0

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport071419.pdf

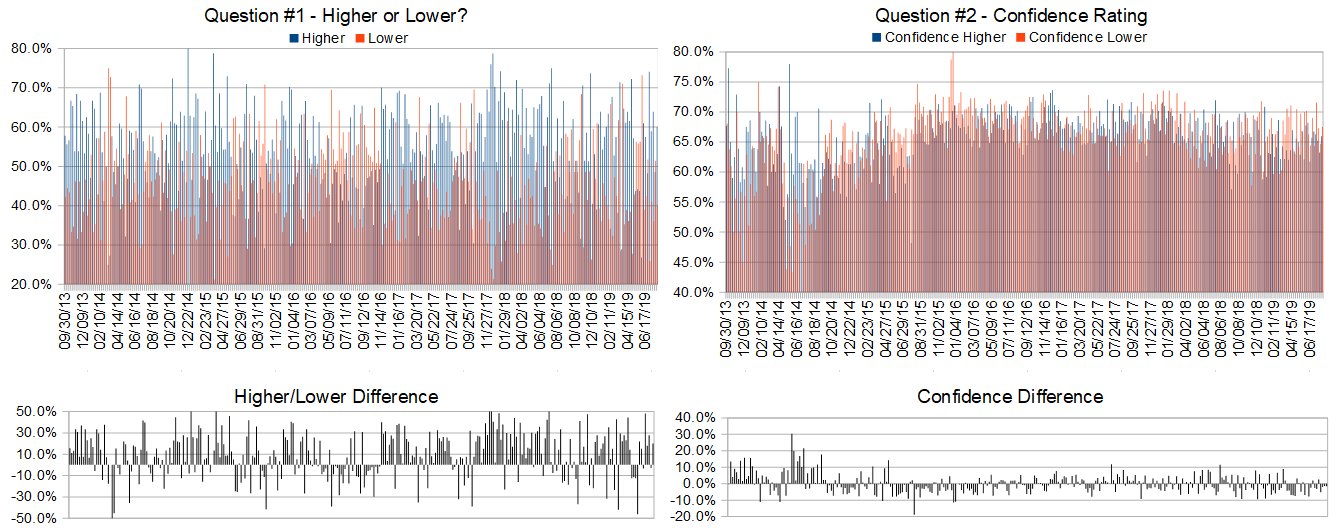

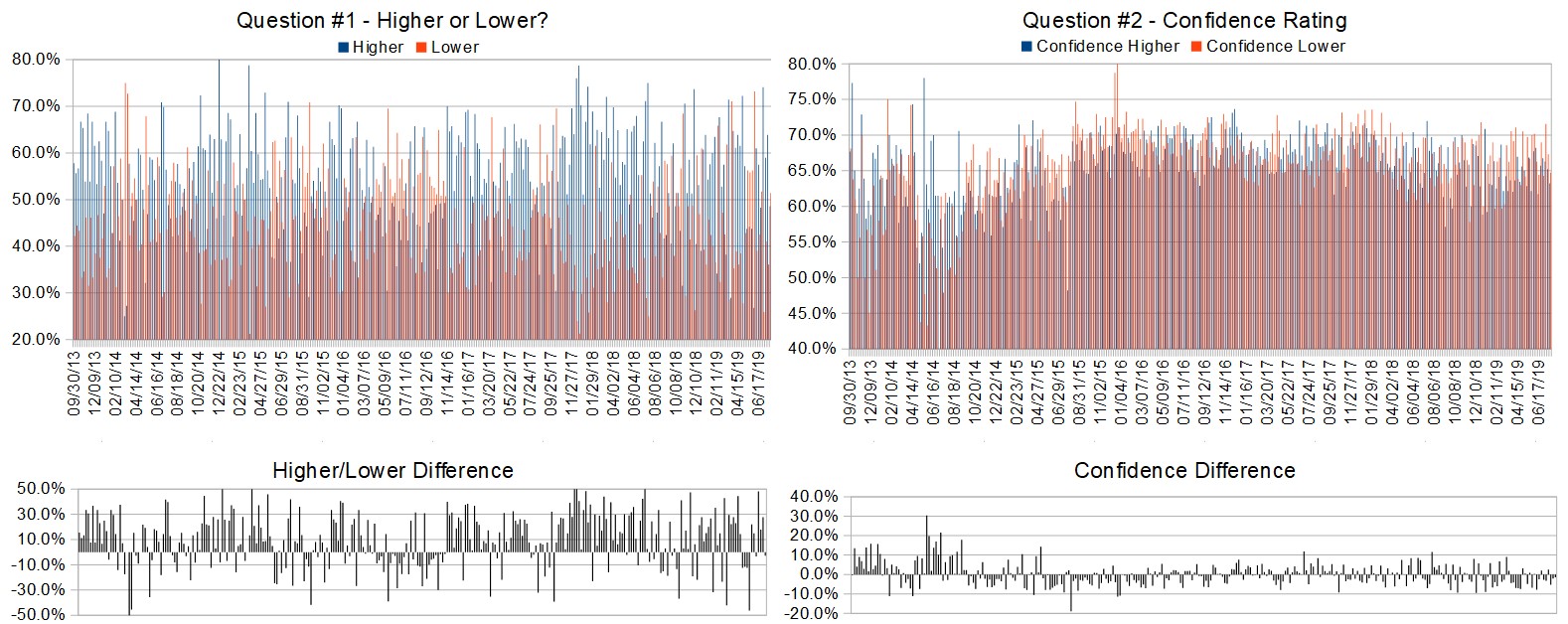

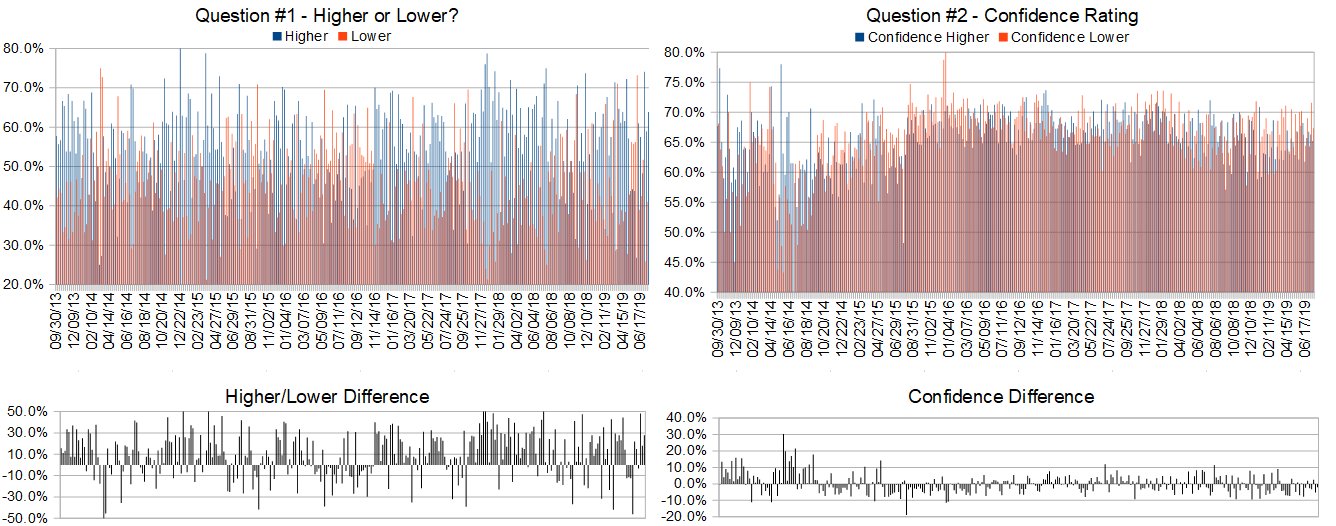

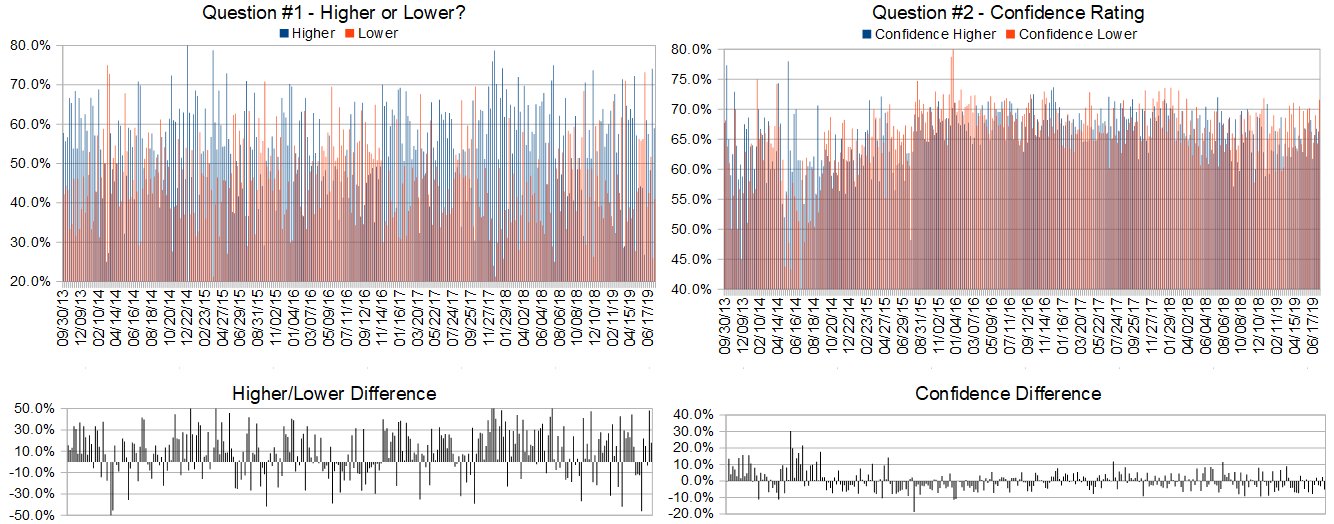

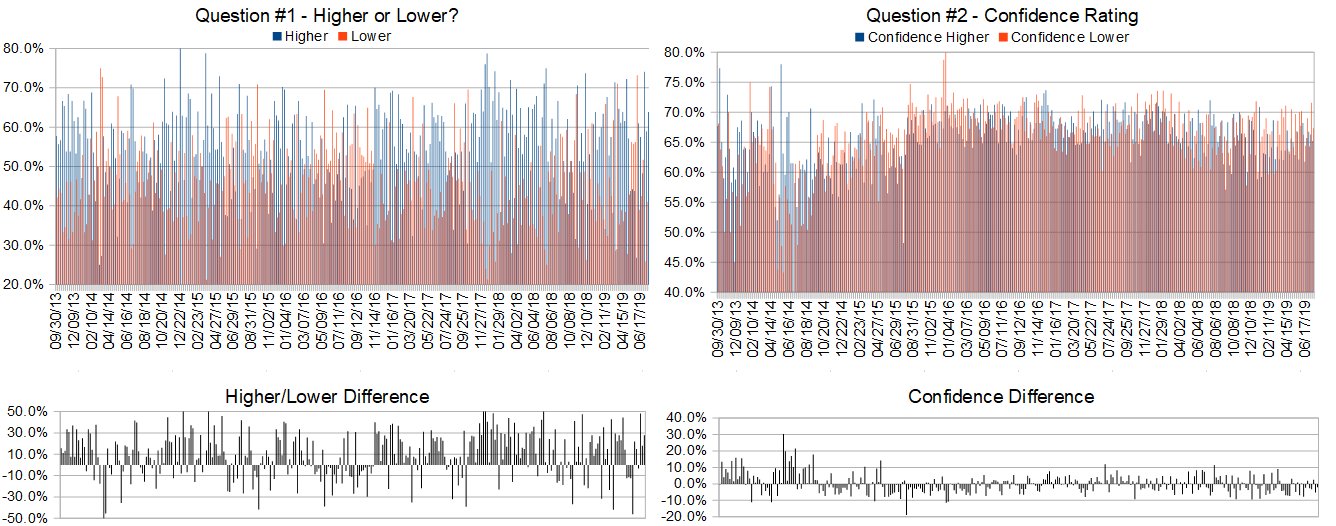

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (July 15th to 19th)?

The order of possible responses to this question on the survey were randomized for each viewer.)

Higher: 63.9%

Lower: 36.1%

Higher/Lower Difference: 27.8%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 66.0%

Average For “Higher” Responses: 65.2%

Average For “Lower” Responses: 67.3%

Higher/Lower Difference: -2.1%

Responses Submitted This Week: 36

52-Week Average Number of Responses: 37.3

TimingResearch Crowd Forecast Prediction: 57% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

