always saw the value of and experienced the tremendous success of real solid corporations that could and did bring value to all of our lives.

• Stupidity I believed all you crooked bastards and it has cost me over $100K

• Losses

• I’ve always liked playing with numbers and patterns. At first, it was paper-trading.

• Dont remember

• Jim Slate

• I’m retired/something to do.

• 40 years ago when I was 14 I seen advertisement :Invest for Success”, consisted of Cassettes and book. I saved my paper route money and bough it. Today I’m trading more than I was 10 or 20 years ago.

Question #5. Additional Comments/Questions/Suggestions?

• Think Gold & Silver will move one way or another for sure this week!

• How about SEND US A LINK OF ALL you collect : the comments and the poll data and let us see the results and read the other comments like such as I have submitted. HOWEVER POST THEM ALL AS ANONYMOUS, I PREFER MY FULL PRIVACY, Please.

TimingResearch Response: Thanks! That’s exactly what we’ve been doing for over 6 years with this project! Hope you enjoy the info.

Join us for this week’s shows:

Crowd Forecast News Episode #247

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, December 2nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

– Norman Hallett of TheDisciplinedTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Analyze Your Trade Episode #104

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, December 3rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– Harry Boxer of TheTechTrader.com

– Jim Kenney of OptionProfessor.com (moderator)

Click here to find out more!

Synergy Traders Event #8

Join us for this event. This is your chance to be the first to get the secrets, tips, tricks, and tactics from top trading educators.

Date and Time:

– Saturday, December 7th, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Click here to find out more!

[AD] eBook:

NEW! 15 Ways to Stay Ahead in Choppy, Headline-Driven Markets