Crowd Forecast News Report #275

The new TimingResearch report for the week has been posted, you can download the full PDF report with the link below or you can read the full report in this post below.

Click here to download report in PDF format: TRReport123018.pdf

Scroll down for the full web version of the report.

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #1. Which direction do you think the S&P500 index will move from this coming Monday’s open to Friday’s close (December 31st to January 4th)?

Higher: 60.7%

Lower: 39.3%

Higher/Lower Difference: 21.4%

Question #2. Rate your confidence in your answer to Question #2 by estimating the probability you have correctly predicted next week’s market move.

Average of All Responses: 59.3%

Average For “Higher” Responses: 58.8%

Average For “Lower” Responses: 60.0%

Higher/Lower Difference: -1.2%

Responses Submitted This Week: 30

52-Week Average Number of Responses: 43.8

TimingResearch Crowd Forecast Prediction: 56% Chance Higher

This prediction is an attempt by the editor of this newsletter to use the full 5 year history of data collected from this project to forecast a probability estimate for whether this week’s sentiment is going to be correct and ultimately what the markets will do this coming week.

Details: Last week’s majority sentiment from the survey was 61.0% Lower, and the Crowd Forecast Indicator prediction was 83% Chance Higher; the S&P500 closed 3.55% Higher for the week. This week’s majority sentiment from the survey is 60.7% Higher with a greater average confidence from those who responded Lower. Similar conditions have occurred 27 times in the previous 274 weeks, with the majority sentiment being correct 56% of the time and with an average S&P500 move of 0.07% Lower for the week (one of the rare circumstances where the market went up more frequently but the overall average move was negative for these weeks). Based on that history, the TimingResearch Crowd Forecast Indicator is forecasting a 56% Chance that the S&P500 is going to move Higher this coming week.

Raw Data Page (raw data files include full history spreadsheet and the above charts):

TimingResearch.com/data.

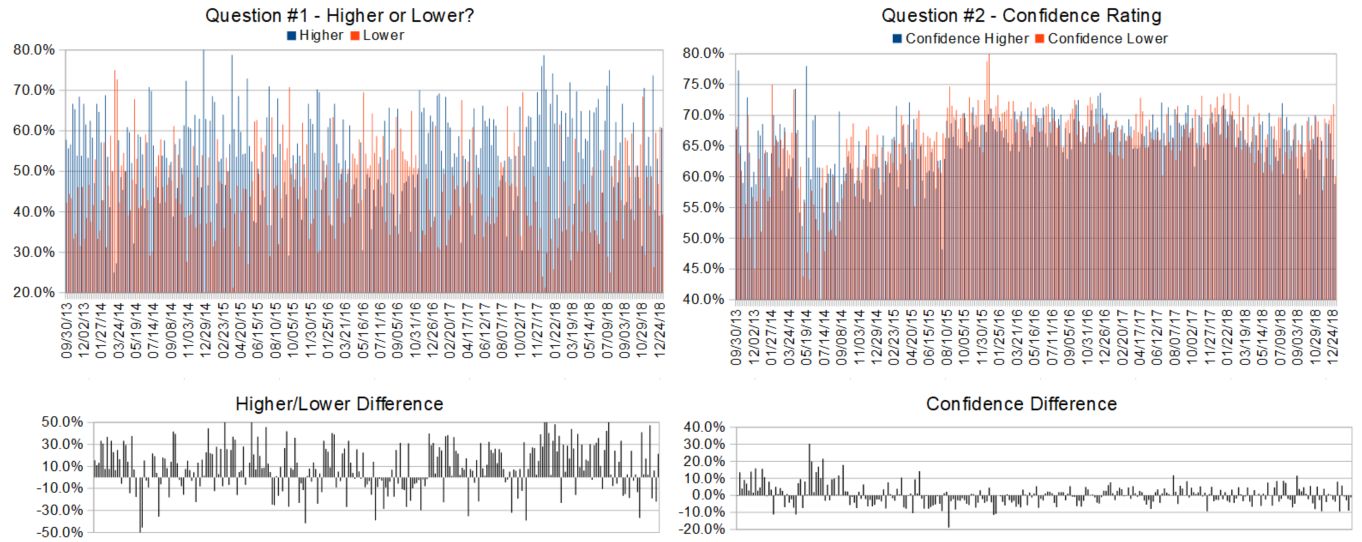

Full Weekly Results (full version of this chart available in the raw data spreadsheet for this week, “Date” field below lists the Monday of the week being predicted).

Overall Sentiment All-Time “Correct” Percentage: 51.1%

Overall Sentiment 52-Week “Correct” Percentage: 56.9%

Overall Sentiment 12-Week “Correct” Percentage: 45.5%

Only the previous 52 weeks of data are shown below, please download the raw data to see the full range of past data.

Weekly Reports Page: TimingResearch.com/reports

Raw Data Page: TimingResearch.com/rawdata

Current Survey Page: TimingResearch.com/currentsurvey

Any feedback: TimingResearch.com/contact

Email Alerts

Make sure you don’t miss all the future reports, show reminders, and bonus offers from TimingResearch, enter your email here:

By signing up you agree to receive newsletter and alert emails. You can unsubscribe at any time. Privacy Policies

NOTE: The following open-ended answers are solely the opinions of the anonymous respondents to this survey. Responses are mostly unedited, but some have been reformatted slightly for to make them easier to read. Some irrelevant responses (e.g. “none”), or anything obviously fake, or copy and pasted responses have been omitted. All-caps responses have been changed to all lowercase. All responses for each week, unedited, are available in the raw data spreadsheets at TimingResearch.com/data.

Question #3. For your answer to Question #1, please share what specific reason(s) you think the S&P500 will be heading the direction you chose.