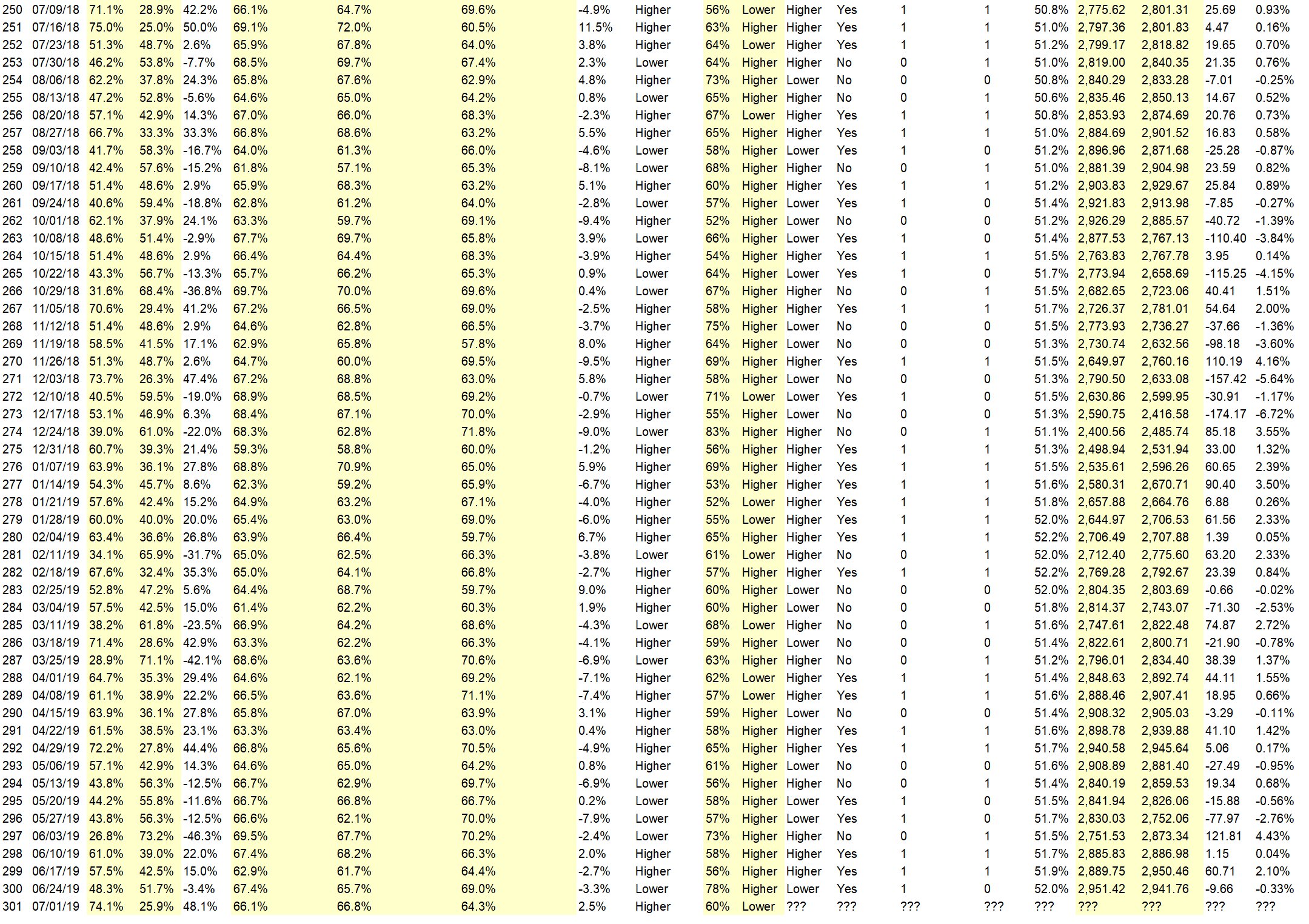

Details: Last week’s majority sentiment from the survey was 59.0% Higher, and the Crowd Forecast Indicator prediction was 57% Chance Higher; the S&P500 closed 0.99% Higher for the week. This week’s majority sentiment from the survey is 63.9% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 42 times in the previous 302 weeks, with the majority sentiment (Higher) being correct 57% of the time and with an average S&P500 move of 0.14% Lower (rare instance where it more frequently moves Higher but the average of all moves is Lower) for the week. Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 57% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

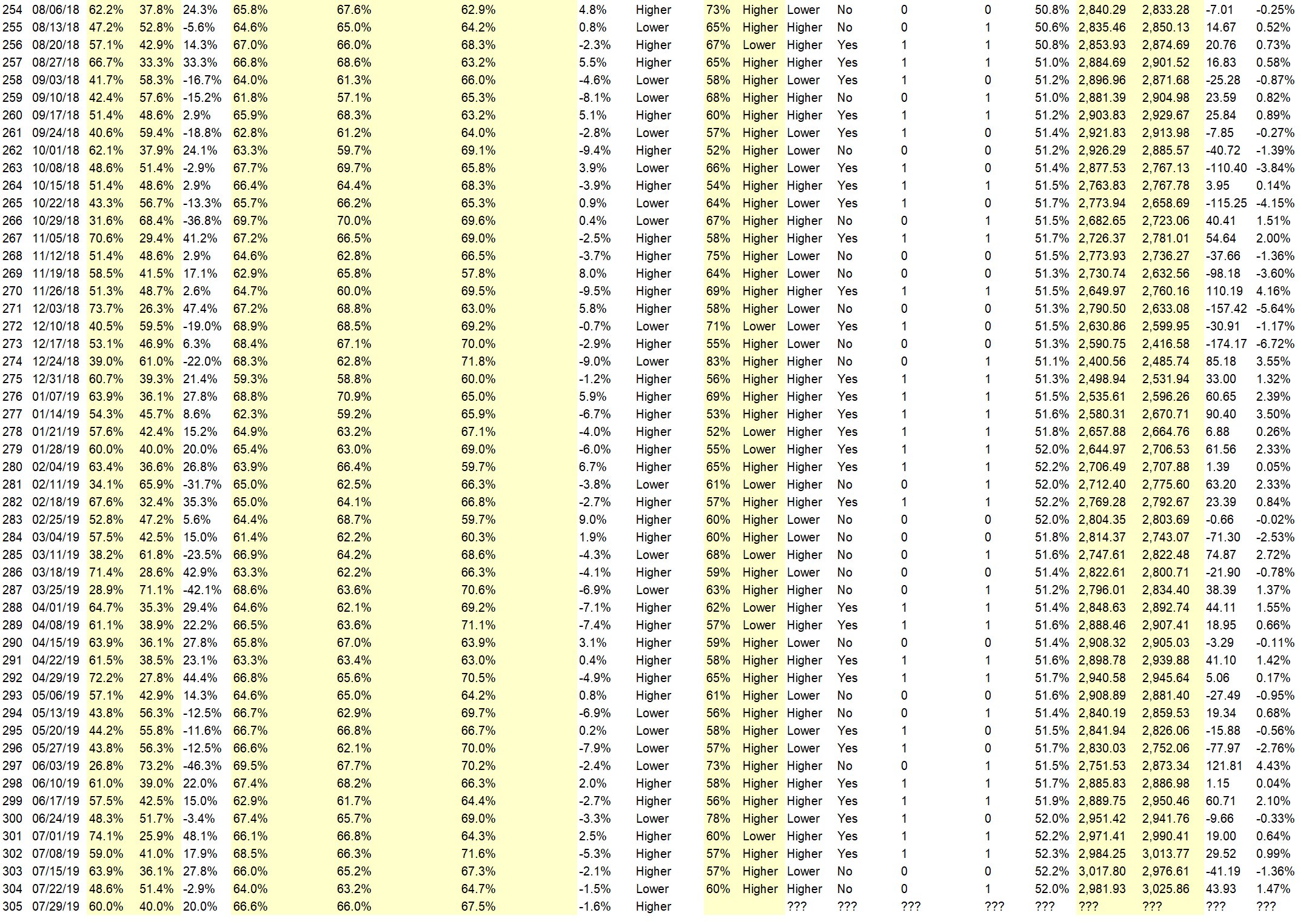

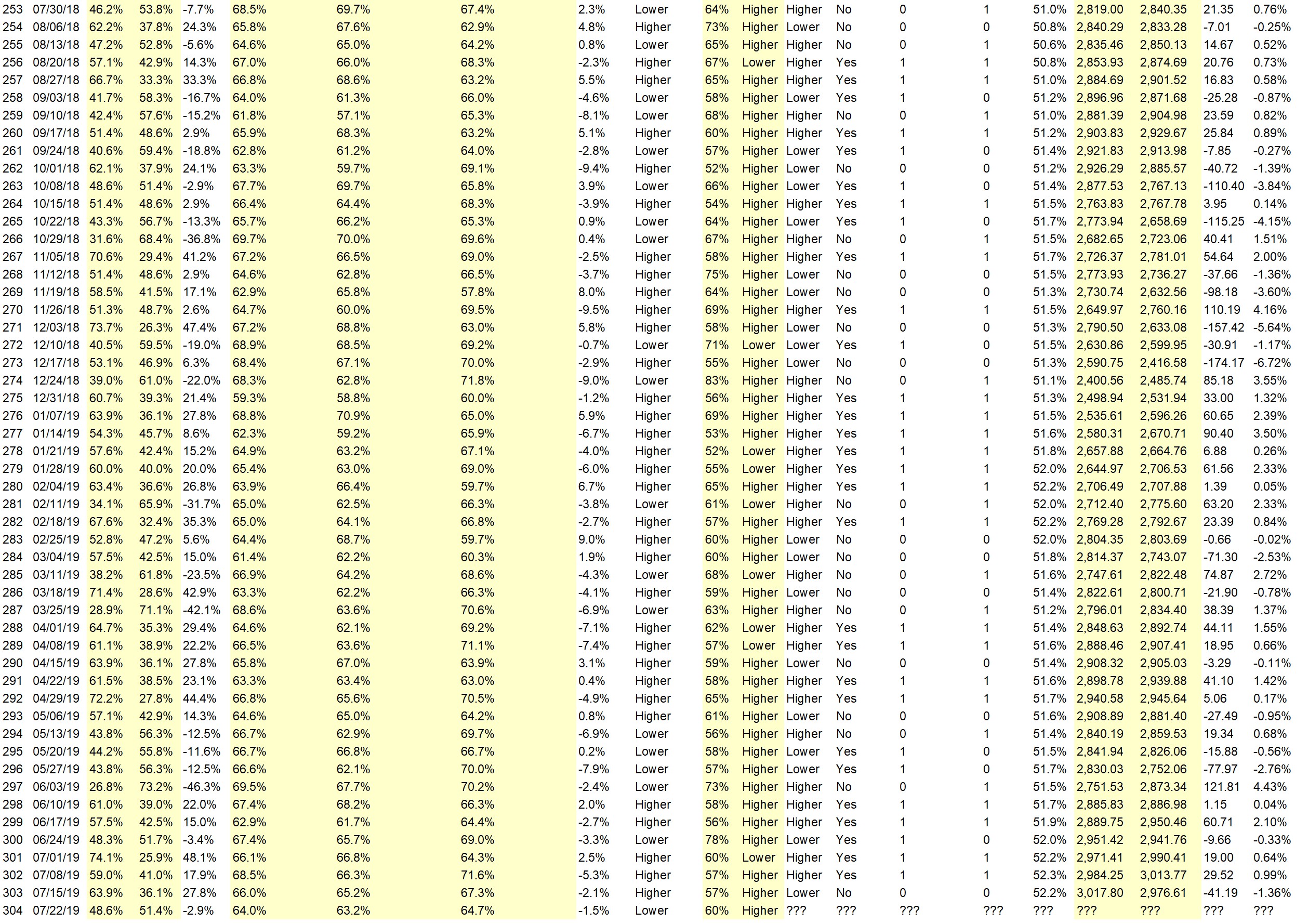

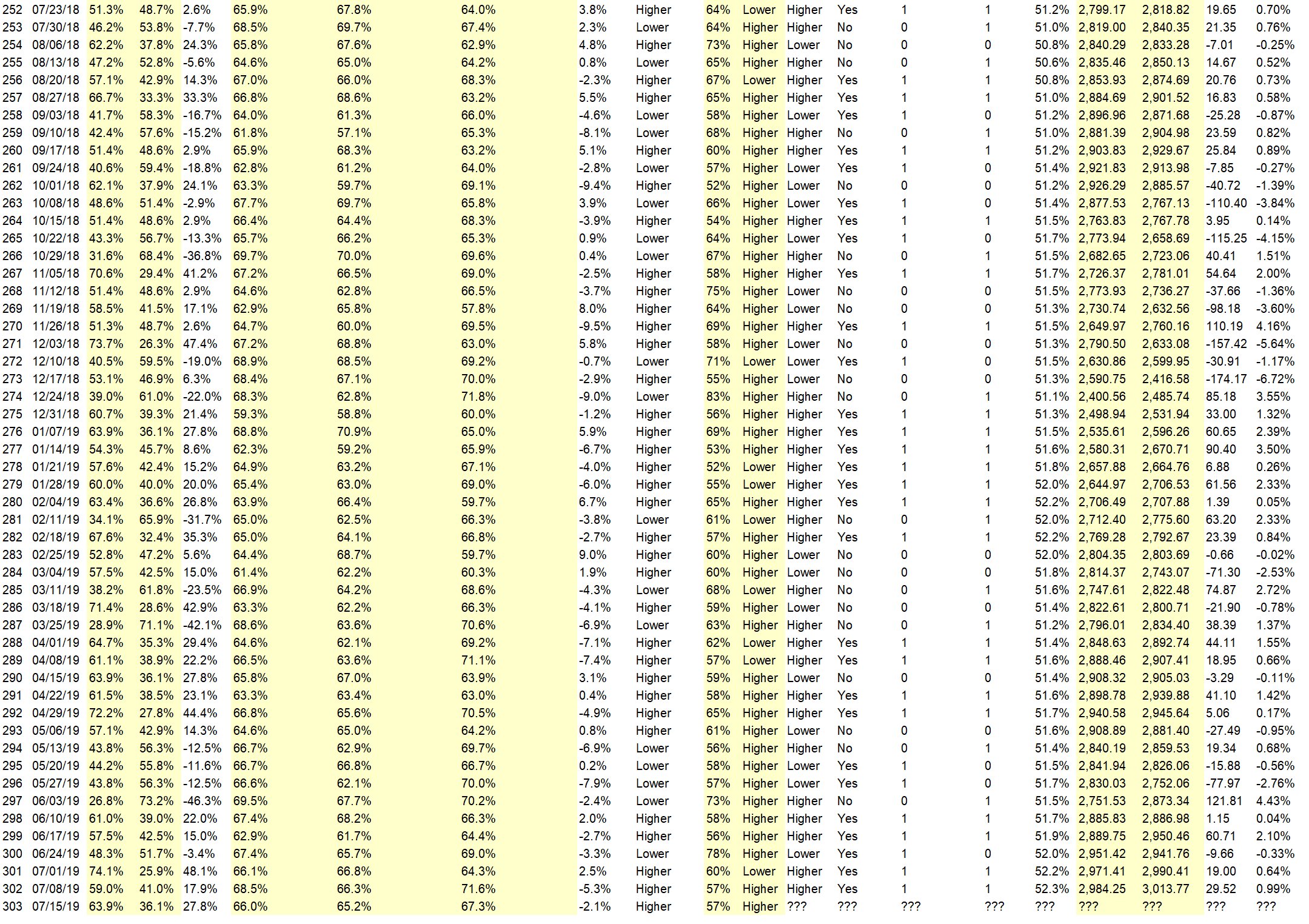

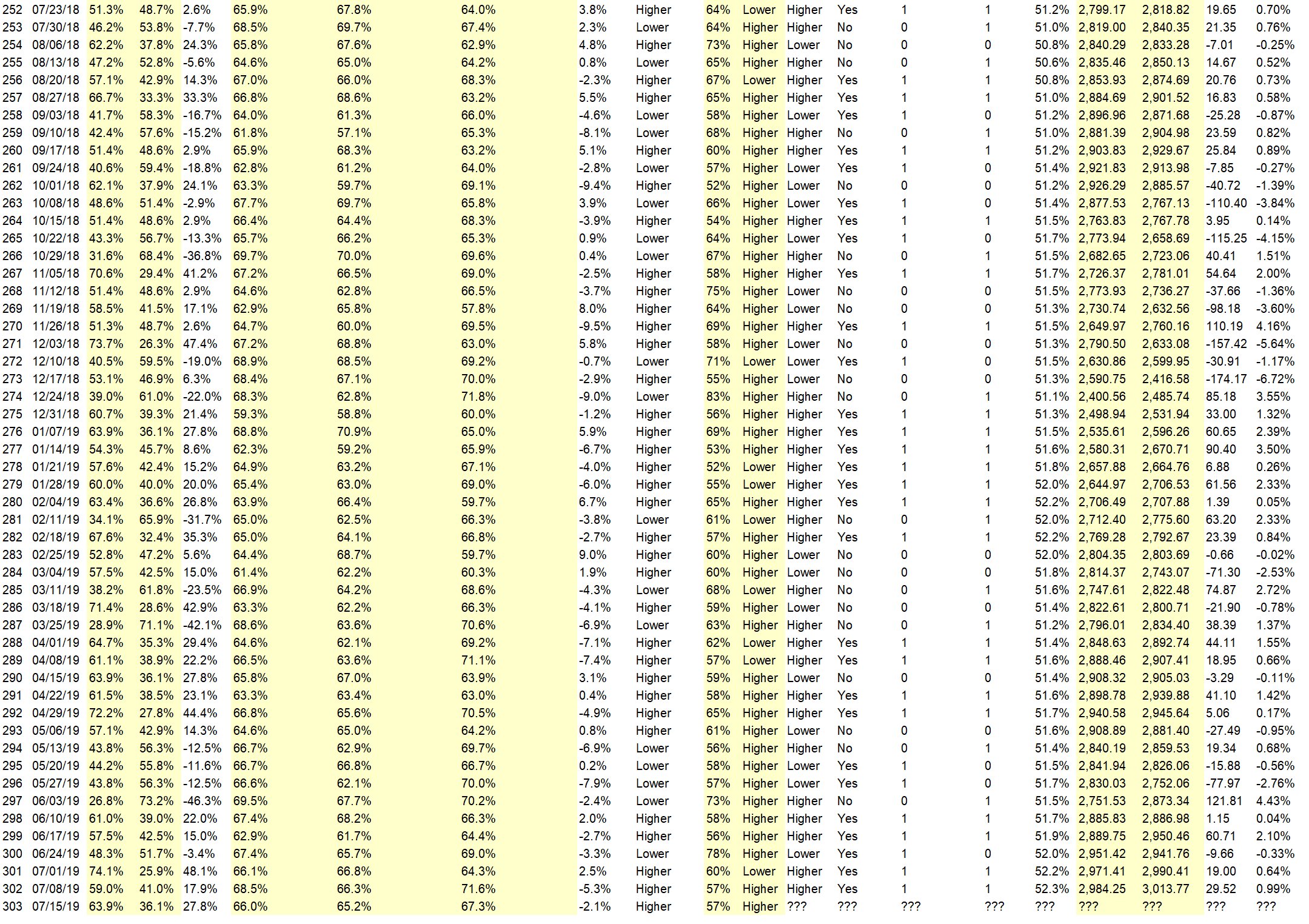

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 52.3%

Overall Sentiment 52-Week “Correct” Percentage: 58.8%

Overall Sentiment 12-Week “Correct” Percentage: 72.7%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• ma 7, ma14 both up. but bars momentum is losing. So higher high is more likely, but may not be able to last till Friday (hence probability = 55% only)

• Trend

• Tariffs issue settled r

• The growing optimism of the public and the anticipated increase in available income generated by tax cuts. There could be a fear of missing out syndrome forming.

• interest rate cut

• The possibility of lower interest rates will make the stock market skyrocket.