“Higher” Respondent Answers:

• Republicans majority

• best six months of the year historically

• Because the RSI and the Fast Stockastic are very low with inclinations to go up. The MACD IS ALSO with inclinacion to go UP.

• Value buyers thinking the market will try to protect against the possibility that the selling will subside somewhat before any considerable big down days again appear.

• momentum and volatility trends

• start monday higher or lower but end of week will slightly higher. hedge all trades to make money

• New Year rally

• With the market oversold, looking for a move up to the 2575-2600 range of resistance.

• Selling in the market seems to have slowed a little.

• Which direction will confuse people the most? Higher will confuse us.

“Lower” Respondent Answers:

• Sell programs

• higher thru tuesday then drop , but not sure if it will go below this week low

• All the things that tanked the markets are still in play but it is oversold enough for some good positive days to happen until it becomes overbought and drops again.

• Govt. shutdown.

• The downside correction will continue until the public says “Just get me out”.

• trend is down and the bear rally is over

• Relief rally over(?)

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!

Question #4. What are you hoping to learn more about, or change, or improve related to your trading or investing in 2019?

• cut losses short

• EM

• swing trading

• Profit

• Bonds 3 percent opens plans to start a bond portfolio

• I want to receive a list of stocks to BUY and stocks to SELL when experts using a very complex computer program can decide when is the right time. I do not want to read lots of information about many companies when some one can provide me the list of stocks already found by experts.

• To get a better picture of the thinking of the big fund managers relative the the recent trading activity.

• money management ,, how to use stop loss on new platform

• Fewer trades. More smarter trades.

• Be more patient about jumping into trades.

• Get better understanding of option spreads.

• keep better records

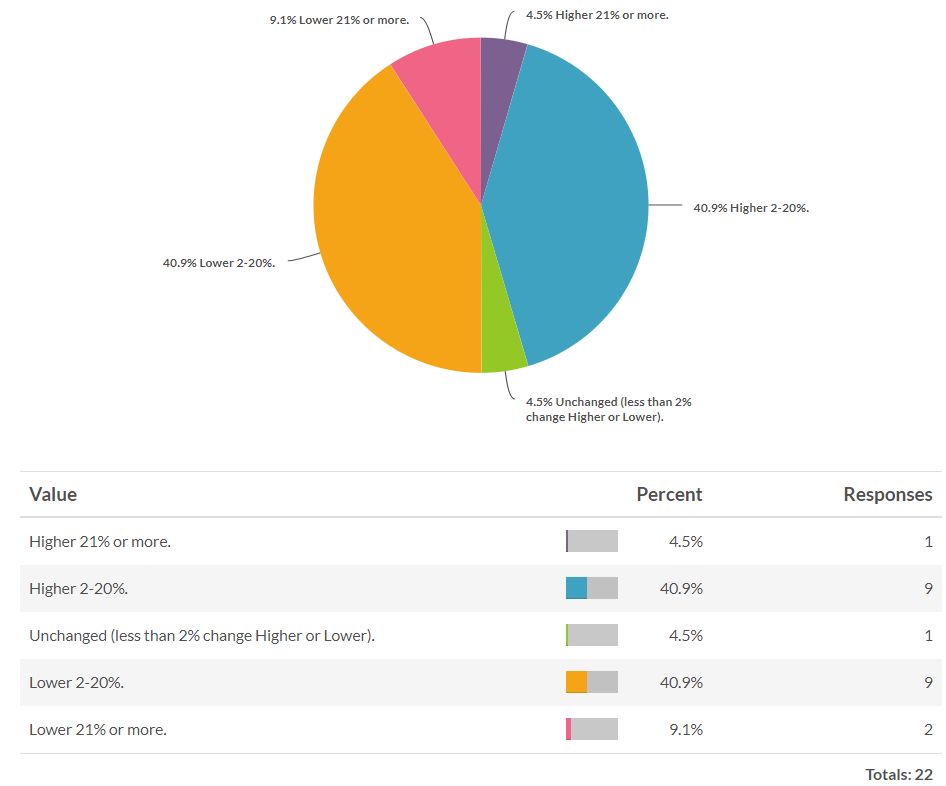

BONUS: Where do you think the S&P500 will close for 2019 (relative to where it will close for 2018)?

Question #5. Additional Comments/Questions/Suggestions?

• I wish to have the right recomendations with you using the right tools to decide what to BUY and what to SELL and the right time. VECTORVEST is a program that can do it.

• keep up the informative viewpoints

The shows are off this week but join us again on January 7th!

Crowd Forecast News Episode #209

This week’s show will feature a discussion with the trading experts listed below about the most recent TimingResearch Crowd Forecast Newsletter report, where they think the S&P500 is headed, what they are watching for in the markets currently, and their best trading idea.

Date and Time:

– Monday, January 7th, 2019

– 1PM ET (10AM PT)

Moderator and Guests:

– John Hoagland of TopstepTrader.com

– Jim Kenney of OptionProfessor.com

– Simon Klein of TradeSmart4x.com

– Rob Hanna of InvestiQuant.com & QuantifiableEdges.com (moderator)

Analyze Your Trade Episode #61

When you register, you will be prompted to list the top 5 stocks that you are interested in trading. We will list the top 5 from all registrants and our experts will be prepared to offer their opinions on these trades.

Date and Time:

– Tuesday, January 8th, 2019

– 4:30PM ET (1:30PM PT)

Moderator and Guests:

– Neil Batho of TraderReview.net

Partner Offer:

The Beauty of Options: In this free training, world renowned options trader, Jeff Bishop, will walk you through this ONE KEY SETUP that he uses daily to take advantage of crashing stocks. A small move in stock price can yield astronomical returns with options. Learn how here!