• momentum

• Fed week ….

• wave 5 may not be finished — target SPY above 304.13 by 31 July

• history

• With the help of the FOMC’s stance on interest rates, expecting the market to grind some higher.

• Beginning of earnings and companies that report early usually do ok

• breakout at new highs

• new highs

• Earnings week

• Breakout

• large institutions are buying

“Lower” Respondent Answers:

• it coukd fir a new resistance line maybe that is more selling than buying maybe i guess

• Small caps are not moving higher with large cap stocks

• This week has been a poor performer historically

• seasonallity

• because everyone says the market is going higher,

• The market continues to be overbought. The market needs to back and fill to be healthy.

• The drunken orgy continues to a blow off top 1k more points up, Euphoria will take the market to even higher highs

• I don’t really expect it to go lower anymore. But I’m short calls, so just hoping that my answer can influence reality.

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.

Question #4. What trading-related questions or topics would you like the experts to discuss on future episodes of the weekly Crowd Forecast News show? (The show is off this coming week for Wealth365, but back on July 22nd.)

• Impact of gold on the market. Brexit repercussions. Repatriation of American jobs.

• Forecasting options time decay

• protect principal/

• Leverage etfs

• Need to know which are good Stocks to trade options for.

• Market Sentiment, Fund Flows,

• profit

• tarriffs

Question #5. Additional Comments/Questions/Suggestions?

• waar with Iran how will affect us

Both shows are off this coming week so you can attend Wealth365 instead!

Wealth365 is the largest free online trading and investment conference in the world. Join us and discover the best tips & strategies, directly from celebrity personalities, financial advisers, champion traders, and business thought leaders.

Click here to learn more.

The TimingResearch shows will be back on July 22nd…

Crowd Forecast News Episode #231

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, July 22nd, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– TBA

Click here to find out more!

Analyze Your Trade Episode #86

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, July 23rd, 2019

– 4PM ET (1PM PT)

Moderator and Guests:

– TBA

Click here to find out more!

AD: The Ultimate Online Trading, Investing, and Wealth Building Education Confrence starts Monday, click here to learn more.